Did the Dutch Central Bank Lie About Its Gold Bar List?

Head of the Financial Markets Division of the Dutch central bank, Aerdt Houben, stated in an interview for newspaper Het Financieele Dagblad published in October 2016 that releasing a bar list of the Dutch official gold reserves “would cost hundreds of thousands of euros”. In this post we’ll expose this is virtually impossible – the costs to publish the bar list should be close to zero – and speculate about the far reaching implications of this falsehood.

Recap

This story started a couple of years ago. As I am Dutch and concerned not only about my own financial wellbeing but of my country as well, I commenced inquiring my national central bank about the whereabouts and safety of our gold reserves in late 2013. One of my first actions was submitting the local equivalent of a Freedom Of Information Act – in Dutch WOB – to De Nederlandsche Bank (DNB) in order to obtain all written communication of the past decades between DNB and the Federal Reserve Bank Of New York (FRBNY). In 2013 I knew a large share of the Dutch gold was stored at the FRBNY, which I deemed to be an unnecessary risk. In a crisis situation, for example, the US government would be able to confiscate Dutch gold stored on American soil. Unfortunately, DNB responded it’s exempt from certain WOB requests under the banking law from 1998, article 3. (I thought the WOB hit a dead end, though recent developments have changed my mind regarding the legitimacy of the rejection. In a forthcoming post more on my WOB from 2013.)

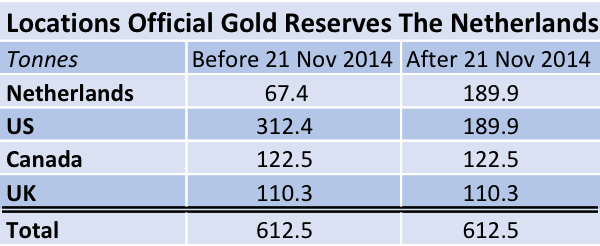

Subsequently, on 21 November 2014 DNB shocked the financial world by announcing it had covertly repatriated 123 tonnes of gold from the FRBNY vaults. Did DNB question the trustworthiness of the FRBNY like myself? Most likely, as I see few other reasons for repatriating, next to losing trust in the international monetary system itself. The gold wasn’t sold in the Netherlands, as our gold reserves have remained unchanged at 612 tonnes since 2008. Apparently DNB felt safer having less gold stored at the FRBNY. Note, the FRBNY offers institutional clients to store gold free of charge, yet DNB favored to ship it home. From the FRBNY website:

The New York Fed charges account holders a handling fee for gold transactions, including when gold enters or leaves the vault or ownership transfers (moves between compartments), but otherwise does not charge fees for gold storage.

In the press release DNB stated repatriating gold “may have a positive effect on public confidence”. Suggesting the Dutch public – or central bank or government – does not have full faith in the FRBNY as a custodian.

My focus on the Dutch gold, in a way partially mine as our official gold reserves are not owned but merely managed by DNB, was sharpened in 2015. On 26 September of that year I visited the Reinvent Money conference in Rotterdam, the Netherlands. One of the speakers was Jacob De Haan from DNB’s Economics and Research Division. In his presentation, De Haan repeatedly emphasized the importance of transparency in central banking.

Through my WOB experience, however, DNB appeared to be not transparent at all. Thereby, if DNB wants to be transparent and boost public confidence, why doesn’t it publish a gold bar list? The publication of this list would provide one of the most important checks on the existence of the Dutch official gold reserves, as the list can then be cross checked with the inventory lists of gold ETFs and alike, possibly exposing multiple titles of ownership on single gold bars. And this act of transparency could be accomplished within minutes by uploading an excel sheet to the DNB website. When I approached De Haan after the conference and asked why DNB doesn’t put out a gold bar list, he offered me he would look into it. He gave me his email address and we agreed to stay in touch.

Many months pasted, but after countless emails and phone calls DNB finally notified me it would not publish any gold bar list. So much for transparency! The following is what DNB wrote me on 11 August 2016 as the reason not to publish:

…we do not intend to publish a gold bar list. This serves no additional monetary purpose to our aforementioned transparency policy, however it would incur administrative costs.

Administrative costs? There hardly could be administrative costs as this list should be readily available in one or more spreadsheets, I reckoned. When confronting DNB with my logic they replied on 15 August 2016:

DNB has internal gold bar lists, however the conversion of internal lists to documents for publication would create too many administrative burdens.

