Chinese Cross-Border Gold Trade Rules

This post is part of the Chinese Gold Market Essentials series. Click here to go to an overview of all Chinese Gold Market Essentials for a comprehensive understanding of the largest physical gold market globally. This post was updated in late 2017.

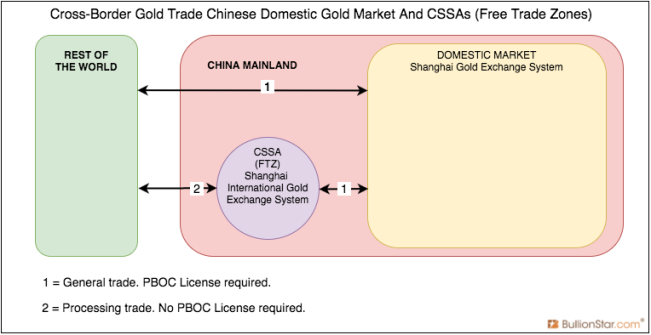

This article covers how gold can be imported into and exported from China mainland. There are two types of cross-border trade in China: general trade and processing trade.

Only through general trade gold can be imported into the Chinese domestic gold market where it’s required to be sold first through the Shanghai Gold Exchange (SGE). Gold imported through processing trade must be used for manufacturing or assembling purposes after which the finished goods are required to be exported.

Usually processing trade is conducted through Customs Specially Supervised Areas (CSSAs) – also called Free Trade Zones, Customs Specially Regulated Areas, Special Customs Supervision Areas or Customs Special Supervision Regions, these are all the same. When processing trade is performed outside CSSAs (the rest of the mainland, non-CSSA) the materials will be strictly monitored by Chinese customs. Through processing trade gold cannot enter the Chinese domestic gold market where the SGE operates. Processing trade and CSSAs are strictly separated from the Chinese domestic gold market.

Processing trade is meant for China’s manufacturing industry to efficiently connect with the rest of the world. The Chinese and foreign companies engaging in processing trade are exempt from, in example, import duties and Value-Added Tax (VAT).

General Trade

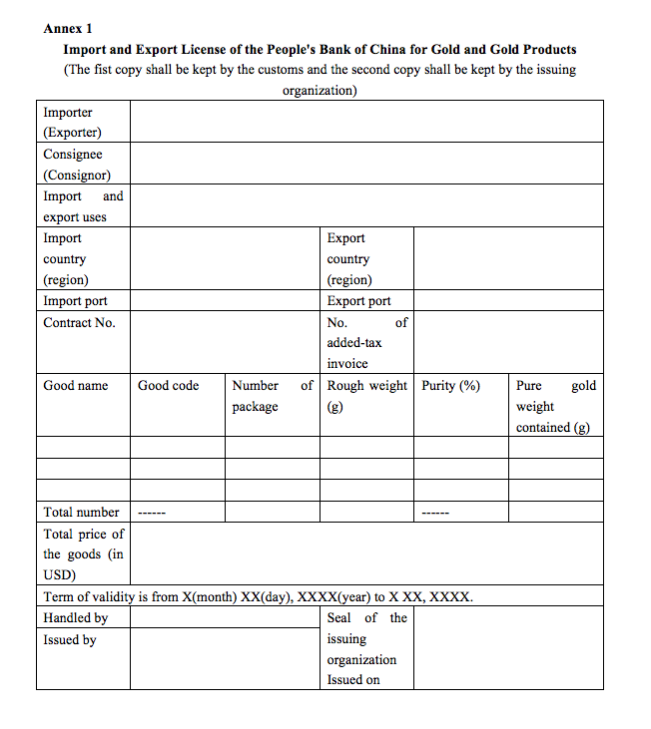

When gold is imported into the Chinese domestic market this is referred to as general trade. The agency that controls all forms of gold in general trade is China’s central bank, the People’s Bank Of China (PBOC). Only financial institutions and gold enterprises that carry the Import and Export License of the People’s Bank of China for Gold and Gold Products (the License hereafter) can get gold to pass customs into the Chinese domestic gold market. The rules for cross-border gold trade in general trade have been lastly drafted by the the PBOC in March 2015 and are called Measures for the Import and Export of Gold and Gold Products (the Measures hereafter). In the Measures it’s stated [brackets added]:

For the import and export customs clearance of gold and gold products as included in the Catalogue for the Regulation of the Import and Export of Gold and Gold Products, the Import and Export License of the People’s Bank of China for Gold and Gold Products (Annex 1) issued by the People’s Bank of China or a People’s Bank of China branch shall be submitted to the Customs.

