The Mechanics of the Chinese Domestic Gold Market

This post is part of the Chinese Gold Market Essentials series. Click here to go to an overview of all Chinese Gold Market Essentials for a comprehensive understanding of the largest physical gold market globally. This post was updated until 2016.

The largest physical gold market globally is the Chinese domestic gold market. At the core of this market is the Shanghai Gold Exchange. This article is serves as an introduction to both.

The Shanghai Gold Exchange (SGE) is the largest physical gold exchange globally because China is both the largest gold importer and mine producer, and nearly all supply channels in the Chinese domestic market flow through the SGE. Since 2013 the yearly amount of physical gold withdrawn from the SGE vaults has exceeded 2,000 tonnes.

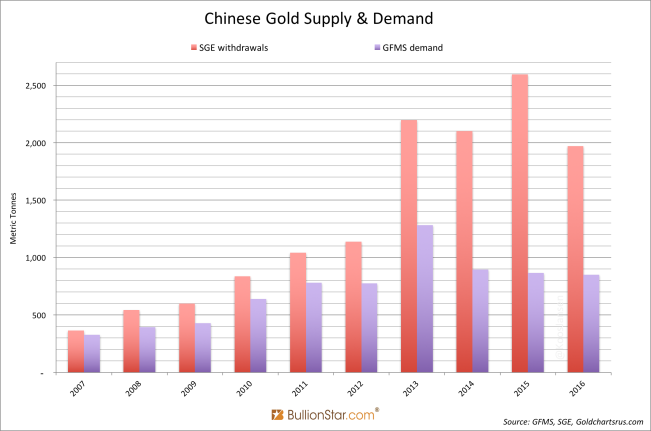

While Western consultancy firms like the World Gold Council (WGC) and Thomson Reuters GFMS (GFMS hereafter) report annual Chinese gold demand to be roughly 900 tonnes, the China Gold Association (CGA) states Chinese demand equals SGE withdrawals and thus is more than twice as much as is portrayed by the WGC and GFMS.

This article examines the basic mechanics of the Chinese domestic gold market and how nearly all physical gold in China flows through the SGE, in order to achieve the best understanding of the size of this market and true Chinese gold demand. In addition, the enormous difference between SGE withdrawals and Chinese gold demand as disclosed by GFMS is highlighted.

According to my analysis the structure of the Chinese domestic gold market with the SGE at its core has been designed by the People’s Bank Of China (PBOC), (i) to provide the Chinese citizenry direct access to the gold wholesale market, (ii) to grant all gold traded in the Chinese wholesale market to be of the highest quality, (iii) to be able for the PBOC to monitor the gold traded in the Chinese market, and (iiii) keep track of the amount of gold added to Chinese (non-government) reserves. Sprouted from the centrally minded Chinese authorities the SGE system was conceived in 2002 to facilitate the citizenry to buy physical gold, strengthen the Chinese economy, develop the Chinese gold market and to support renminbi internationalization.

For our analysis of the Chinese domestic gold market I’ve relied on Chinese laws, annual reports drafted by the CGA, SGE, PBOC and Shanghai Futures Exchange (SHFE), next to sources in China at commercial banks and individual traders. The aforementioned reports are:

- China Gold Association (CGA) Gold Yearbook 2006, 2007, 2008, 2013 (Chinese).

- SGE Annual Report 2007, 2008, 2009, 2010, 2011 (English and Chinese).

- SGE Monthly Report December 2013.

- China Gold Market Report 2008, 2009, 2010, 2011 (English and Chinese).

Most of these reports have been written in conjunction by the CGA, SGE, PBOC and SHFE.

All the English reports were available on the SGE website until 2014, after which they’ve been taken offline.

Introduction

Prior to 2002 the Chinese gold market was practically non-existent. Back then the PBOC had the monopoly in trading gold in China and the people were only allowed to buy jewelry in designated shops. In 2002 the PBOC erected its subsidiary the SGE to allow the free market to take over the the pricing and allocation of gold. However, the Chinese domestic gold market didn’t change over night.

