Debunking GFMS’s Gold Demand Statistics

What came to light as on odd discrepancy between GFMS’ Chinese gold demand and “apparent supply" has proven to be a tenacious cover-up by the oldest consultancy firm in the gold market. And not only does GFMS publish incomplete and misleading data on Chinese gold demand, all its supply and demand data is incomplete and misleading. As a result, the vast majority of investors across the globe has been brainwashed to believe total gold supply and demand mainly consists of global mine output and jewelry demand. In reality, the supply and demand data GFMS publishes is just the tip of the iceberg. But the firm is reluctant to admit this publicly, lest their business model would be severely damaged.

GFMS has denied all allegations about their incomplete Chinese gold demand statistics by continuously making up false arguments. Therefore, BullionStar will debunk, once more, such arguments spread by GFMS – which are supposed to explain how from January 2007 until September 2016 the difference between GFMS’ Chinese gold demand and apparent supply reached over 4,500 tonnes – in order to expose true Chinese gold demand.

Since 2013 I’ve witnessed GFMS shamelessly present nine arguments in their Gold Survey reports, but along the way abandoned the arguments that I had debunked on these pages. Indeed, few of all these arguments have ever proven to be valid, illustrated by the fact that GFMS perpetually keeps making up new ones. What’s left is to disparage are the final three arguments from GFMS’ most recent annual report: the Gold Survey 2016 (GS2016). Because GFMS chooses their arguments to be ever more complicated, I’ll have to be precise in my wordings not to allow any margin for interpretation errors. For detailed information regarding the mechanics of the Chinese gold market and supply & demand metrics readers can click the links provided.

Debunking Final GFMS Arguments

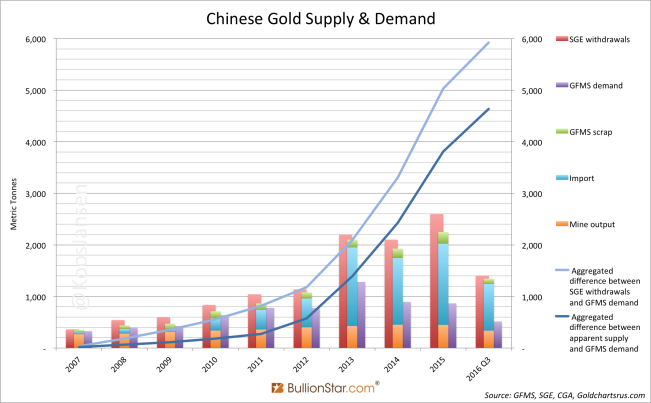

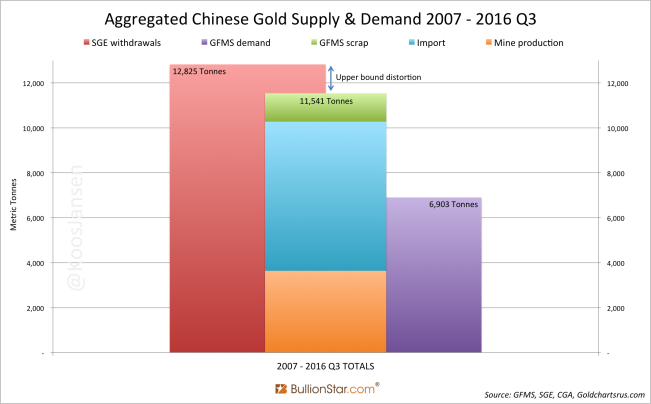

In the Chinese domestic gold market nearly all supply (import, mine output, scrap supply) is sold through the Shanghai Gold Exchange (SGE), and so Chinese wholesale gold demand can be measured by the amount of gold withdrawn from the SGE vaults; data published on a monthly basis. As I’ve been reporting on withdrawals from the Chinese core exchange since 2013, the debate between me and Western consultancy firms like GFMS with respect to true Chinese gold demand has centered around these infamous SGE withdrawals (exhibit 1). Per mentioned above, GFMS has put out nine arguments in recent years explaining their reader base why SGE withdrawals do not reflect gold demand. Firstly, let us have a look at the five arguments now abandoned by GFMS:

- Wholesale stock inventory growth (Augustus 2013) (Gold Survey 2014, page 88)

- Arbitrage refining (Gold Survey 2014, page 88) (Reuters Global Gold Forum 2015)

- Round tripping (Gold Survey 2014, page 88) (Gold Survey 2015, page 78, 82)

- Chinese commercial bank assets to back investment products. “The higher levels of imports, and withdrawals, are boosted by a number of factors, but notably by gold’s use as an asset class and the requirement for commercial banks to hold physical gold to support investment products.” (Gold Survey 2015, page 78).

