At BullionStar, we are passionate about gold & silver.

Gold has been used as money for at least 6,000 years. When BullionStar was founded in Singapore in 2012, it was founded on the belief that gold & silver are money.

We help people protect their savings against inflation and financial uncertainty. When you buy gold & silver bullion coins and bars, you hold the ultimate tangible asset.

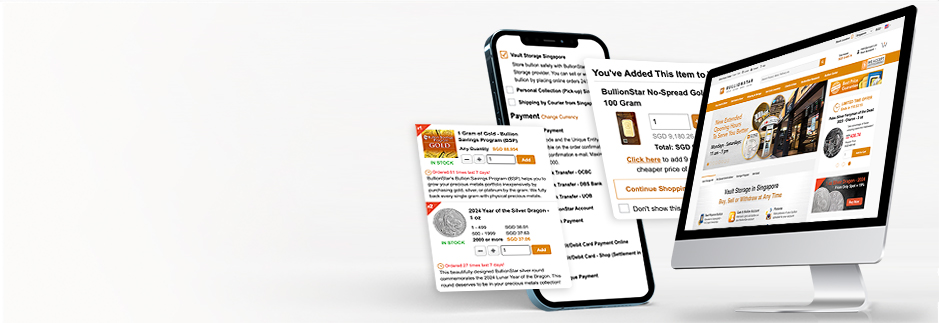

BullionStar is Singapore’s #1 precious metals dealer with over $2 billion worth of gold, silver, and platinum orders fulfilled.

Our prices are the lowest in Singapore – guaranteed! With more than 1,000 different precious metals products available, our bullion selection is the best in Singapore. We carry all popular bullion bar and coin brands including PAMP, Heraeus, Perth Mint, Canadian Maples, American Eagles, Britannias, Krugerrands, Australian Kangaroos, Austrian Philharmonics, and many others.

BullionStar is a full-service provider for all of your precious metals needs. With us, you can buy, sell, store, ship, and collect your precious metals in any of our 3 locations – Singapore, United States and New Zealand!