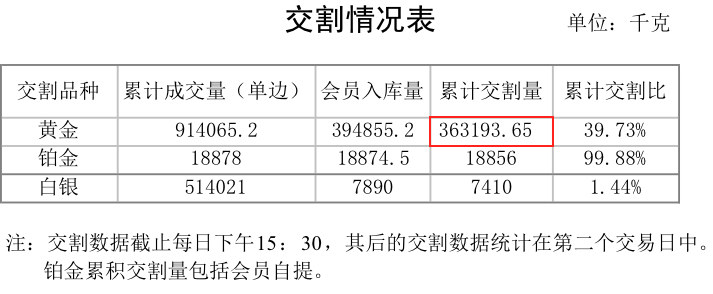

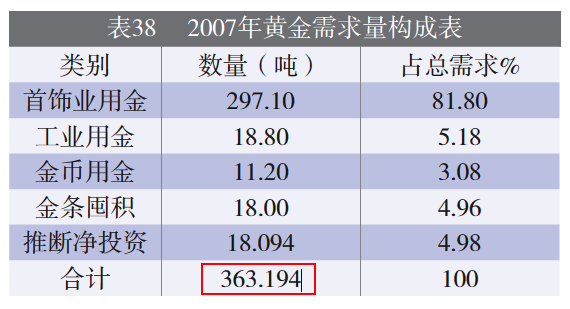

By approximation, the Chinese domestic gold market functioned as was planned starting in 2007, as in that year for the first time the amount of physical gold withdrawn from SGE vaults equaled Chinese wholesale gold demand that year. All supply and demand was matched at the SGE, without the interference of the PBOC in 2007. In the CGA Gold Yearbook 2007 it’s stated [brackets added]:

2007年,上海黄金交易所黄金出库量363.194 吨,即我国当年的黄金需求量,

In 2007, the amount of gold withdrawn from the warehouses of the Shanghai Gold Exchange, the total [wholesale] gold demand of that year, was 363.194 tonnes …

From 2002 until 2007 Chinese wholesale gold demand did not equal SGE withdrawals, to which we conclude the reform of the market wasn’t fully worked out in those years. From 2007 until 2011 SGE withdrawals exactly matched Chinese wholesale gold demand, from 2012 until present SGE withdrawals roughly matched Chinese wholesale gold demand, according to the metrics used by the CGA in its Gold Yearbooks published in Chinese print.

Until this date (2017) we deem SGE withdrawals to be a useful indicator for Chinese wholesale gold demand, though true Chinese gold demand is slightly lower.

There are a few basic rules in the Chinese domestic gold market that make SGE withdrawals equal Chinese wholesale gold demand, these rules compound to the mechanics of this market. In the following these rules are expanded upon. First with respect to the supply side, then the demand side.

Chinese Gold Import

Since 2011 the main conduit of supply into the Chinese domestic gold market has been bullion import. Gold bullion import into the domestic market can be done by banks that enjoy approval by the PBOC, though for every shipment a new License must be requested at the central bank. This policy is referred to as “one batch, one License". Bullion export from the Chinese domestic gold market is prohibited as far as is publicly known.

Currently there are thirteen banks that have been approved by the PBOC to import bullion, presented in random order:

- HSBC Bank (China) Ltd

- Australian and New Zealand Bank (China) Company Ltd

- Standard Chartered Bank (China) Ltd

- United Overseas Bank (UOB)

- Industrial and Commercial Bank of China (ICBC)

- China Construction Bank (CCB)

- Bank of China

- Agricultural Bank of China (ABC)

- Bank of Shanghai

- China Minsheng Bank (CMB)

- Industrial Bank

- Shenzhen Development Bank (SDB) / Ping An Bank

- Everbright

All bullion imported into the Chinese domestic gold market by one of the thirteen banks must be standard gold and sold first through the SGE. Standard gold in China is bullion casted by an LBMA or SGE approved refinery in bars or ingots of 50g, 100g, 1Kg, 3Kg or 12.5Kg, with a fineness of 9999, 9995, 999 or 995. Solely standard gold is allowed into SGE certified vaults to be traded through the SGE system. The Chinese cross-border gold trade rules state [brackets added]:

Gold to be imported … shall be registered at a spot gold exchange [SGE] approved by the State Council where the first trade shall be completed.

It’s possible non-bank gold enterprises, if approved by the PBOC, can import (and export) gold doré, ore and jewelry into / out of the domestic market if accompanied by a License, but this tonnage is insignificant in the greater scheme of things. Most gold imported is standard gold and very little gold is permitted to be exported. An exception, for example, is the Chinese Mint that can export golden Panda coins from the domestic market.

The Chinese domestic gold market with the SGE at its core is separated from Chinese Free Trade Zones (/Customs Specially Supervised Areas) where different cross-border trade rules are applicable.

Individuals can freely import and export 50 grams of gold when traveling abroad. However, the rule isn’t very stringent on the import side. Many mainland tourists visit Hong Kong to buy jewelry and bring as much jewelry as they like across the border when they return home. In Hong Kong jewelry doesn’t carry Value-Added Tax which makes these products less expensive than in China mainland.