DNB claims to have “internal lists”, but creating “documents for publication” would create too many administrative burdens. I couldn’t believe it. The only way this excuse would hold was if DNB’s internal lists are non-digital, which then need to be either physically copied or manually inserted in spreadsheet software. However, it’s highly unlikely DNB doesn’t have a digital gold bar list in this day and age. Computers have been widely used since the eighties; that’s more than thirty years ago. One the first applications that computers supported were spreadsheet programs designed for accounting.

Roughly 65 % of the international reserves of the Netherlands are held in gold. Would DNB still keep their precious gold records on pieces of paper?

In my professional opinion the Dutch gold must be meticulously recorded in digital documents and thus publishing a bar list should cost nothing. But showing proof will strengthen my perspective. Up till now this post has been more or less a summary of my previous writings. Down below we’ll zoom in on this material, and reveal why it’s virtually impossible for DNB to gain any administrative burdens for publishing a gold bar list.

The Dutch Gold Is Fully Allocated

Let us establish the Dutch gold is fully allocated. According to the London Bullion Market Association (LBMA), which sets the global gold wholesale standards, gold held in allocated accounts is [brackets added by Koos Jansen]:

Allocated Accounts: These are accounts held by dealers [/custodians] in clients’ names on which are maintained balances of uniquely identifiable bars of metal ‘allocated’ to a specific customer and segregated from other metal held in the vault. The client has full title to this metal with the dealer holding it on the client’s behalf as custodian.

Clients’ holdings will be identified in a weight list of bars showing the unique bar number, gross weight, the assay or fineness of each bar and its fine weight.

Clearly, allocated accounts contain uniquely identifiable gold bars owned by one specific client.

DNB discloses the Dutch official gold reserves position according to the International Monetary Fund’s Balance of Payments and International Investment Position Manual version 6 (BPM6). From DNB [brackets added by Koos Jansen]:

De Nederlandsche Bank [DNB] publishes the balance of payments statistics according to the sixth edition of the Balance of Payments and International Investment Position Manual (BPM6) since October 2014.

The figures for the Netherlands have been adjusted for the period since 2008.

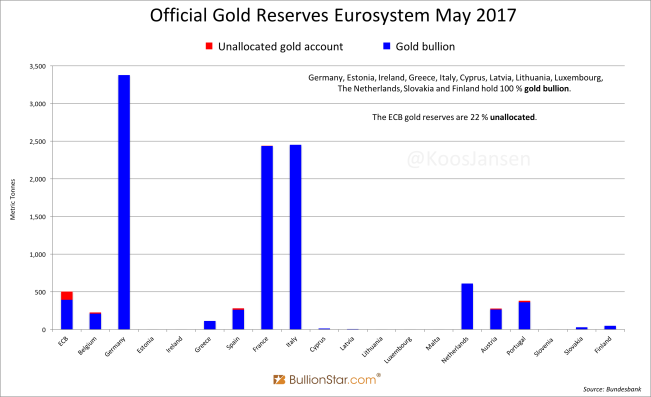

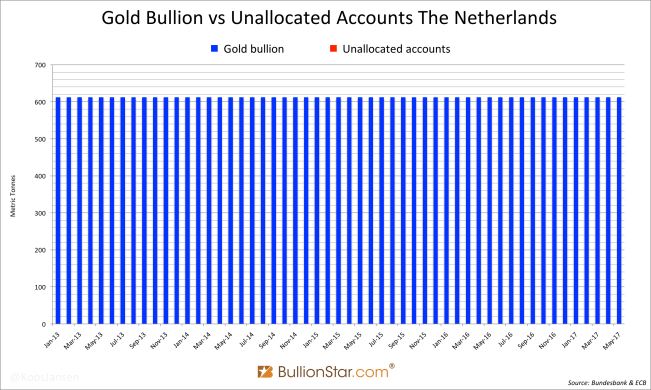

BPM6 forces national authorities to distinguish between gold bullion and unallocated accounts, of which gold bullion can be held in allocated accounts. The German central bank wrote in June 2014 on adopting BPM6 [brackets added by Koos Jansen]:

The new rules are binding for the EU member states [which includes the Netherlands] by virtue of a Council regulation amended by the European Commission.

With regard to reserve assets, gold transactions and positions will in future be subdivided into [1] gold bullion, which includes gold bars and allocated gold accounts, and [2] gold receivables, to which no specific gold holdings are assigned [unallocated accounts].

