PBOC Gold Purchases: Separating Facts from Speculation

This post is part of the Chinese Gold Market essentials series. Click here to go to an overview of all Chinese Gold Market Essentials for a comprehensive understanding of the largest physical gold market globally. This post was updated late 2017.

In this post we will analyze everything there is to learn about PBOC gold purchases. Grasping the exact size of their official gold reserves is unfortunately impossible, assuming they have more than what is publicly disclosed (roughly 1,840 tonnes as of 2017), but there are many clues signalling they’ve covertly bought hundreds if not thousands of tonnes of gold since 2009.

The purpose of this post is to get an overview of all clues and data in order to separate the facts from speculation regarding PBOC purchases. Subsequently, we’ll estimate how much above ground gold is held in China mainland – official (PBOC) and private reserves.

I have been writing for a long time the PBOC does not buy any gold trough the SGE, and therefor PBOC purchases must be seen in addition to the flows of gold going through the famous bourse in Shanghai. Though, it’s necessary to expand on this subject in great detail.

We have a fairly good view on how much gold is going through the SGE and thus how much non-monetary gold is net imported into China from countries like the UK, Switzerland, Hong Kong and Australia (after which it’s not allowed to be exported and thus is accumulated in the mainland). If we add domestic mine supply to imported gold, we can estimate how much gold is held in reserves by the Chinese. But, are any of these visible gold flows bought by the PBOC? Not according to my investigation.

Why The PBOC Does Not Buy Gold Through The SGE

Below are the reasons why I think the PBOC does not buy gold through the SGE.

To get a better grip on this subject it helps if we understand why the PBOC would buy gold in the first place, so let’s sum up all possible incentives. The main objectives for the PBOC to accumulate physical gold are:

- Supporting the renminbi for its internationalization (adding trust and credibility to the renminbi).

- Owning hard currency (gold) as the cornerstone of capitalism.

- Owning reserves (gold) that protect the Chinese economy from external/internal shocks and inflation.

- Owning neutral reserves (gold) that are not controlled by a foreign nation (the US).

- Diversifying its excessively large US dollar (USD) reserves.

- Hedge their USD reserves.

- Overthrow the USD hegemony.

After reading this list it should be clear the PBOC rather buys gold with their foreign exchange reserves than with renminbi – China’s FX reserves are worth about $3.0 trillion (2017) and mostly held in USD. The amount of gold currently on the PBOC’s balance sheet (roughly 1,800 tonnes) is disproportionate to the amount of USD held. Hence, the PBOC would prefer to exchange USD for gold. All gold on the SGE is quoted in yuan, meaning the PBOC can’t exchange USD for gold through the SGE. Therefor, the PBOC is more likely to buy gold abroad and these purchases should be added to the visible gold flows we see entering the mainland through the SGE.

1) The PBOC prefers to buy gold with US dollars, while all physical gold on the SGE is quoted in yuan.

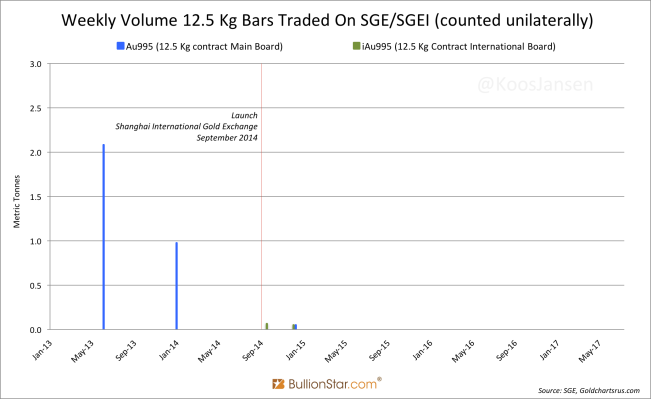

2) The PBOC would prefer to buy gold in large 12.5 Kg bars, which are relatively cheaper. 12.5 Kg bars have almost never traded over the SGE.

It should be said the SGE is a subsidiary of the PBOC. In 2002 China’s central bank erected the SGE to develop the domestic Chinese gold market; for the people to trade gold in yuan. The gold bar sizes available on the SGE are 50 gram, 100 gram, 1 Kg, 3 Kg and 12.5 Kg. Though, the volume of 12.5 Kg contracts (Au99.5 and iAu99.5) ever traded on the SGE is close to nil.

