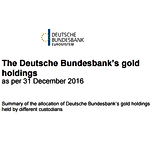

BoE Refuses to Return 14 Tonnes of Gold to Venezuela

A number of news stories have circulated recently that Venezuela is having difficulty withdrawing 14 tonnes of its gold from the Bank of England vaults in London.

While official sources quoted in these articles offer explanations for the delay which are clearly bogus, and the real reason is one of politics, Venezuela's inability to withdraw its gold from the Bank of England... Continue Reading

Ronan Manly

Ronan Manly 0 Comments

0 Comments