In the next chart we can see the ratio between gold bullion and unallocated accounts of all the Eurosystem’s national central banks. The data has been sourced from the German central bank, as the BundesBank’s website has the most user friendly interface. The Netherlands is said to hold 100 % in gold bullion.

When asked directly, DNB replied all the Dutch official gold is indeed fully allocated. Accordingly, there should be lists from all custodians that show the uniquely identifiable gold bars owned by the Dutch state, as stipulated by LBMA guidelines.

Displayed above in exhibit 1, the Dutch gold is mainly stored abroad. Since November 2014 the breakdown by location is as follows: 31 % in Amsterdam at DNB headquarters, 31 % in New York at the FRBNY, 20 % in Ottawa at the Bank Of Canada (BOC) and 18 % in London at the Bank Of England (BOE).

The BOE And FRBNY Provide Clients A Gold Bar List In Digital Format

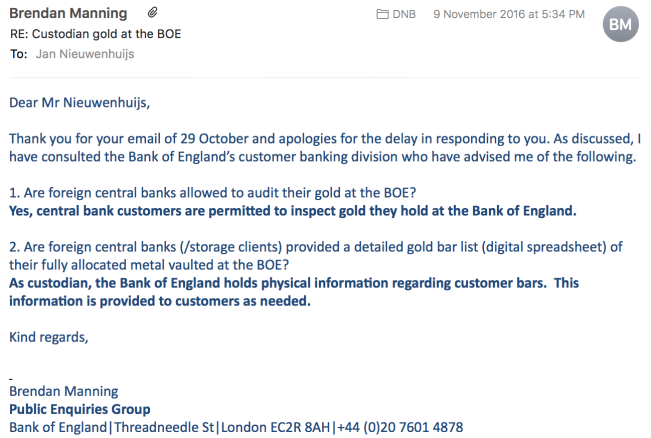

I’ve inquired at the BOE if they furnish clients digital gold bar lists that comply with LBMA standards (more specific, with Annex H of the LBMA’s Specifications for Good Delivery Bars and Application Procedures for Listing), and if clients are allowed to physically audit their precious metals at the BOE vaults. Brendan Manning of the Public Enquiries Group responded:

We can read the BOE claims to provide clients a digital gold bar list that complies with Annex H of the LBMA’s Specifications for Good Delivery Bars and Application Procedures for Listing, and clients are permitted to inspect their gold at the BOE.

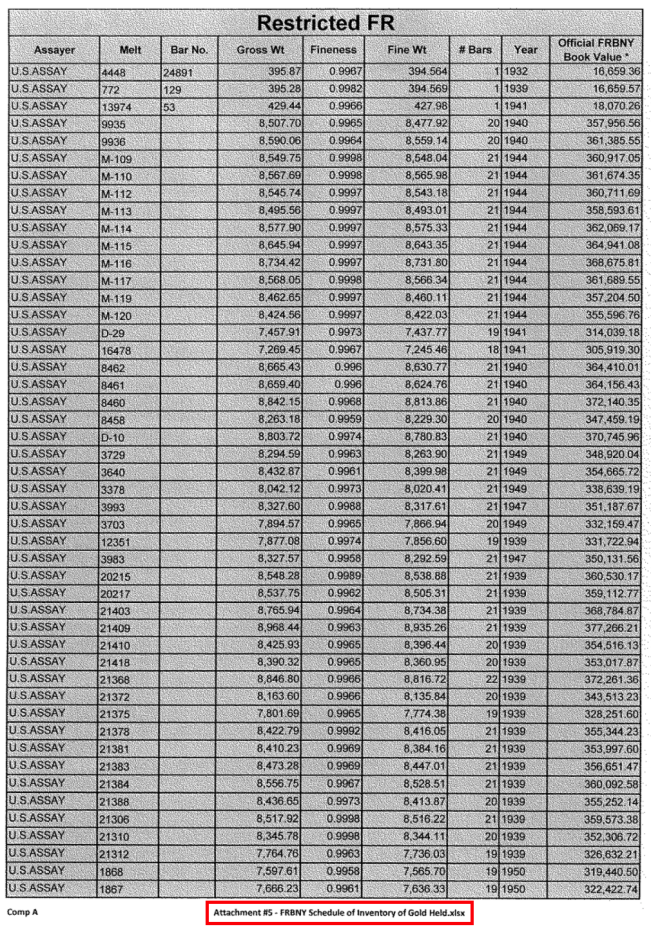

When approached with the same questions, the custodian bank in New York replied it couldn’t comment on this subject. However, there is a bar list of gold stored at the FRBNY in the public domain. For the Gold Reserve Transparency Act (2011, not enacted) the US Treasury published two gold bar lists. The first list in excel sheet format covers the US official gold stored at Fort Knox, Denver and West-Point, which aggregates to 7,715 tonnes (click to download the list). The second list in PDF format covers the US gold stored at the FRBNY, which accounts for 418 tonnes (click to download the list starting on page 128). Below is a screenshot of the FRBNY list:

As shown the FRBNY list fully complies with LBMA standards: included is refinery brand, unique serial/melt number, gross weight, fineness, fine weight and year of manufacturing.

