Workings Of The Shanghai International Gold

This post is part of the Chinese Gold Market Essentials series. Click here to go to an overview of all Chinese Gold Market Essentials for a comprehensive understanding of the largest physical gold market globally. This post was updated in late 2017.

“This event is a major milestone in China’s opening of its financial market to foreign investors. The Shanghai International Gold Exchange will bolster China’s gold market toward greater trading volume and further highlight the price discovery function of the gold market”, said Zhou Xiaochuan governor of the People’s Bank Of China at the opening ceremony of the Shanghai International Gold Exchange (SGEI) September 18, 2014.

Introduction

The launch of the SGEI is an important step for China’s process of financial liberalization, opening up, going out and internationalizing the renminbi.

On September 18, 2014, the Shanghai Gold Exchange (SGE, or Main Board, MB) launched it’s subsidiary the Shanghai International Gold Exchange (SGEI, or International Board, IB) physically vested in the Shanghai Free Trade Zone. This article covers how the SGEI operates and how its connected to the SGE and the rest of the world.

The Working Of The Shanghai International Gold Exchange

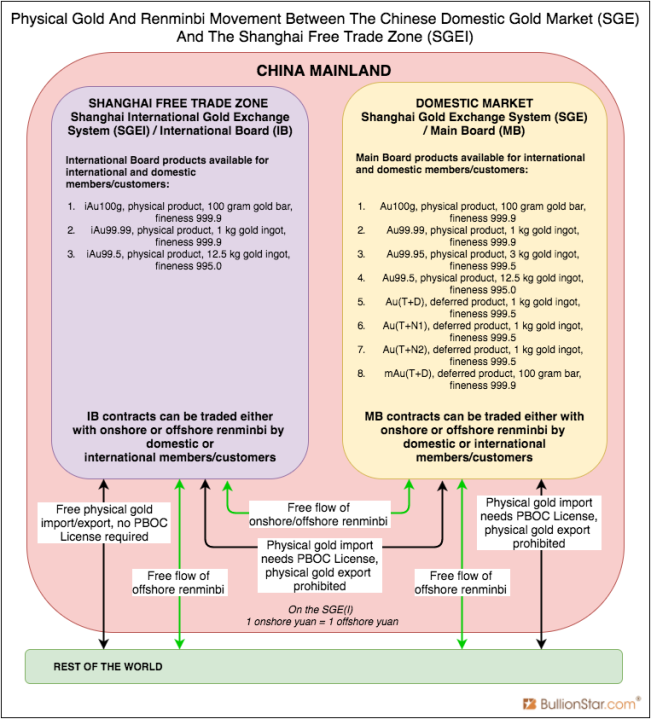

The SGE and SGEI are physically separated exchanges, although they operate under the same umbrella (the Exchange hereafter). They’re separated in order for the International Board (IB) to facilitate gold trading in renminbi for international members/customers, completely segregated from the domestic market. The PBOC doesn’t allow gold export from the domestic market, but does provide an exchange that offers gold contracts denominated in renminbi. Hence the SGEI is located in the Shanghai Free Trade Zone (SFTZ) which in terms of cross-border gold trade is a separate region from the Chinese domestic market. However, with the IB the Chinese government has conceived a link between the Chinese domestic gold market and the international gold market.

The SGEI is an international exchange where international members/customers of the Exchange can trade gold exclusively in renminbi (both onshore and offshore renminbi by the way). Any international member/customer can trade SGEI gold products (/contracts) and the gold can be freely imported and exported from the SFTZ. But international members/customers can also trade the Main Board products although the related metal located in the Chinese domestic market is prohibited from being withdrawn (/load out) from SGE certified vaults by international members/customers.

The SGE is the core exchange in the Chinese domestic gold market where domestic members/customers of the Exchange can trade gold in renminbi. Additionally, domestic members/customers can trade all IB products although they cannot withdraw this gold located in the Shanghai Free Trade Zone from SGEI certified vaults. An exception is made for members/customers holding a License by the PBOC to import gold into the Chinese domestic market.

