Mechanics of the Chinese Domestic Gold Market

Introduction

The Chinese gold market is the world’s largest physical gold market. It is also one of the world’s most protected gold markets given that the importation of gold into China is still strictly controlled by the Chinese authorities, and the exportation of gold out of China is generally prohibited.

Hence, the market is often referred to as the Chinese ‘domestic’ gold market since gold flows and gold trading in the market are predominantly domestic in nature. Despite these trade restrictions, China still manages to be the largest importer of gold in the world. Furthermore, the Chinese gold mining sector is also the largest producer of gold in the world.

At the heart of the Chinese domestic gold market lies the Shanghai Gold Exchange (SGE). Due to the depth of SGE liquidity and the centrally imposed rules of the Chinese gold market such as cross-border trade rules and VAT rules, nearly all gold flows in China are required to and/or are incentivized to pass through the SGE trading and vaulting system. This includes nearly all gold imported into China and nearly all gold mined within China. The SGE vaulting system consists of 61 vaults across 35 Chinese cities.

In 2016, China net imported an estimated 1300 tonnes of gold[1], and Chinese gold mines produced an estimated 455 tonnes of gold[2].

During 2016, physical gold withdrawals from the SGE totalled 1970 tonnes[3], and total gold trading activity on the SGE during 2016 reached a record 24,338 tonnes[4].

Since nearly all physical gold supply in the Chinese market flows through the SGE vault network, by definition nearly all Chinese gold demand has to be met by withdrawing physical gold from the SGE (i.e. SGE gold withdrawals). Therefore an analysis of SGE gold withdrawals provides a realistic window into the true size of the Chinese gold market and the true size of Chinese gold demand.

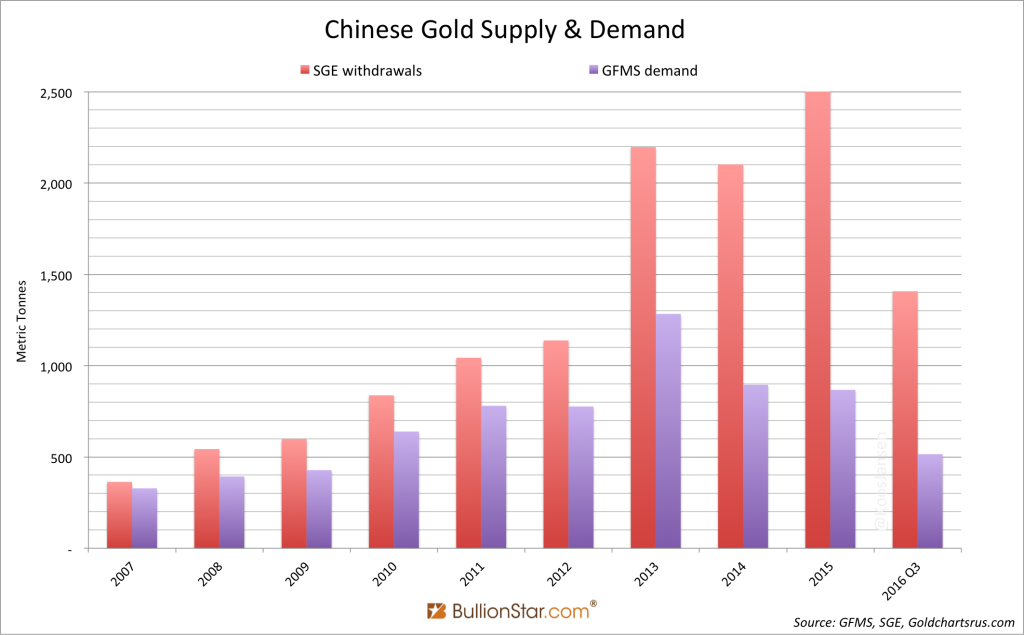

Physical gold withdrawal volumes from the SGE vaults are now remarkably large each year, and have continued to ramp up noticeably since 2013. In 2012, SGE gold withdrawals totalled 1139 tonnes. By 2013, gold withdrawals from the SGE vaults nearly doubled to 2197 tonnes. In 2014, the Exchange saw 2102 tonnes of gold withdrawn, and in 2015 a huge 2596 tonnes of gold left the SGE vaults. Gold withdrawals in 2016 were slightly down on 2015 with 1970 tonnes withdrawn.