At the bottom of exhibit 8 we read the original document name is “FRBNY Schedule of Inventory of Gold Held.xlsx“. The extension of the document name “.xlsx" means the file was created by Microsoft Excel software, which is the most commonly used spreadsheet application. So, either, the FRBNY keeps its bar lists in excel sheets, or is capable of converting their data to excel format.

Kindly remember the US official gold reserves are owned by the US Treasury, not by the FRBNY. We may conclude the FRBNY is able to provides its clients, such as the US Treasury, gold bar lists in electronic format. There should be no problem whatsoever if DNB would ask the FRBNY for the Dutch gold bar list in excel format.

The Bank of Canada didn’t reply to my inquiries, but it doesn’t matter at this point. It should be clear gold custodians keep their books electronically and fully comply with LBMA standards.

I did find a hint of how the BOC operates. In 1997 Professor Duncan McDowall and his team investigated all gold dealings by the BOC from 1935 until 1956 to evaluate if some of the gold stored in Ottawa had ever been intertwined with Nazi gold. McDowall’s investigation is titled “Due Diligence: A report on the Bank of Canada’s handling of foreign gold during World War II“. One of the professor’s observations with respect to the BOC’s historical documents reads [brackets added by Koos Jansen]:

Fiduciary obligation is similarly represented in the Bank’s [BOC] written dealings with its clients: the entitlement of any client to have a written confirmation of the disposition of the assets they have placed in the care of a bank. A good example of such an obligation in the context of this report would be the regular production of account statements that provided foreign central banks [i.e. DNB] with precise month-end and year-end reckonings of their earmarked gold holdings [allocated accounts] in Ottawa. … Currency Division’s reports on the arrival and departure of gold to and from these accounts therefore provided a meticulous record of foreign clients’ dealings with the Bank.

Even the BOC’s gold books from before the war appeared to be impeccable. I assume the BOC’s current custodial gold bookkeeping is as precise and meticulous now as it was then

DNB Is Likely To Maintain A Gold Bar List in Digital Format

Which leaves us to speculate if DNB itself, as the fourth custodian, holds a digital bar list of the 190 tonnes stored in Amsterdam. Allow me to share why I think they do.

The fact DNB repatriated 123 tonnes in November 2014 from New York, shows they’ve revived their affinity with gold. Few central banks have brought their gold home in recent years, which clearly makes DNB a physical gold advocate. No matter how you look at it, this can’t be denied.

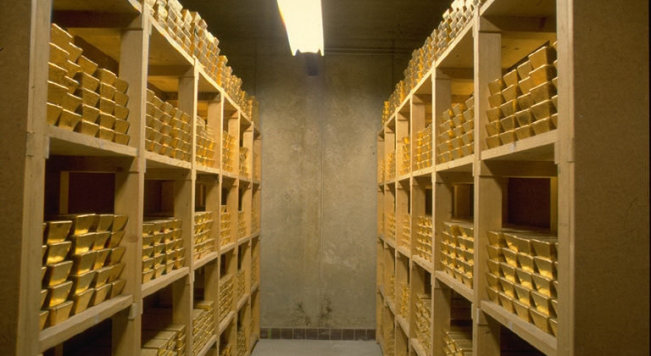

While repatriating DNB took the opportunity to upgrade its vault room at the Frederiksplein in Amsterdam, the Netherlands. Have a look at the DNB gold vault shelving system prior to November 2014 in the picture below:

Now have a look at the new shelving system at the Frederiksplein. This next picture was taken after November 2014:

Obviously, DNB made the structures more robust by switching from wooden shelves to what looks to be iron. DNB consulted the BOE for a new shelving system as the BOE has an identical system since many years prior to 2014. Have a look at a photo from the BOE’s gold vault below:

Compressed:

- DNB repatriated 123 tonnes, worth roughly 22 billion euros, from the FRBNY somewhere in the months prior to November 2014, exposing a deep and renewed affinity with gold.