The Value-Added Tax System

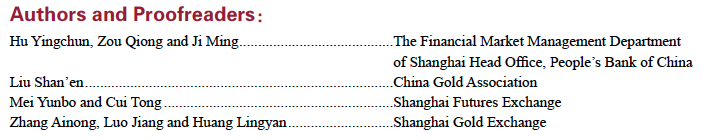

When standard gold is traded over the SGE or SHFE it’s exempt from Value-Added Tax (VAT). When standard gold is not traded over the SGE or SHFE it’s not exempt from VAT. In addition, when non-standard gold, for example 200 gram bars, is traded in the Chinese domestic gold market off-SGE it’s exempt from VAT.

The VAT rules in the domestic market incentivize wholesale gold supply to be traded in the form of standard gold through the SGE which is the most liquid exchange. (Also because gold within the SGE system is granted to be of the highest quality, which attracts most of demand in China. Any gold sold off-SGE can be of inferior quality.)

In the table below the different types of gold in China and the related VAT rates are listed.

Domestic Gold Mining

The People’s Republic of China has the biggest gold mine production globally with an output of roughly 453.49 tonnes per annum (2016). The vast majority of this output is sold first through the SGE, as Chinese miners are required to sell standard gold over the SGE (another incentive to channel supply to the SGE).

Overseas gold mining output can be imported into the Chinese domestic gold market, subsequently to be refined into standard gold by an SGE approved refinery and traded over the SGE.

Because of the aforementioned rules the best trading liquidity in China is at the SGE and thus gold mining companies are incentivized to cast their output in standard gold bars to sell on the SGE. However, miners are also allowed to sell non-standard gold or gold products off-SGE. For example, China National Gold Group Corporation is a mining company that has its own physical stores to sell bars and ornaments.

Recycled Gold

All supply that is not domestically mined or imported into China we’ll label as recycled gold. Because of the liquidity on the SGE and the VAT rules regarding standard gold, recycled gold in the domestic market has an incentive to flow through the Chinese center bourse as well. Recycled gold is not required to be sold through the SGE, yet many refineries cast standard gold and thus most finds its way to the center bourse.

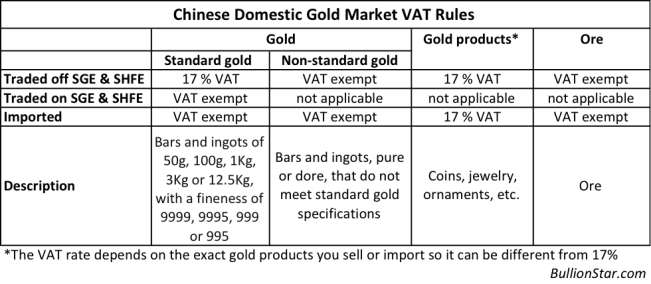

1. 上海黄金交易所标准金条 SGE Standard Gold Bar.

2. 上海黄金交易所标志 SGE Logo.

3. 品牌标志 Brand Logo.

4. 金条品牌 Bar Brand (泰山 is Mount Tai, which is produced by Shandong Gold).

5. 成色 Fineness.

6. 重量 Weight.

7. 金条编号 Bar Serial Number.

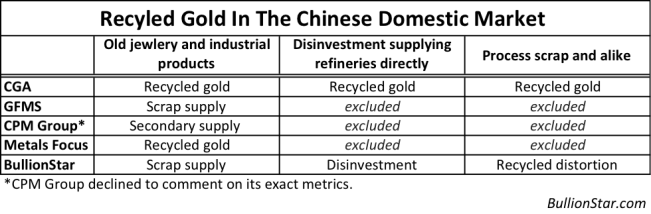

When it comes to measuring recycled gold supply it gets complicated as all sources available (CGA, GFMS, Metals Focus, CPM Group) for this data do not use the same methodology and nomenclature. In the remainder of this article the focus will be on the differences between GFMS and CGA metrics and nomenclature. The most significant difference with respect to recycled gold is that GFMS merely discloses scrap (old jewelry and industrial products that are sold by consumers) in their statistics, where the CGA discloses scrap, disinvestment, and “recycled distortion“, lumped together as recycled gold.

The significance of differentiating between several recycled gold types is to separate the ones that have no net effect on the price from the ones that do. Recycled gold can be subdivided in three categories (the following is BullionStar nomenclature):

- Scrap: old gold products (jewelry or industrial) sold for cash by consumers at retail level, and therefore true supply having a net effect on the gold price. These scrap flows are included by both GFMS and the CGA in their statistics.