Some high-profile precious metals consultancies such as Thomson Reuters GFMS and the World Gold Council still publish annual Chinese gold demand figures that are far lower (for example 900 tonnes per annum) than the annual SGE gold withdrawal figures. These discrepancies are so large that they call for rigorous analysis and explanation. Note that other bodies, such as the China Gold Association (CGA) do state that Chinese gold demand equals SGE gold withdrawals.

Contents

- 1. Introduction

- 2. Brief History of the Shanghai Gold Exchange

- 3. SGE Withdrawals Equal Chinese Wholesale Gold Demand

- 4. Standard Gold

- 5. VAT Rules on Gold On and Off the SGE

- 6. SGE Gold Refiners

- 7. Chinese Gold Imports

- 8. Domestic Gold Mining

- 9. Recycled Gold

- 10. Chinese Wholesale Gold Demand

- 11. References and Links

Highlights

-

The Shanghai Gold Exchange (SGE) was established in 2002 as a free-market gold allocation mechanism for the domestic Chinese gold market in place of the previous central allocation model employed by the Chinese central bank.

-

By 2007, physical gold withdrawals from the SGE (SGE Gold Withdrawals) were fully meeting Chinese wholesale gold demand. Therefore SGE Gold Withdrawals are a suitable proxy for Chinese wholesale gold demand.

-

Gold supply in China can be accounted for by gold imports, gold production from mining, gold recycling, disinvestment and recycling distortion

-

Gold demand in China comprises both consumer gold demand and institutional gold demand, both of which are met from gold withdrawals from the SGE

-

Since the SGE plays such a central role in the Chinese gold markets, the Chinese gold supply-demand equation can be overlaid on to SGE Supply and SGE Gold Withdrawals

Brief History of the Shanghai Gold Exchange

The idea for a central gold exchange in China was first publicised in 2000 and grew out of China’s gold market liberalisation strategy which involved the transition from a State / PBoC controlled monopoly on the gold market to a free market gold sector involving a ‘gold exchange’ in Shanghai[5]. The structure of this Exchange, still under the administration of the PBoC, would allow the Chinese State to monitor gold trading in the Chinese market, while giving China’s population access to the wholesale gold market. The Exchange was launched in October 2002, and by 2004, private citizens in China were allowed to trade in and own gold bullion.

Prior to the launch of the SGE in 2002, the Chinese State had for 50 years practised a centralised model of gold allocation in the economy, with the PBoC solely responsible for trading gold in China and supplying the Chinese gold ‘market’ with an adequate allocation of gold each year.

The adjustment from centralised allocation of gold to free market allocation of gold took a few years to reach a stage at which the Exchange was fully playing the allocation role. This is evident from the fact that between 2002 and 2006 inclusive, annual Chinese wholesale gold demand still exceeded SGE gold withdrawals, which meant that SGE gold supply was only partially meeting the national wholesale gold demand, with the PBoC still facilitating residual supply by direct allocation.

Then in 2007 for the first time, physical gold withdrawals from the SGE began to equal Chinese wholesale gold demand. This signalled that the SGE had begun to fully fulfilling its gold allocation function for the entire Chinese gold market.

The 2007 China Gold Association (CGA) Gold Yearbook confirmed this milestone:

“2007年,上海黄金交易所黄金出库量363.194 吨,即我国当年的黄金需求量,

In 2007, the amount of gold withdrawn from the warehouses of the Shanghai Gold Exchange, the total [wholesale] gold demand of that year, was 363.194 tonnes …”

The relevant CGA Gold Yearbooks from 2008 to 2011 also confirm that in each of these years SGE withdrawals exactly matched Chinese wholesale gold demand. Following this, from 2012 to the present, annual SGE withdrawals have approximately matched Chinese wholesale gold demand.