- DNB must have received a digital list from New York with the bars transported, as we know the FRBNY keeps its records in an electronic configuration.

- While repatriating DNB consulted with the BOE for a robust shelving system in order to upgrade the vault room in Amsterdam, which reaffirms DNB’s careful attention for the gold they store.

Judging from the actions above I dare to say DNB had meticulously, and thus electronically, inventoried the 67 tonnes already stored in Amsterdam before November 2014, or registered this metal when the batch from New York arrived. So very likely all gold stored in Amsterdam is properly recorded in digital format.

A summary of the previous three chapters before we continue:

- All the Dutch official gold reserves are held in allocated accounts and thus there are bar lists available, which comply with LBMA standards, from all custodians.

- We may conclude all custodians save and distribute their bar lists electronically.

Het Financieele Dagblad

Meanwhile, I was interviewed by Het Fiancieele Dagblad, the Dutch version of the Financial Times, on 27 September 2016 for a weekend special on gold. In the interview I told two FD journalists about my views on gold and my curious encounters with DNB. The next day one of the journalists wrote me he would interview Aerdt Houben, Head of DNB’s Financial Markets Division, for the same gold special and invited me to share what I would ask Houben in his seat. I wrote back I would inquire about the gold bar list and if DNB had ever physically audited all the Dutch gold, among other topics.

In Het Financieele Dagblad (FD) from 28 October 2016 the interview with Houben reads:

FD: Some people are worried the Dutch gold might be gone.

Houben: To a certain degree the people should have trust in us. We are transparent about how much gold we hold and the locations.

FD: Are there any reports and bar lists on this, if so: why aren’t those public?

Houben: The content of the reports is also being checked by our accountants for our annual report. But the gold bar lists that would costs hundreds of thousands of euros. Because many people would have to check the contents and the many updates that are required.

In part Houben said the same as DNB mailed me months before, while specifying the administrative burdens would be several hundreds of thousands of euros. By now we know this is a fallacy.

Regarding the “reports” as mentioned in the FD: according to Houben these “reports” (whatever they are) are checked by DNB’s accountants for the annual report and presumably should proof the existence of the Dutch gold. However, in DNB’s annual report 2016 there is no mentioning of such gold related “reports”, or any gold auditing for that matter. What are these “reports”? And in case these are audit reports, why aren’t those public?

Let’s address the arguments for DNB’s excuse in the FD: “because many people would have to check the contents and the many updates that are required" . This is nonsense. For a proper audit, indeed, the bar lists would have to be checked against the physical inventory at the BOE, FRBNY, BOC and DNB. But, if the Dutch gold is audited by now, what additional checks would have to be done for publishing the bar list? Neither are any “updates" required as everything has been allocated since 2008. All DNB’s justifications have fallen apart.