The Catalogue for the Regulation of the Import and Export of Gold and Gold Products describes all forms of gold (coins, ore, bullion, unwrought, scraps, jewelry) that can cross the Chinese border. For all gold to be imported into the Chinese domestic gold market the materials are required to be accompanied by the License.

Currently there are thirteen commercial banks that are approved by the PBOC to apply for the License to import standard gold, which in China is bullion in bars or ingots of 50g, 100g, 1Kg, 3Kg or 12.5Kg, having a fineness of 9999, 9995, 999 or 995. The thirteen commercial banks are (random order):

- HSBC Bank (China) Ltd

- Australian and New Zealand Bank (China) Company Ltd

- Standard Chartered Bank (China) Ltd

- United Overseas Bank (UOB)

- Industrial and Commercial Bank of China (ICBC)

- China Construction Bank (CCB)

- Bank of China

- Agricultural Bank of China (ABC)

- Bank of Shanghai

- China Minsheng Bank (CMB)

- Industrial Bank

- Shenzhen Development Bank (SDB) / Ping An Bank

- Everbright

All standard gold imported through general trade into the Chinese domestic gold market is required to be sold first through the SGE (the core of the Chinese domestic gold market). In the Measures it’s stated [brackets added]:

… An applicant for the import and export of gold … shall have corporate status, … it is a financial institution member or a market maker on a gold exchange [SGE] approved by the State Council.

… The main market players with the qualifications for the import and export of gold shall assume the liability of balancing the supply and demand of material objects on the domestic gold market. Gold to be imported … shall be registered at a spot gold exchange [SGE] approved by the State Council where the first trade shall be completed.

Next to standard gold there are non-standard gold (for example bullion bars weighing 200g 9999 fine, and doré bars), gold products (jewelry, coins and ornaments) and ore. Non-standard gold, gold products and ore are not required (and not allowed) to be sold through the SGE when imported into the Chinese domestic gold market. Only a limited number of gold enterprises can apply for the License to import non-standard gold, gold products and ore under general trade. Although, the Measures released in March 2015 by the PBOC loosened the requirements for such enterprises.

Example given of a gold enterprise that can import non-standard gold into the Chinese domestic gold market: On 26 May 2015 Zijin Mining Group bought a 50 % stake in Barrick Gold Corp’s Porgera mine in Papua New Guinea for $298 million. On 9 October 2015 China Gold Network wrote that Zijin Mining was one of the first mining companies to be granted the qualification by the PBOC to import gold under general trade, allowing Zijin to import doré from Papua New Guinea into the Chinese domestic gold market. From China Gold Network:

9月25日,紫金矿业获得中国人民银行批复允许从事黄金进口业务,打破了国内只有金融机构从事该业务的惯例,开创了国内大型黄金企业从事黄金进口业务的先河。

On Sept 25, Zijin Mining was granted by the People’s Bank of China the permission to do gold import business [under general trade], which broke the common practice that in China only financial institutions do this business, and became the first case that a big domestic gold miner does gold import business [under general trade].

By loosening the rules for enterprises to import non-standard gold into the Chinese domestic gold market the PBOC has helped Chinese mining companies to strive for more overseas acquisitions.

Above is the License form that banks have to submit for every gold import batch. Being able to apply for the License does not grant unlimited permission to import gold into the Chinese domestic gold market – from abroad or CSSAs – as for every shipment a stamp from the PBOC is needed. This policy is referred to as “one batch one License". In the Measures it’s stated:

There shall be one Import and Export License of the People’s Bank of China for Gold and Gold Products for each batch of product and the License shall be used within 40 work days since the issuing date.

The table below helps in understanding how the PBOC distinguishes between different types of gold.