- Defaulting gold enterprises send inventory directly to refiners and SGE (Gold Survey 2015 Q2, page 7)

No need to discuss these anymore, as GFMS dedicated a full chapter in the GS2016 report titled, “A Review And Explanation Of How China’s SGE’s Withdraw Numbers Are Impacted By Other Trading Activities”, in which the arguments above are not listed, implying GFMS ceased to recognize them as relevant. However, there are three new arguments listed, and one old one, that will be discussed in this post:

- Tax avoidance (Gold Survey 2016, page 56).

- Financial statement window dressing (Gold Survey 2016, page 58).

- Retailers selling unsold inventories directly to refiners (Gold Survey 2016, page 58)

- Gold leasing activities and arbitrage opportunities (in China gold is money at lower cost) (Gold Survey 2016, page 57, Gold Survey 2015, page 78)

Because gold leasing is an old argument it will only briefly be addressed here.

1. Tax Avoidance

This argument entails an illegal Value-added tax (VAT) invoice scheme. Although this scheme exists, it can not have the impact on SGE withdrawals like GFMS wants you to think.

GFMS introduces its special investigation chapter by stating:

TAX AVOIDANCE

The first and foremost factor behind why we believe the SGE’s withdrawal number differs from the country’s total gold demand is related to China’s current tax system, with some people exploiting this grey area.

… the number of industry participants mushroomed in 2014 and 2015 as other traders became aware of the potential loophole.

The GFMS team uses the terms “tax avoidance” and “loophole”. For the ones that don’t know, tax avoidance and tax evasion are two opposing practices. Tax avoidance is the legal usage of a tax regime to one’s advantage in order to reduce the amount of tax payable by means that are within the law (Wikipedia). Tax evasion is the illegal evasion of tax payable (Wikipedia). In other words, tax avoidance is legal while tax evasion is illegal. In the introduction the GFMS team pretends the tax scheme is legal, while this is anything but true. In China one can risk life imprisonment or the death penalty when caught for tax evasion:

Whoever forges or sells forged special invoices for value-added tax shall, if the number involved is especially huge, and the circumstances are especially serious so that economic order is seriously disrupted, be sentenced to life imprisonment or death and also to confiscation of property.

Then, to add to the confusion, further down the GFMS team writes, “of course, all of the activities are considered illegal by the Chinese government.” Maybe GFMS doesn’t understand the difference between tax avoidance and tax evasion, two diametrically different practices, which makes their professionalism highly questionable.

GFMS writes, “the first and foremost factor behind why we believe the SGE’s withdrawal number differs from the country’s total gold demand is related to China’s current tax system”. So we’re supposed to believe that after all these years – GFMS is operational for decades – and all that has been written on the Chinese gold market, now GFMS has finally found the “first and foremost reason” why SGE withdrawals do not reflect demand? Or did it recently stumble upon this scheme to use in its defence? I think the latter.

The understand the details of this illegal VAT invoice scheme please read my post The Value-added Tax System In China’s Domestic Gold Market, written to substantiate this blog post.

Regarding using VAT invoices for tax evasion, the GFMS team must have read this news article by the Shenzhen Municipal Office. In the news, a company called Longhaitong used SGE VAT invoices for tax evasion. How does it work? For example: the prevailing spot gold price on the SGE is 234 CNY/gramme. Company X tells a mom-and-pop jewelry fabricator that they can supply good quality cheap gold, say the SGE spot price minus 2 CNY/gramme, but without a VAT invoice. The mom-and-pop fabricator wants to buy 1 Kg so it gives 232,000 CNY to company X (the mom-and-pop shop will fabricate jewelry from the gold to be sold covertly without VAT to consumers). Company X buys 1 Kg of gold on the SGE at the spot price of 234 CNY/gramme, paying 234,000 CNY. Then company X gives the gold to the mom-and-pop fabricator but keeps the VAT invoice. Up till now, company X has incurred a loss of 2,000 CNY (bear in mind, because of China’s VAT system buyers pay the spot price at SGE which doesn’t include any VAT, but when companies withdraw the metal they receive a VAT invoice from the tax authority that describes 17 % of the all-in price is VAT, because the gold leaves a VAT exempt environment). However, company X can then sell the VAT invoice for 4,000 CNY to, in example, a brick trader. Company X effectively makes 2,000 CNY. If the brick trader alters the subject header on the invoice from “gold” into “bricks” he can tax deduct 34,000 CNY (234,000 / (1+17%) * 17%) from his VAT payable. In this scenario, the brick trader effectively makes 30,000 CNY (34,000 CNY minus the 4,000 it paid to company X). Naturally, all exemplar numbers can vary.