The next quote is from an announcement published on the SGE website on 16 September 2014 and supports what was just described:

No 3. The products that international members and international customers can trade include 3 International Board products and 8 Main Board products … . However, they can only deposit and withdraw on the international products.

No 4. Domestic members and domestic customers can participate in trading all the International Board products, but can’t deposit and withdraw on the International Board products (the members with import and export qualifications excluded).

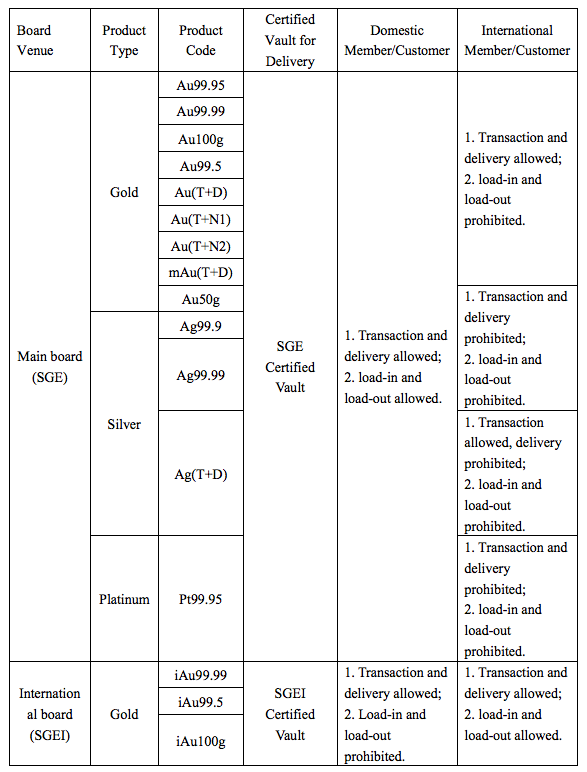

In the overview below every SGE(I) product is listed, next to all members/customers’ trading privileges. In the last two columns it shows what products domestic and international are allowed to withdraw (load-out) from what vaults.

As mentioned before the SGEI certified vaults are located in the SFTZ. On the Exchange’s website we read the SGEI certified vaults are owned by the Bank Of Communications. According to China’s state TV network CCTV this vault has a capacity of 1,000 tonnes. Global gold vaulting and transportation company Malca-Amit opened a 2,000 tonnes vault in the SFTZ in November 2013. Possibly, this vault will become an SGEI certified vault in the future.

All SGE(I) Products

With the inception of the SGEI 3 new physical products have been introduced at the Exchange in September 2014. The IB products are:

- iAu100g physical product 100 gram gold bar fineness 999.9

- iAu99.99 physical product 1 kg gold ingot fineness 999.9

- iAu99.5 physical product 12.5 kg gold ingot fineness 995.0

In addition to the IB products international members/customers can trade 8 MB contracts – divided in 2 categories, 4 physical and 4 deferred products (although international members/customers cannot load-out these products from MB vaults):

- Au100g physical product 100 gram gold bar fineness 999.9

- Au99.99 physical product 1 kg gold ingot fineness 999.9

- Au99.95 physical product 3 kg gold ingot fineness 999.5

- Au99.5 physical product 12.5 kg gold ingot fineness 995.0

- Au(T+D) deferred product 1 kg gold ingot fineness 999.5

- Au(T+N1) deferred product 1 kg gold ingot fineness 999.5

- Au(T+N2) deferred product 1 kg gold ingot fineness 999.5

- mAu(T+D) deferred product 100 gram bar fineness 999.9

One MB product can exclusively be traded by domestic members/customers:

- Au50g physical product 50 gram gold bar fineness 999.9

According to the rulebooks of the Exchange gold bars weigh 0.05 kg, 0.1 kg and gold ingots 1 kg, 3 kg, 12.5 kg.