SGE gold withdrawals are therefore a suitable proxy for Chinese wholesale gold demand. However, note that true Chinese gold demand is slightly lower than SGE gold withdrawals due to adjustments for gold recycling.

SGE Withdrawals Equal Chinese Wholesale Gold Demand

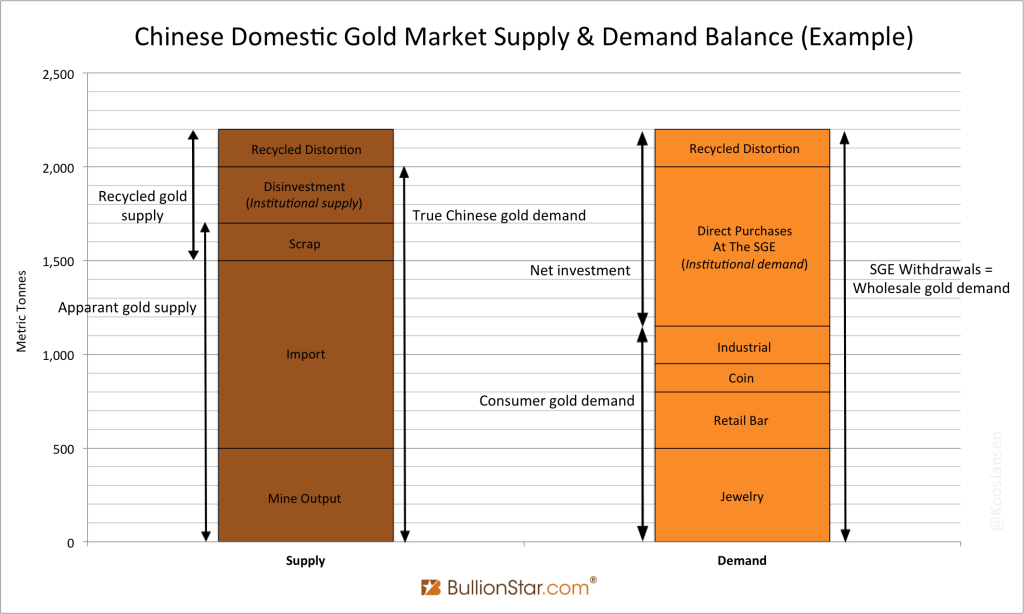

At a high level, Gold Supply in the Chinese domestic gold market equals Gold Demand in the Chinese domestic gold market. This is so because nearly all gold supply in the Chinese domestic gold market flows through the SGE. Correspondingly, the volume of gold withdrawn from the SGE gold vaults is a suitable proxy for Chinese wholesale gold demand.

These supply-demand relationships can be summed up in the following Identities:

Physical Gold Supply to the SGE = SGE Withdrawals = Chinese Wholesale Gold Demand

SGE Physical Gold Supply = Gold Imports (1) + Mine supply (2) + Gold Scrap / Recycling (3) + Disinvestment (4) + Recycled Distortion (5)

Chinese Wholesale Gold Demand = SGE Withdrawals = Consumer Demand + Institutional Demand + Recycled Distortion

Consumer Demand = Jewellery + Retail Gold Bar & Gold Coin demand + Industrial demand

Institutional Demand = Direct Gold Purchases At The SGE

Consumer Demand + Institutional Demand = True Chinese Gold Demand

SGE Withdrawals – Recycled Distortion = True Chinese gold demand

Direct Purchases At The SGE = SGE Withdrawals – Consumer Demand – Recycled Distortion

It’s instructive to examine in turn each of the components of SGE gold supply. It’s also important at the outset to discuss the concepts of ‘Standard Gold’ and VAT rules as they apply to gold in China, and to appreciate the SGE chain of integrity which prevents gold that has exited the SGE vaulting system from re-entering the SGE vaulting system unless it has been recast into new gold bars by an SGE approved gold refinery.