For sure this illegal VAT scheme exists and has been used. But, only to a limited extent – in my conclusion I will tell you the upper bound. Mind you, in the scenario I just described the gold does meet demand, albeit through an illegal scheme!

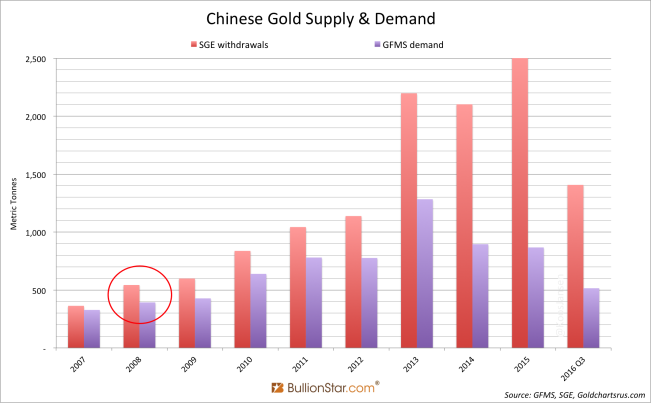

In addition, the discrepancy between the GFMS Chinese demand figures and SGE withdrawal numbers first appeared in 2008, and have exploded since 2013.

In the GS2016 GFMS writes:

We initially became aware of the scheme in 2013 when it first emerged, but based on information gathered from our contacts, the number of industry participants mushroomed in 2014 and 2015 as other traders became aware of the potential loophole.

The GFMS team wants readers to believe that it was the tax scheme that caused the discrepancy between GFMS Chinese demand and SGE withdrawals since 2013, but the VAT regulation regarding gold has remained unchanged since 2002. Is it believable that criminals found the possibility of these illegal practices 11 years later, exactly when Chinese demand exploded? No. If you click this link, you will see a similar incident that happened in 2010 and was reported at the end of 2011. The VAT scheme has existed for many years and crime incidents happen, but not like GFMS wants you to think.

If the GFMS team was indeed aware of the illegal practices as late as 2013 and thought that was the year when these practices first emerged, then GFMS is not properly informed in the Chinese gold market.

More from GS2016:

One of our contacts with some understanding of this activity estimated that just from Shenzhen alone, such trading activities could have possibly impacted the SGE’s withdrawal volumes by a few tonnes per day. Approximately half of the gold being sold in the black market at discounts would eventually flow back to the SGE.

In my opinion this is speculation. According to the news available, buyers in the black market are those who want the gold to fabricate jewelry that eventually is being met by true demand. In contrast, GFMS wants readers to believe half of the gold involved in the scheme flows back to the SGE. But bars withdrawn from the SGE vaults are not allowed to re-enter, only if they’re recast into new bars by SGE approved refineries (the gatekeepers of the Chinese chain of integrity). For gold involved in VAT invoice schemes to flow back to the SGE, technically SGE approved refineries would be complicit. Though the SGE conducts a campaign to crack down on such illegal tax activities.

As stated above, the VAT scheme is real, though it can not involve as much gold as GFMS wants you to believe. Unfortunately we can’t compute the exact amount recycled through the SGE through this practice, we can only identify the upper bound, which we’ll do in the conclusion.

As background information: when gold is withdrawn from SGE vaults and promptly flows back to the SGE, this overstates withdrawal numbers as it creates equal demand and supply that has no net effect on the price. Therefore, such recycle flows should not be counted in supply and demand statistics. Readers can click this post for more information.

Financial Statement Window Dressing

The GFMS team writes:

Some companies attempted to build up their revenues by merely trading and withdrawing physical gold from the SGE vault so it would appear they have a high level of business activity, while in reality there is no real genuine demand behind this.