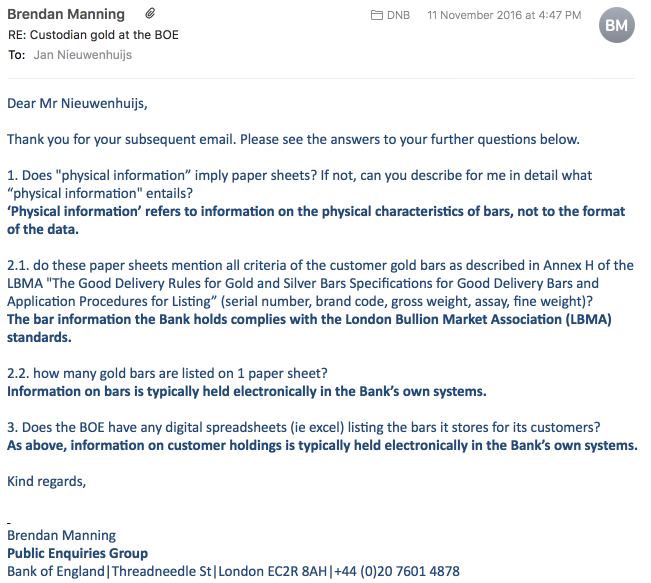

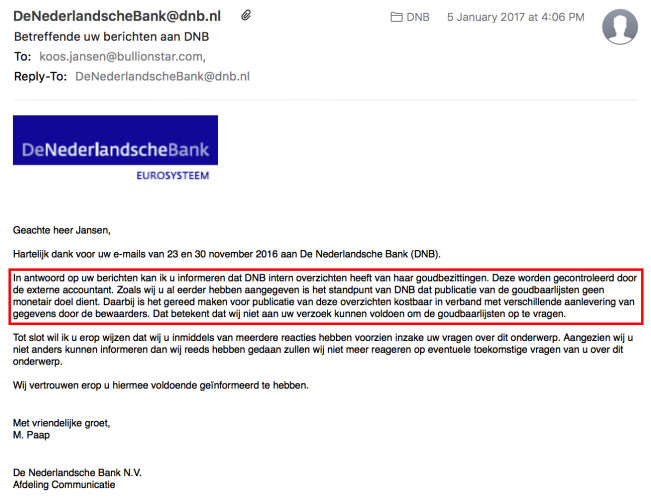

I asked DNB in November 2016 by email, what exactly are the “reports” mentioned in the FD special, and why can’t DNB publish the gold bar list as provided by the BOE (the one custodian openly stating to provide clients a bar list)? DNB replied [brackets added by Koos Jansen]:

In the red frame it reads:

In response to your messages I can inform you DNB has internal overviews of her gold possessions. These are being checked by external accountants [presumably this means the Dutch gold is audited]. As stated previously, DNB considers publishing a gold bar list to serve no monetary purpose. Thereby, creating a bar list for publication would be costly regarding the different formats delivered by our custodians. This means we will not respect your request for obtaining the gold bar list.

I presume DNB tries to communicate the gold has been audited, but how does one audit gold without a gold bar list that complies with LBMA standards? Only when cross checking bars with an inventory list that discloses all physical characteristics of the bars can audits be performed competently. Bar lists that comply with LBMA standards are indispensable for a physical audit.

Relying on audit documents (“reports“?) drafted by custodians is forgery. A physical audit has to be executed by a third party (not the owner and not the custodian). Common practise in the gold industry is to count 100 % and weigh 2 % of all bars at least once a year for an audit (source Bureau Veritas).

I don’t believe it would take DNB any effort to convert the different list formats by its custodians. It’s all digital and can be converted into one file within seconds. (Though publishing the bar list in different formats is fine too.)

By and by, publishing a gold bar list does serve a monetary purpose as it confirms how much monetary gold as nation truly holds. Without public bar lists countries can more easily create false data.

Sadly, in the email dated 5 January 2017 (exhibit 14) DNB told me it won’t reply to me anymore with respect to their bar list.

haha. DNB paper “gold and secrets". Openness is our new policy. https://t.co/I1lYytYxaDpic.twitter.com/uURSX47WmV

— BullionStar (@KoosJansen) October 26, 2016

In the Tweet above it reads in Dutch:

Secrets. In the past a central bank was proud of it. Nobody was allowed to know how much gold we had and where it was stored. But the age of central banks cherishing their image of a closed fortress is long gone. Openness is our new policy.

Conclusion

The question is, who’s not telling the truth here? That would be DNB, for sure, and possibly also the BOE and FRBNY.

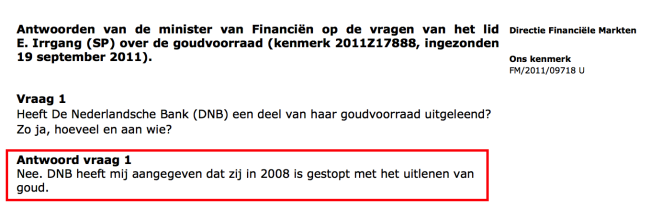

Just to be clear, the amount of gold leased out by DNB is nil. In 2012 the Dutch Minister Of Finance, De Jager, declared in congress DNB had ceased all gold leasing activities by 2008.

Again, all the Dutch gold is allocated, and yet DNB declared in a newspaper the bar list can’t be published because it would cost “hundreds of thousands of euros“ – this has appeared to be an embarrassing statement and truly blows DNB’s credibility. If DNB doesn’t wish to disclose its bar list, for whatever reason, it would have done wise not to comment at all on this issue.

But why all the nonsense? Time to speculate. We’ll run through a few scenarios:

Scenario 1) Publishing a bar list might limit DNB’s future flexibility to intervene in financial markets. Currently, DNB hasn’t got any gold leased out. But if the bar list would be published, my central bank would be obstructed in future covert leasing activities.