Gold export from the Chinese domestic market is prohibited by the PBOC (banks won’t get a License), except for golden Panda coins. The reason the Measures mention export is because if the PBOC would ever change its policy in allowing gold export from the Chinese domestic market it doesn’t need to rewrite the laws. Currently, if one of the thirteen banks (or Zijin Mining) will submit a request at the PBOC for an export License it will be rejected. This is the reason SGE bars are rarely seen outside China. The SGE system operates in the Chinese domestic gold market and thus bars withdrawn from the SGE vaults are prohibited form being exported.

There is but one possibility to export an SGE bar from the Chinese domestic gold market. Individuals can bring 50 grams of gold when traveling abroad. Though this rule is not very stringent on the import side, on the export side one individual would be allowed to bring a 50g SGE bar across the border, two individuals would be allowed to bring a 100g SGE bar, etcetera.

Processing Trade

Next to gold import into the Chinese domestic gold market through general trade, Chinese authorities allow gold import into/ export from China through processing trade. Through processing trade enterprises not carrying the License can import gold into China mainland which then must be used for manufacturing or assembling purposes after which the finished products are required to be exported. In the Measures it’s stated:

…, gold and gold products imported and exported by the following means shall exempted from handling Import and Export License of the People’s Bank of China for Gold and Gold Products and shall be supervised by the customs instead:

(I) Imported or exported by processing trade;

Enterprises can import gold into/ export from China through processing trade without the License from the PBOC because these flows are strictly separated from the Chinese domestic gold market. However, for processing trade the enterprises are required to be engaged in gold business, for example, as jewelry manufacturers or refineries.

Processing trade is usually done between countries abroad and what is referred to as Customs Specially Supervised Areas (CSSAs) – also called Free Trade Zones.

Gold trade between a CSSA and the Chinese domestic market is considered as general trade. Meaning, for gold to be imported from a CSSA into the Chinese domestic gold market the License must be provided and gold export from the domestic market to CSSAs is prohibited.

CSSA is a collective noun for free trade zones, export processing zones, bonded logistics parks, bonded ports, comprehensive bonded zones, etcetera. Without going into detail what the differences are between various types of CSSAs, all such areas must be seen as regions in China mainland where rules for taxes, customs and foreign exchange administration can diverge from the rest of the mainland.

Through CSSAs China’s manufacturing industry is efficiently connected to the rest of the world. Hong Kong is not a CSSA, but a Special Administrative Region of the People’s Republic of China. In terms of trade Hong Kong is treated as a separate country from China mainland, having its own customs department and currency.

Some CSSAs are physically open to the rest of the mainland, people are free to go in and out without being asked to show documentation by Chinese customs, others are restricted, surrounded by a fence and goods moved in or out can be subject to checks.

To study processing trade we’ll use the official PRC Customs Supervision and Administration of Processing Trade Goods Procedures (2004) and Managing Trade & Customs in China (2011, KPMG) as our guides. To avoid misunderstandings, henceforth we’ll work with the nomenclature provided in these documents. According to the PRC Customs Supervision and Administration of Processing Trade Goods Procedures the definition of processing trade is:

“Processing trade” shall refer to the business activity of import of operating enterprises of all or some raw and auxiliary materials, components, parts, mechanical components and packing materials (Materials and Parts) and the export thereof as finished products after processing or assembling. It includes processing of supplied materials and processing of purchased materials.

Understanding processing trade is mainly important for gold trade between Hong Kong and the Shenzhen CSSA where the bulk of China’s jewelry manufacturing industry is vested, and gold import into/ export from the Shanghai Free Trade Zone through the Shanghai International Gold Exchange (SGEI).