Standard Gold

Standard Gold in China is bullion cast by a LBMA or SGE approved refinery in the form of bars or ingots of 50 gram, 100 gram, 1 kilogram, 3 kilogram or 12.5 kilogram form, with a fineness (gold purity) of 9999, 9995, 999 or 995. The SGE defines the 1 kg, 3 kg and 12.5 kg weights as ‘Ingots’, and the 50 gram and 100 gram weights are ‘Bars’. These 5 ingot / bar sizes are also known as Shanghai Good Delivery bars[6].

Specifically, the physical gold ingots /bars deliverable on the SGE Main Board[7] are:

- gold ingots with a standard weight of 1 kg and a fineness of >= 999.9

- gold ingots with a standard weight of 3 kg and a fineness of >= 999.5

- gold ingots with a standard weight of 12.5 kg and a fineness >= 995.0

- gold bars with a standard weight of 0.05 kg and a fineness of >= 999.9

- gold bars with a Standard Weight of 0.1 kg and a fineness of >= 999.9

Note that the gold ingots /bars deliverable on the SGE International Board[8] are the 1 kg and 12.5 kgs gold ingots and the 0.1 kg gold bars.

In July 2015, the LBMA and the SGE announced that they would both mutually recognise specifications for 9999 gold kilobars[9], such as weight, dimensions, fineness, marks on bar.[10]

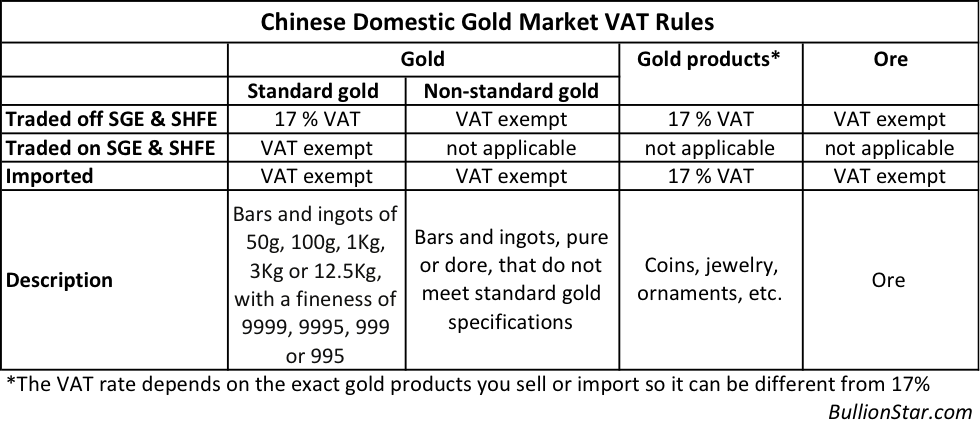

VAT Rules on Gold On and Off the SGE

When Standard Gold is traded on the SGE, it is exempt from Value-Added Tax (VAT). When Standard gold is not traded over the SGE it is not exempt from VAT. There is therefore an incentive for the gold owner to trade Standard Gold on the SGE. Note that these VAT rules also apply to the Shanghai Futures Exchange (SHFE), where Standard Gold is VAT-exempt on the SHFE but not off the SHFE.

Furthermore, when Non-Standard gold, for example 200 gram gold bars, is traded in the Chinese domestic gold market off the SGE, it is exempt from VAT. To summarize:

- Standard Gold traded on SGE is VAT exempt

- Standard Gold traded off the SGE incurs a VAT rate of 17%

- Non-Standard Gold traded off the SGE is VAT exempt

- Non-Standard Gold cannot be traded on the SGE

The VAT rules on gold in the domestic Chinese gold market therefore incentivize wholesale gold supply to be traded in the form of Standard Gold through the SGE.