Only the 50g, 100g, 1 Kg and 3 Kg bars are traded, which are consumer sizes. This is a sign the PBOC is not buying gold through the SGE. Gold in large 12.5 Kg bars is relatively cheaper and more attractive for central banks. All central banks, that I know of, hold large bars.

3) The PBOC would prefer to hide its gold purchases. The reason we don’t know how much Chinese official gold reserves are is because this is the best kept secret in China. The PBOC buys gold in utmost secret or it would influence the market and geo-politics. If we think from the PBOC’s point of view, why would they leave a single trace when buying gold? Why would the PBOC buy any gold through the SGE for the world to see? I think they wouldn’t.

4) The PBOC would prefer to import monetary gold which is exempt from being disclosed in customs reports. Let me explain. All bullion gold trade on this planet that is visible (that shows up in customs reports) is classified as non-monetary. Monetary gold is exempt from being published in customs reports according to the guidelines in the International Merchandise Trade Statistics 2010 (IMTS) drafted by the United Nations. This is perfect for the PBOC to covertly ship gold to China.

The PBOC, having an incentive to exchange its superfluous USD in the international OTC market for gold, is actually obliged to monetize the gold it buys abroad. And when these purchases are transferred to China they will not be disclosed in foreign customs statistics. Subsequently, monetary gold imported into China does not go through the SGE, as only the non-monetary small gold bars go through the SGE.

All visible gold exports to China, traded over the SGE, are not PBOC purchases.

For more information on global trade rules for monetary and non-monetary gold, please read my blog post The London Bullion Market And International Gold Trade.

5) The PBOC would prefer to buy gold in an OTC market, not over an exchange like the SGE. The majority of global gold trade is done through the London Bullion Market; the most liquid market there is. This is not a central exchange like the COMEX, but an Over The Counter (OTC) market where buyers and sellers connect (electronically) one on one to trade gold without nosy analysts taking notes. The gold traded can be Loco London – located in London – or elsewhere. The London Bullion Market is ideal for the PBOC, as opposed to the SGE.

6) Another reason for the PBOC to buy abroad would be because it’s cheaper. Gold on the SGE often attracts a significant premium over London spot. Why would the PBOC pay that premium? Especially if it’s buying large quantities.

7) There is anecdotal evidence the PBOC covertly imports gold. Gold industry expert Jim Rickards has written in The Death Of Money (2014):

A senior manager of G4S, one of the world’s leading secure logistics firms, recently revealed to a gold industry executive that he had personally transported gold into China by land through central Asian mountain passes at the head of a column of People’s Liberation Army tanks and armored transport vehicles. This gold was in the form of the 400- ounce “good delivery” bars favored by central banks rather than the smaller one- kilo bars imported through regular channels and favored by retail investors.

This is very interesting. Not only because it demonstrates the PBOC prefers 400 ounce (12.5 Kg) bars over 1 Kg bars, but more so because it confirms the PBOC does not import gold through visible channels. This strengthens my analysis the PBOC does not buy any gold through the SGE. Again, all visible import (in general trade) is required to be sold through the SGE in China.

For information on how monetary gold might be imported into China by the military please read my post China’s Gold Army.

8) Early 2017 Jim Rickards was in a meeting with the three heads of precious metals trading desks of large Chinese bullion banks. These gold dealers told Rickards that indeed the PBOC does not buy any gold through the SGE. Jim stated in the Gold Chronicles podcast published January 17, 2017 (at 25:00)[brackets added by Koos Jansen]:

What I [Jim Rickards] don’t know is about the Shanghai Gold Exchange sales, they’re pretty transparent, how much of that is private and how much of that is the government [PBOC]. And I was sort of guessing 50/50, 70/30, whatever. What they told me, and these guys are the dealers [the three heads of the largest bullion banks in China], it’s 100 % private. Meaning, the government operates through completely separate channels. The government does not operate through the Shanghai Gold Exchange. … None of what’s going on on the Shanghai Gold Exchange is going to the People’s Bank Of China.

9) The SGE chairman has stated only consumers buy gold over his exchange. On the LBMA Forum in Singapore on June 25, 2014, a speech was delivered by Xu Luode, then Chairman of the Shanghai Gold Exchange. Below is a snippet from Xu:

Last year, China imported 1,540 tonnes of gold. Such imports, together with the 430 tonnes of gold we produced ourselves, means that we have, in effect, supplied approximately 2,000 tonnes of gold last year.