- Disinvestment: bullion wholesale supply. Fact is, in China any individual or institutional investors can buy (demand) gold directly at wholesale level (SGE). If down the road these investors decide to sell (supply) gold they can do so directly to a refinery. Such disinvestment can then make its way to the SGE. An investor wanting to sell 1500 Kg in gold bars is not likely to walk into a jewelry store to sell its materials, more likely he will approach a refinery. Because disinvestment surpasses retail stores (jewelry shops and banks) it’s not included by GFMS in their supply statistics. The CGA does include disinvestment in their supply statistics. Disinvestment has a net effect on the price. It can also be referred to as institutional supply.

- Recycled distortion: recycled distortion can be for example process scrap, which is metal spilled in manufacturing processes of jewelry or industrial products. Suppose, a jewelry manufacturer buys 1 tonne of gold at the SGE and starts fabricating jewelry. During production 800 Kg makes it into finished products while 200 Kg is scrap spill over. The spill over, called process scrap, is directly being sold back from the jewelry manufacturer to a refinery making its way to the SGE. Effectively the 200 Kg has been recycled through the SGE being both demand and supply, having no net effect on the price. Therefore, process scrap overstates the supply and demand balance. Next to process scrap there can be other forms of gold being recycled through the SGE (i.e. gold used in VAT schemes), which we’ll collectively label as recycled distortion. Recycled distortion is not included in GFMS data, but is included in CGA data.

Have a look at an overview on how recycled gold types are named by all consultancy firms, next to if they’re included in their statistics.

Because in terms of trading total supply and total demand are exactly equal – one cannot sell gold without a buyer or buy gold without a seller – consequently we can gauge demand by measuring supply. And, as GFMS publishes incomplete Chinese gold demand statistics, it’s essential to measure all types of supply to get the best estimate of true Chinese gold demand.

Just like the London Bullion Market Association (LBMA) the SGE respects a chain of integrity. Meaning, only SGE approved refineries can supply bars to the SGE system and once bars are withdrawn from SGE certified vaults they leave the chain of integrity. To prevent fraud, hereafter, the bars that are withdrawn are not allowed to re-enter the SGE vaults. The only way they can re-enter the SGE system (the Chinese wholesale market) is if the bars are melted down and recast into new bars by an SGE approved refinery. In the SGE’s Detailed Rules for Physical Delivery of the Shanghai Gold Exchange it’s stated:

Article 23

Any gold bullion withdrawn by a member or customer shall not be loaded into any Certified Vault in the future.

The same rule is disclosed on the websites of China’s largest banks that offer customers SGE trading accounts. On ICBC’s website it’s stated (point 2):

This rule is important for comprehending the mechanics of the Chinese domestic gold market, because traders cannot easily recycle gold through the SGE.

SGE Withdrawals Equal Chinese Wholesale Gold Demand

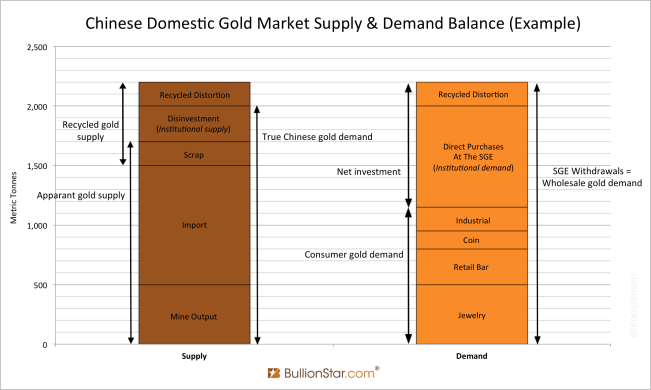

Above has been established that (in general) supply equals demand and in the Chinese domestic gold market nearly all supply flows through the SGE. Consequently, the volume of gold being withdrawn from SGE vaults is a proxy for Chinese wholesale gold demand. Additionally, we saw that that there is recycled distortion flowing through the SGE that is overstating the supply and demand balance. Simply put, when the volume of recycled distortion is subtracted from SGE withdrawals what is left is true Chinese gold demand.