As regards trading liquidity, this creates a virtuous circle for the SGE since the rules on Standard Gold and the VAT rules funnel more gold trading activity through the Exchange. This boosts liquidity which in turn attracts more trading to the SGE to the higher trading liquidity present on the Exchange.

SGE Gold Refiners

The SGE operates a gold bar chain of integrity system wherein only SGE approved gold refineries can supply gold bars to the SGE system (aka the Chinese wholesale market) and once gold bars are withdrawn from SGE certified vaults they leave the chain of integrity. This means that gold bars withdrawn from the SGE vaults are precluded from re-entering SGE vaults except if they have been melted down and recast into new gold bars by an SGE approved refinery. This chain of integrity is similar to the one employed by the London Bullion Market Association (LBMA).

Article 23 of the SGE’s Detailed Rules for Physical Delivery of the Shanghai Gold Exchange states that:

“Any gold bullion withdrawn by a member or customer shall not be loaded into any Certified Vault in the future“

This strict gatekeeping for gold returning to the SGE system is important to bear in mind as it has a real impact on the supply-demand mechanics of the Chinese domestic gold market.

A full list of SGE Standard Gold Bars and Standard Gold Ingot Delivery Refiners is available on the SGE website[11]

Chinese Gold Imports

In 2011, for the first time ever, Chinese gold imports exceeded Chinese domestic gold production, with China importing 380 tonnes of gold against domestic gold mining output of 360 tonnes of gold. This trend has persisted in all years since 2011. most recently, for the full year 2016, China net imported an estimated 1300 tonnes of gold from abroad[12].

Only PBoC approved commercial banks can import gold bullion into the domestic gold market. Currently there are thirteen banks approved by the PBOC to import gold bullion into China, four of which are foreign banks, namely HSBC, ANZ, Standard Chartered and United Overseas Bank (UOB), and the other nine of which are Chinese banks including ICBC, Bank of China, and China Construction Bank. See BullionStar Gold University article “Chinese Cross-border Trade Rules on Gold” for more details and a list of approved banks[13]:

All bullion imported into the Chinese domestic gold market by PBoC approved banks above must be in the form of Standard Gold. And since Standard Gold must be first sold through the SGE, all bullion imported by the approved banks is first sold on the SGE.

Chinese cross-border gold trade rules, specifically Article 6 of the PBoC “Measures for the Import and Export of Gold and Gold Products” states that:

“Gold to be imported … shall be registered at a spot gold exchange [SGE] approved by the State Council where the first trade shall be completed”[14]

Since only Standard Gold is tradable on the SGE, only Standard Gold is allowed into SGE certified vaults. Non-bank gold enterprises can also gain PBoC approval to import (and export) gold doré, ore and jewellery into / out of the domestic market.

In general, gold bullion exports from the Chinese domestic gold market are prohibited. However, a number of forms of gold exports out of China are allowed. These include gold exports via processing trade, China Panda gold coin exports by the Chinese Mint, and small individual limits (50 grams) on individuals legally carrying gold across the border when leaving China.

Domestic Gold Mining

With gold output in 2016 reaching an estimated 455 tonnes of gold[2], gold mining production in the People’s Republic of China (PRC) is the second largest source of gold supply for the Chinese domestic gold market after gold imports.

The vast majority of this Chinese gold mining output is initially sold through the SGE. This is because trading liquidity is highest on the SGE. Since Standard gold is VAT exempt when traded on the SGE and since only Standard Gold can be traded on the SGE, Chinese miners are incentivized to cast their output into Standard Gold and sell it on the SGE.

Note that overseas gold mining output from Chinese owned mines abroad can also be imported into the Chinese domestic gold market and then refined into Standard Gold by an SGE approved refinery before being traded over the SGE.