The 2,000 tonnes of gold were consumed by consumers in China. Of course, we all know that the Chinese ‘dama’ [middle-aged women] accounts for a significant proportion in purchasing gold. So last year, our gold exchange’s inventory reduced by nearly 2,200 tonnes, of which 200 tonnes was recycled gold.

Xu mentions the amount of gold imported into China mainland in 2013 (1,540 tonnes). Would Xu be allowed to break China’s best kept secret on an LBMA forum? Would any of these imports end up at the PBOC? I don’t think so. Moreover, Xu explicitly says all imports and mine output (and scrap supply) has been sold through the SGE system to consumers, not the PBOC.

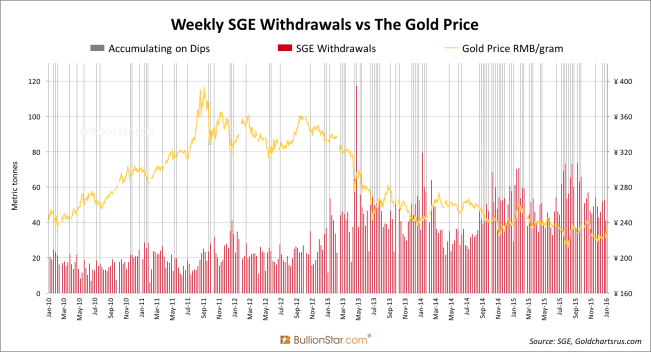

10) SGE withdrawals are elevated when consumer buying is strong. When examining SGE gold purchases by withdrawals from SGE designated vaults, we can depict a seasonal trend of strong demand around New Year (and in April 2013 and mid 2015). The Chinese people typically buy gold in this period as gifts for each other. Does this trend look like PBOC activity? No.

11) The World Gold Council assumes the PBOC doesn’t buy gold through the SGE. From Understanding China’s gold market, July 2014:

China’s authorities have a range of options when purchasing gold. They may acquire some of the gold which flows into China; there has been no shortage of that. But there are reasons why they may prefer to buy gold on international markets: gold sold on the SGE is priced in yuan and prospective buyers – for example, the PBoC with large multi-currency reserves – may rather use US dollars than purchasing domestically-priced gold. The international market would have a lot more liquidity too.

12) All reliable sources I have regarding the Chinese gold market tell me the PBOC does not buy gold through the SGE. One of these gentlemen, with ties to bullion banks worldwide, confirmed to me proxies of the PBOC purchase gold directly in the London OTC gold market that is shipped to Beijing with “own airplanes" (possibly by the Chinese gold army). In addition, a Chinese banker told me the PBOC buys gold “in the OTC market", and, “PBOC proxies can deal directly with refineries in Switzerland and Africa, such as Rand and MKS“.

13) The SGE President of the Transaction Department confirmed to Na Liu from CNC Asset Management Ltd. the PBOC does not buy gold through the SGE. Na Liu wrote in a report about 2013 SGE withdrawals:

…none of the 2,200 tonnes of gold was bought by the Chinese central bank. The President said: “The PBOC does not buy gold through the SGE.”

14) The head of a global operations company in security transport leaked in 2013 that 12.5 Kg bars were covertly imported into China for the PBOC. When I interviewed Alex Stanczyk, currently Managing Director of Physical Gold Fund SP, on 9 September 2013 he told me [brackets added by Koos Jansen]:

One of our partners had lunch in the recent past with the head of the largest global operations company in security transport. He said there is a lot of gold that they’re moving into China that’s not going through exchanges [SGE]. If the gold is for the government they don’t have to declare where it’s going. They don’t have to declare where it’s going in, or where it’s heading.

…We talked to the head of the largest refinery in Switzerland and he told us directly that all that metal that’s coming out of London (904 tons YTD) is being refined into kilo bars and send to China, as well as metal that’s coming in from other areas in the world, that’s all going to China. It’s way more than is being reported or moved through the exchanges. All the kilo bars go to the Chinese people but the PBOC is likely only buying good delivery.

With ‘good delivery’ Alex means the 12.5 Kg large bars that are not being sold through the SGE, but are imported as monetary gold into China without showing up in any country’s customs reports. The quote very clearly indicates that 12.5 Kg bars are imported into China for the PBOC without moving through the SGE.