Presented below are a few equations for clarification:

SGE withdrawals = Chinese Wholesale Gold Demand

As import + mine + scrap + disinvestment + recycled distortion is total physical supply to the SGE and everything that is withdrawn is total demand:

SGE Withdrawals = Import + Mine + Scrap + Disinvestment + Recycled Distortion = Total Supply = Wholesale Demand

But as was mentioned before recycled distortion blurs our view of demand, it has no net effect on the price, so it has to be subtracted from SGE withdrawals:

True Chinese Gold Demand = Import + Mine + Scrap + Disinvestment = SGE Withdrawals – Recycled Distortion

Chinese Wholesale Gold Demand = True Chinese gold demand + Recycled Distortion = SGE Withdrawals

In a graph:

Please note, in our Chinese gold supply and demand study two elements are left out. On the supply side we left out stock carry over in SGE vaults from previous years, as this information is not publicly available, on the demand side we left out gold bought at the SGE that was not withdrawn from the vaults (i.e. GAP and ETF holdings), as this information is not precisely known.

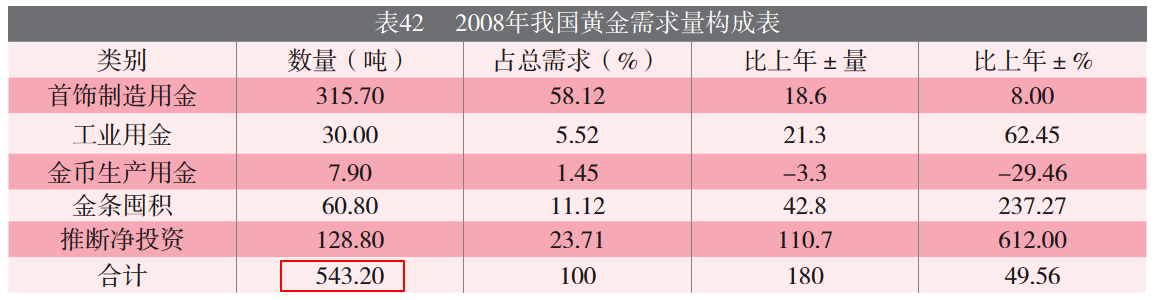

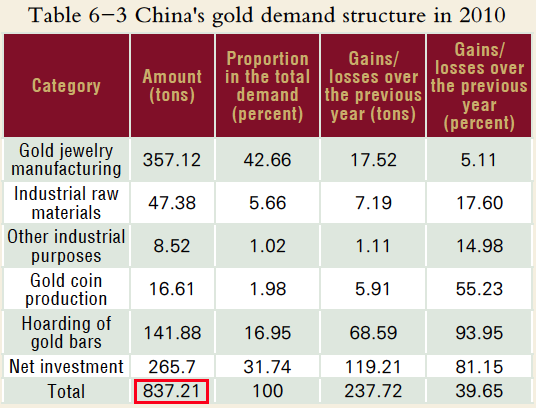

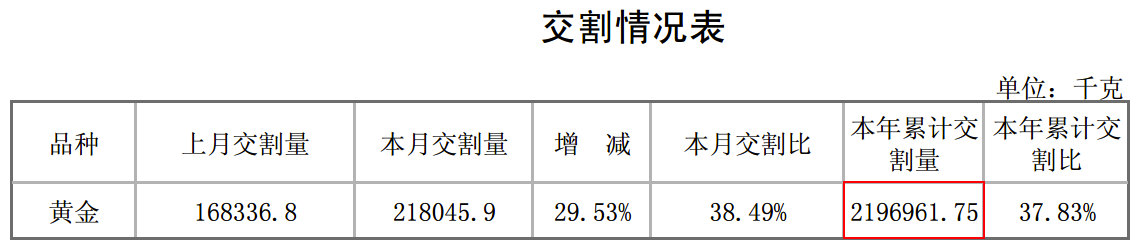

The formulas are supported by reports from the CGA and SGE from 2007 until 2013, as every year SGE withdrawals equaled wholesale gold demand in these documents. Presented are CGA demand figures and SGE withdrawals from 2007 until 2013:

2007: SGE Withdrawals 363.2 Tonnes

2008: SGE Withdrawals 543.2 Tonnes

2010: SGE Withdrawals 837.2 Tonnes

2013: SGE Withdrawals 2,197 Tonnes

In the last screen shots (from the CGA Gold Yearbook 2013) we can see total supply/demand in 2013 was 2,198.84 tonnes, which is 1.88 tonnes higher than SGE withdrawals. This can be explained by jewelry import that was counted as demand, but not sold through the SGE.

Chinese Gold Demand Metrics

After having examined the supply side of the Chinese domestic gold market let’s move on to the demand side. From the fact most supply flows to the SGE, logically most demand is directed to to the SGE as well.