Note also that Chinese gold mining companies are permitted to sell Non-Standard gold and other gold products off of the SGE. For example, the large gold miner China National Gold Group Corporation operates its own physical shop outlets / stores in which it sells gold bars and gold ornaments.

Recycled Gold

The third distinct source of gold supply to the Chinese domestic gold market is ‘Recycled gold’. The fraction of Chinese gold supply that is not imported into the Chinese domestic market and that is not domestically mined can be categorized as recycled gold.

Similar to primary gold mining output, recycled gold is also incentivized by the SGE liquidity and VAT rules to flow into the SGE vaults for trading on the Exchange. However, there is no regulatory or government obligation for recycled gold to have to be sold via the SGE. The liquidity and VAT rules merely make it attractive for gold refineries to refine recycled gold into Standard Gold ingots or Standard Gold bars and then to trade these ingots and bars through the SGE.

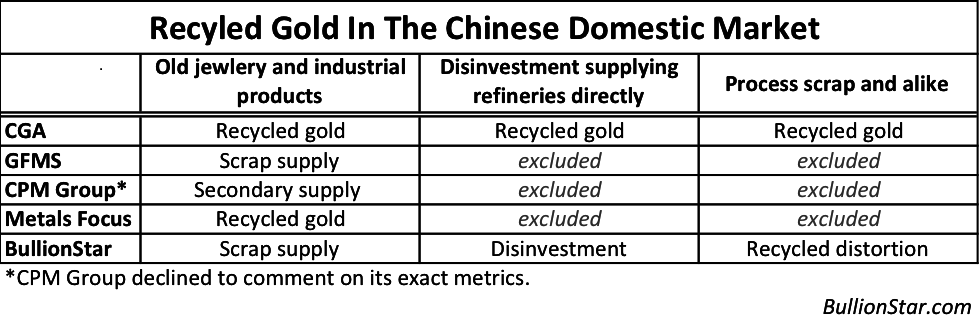

Importantly however, the measurement of recycled gold as a component of Chinese gold supply is not consistent between the well-known data providers such as the China Gold Association (CGA) and Thomson Reuters GFMS. This is because the various data providers use differing sets of metrics and nomenclature.

Estimates of the amount of recycled gold in the Chinese gold market will therefore vary. The following table lists recycled gold category names used by a number of consultancy firms, and shows which types are included in which sets of gold supply statistics.

Recycled Gold in the Chinese Domestic Market, by Category

GFMS’ recycled gold data focuses only on scrap gold. This includes old gold jewellery sold by consumers and industrial product scrap. Conversely, the CGA data for recycled gold consists of three elements, namely, scrap gold, disinvestment, and a category of recycled gold known as recycled distortion. Some of these categories have a net effect on the gold price and some do not.

Scrap Gold: Scrap gold refers to old gold products (from either jewellery or industrial products) that are sold for cash by consumers at the retail level. Scrap gold boosts real gold supply and has a net effect on the gold price. Both GFMS and the CGA include scrap gold flows in their respective gold supply statistics.

Disinvestment: Disinvestment has an effect on institutional gold supply and also has a net effect on the gold price. In China, any individual or institutional investor can buy gold directly at the wholesale level on the SGE (investment demand) and then withdraw this gold from the SGE. If some of these investors subsequently decide to sell (supply) their gold again, they can sell it directly to a gold refinery. These gold flows are defined as disinvestment and these flows can then make their way back to the SGE vaults for trading on the SGE.

Disinvestment of large amounts of investment gold will tend to be executed not at the retail level such as at a jewellery store but more likely at a gold refinery. But because disinvestment bypasses the retail level (e.g. jewellery shops and bank branches), disinvestment will not be captured by GFMS in its gold supply statistics. Note that the CGA does include disinvestment in its gold supply statistics.