I shall rest here. The purpose of the listed arguments is to provide you with as much information about the Chinese gold market and PBOC purchases as possible.

In short: according to my analysis the PBOC does not buy gold through the SGE!

How Much Gold Does The PBOC Hold?

What do we know about how much the PBOC has bought? Allow me to present a few clues:

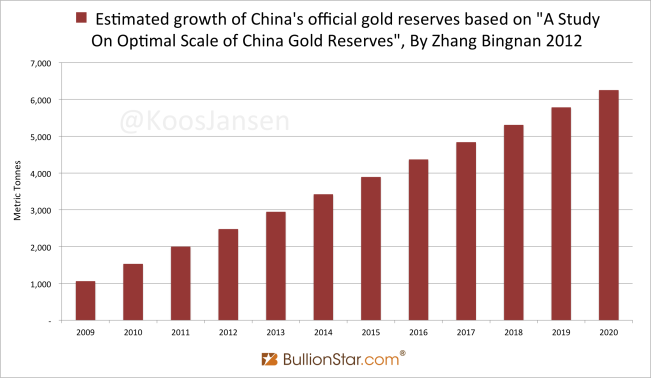

1) From a study by Zhang Bingnan, Vice President of the China Gold Association, we can read the PBOC buys approximately 500 tonnes a year (August 2012):

Forecast the optimal gold reserve capacity in the next 20 years. The conclusion is: 2020, China’s gold optimal reserves should be 5,787 tonnes – 6,750 tonnes. 2030 should be 8,995 tonnes – 10,532 tonnes.

2) Yi Gang, deputy Chinese central bank governor, stated the PBOC is able to buy approximately 500 tonnes a year (March 2013):

We will always keep gold in mind as an option in reserve assets and investments. We are able to import 500-600 tons a year, or more, but we will also take into consideration a stable gold market. If the Chinese government were to buy too much gold, gold prices would surge, a scenario that will hurt Chinese consumers. We can only invest about 1-2 percent of the foreign exchange reserves into gold because the market is too small.

3) Song Xin, President of the China Gold Association, wrote on July 2014 the PBOC should first aim to reach the 4,000 tonnes mark [brackets added by Koos Jansen]:

That is why, in order for gold to fulfill its destined mission, we must raise our [official] gold holdings a great deal, and do so with a solid plan. Step one should take us to the 4,000 tonnes mark, more than Germany and become number two in the world, next, we should increase step by step towards 8,500 tonnes, more than the US.

4) According to Deutsche Bank Markets Research the PBOC buys 500 tonnes a year (November 2014):

In another example, the Chinese government’s open market purchases of roughly 500 tonnes per year have not prevented the gold price from plummeting in recent years.

5) Numerous Chinese analyst suggest the PBOC aims to hold 5,000 tonnes in official gold reserves. Roland Wang, World Gold Council China Managing Director, said (March 26, 2015):

China currently holds about 1.6 percent of its foreign exchange reserves in gold, which is relatively low compared with developed countries and some developing countries, WGC China managing director Roland Wang said.

“The ideal amount should be at least 5 percent of its total forex reserves,” Wang told Reuters in an interview in Hong Kong.

Remarkably, the exact same day Reuters published Wang’s statement Chinese newswire Caixin published a story on gold written by Hedge Fund manager Li Sheng (March 26, 2015):

Gold accounts for only 1.6 percent of China’s forex reserves. This is only a fraction of the figure in the United States and many other developed countries. If China ever increased the level to 5 percent, it would have an enormous impact on global demand for gold.

Li mentions the exact same numbers as Wang from the World Gold Council on the same day: 1.6 % and 5 % of total FX reserves. If China would announce they hold 5 % of total reserves in gold, this would translate into roughly 5,000 tonnes.