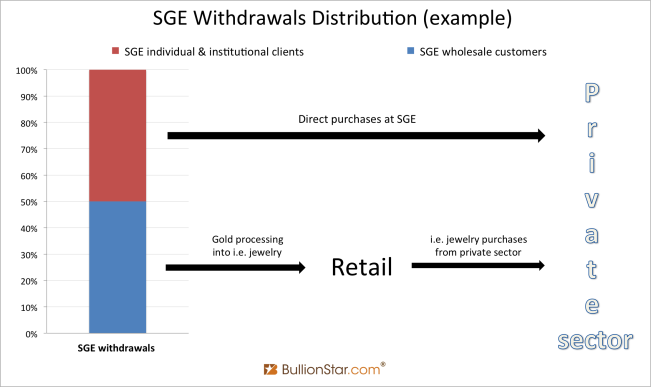

Chinese wholesale gold demand as disclosed by the CGA, which equals SGE withdrawals, is the widest measure of demand. It consists of consumer demand, institutional demand and recycled distortion (see exhibit 6 and 15). Consumer demand includes jewelry, bar and coin sales at retail level and gold used in industrial fabrication. Institutional demand comprises, in the case of China, individual and institutional investors buying bullion directly in the SGE wholesale market.

The predominant reason for the difference between SGE withdrawals and Chinese gold demand as disclosed by GFMS, is the fact that GFMS only discloses consumer demand in its reports, not institutional demand. (And they do so not only for China but for the rest of the world as well, which is an incomplete and misleading representation of gold supply and demand. Hereby GFMS makes gold look like a commodity instead of a currency, denying its most important trading characteristics in price formation.) Stunningly, the difference between SGE withdrawals and GFMS demand has aggregated to an astonishing 6,032 tonnes from January 2007 until December 2016. The next graph illustrates the difference.

As on the supply side, we can draft simple equations for the demand side:

SGE Withdrawals = Consumer Demand + Institutional Demand + Recycled Distortion = Chinese Wholesale Gold Demand

Consumer Demand + Institutional Demand = True Chinese Gold Demand

Consumer Demand = Jewelry + Retail Bar & Coin + Industrial

Institutional Demand = Direct Purchases At The SGE

Direct Purchases At The SGE (Institutional Demand) = SGE Withdrawals – Recycled Distortion – Consumer Demand

In the CGA demand table for 2013 (exhibit 14) it’s stated the difference between consumer demand and total demand was labeled as net investment, which is calculated by the CGA as a residual, ‘SGE withdrawals minus consumer demand’. Demonstrated in equations:

Net Investment = Institutional Demand + Recycled Distortion

Net Investment = SGE Withdrawals – Consumer Demand

Institutional Demand = Net Investment – Recycled Distortion

However, because the exact volume of recycled distortion and disinvestment is unknown, institutional demand is unknown as well. Our best estimate of institutional demand is net investment. Again, all this is clearly illustrated in exhibit 6.

Everyone In China Can Buy Gold Directly At The SGE

So what’s causing the massive direct purchases at the SGE? “Demand for gold", is the simple answer. But there’s more that can be told on direct purchases.

In China not only wholesale enterprises such as jewelry manufacturers and bullion banks can trade gold on the SGE, everyone can open an SGE account and start trading. The next graph illustrates how wholesale manufacturers are responsible for approximately half of SGE withdrawals (for exact ratios see exhibit 16). These wholesale enterprises will buy gold at the SGE and subsequently withdraw the metal to fabricate products (ie jewelry, ornaments and bank bars) to be sold at retail level. Individual and institutional SGE customers are responsible for the other half of SGE withdrawals. These customers will buy gold directly at the SGE and withdraw the metal to store in private vaults.

According to my analysis the PBOC does not buy its monetary gold through the SGE, so effectively all gold flowing through the SGE ends up in the private sector.