The final category can be labelled as Recycled Distortion, an example of which is “Process Scrap”. Process scrap refers to residual metal left over after fabrication or manufacturing of gold jewellery or industrial products. This could, for example, be from metal spilled during jewellery fabrication. The fabricator sells this scrap to a gold refinery which then reforms the gold into Standard Gold and the gold makes its way back to the SGE. Process scrap gold overstates supply to the SGE and also subsequent demand on the SGE because it has no net effect on the gold price. So both supply and demand would need to be adjusted downwards in this case.

Recycled distortion is a term used at BullionStar to refer to recycled gold that is not scrap and is not disinvestment, and that could include process scrap but also other types of recycling. Recycled distortion is not included in GFMS data, but is included in CGA data.

Recycled distortion that flows through the SGE overstates both the supply and demand sides. When the volume of recycled distortion is subtracted from SGE withdrawals, the result is ‘True Chinese gold demand’.

Chinese Wholesale Gold Demand

Having looked at the supply side of the equation in the domestic Chinese gold market, it’s important to examine the demand side. Since most gold supply in China flows through the SGE, logically, most gold demand has to be met by SGE gold withdrawals.

Therefore, SGE gold withdrawals are a suitable proxy for Chinese wholesale gold demand which is the widest measure of gold demand in China. On a high level, Chinese wholesale gold demand consists of consumer demand, institutional demand and recycled distortion.

Consumer demand is primarily gold jewellery demand, gold bar and gold coin sales at the retail level, and gold that is used in industrial fabrication. Institutional demand comprises individual and institutional investor purchases of gold bullion directly on the SGE wholesale market.

The following bar chart graphically captures the supply side and demand side components of the domestic Chinese gold market. Gold supply is broken down into mine output, imports, scrap, disinvestment and recycled distortion. Gold demand is broken down into jewellery demand, coin and bar demand, and industrial demand (all of which are consumer related), and also direct gold buying on the SGE (institutional demand), and finally a recycled distortion component which is the same size as on the supply side.

Chinese Domestic Gold Market Supply & Demand Balance

From the above bar chart, it can be seen that the main reason why annual gold demand as defined by, for example, consultancy Thomson Reuters GFMS is far lower than the size of SGE withdrawals each year is because GFMS only estimates consumer gold demand and ignores institutional demand.

GFMS Demand Data = Chinese consumer gold demand data

By ignoring institutional demand which is essentially investment demand, the GFMS data is vastly underestimating investment demand for gold in China. The GFMS data is therefore incomplete and is not an accurate representation of full gold supply and demand in China[16].

On a cumulative basis from January 2007 to September 2016, the difference between SGE gold withdrawals and GFMS gold demand reaches a massive 5922 tonnes of gold, as can be seen in the following chart:

GFMS Gold Demand and SGE Gold Withdrawals, 2007 – 2016

Remembering that:

Chinese Wholesale Gold Demand = SGE Withdrawals = Consumer Demand + Institutional Demand + Recycled Distortion

and that:

Institutional Demand = Direct Purchases At The SGE

and that:

Consumer Demand + Institutional Demand = True Chinese Gold Demand

Then it’s interesting to note that the China Gold Association (CGA) defines the difference between Chinese total gold demand and Chinese consumer gold demand as ‘Net Investment’. i.e.:

Net Investment = SGE Withdrawals – Consumer Demand

Net Investment = Institutional Demand + Recycled Distortion

The composition of ‘Direct Purchases on the SGE‘ is also illuminating. In China, anyone can open an account and buy gold directly on the Shanghai Gold Exchange. This includes individual citizens and wholesale enterprises such as jewelry manufacturers and bullion banks. About 50% of SGE gold withdrawals are from wholesale gold manufacturers/fabricators. The other 50% of SGE gold withdrawals are from individual and institutional customers who purchase gold on the SGE and then withdraw it from the SGE vault network.