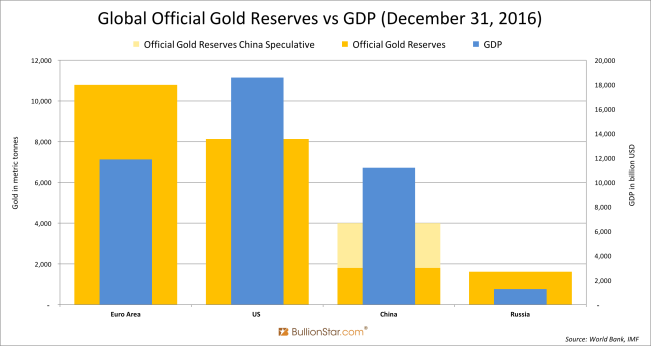

If the PBOC would have more than 5,000 tonnes of official gold reserves their ‘gold to GDP ratio‘ would be roughly on par with to the US, Europe and Russia. One of the theories about our current international monetary system – that was detached from gold in 1971 – is that it can shift to a new gold anchored system when all power blocks have equalized the chips (Jim Rickards). In other words, if the US, Europe, Russia and China all have an equal ratio of official gold reserves to their GDP, the international monetary system could make a transition towards gold.

6) Jeremy East, Managing Director Global Head, Metals Trading, Standard Chartered Bank, stated the PBOC is planning to support the renminbi with gold for internationalization (June 25, 2014):

I was at the Shanghai Derivatives Forum at the end of May and one of the speakers was a representative of the [China] Gold Association. He gave us quite an interesting insight into the flavor of what is going on in China from a strategic perspective. Some of the things he talked about included that China planned to change the landscape of world gold markets. He talked about having a strong currency and about having that currency backed by gold, like the US dollar. He also talked about people holding more gold and encouraging more people to hold gold. That is not just individuals, but also the central bank. …

(By the way, China is not planning to “back" their currency with gold in my opinion, they’re more likely to “support" their currency with gold at no fixed parity.)

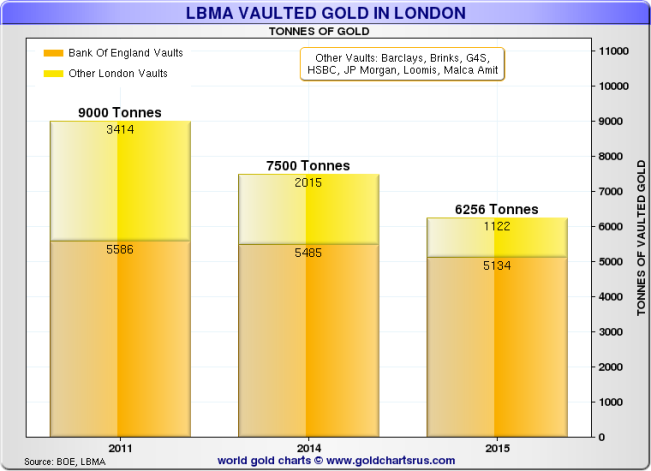

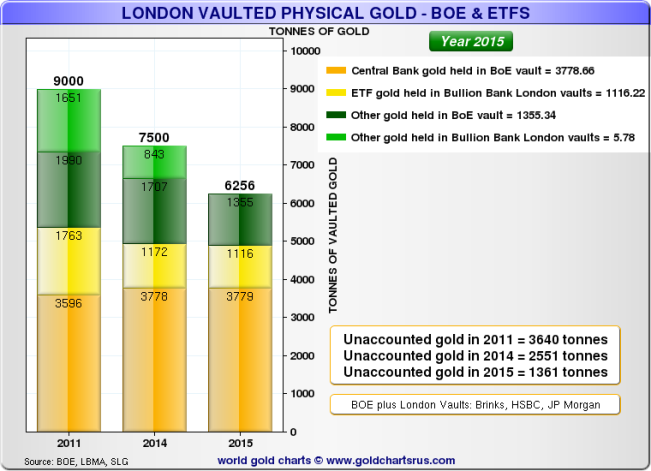

7) The PBOC could have bought as much as 1,750 tonnes of gold in London in between 2011 and 2015. Although, it’s virtually impossible to track monetary gold flows around the world, as these are exempt from international merchandise trade statistics, the least we can do is try. In September 2015 Ronan Manly and Nick Laird conducted an investigation with respect to how much monetary and non-monetary gold was present in the UK. Luckily, the London Bullion Market Association (LBMA) had published a few estimates in recent years about the total amount of physical gold in London (monetary and non-monetary). In 2011, there were 9,000 tonnes in London. In 2015, there were 6,256 tonnes in London – likely all in 12.5 Kg Good Delivery (GD) bars. These estimates from the LBMA combined with Manly and Laird their investigation have resulted in the next charts (conceived by Nick Laird, Sharelynx):