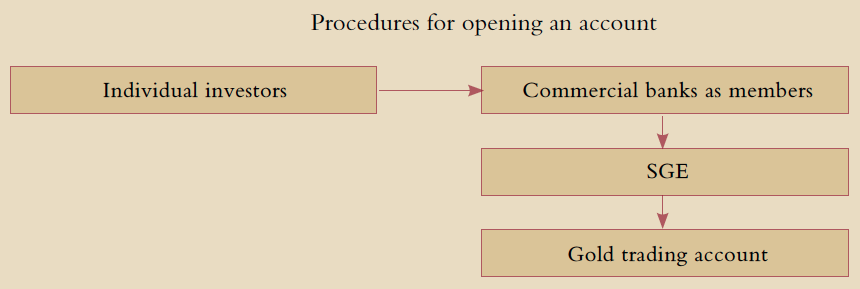

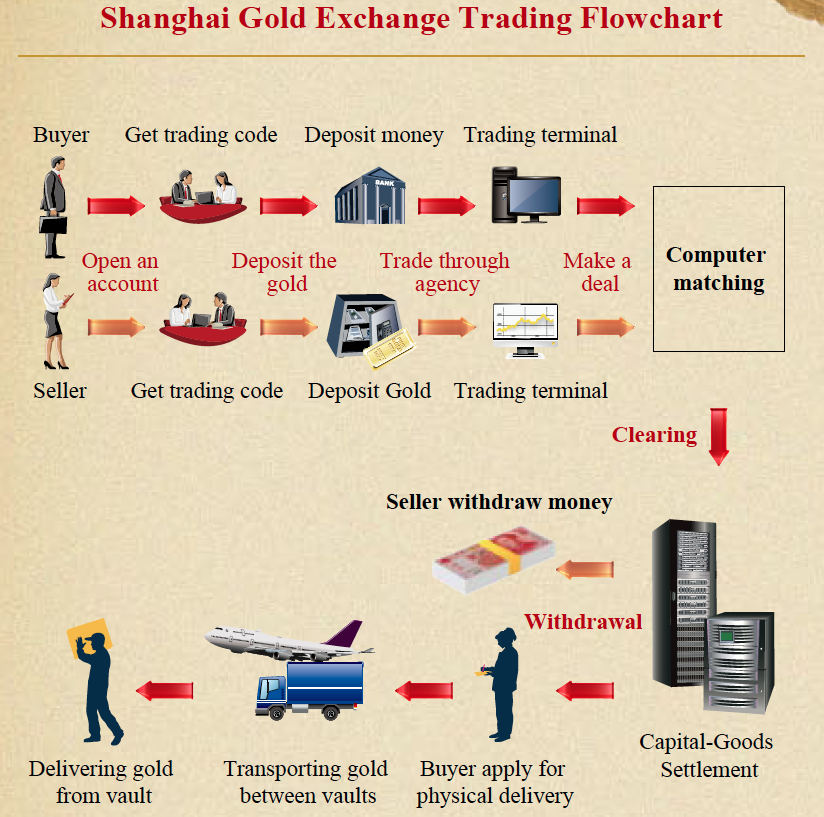

Purchasing gold directly at the SGE is fairly simple in China. Every natural person, institution or wholesale enterprise can buy gold or trade derivatives at the SGE. For 50 RMB one can open an SGE account at his local commercial bank branch or via a smartphone application. Then, he or she receives a unique 10-digit trading number that gives access to the account consisting of a Bullion Account and Margin Account. The 10-digit trading number will stay with an individual forever, even if he or she switches banks. The procedure is illustrated in the picture below:

When an SGE physical gold contract is exchanged the full amount of funds is promptly transferred from the buyer’s Margin Account to seller’s Margin Account. At the same time the related bullion is transferred from the seller’s Bullion Account to the buyer’s Bullion Account (settlement is T+0). Gold credited to a Bullion Account is allowed to be withdrawn from the vaults at any time.

Early 2016 was the launch of the smartphone application Yijintong that allows anyone with an internet connection in China to open an SGE account and trade directly on the SGE wholesale platform appreciating the lowest spreads in China. The Yijintong smartphone app can be downloaded through the following QR-code:

As fas as is publicly known, when Yijintong was launched the SGE already counted 8.3 million individual and 10,000 institutional customers, next to 246 members globally of which 183 domestic members and 63 international members. From the huge amount of individual and institutional customers we can easily understand the huge volumes of direct purchases at the SGE.

The only reason individual investors would buy gold in a jewelry shop or bank is because these bars are aesthetically superior and come in all sorts of shapes and sizes.

Though decorated bars come at a significant premium. Obviously, large investors would not buy retail bars but prefer relatively cheaper SGE bars. Which is the reason for the huge discrepancy between consumer demand and SGE withdrawals: many investors buy gold directly at the SGE.

Wang Zhe, Chairman & President of the SGE in 2010 wrote:

During the first four months of this year, the number of individual investors kept growing rapidly and now has exceeded two million. The Exchange has become the main channel of investment of physical precious metals, fulfilling the needs of domestic residents.

This quote describes that as early as in 2010 direct purchases at the SGE by individual clients exceeded retail bar purchases. And individual/institutional investors bypassing retail shops buying gold directly at the SGE has been a trend that has accelerated ever since (see exhibit 16).

Conclusion

By now a comprehensive framework has been provided of the basic mechanics of the Chinese domestic gold market. From all the equations and illustrations presented readers should be able to grasp the sheer size of this physical gold market.