Some of the difference between GFMS consumer gold demand numbers and SGE gold withdrawals can legitimately be explained by phenomena that would inflate Chinese gold demand, such as inventory / stock movement changes and gold-for gold scrap (process scrap). Inventory / stock movement changes would, for example, be gold that jewellery manufacturers, gold refineries, industrial companies and the mint have bought at the SGE, but not yet sold in the retail market. But after adjusting for these legitimate explanations, whatever is left is genuine gold demand, created by direct purchases from individual and institutional customers on the SGE.

References and Links

1.^ “China Net Imported 1,300t Of Gold In 2016”, BullionStar blogs, February 2016 https://www.bullionstar.com/blogs/koos-jansen/china-net-imported-1300t-of-gold-in-2016/

2.^ U.S. Geological Survey, Mineral Commodity Summaries ‘Gold’, January 2017 https://minerals.usgs.gov/minerals/pubs/commodity/gold/mcs-2017-gold.pdf

3.^ Gold Market Charts, January 2017 https://www.bullionstar.com/blogs/gold-market-charts/gold-market-charts-january-2017/

4.^ Shanghai Gold Exchange trading volumes, December 2016 and Year-to-Date http://www.en.sge.com.cn/upload/file/201701/11/o9wsyZKEsMfjf0cp.pdf

5.^ World Gold Council, “2000 China Gold Economic Forum release action plan to deregulate China’s gold market”, press release, 15 November 2000 https://www.gold.org/download/file/2756/151200a.pdf

6.^ Shandong Zhaojin Gold & Silver Refinery Co Ltd https://www.goldbarsworldwide.com/PDF/NBA_91_Shandong_Zhaojin_Gold_Bars.pdf

7.^ Spot Trading Rules of the SGE, January 2015, Article 89 http://www.en.sge.com.cn/upload/resources/file/2015/01/26/29484.pdf

8.^ “Mechanics of the Shanghai International Gold Exchange”, BullionStar Gold University https://www.bullionstar.com/gold-university/the-mechanics-of-the-shanghai-international-gold-exchange

9.^ “9999 Kilobar Standard – Endorsed by LBMA & SGE”, LBMA website http://www.lbma.org.uk/_blog/lbma_media_centre/post/9999-kilobar-standard-endorsed-by-lbma-sge/

10.^ “Specifications for a 1kg 9999 gold bar endorsed by the LBMA and SGE” http://www.lbma.org.uk/assets/Press%20Releases/9999%20Kilobar%20Standard.pdf

11.^ list of SGE Standard Gold Bars and Standard Gold Ingots Delivery Refiners, February 2017, SGE website http://www.en.sge.com.cn/eng_news_Announcement/542320

12.^ “China Net Imported 1,300t of Gold In 2016”, BullionStar blogs, February 2016 https://www.bullionstar.com/blogs/koos-jansen/china-net-imported-1300t-of-gold-in-2016/

13.^ “Chinese Cross-border Trade Rules on gold – Importing Gold: Authorisation and Licensing” BullionStar Gold University https://www.bullionstar.com/gold-university/chinese-cross-border-trade-rules-gold#heading-3

14.^ “Measures for the Import and Export of Gold and Gold Products” People’s Bank Of China, https://static.bullionstar.com/blogs/uploads/2015/11/PBOC-2015-gold-trade-rules-announcement.pdf

15.^ U.S. Geological Survey, Mineral Commodity Summaries ‘Gold’, January 2017 https://minerals.usgs.gov/minerals/pubs/commodity/gold/mcs-2017-gold.pdf

16.^ “The Great Physical Gold Supply & Demand Illusion”, BullionStar, October 2016 https://www.bullionstar.com/blogs/koos-jansen/the-great-physical-gold-supply-demand-illusion

Subscribe to Gold University Articles

Copyright Information: BullionStar permits you to copy and publicize articles or information from the BullionStar Gold University provided that a link to the article's URL or to https://bullionstar.com is included in your introduction of the article or blog post together with the name BullionStar. The link must be target="_blank" without re="nofollow". All other rights are reserved. BullionStar reserves the right to withdraw the permission to copy content for any or all websites at any time.