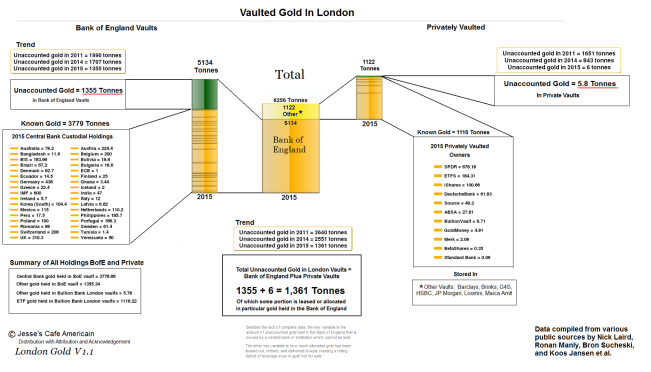

For a better understanding of physical gold located in London you can read this post by Ronan, this post by Nick or have a look at the next illustration conceived by Jesse from Cafe Americain:

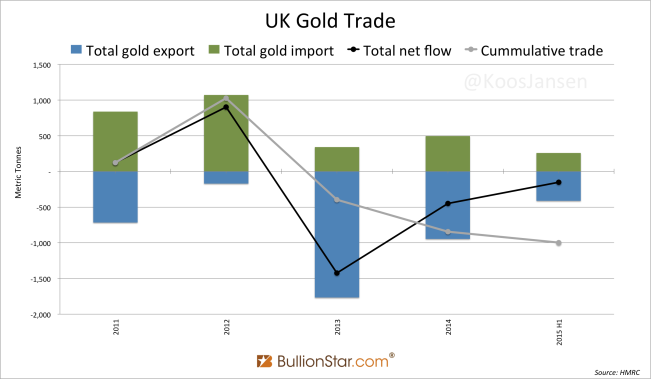

Remarkably, according to estimates by the LBMA the total amount of gold in London decreased by roughly 2,750 tonnes in the period from 2011 until early 2015, while UK’s customs department discloses only 1,000 tonnes were net exported as non-monetary gold during this period. Implying, 1,750 tonnes have been (covertly) exported as monetary gold.

For more information please read my post The London Float And PBOC Gold Purchases.

8) Dutch newspaper NRC Handelsblad published an article in 1993 about a 400 tonnes gold sale from the Dutch central bank that was partially bought by the PBOC (you can read a translation of the article here). From NRC:

“With 99 percent certainty we know that the People’s Bank of China has been one of the buyers of the Dutch gold”, said Philip Klapwijk from Goldfields Mining Services, an institute in London affiliated with the South African gold mines that specializes in research into the gold market. Also other London bullion dealers have a strong suspicion that China was involved in the gold sales of DNB. “We have noted that the Chinese central bank has bought gold in recent months”, said John Coley of the London bullion dealer Sharp Pixley and spokesman of the London Bullion Market Association.

I should add, in the nineties the PBOC was the primary (monopoly) dealer in the Chinese domestic gold market and in theory could have sold the gold to Chinese jewelry fabricators.

Facts And Speculation

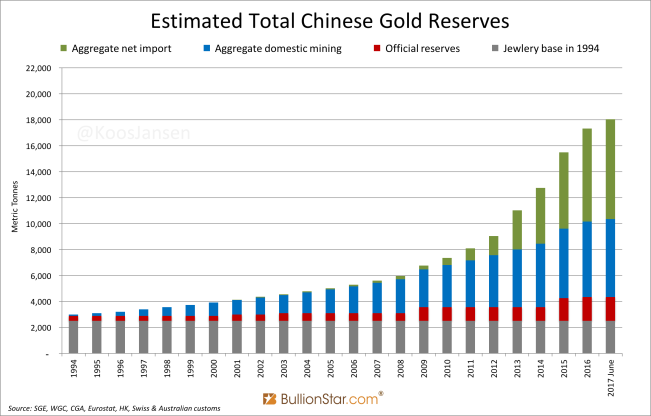

Let’s chew on some numbers. In the first chart below I’ve plotted a conservative estimate of the total above ground gold reserves in China mainland in June 2017. This conservative estimate is based on the assumption the PBOC owned 1,842 tonnes in June 2015 (this is what the PBOC officially discloses), and the rest of imports and mining were added to private holdings.