Suppose, the gold price spikes in five months from now. DNB, or multiple central banks in concert, decide to lease out monetary gold in order to calm the physical market. When the leases would be undone several years later, surely the bars returned will not be the ones lend out. Following this scenario, when a bar list is published now it would be inaccurate in a few years time; showing bars that are long gone, and can show up on private gold ETF inventory lists.

If readers question wether central bankers are capable of ‘not telling the truth’, consider what DNB’s Governor said in an interview early 2012 when asked if he would repatriate any gold from the FRBNY. His answer was firm: “No". However, shortly after, DNB started to prepare repatriating by reinforcing its headquarters. A new security barrier was constructed around the compound. DNB confirmed to me this was done to prevent any trucks from crashing the building. Likely, the Governor ‘did not tell the truth’ in the interview for strategic reasons.

Scenario 2) It’s possible the BOE claims to provide its clients gold bar lists and auditing rights, but in reality it doesn’t. Meaning, DNB doesn’t have a bar list from the BOE that complies with LBMA standards, which forces them to come up with excuses whenever confronted. This scenario could mean custodial gold at the BOE (and FRBNY) has been embezzled.

In 2016 economist Guillermo Barba pressured the Banco de México to publish a gold bar list of the Mexican gold stored at the BOE. In February 2017 Banco de México delivered Barba a list, but it didn’t satisfy LBMA standards by far. Surely this was done on purpose, because how the list was distributed can never have been how the BOE keeps it. So prior to distribution parts of the list were edited. Barba pressured Banxico once more and received a new list in March 2017 (click here to download the list). But neither did the new list satisfy LBMA standards! The column in the list that reads “serial number“, doesn’t disclose the serial numbers physically inscribed on the bars, which makes them uniquely identifiable, but shows the BOE’s internal numbering. In my opinion Barba was fooled twice by Banxico. Or Banxico was fooled twice by the BOE.

In July 2014 the Australian central bank (RBA) published its bar list of gold stored at the BOE due to intense efforts by gold blogger Bullion Baron. But alas, the RBA gold bar list does not disclose unique serial numbers (click here to download).

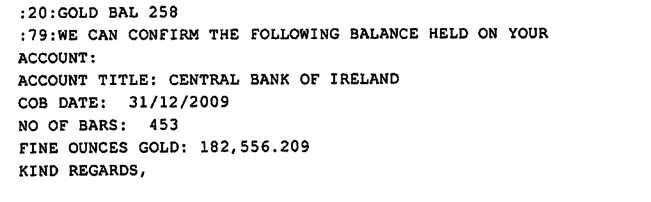

My colleague Ronan Manly tried to obtain a gold bar list from the Irish central bank (CBI); gold stored at the BOE. The CBI’s first response was:

The record concerned does not exist or cannot be found after all reasonable steps to ascertain its whereabouts have been taken, …

Your request was referred to two divisions within the Central Bank of Ireland, … Both divisions have confirmed that they do not hold any such records which fall within the scope of this part of your request. Accordingly, this part of your request is refused.

Eventually, after the BOE tried to block the request from CBI, Manly was duped with this file. All it really contains is a bar total and the total in fine ounces:

As far as I know, there has never been a serial number of a gold bar stored at the BOE released in the public domain. It can be the BOE is routinely deceiving its clients by distributing incomplete bar lists.

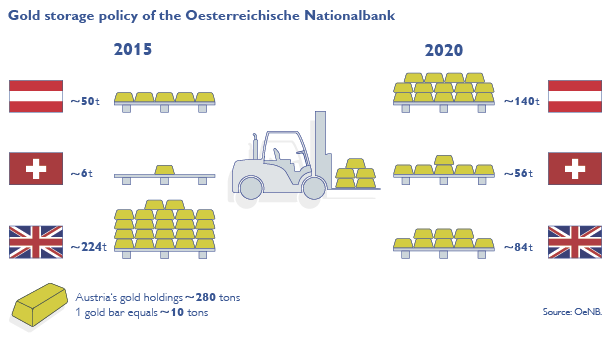

In the past, the central bank of Austria (OeNB) has failed to audit its gold at the BOE. The Austrian Court of Audit (Der Rechnungshof) wrote in a report in 2015 [brackets added by Koos Jansen]:

… the gold depository contract with the depository in England [BOE] contained deficiencies. With respect to the gold reserves stored abroad, internal auditing measures were lacking.

The OeNB had no appropriate concept to perform audits of its gold reserves. …

Was the OeNB blocked entrance from BOE vaults in 2015?