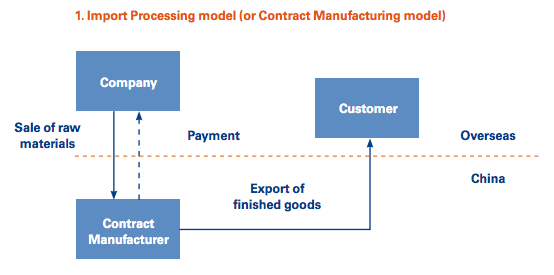

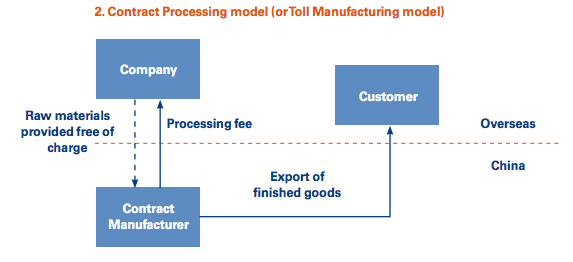

There are two types of processing trade. There is the Processing Of Purchased Materials Model (or Contract Manufacturing model) and the Processing Of Supplied Materials Model (or Toll Manufacturing model).

The Processing Of Purchased Materials Model involves a Chinese manufacturer to import raw materials and parts from abroad into China to assemble or process into finished goods. Upon completion the finished goods will be exported and sold in an overseas market by the Chinese manufacturer.

The Processing Of Supplied Materials Model involves a foreign company to export raw materials and parts to China to be processed by a Chinese manufacturer into finished goods. Upon completion the finished goods are exported to an overseas market to be sold at the discretion of the foreign company. This foreign company will pay the Chinese manufacturer a processing fee for its services provided.

Example given of a processing trade with gold: standard gold from Hong Kong is exported to the CSSA in Shenzhen where 4,000 Chinese gold manufacturers are located. Subsequently, the gold is fabricated into jewelry and upon completion imported back into Hong Kong to be sold in jewelry shops. This trade can be either conducted through the Processing Of Purchased Materials Model or the Processing Of Supplied Materials Model.

Essential to understand is that the flow of material in processing trade is completely separated from the Chinese domestic market, though these goods crossing the Chinese border are included in customs statistics (International Merchandise Trade Statistics). In the PRC Customs Supervision and Administration of Processing Trade Goods Procedures it’s stated:

Article 21. Goods imported and exported by operating enterprises in the form of processing trade shall be included in customs statistics.

Though kindly note, in the case the gold crossing the Chinese border this is only included in customs statistics from China’s trading partners, as China has eclipsed its gold trade in its own customs data.

Processing trade – and the rules just mentioned – explains how gold can be imported into China from Hong Kong and exported back from China to Hong Kong without entering the Chinese domestic gold market and flowing through the Shanghai Gold Exchange (SGE). Since 2004 traders do not need a License to import / export gold through processing trade into/ from China, as was communicated in the People’s Bank of China, General Administration of Customs Announcement No. 19 of 2003.

Gold import into/ export from the Shanghai Free Trade Zone, where the SGEI is located, also is conducted through processing trade – though any standard gold flowing through SGEI certified vaults is not processed.

Popular Blog Posts by Koos Jansen

China’s Secret Gold Supplier is Singapore

China’s Secret Gold Supplier is Singapore

Audits of U.S. Monetary Gold Severely Lack Credibility

Audits of U.S. Monetary Gold Severely Lack Credibility

China Gold Import Jan-Sep 797t. Who’s Supplying?

China Gold Import Jan-Sep 797t. Who’s Supplying?

The Gold-Backed-Oil-Yuan Futures Contract Myth

The Gold-Backed-Oil-Yuan Futures Contract Myth

Estimated Chinese Gold Reserves Surpass 20,000t

Estimated Chinese Gold Reserves Surpass 20,000t

Did the Dutch Central Bank Lie About Its Gold Bar List?

Did the Dutch Central Bank Lie About Its Gold Bar List?

PBOC Gold Purchases: Separating Facts from Speculation

PBOC Gold Purchases: Separating Facts from Speculation

U.S. Mint Releases New Fort Knox Audit Documentation

U.S. Mint Releases New Fort Knox Audit Documentation

China Net Imported 1,300t of Gold in 2016

China Net Imported 1,300t of Gold in 2016

Why SGE Withdrawals Equal Chinese Gold Demand and Why Not

Why SGE Withdrawals Equal Chinese Gold Demand and Why Not

Koos Jansen

Koos Jansen