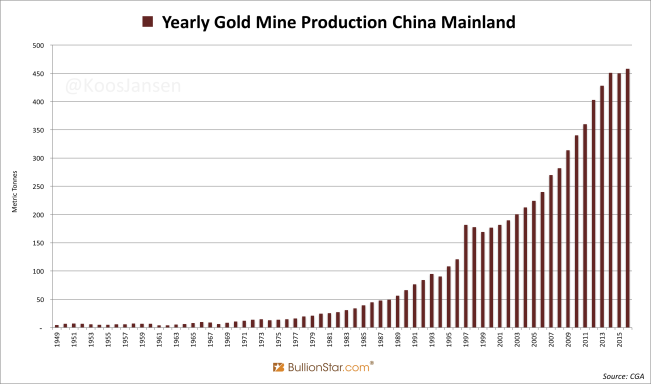

What about the amount of private reserves displayed in the chart? Let me explain my calculations from the starting point in 1994. Precious Metals Insights (PMI) has estimated that 2,500 tonnes of gold where held by population in the mainland in 1994, that’s the dark grey jewelry base you can see in the chart. The PBOC official reserves in 1994 accounted for 394 tonnes. In addition, Chinese domestic mining was 90 tonnes in 1994. Below is a chart showing historic Chinese domestic mining output.

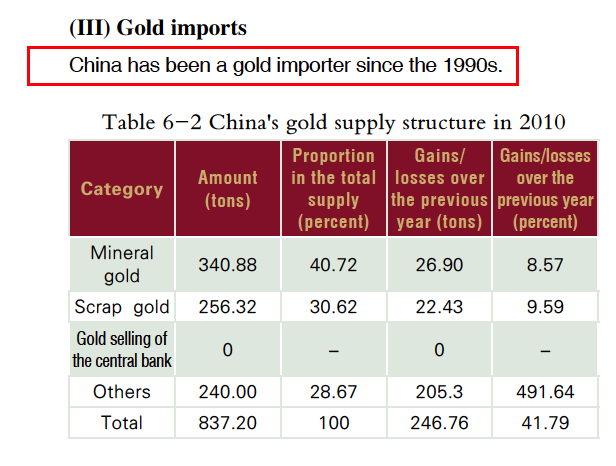

China is said to be a gold “importer since the 1990s", suggesting domestically mined gold was not exported after 1994. In the next screen shot from the China Gold Market Report 2010 we can read “China has been a gold importer since the 1990s”.

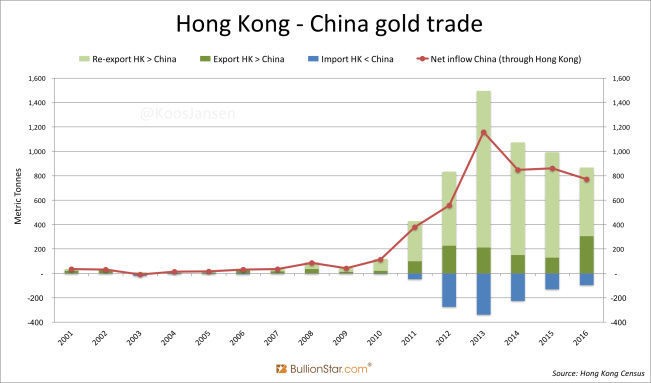

Furthermore, China began importing (non-monetary) gold a few years ago, have a look the next chart that shows historic gold trade between Hong Kong and China. Net imports ramp up in 2010. Other countries than Hong Kong, such as Switzerland, also started to visibly export to China after 2010.

So, the starting point in the first chart on Estimated Total Gold Reserves in 1994 in China mainland is computed as:

2,500 (jewelry base) + 394 (official reserves) + 90 (mining) = 2,984 tonnes

Subsequently, I’ve added annually domestic mining output – as the Chinese didn’t net export any gold since 1994 – and net imports every succeeding year in the chart. I’ve subtracted all PBOC official reserves gains before 2007 from cumulative domestic mining, the gains after 2007 have I have not subtracted from cumulative domestic mining. Why? Two reasons:

- The Chinese domestic gold market (SGE) was fully liberalized in 2007 after which I think the PBOC stopped taking in any gold from domestic mines. (Prior to the liberalisation of the Chinese domestic gold market the PBOC was the primary dealer.)