Kindly note, to avoid confusion, in some publications the CGA discloses only consumption demand, similar to GFMS, excluding net investment. For example in 2014 [brackets added]:

Gold consumption in China grew to 1,176.40 tonnes [in 2013] … , with jewellery demand … 716.50 tonnes and [retail] bullion demand … 375.73 tonnes

The CGA states in the quote above consumer gold demand was 1,176.4 tonnes in 2013, while we read in other publications (exhibit 14) wholesale gold demand was over 2,000 tonnes.

Lastly, more examples are provided that confirm the more realistic size of Chinese gold demand. Na Liu, from CNC Asset Management Ltd, traveled to China in 2014 and spoke to The President of the SGE Transaction Department. Afterwards Na reported on Chinese gold demand in 2013 [brackets added]:

The President of SGE Transaction Department (The President) said: “This 2,200 tonnes of gold, after leaving our vaults, they entered thousands of Chinese households in the form of jewellery and investment purchases [consumer demand + direct purchases].”

…when we asked why the China Gold Association’s [consumer demand] number is so low, the President said: “They mainly cover the gold sales through the gold shops. This is their main source of information. And their number is quite useful in that way. However, our system [SGE withdrawals] has broader coverage.”

Clearly consumer demand is “gold sales through the gold shops" and SGE withdrawals have “broader coverage" (consumer demand + direct purchases at the SGE).

Needless to say, the people that run the SGE, CGA, PBOC and SHFE are all related. Depending on the occasion they choose to disclose consumer demand or wholesale gold demand. SGE Chairman, Xu Luode, said at the LBMA conference in 2014 [brackets added]:

Last year [2013], China imported 1,540 tonnes of gold. Such imports, together with the 430 tonnes of gold we produced ourselves, means that we have, in effect, supplied approximately 2,000 tonnes of gold last year.

The 2,000 tonnes of gold were consumed by consumers in China. Of course, we all know that the Chinese ‘dama’ [middle-aged women] accounts for a significant proportion in purchasing gold. So last year, our gold exchange’s inventory reduced by nearly 2,200 tonnes [SGE withdrawals], of which 200 tonnes was recycled gold.

Typically, Xu measures ‘import + mine production’ (∼2,000 tonnes in 2013) for Chinese gold demand, as this is the amount of gold added to Chinese private sector reserves (recycled gold doesn’t add anything to reserves). Indirectly Xu reveals his interest in the amount of private sector gold reserves within the domestic market.

All in all, there are several ways to measure Chinese gold demand. A next article is dedicated to the data and details of all metrics, for now, please have look at the next overview:

- Gold sold at retail level (consumer demand) = GFMS demand

- Import + mine = net gold added to Chinese private sector reserves

- Import + mine + scrap + disinvestment = true Chinese gold demand

- SGE withdrawals = wholesale gold demand

The definition of SGE withdrawals slightly changed late 2014 with the inception of the Shanghai International Gold Exchange. How it was changed can be read in the subsequent posts of the Chinese Gold Market Essentials (Workings Of The Shanghai International Gold Exchange, Why SGE Withdrawals Equal Chinese Gold Demand And Why Not – The Argument List).

Popular Blog Posts by Koos Jansen

China’s Secret Gold Supplier is Singapore

China’s Secret Gold Supplier is Singapore

Audits of U.S. Monetary Gold Severely Lack Credibility

Audits of U.S. Monetary Gold Severely Lack Credibility

China Gold Import Jan-Sep 797t. Who’s Supplying?

China Gold Import Jan-Sep 797t. Who’s Supplying?

The Gold-Backed-Oil-Yuan Futures Contract Myth

The Gold-Backed-Oil-Yuan Futures Contract Myth

Estimated Chinese Gold Reserves Surpass 20,000t

Estimated Chinese Gold Reserves Surpass 20,000t

Did the Dutch Central Bank Lie About Its Gold Bar List?

Did the Dutch Central Bank Lie About Its Gold Bar List?

PBOC Gold Purchases: Separating Facts from Speculation

PBOC Gold Purchases: Separating Facts from Speculation

U.S. Mint Releases New Fort Knox Audit Documentation

U.S. Mint Releases New Fort Knox Audit Documentation

China Net Imported 1,300t of Gold in 2016

China Net Imported 1,300t of Gold in 2016

Why SGE Withdrawals Equal Chinese Gold Demand and Why Not

Why SGE Withdrawals Equal Chinese Gold Demand and Why Not

Koos Jansen

Koos Jansen