The SGEI Connects The Onshore And Offshore Renminbi Markets

The Exchange connects the onshore and offshore renminbi market because both SGE and SGEI products can be traded with onshore and offshore renminbi and both currencies have the same value. Domestic members/customers can trade SGE and SGEI products, notable using either onshore or offshore renminbi. In turn, international members/customers can trade SGE and SGEI products using either onshore or offshore renminbi as well. Effectively, the Exchange connects the onshore and offshore renminbi markets.

For more clarification on the flows of physical gold and renminbi between the SFTZ and the Chinese domestic gold market have a look at the graph below.

Addendum

More clarification can be read below in parlance of the Exchange. From the Detailed Rules for Physical Delivery of the Shanghai Gold Exchange:

Article 31

A Domestic Member or Domestic Customer may deposit physical bullions deliverable on the Main Board into a Main Board Certified Vault (“MB Certified Vault” for short); the member or customer is not permitted to deposit physical bullions deliverable on the International Board into any MB Certified Vault, nor may the member or customer deposit any physical bullions into any International Board Certified Vault (“IB Certified Vault” for short).

Article 32

An International Member or International Customer who has obtained an approval from the Exchange may deposit physical bullions deliverable on the International Board into an IB Certified Vault. Furthermore, an International Member or International Customer who has obtained an approval may deposit, within its permitted quota, physical bullions deliverable on the Main Board into an IB Certified Vault. An International Member or International Customer is not permitted to deposit bullions into an MB Certified Vault.

Article 36

Each Domestic Member and Domestic Customer may withdraw physical bullions deliverable on the Main Board from an MB Certified Vault, but is not permitted to withdraw physical bullions deliverable on the International Board from an MB Certified Vault. Except for those members and customers qualified to import and export gold, no Domestic Member or Domestic Customer is permitted to withdraw bullions from an IB Certified Vault. Any Domestic Member or Domestic Customer that has gold import and export qualifications may withdraw physical bullions deliverable on the International Board from an IB Certified Vault.

From the Operating Guidelines for International Board Deliveries Of the Shanghai Gold Exchange:

Article 9

… an International Member or International Customer whose application is approved may, within the permitted quota, deposit physical bullions deliverable on the Main Board into an IB Certified Vault.

Article 22

Any approved International Member or International Customer that sells physical bullions deliverable on the Main Board must engage a member which has the gold import/export qualification to carry out the import procedures on its behalf, and pay import agent fees for the fulfillment of such import procedures.

From the Spot Trading Rules of the Shanghai Gold Exchange:

Article 99

Domestic members can trade on the IB. Where physical bullions are delivered and transported into the customs and deposited into a Main Board Certified Vault, the Exchange will further issue a SGE Execution Statement to the Domestic Member or the customer qualified to import gold for customs declaration purposes.

Popular Blog Posts by Koos Jansen

China’s Secret Gold Supplier is Singapore

China’s Secret Gold Supplier is Singapore

Audits of U.S. Monetary Gold Severely Lack Credibility

Audits of U.S. Monetary Gold Severely Lack Credibility

China Gold Import Jan-Sep 797t. Who’s Supplying?

China Gold Import Jan-Sep 797t. Who’s Supplying?

The Gold-Backed-Oil-Yuan Futures Contract Myth

The Gold-Backed-Oil-Yuan Futures Contract Myth

Estimated Chinese Gold Reserves Surpass 20,000t

Estimated Chinese Gold Reserves Surpass 20,000t

Did the Dutch Central Bank Lie About Its Gold Bar List?

Did the Dutch Central Bank Lie About Its Gold Bar List?

PBOC Gold Purchases: Separating Facts from Speculation

PBOC Gold Purchases: Separating Facts from Speculation

U.S. Mint Releases New Fort Knox Audit Documentation

U.S. Mint Releases New Fort Knox Audit Documentation

China Net Imported 1,300t of Gold in 2016

China Net Imported 1,300t of Gold in 2016

Why SGE Withdrawals Equal Chinese Gold Demand and Why Not

Why SGE Withdrawals Equal Chinese Gold Demand and Why Not

Koos Jansen

Koos Jansen