- According to my calculations, from 2003 until 2009 total Chinese gold supply (scrap + mine + import from Hong Kong) wasn’t sufficient to meet total consumer demand and 454 tonnes in PBOC purchases over that period. Although the PBOC claims all purchases before 2009 were done from domestic mines and scrap, I don’t think that’s possible. Hence, I think the PBOC started invisible import somewhere in between 2003 and 2009. And therefor, anything the PBOC added to its official gold reserves after 2007 I did not subtract from cumulative domestic mining.

Lead by the aforementioned calculations, the PBOC had accumulated 1,843 tonnes and the Chinese private sector 16,193 tonnes in June 2017 2016 (in total 18,036 tonnes). This does not capture gold in the black market, that thrived before 2002, neither any assets from wealthy Chinese families. It’s the most conservative estimate I can make using all data I could find.

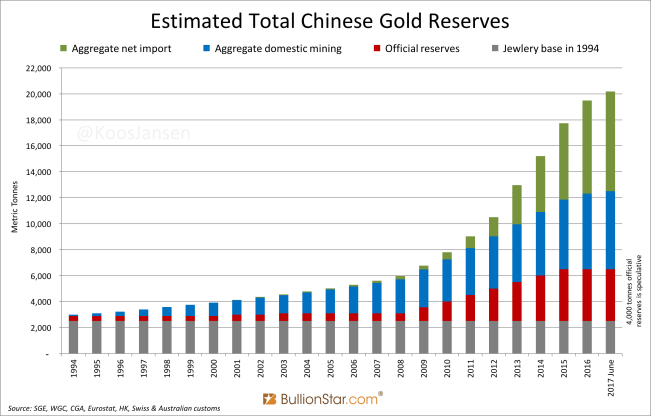

However, in my opinion the PBOC has bought a lot more gold in recent years. What all the clues mentioned above have in common, is that the PBOC has bought roughly 500 tonnes of gold per year since 2009. Let’s make a new more speculative chart:

The above chart is a copy of the previous conservative estimate, supplemented by 500 tonnes per year since 2009 in PBOC purchases, which I have not subtracted from cumulative domestic mining or cumulative import, as my assumption is this gold has invisibly been imported and not bought through the SGE. (I stopped adding 500 tonnes per year after 2015 because evidence is lacking.)

Speculating: the PBOC has accumulated at least 4,000 tonnes and the Chinese private sector 16,193 tonnes as of late June 2017 (in total 20,193 tonnes).

Addendum

Above you could read clues from Song Xin (China Gold Association, July, 2014) and Jeremy East (June 25, 2014) about China working on a ‘new monetary system’ that will include gold. Something similar was said by Zhou Ming, General Manager of the Precious Metals Department at ICBC, when Jeremy East asked him at the LBMA forum in Singapore (June, 2014) if the statement “Western gold moves East” was true:

With the status of the US dollar as the international reserve currency is shaky, a new global currency setup is being conceived. Uncertain changes will happen to gold’s traditional dollar-pricing so the US dollar’s influence on gold pricing needs to be re-evaluated.

But, of course, this could also relate to Ming bragging about renminbi internationalisation.

Popular Blog Posts by Koos Jansen

China’s Secret Gold Supplier is Singapore

China’s Secret Gold Supplier is Singapore

Audits of U.S. Monetary Gold Severely Lack Credibility

Audits of U.S. Monetary Gold Severely Lack Credibility

China Gold Import Jan-Sep 797t. Who’s Supplying?

China Gold Import Jan-Sep 797t. Who’s Supplying?

The Gold-Backed-Oil-Yuan Futures Contract Myth

The Gold-Backed-Oil-Yuan Futures Contract Myth

Estimated Chinese Gold Reserves Surpass 20,000t

Estimated Chinese Gold Reserves Surpass 20,000t

Did the Dutch Central Bank Lie About Its Gold Bar List?

Did the Dutch Central Bank Lie About Its Gold Bar List?

PBOC Gold Purchases: Separating Facts from Speculation

PBOC Gold Purchases: Separating Facts from Speculation

U.S. Mint Releases New Fort Knox Audit Documentation

U.S. Mint Releases New Fort Knox Audit Documentation

China Net Imported 1,300t of Gold in 2016

China Net Imported 1,300t of Gold in 2016

Why SGE Withdrawals Equal Chinese Gold Demand and Why Not

Why SGE Withdrawals Equal Chinese Gold Demand and Why Not

Koos Jansen

Koos Jansen