There is proof FRBNY clients have not been able to audit their gold in New York, at least not in 2007. The German Bundes Rechnungshof released a report in 2012 on the safety of the German gold abroad. Although the report is heavily redacted, on page 10 we read German auditors were not allowed entrance in the FRBNY gold vault to inspect their precious metals, nor were any other clients:

A possibility for the owners to physically record the holdings of their gold is not provided in the terms and conditions. According to the FRBNY, it’s a long-term practice not to allow the owners to inspect their assets in the interest of a safe working and control process. It has confirmed to the Bundesbank that these conditions for gold custody also apply to all other clients that store gold at the FRBNY.

In response to repeated requests from the internal auditors of the Bundesbank, their representatives were given the opportunity to enter the vault system in June 2007 to get an impression of the safety precautions. However, the employees were not given access to the vault compartments, but only to an entrance hall. An examination of gold was therefore not possible.

[Four redacted paragraphs follow]

Clearly the Germans were blocked from auditing their metal, and for decades all FRBNY clients had suffered the same fate.

Not surprisingly, after the developments between the OeNB, BOE, Bundesbank and FRBNY both European central banks decided to repatriate significant shares of their gold stored overseas. And both repatriate over the course of multiple years, which accentuates the friction between the custodians and their clients.

Maybe DNB has experienced the same obstructions in New York as the Germans and hence decided to repatriate.

Scenario 3) DNB just doesn’t feel like publishing a gold bar list.

Who’s to say what the truth is? If readers can think of an additional scenario please comment below.

My final conclusion is that DNB is lying about its gold bar list, which is worrisome as it shouldn’t be necessary, or things behind the scenes are more convoluted and DNB is being lied to by its custodians, which is even more worrisome.

In short, producing a bar list that complies with LBMA standards should be child’s play. And only proper lists can grant us the safety of all the official gold reserves stored at the BOE and FRBNY. As of March 2017 the BOE and FRBNY stored an aggregated 10,821 tonnes of gold, of which the majority is monetary gold.

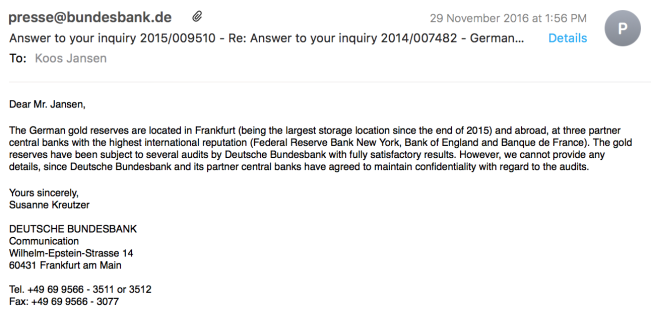

The Bundesbank, OeNB and DNB all claim their gold is audited by now, but none of them has ever released an audit report. The German central bank wrote me it doesn’t publish its audit reports “since Deutsche Bundesbank and its partners have agreed to maintain confidentiality with regard to the audits". More secrecy and central bank collusion, no surprises there.

Until central bankers are fully transparent about their gold dealings we can have but mere distrust in them.

Popular Blog Posts by Koos Jansen

China’s Secret Gold Supplier is Singapore

China’s Secret Gold Supplier is Singapore

Audits of U.S. Monetary Gold Severely Lack Credibility

Audits of U.S. Monetary Gold Severely Lack Credibility

China Gold Import Jan-Sep 797t. Who’s Supplying?

China Gold Import Jan-Sep 797t. Who’s Supplying?

The Gold-Backed-Oil-Yuan Futures Contract Myth

The Gold-Backed-Oil-Yuan Futures Contract Myth

Estimated Chinese Gold Reserves Surpass 20,000t

Estimated Chinese Gold Reserves Surpass 20,000t

Did the Dutch Central Bank Lie About Its Gold Bar List?

Did the Dutch Central Bank Lie About Its Gold Bar List?

PBOC Gold Purchases: Separating Facts from Speculation

PBOC Gold Purchases: Separating Facts from Speculation

U.S. Mint Releases New Fort Knox Audit Documentation

U.S. Mint Releases New Fort Knox Audit Documentation

China Net Imported 1,300t of Gold in 2016

China Net Imported 1,300t of Gold in 2016

Why SGE Withdrawals Equal Chinese Gold Demand and Why Not

Why SGE Withdrawals Equal Chinese Gold Demand and Why Not

Koos Jansen

Koos Jansen