Trading can build up revenues but why do these companies withdraw gold? That doesn’t make economic sense. If a company buys gold on the SGE and leaves the gold in the SGE vault, the gold will be recorded as “inventory” on the company’s balance sheet. If the company then withdraws the gold, the gold is still regarded as “inventory”, so what’s point of withdrawing gold? Changing the location of the gold doesn’t change the accounting nature of the gold.

It is technically possible to buy gold on the SGE, withdraw, refine it into new bars, redeposit the bars into SGE vaults and sell the bars. However, this will incur expenses. When the point is “window dressing”, why incur unnecessary expenses? More logic would be to leave the gold in the SGE system. This argument is false.

Retailers Selling Unsold Inventories Directly to Refiners

In this section, the GFMS team writes:

Retailers often prefer to sell a portion of their working stock at a discount directly to refiners in order to maintain inventories at a desirable level.

Why waste the fabrication costs of jewelry when retailers can sell the products at a discount to customers?

GFMS writes:

By selling to refiners, even if such a transaction may result in a financial loss, it still counts as revenue; but doing the latter only increases the expense category and provides no benefits to the company’s revenues or asset value.

Let’s assume an unsold jewelry stock is worth of 1,000 CNY. The retailer sells it to a refiner at 800 CNY, which results in a loss of 200 CNY. The inventory item on the retailer’s balance sheet is reduced by 1,000 CNY and the cash item increases by 800 CNY. The net result is that the total asset value of the retailer decreases by 200 CNY, then how can this practice provide benefits to the asset value?

GFMS writes:

As an example, during a field research trip earlier this year, a local refiner indicated that one jewellery retailer has sold approximately 40 tonnes of unsold jewellery pieces to them in a single two month period.

But this quote doesn’t mention what the unsold jewelry pieces become in the end. Possibly, these pieces become gold wires, which might be used by jewelry fabricators instead of becoming gold bars that flow back to the SGE. GFMS pretend the majority of gold in China is continuously recycled through the SGE, which is not true. Many refineries are note even approved by the SGE to supply gold bars.

Gold Leasing Activities And Arbitrage Opportunities

This argument is one of the oldest and most persistent. But we can be short about this; in the Chinese gold lease market nearly all trades are conducted within the SGE system. Any speculator borrowing gold for cheap funding will not withdraw his metal loan, as his incentive is to sell spot for the proceeds. GFMS fools readers by mentioning high leasing activity, but it neglects to mention leases aren’t withdrawn from the vaults. Only a jewelry fabricator would withdraw borrowed gold because he wants to fabricate products to meet demand.

Even the World Gold Council has recently stated little borrowed gold leaves the SGE system [brackets added by me]:

Over recent years we have observed a rising number of commercial banks participating in the gold leasing market. … It’s estimated that around 10% of the leased gold leaves the SGE’s vaults. The majority is for financing purposes and is sold at the SGE [and stays within the SGE vaults] for cash settlement.

This argument is false.

Furthermore, it’s noteworthy that GFMS writes:

From the perspective of the bank, lending physical gold is an off-balance sheet item,…

But as I’ve demonstrated in this and this post the majority of the “precious metals” on the Chinese bank balance sheets reflects back-to-back leasing. Meaning banks borrow gold in the SGE system to subsequently lend out at a higher lease rate. So neither do the Chinese bank balance sheets influence SGE withdrawals. What withdrawals largely reflect are direct purchases by individual and institutional investors at the SGE. True demand.

Conclusion

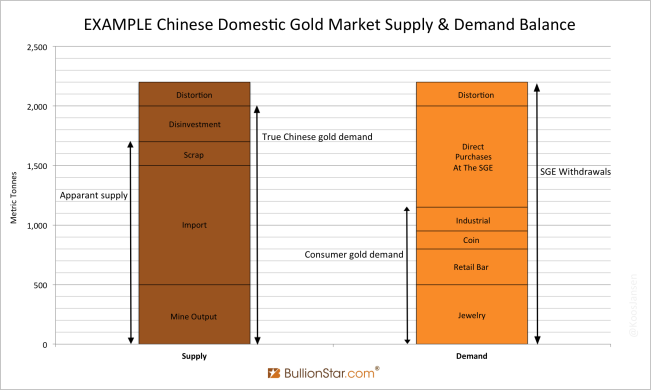

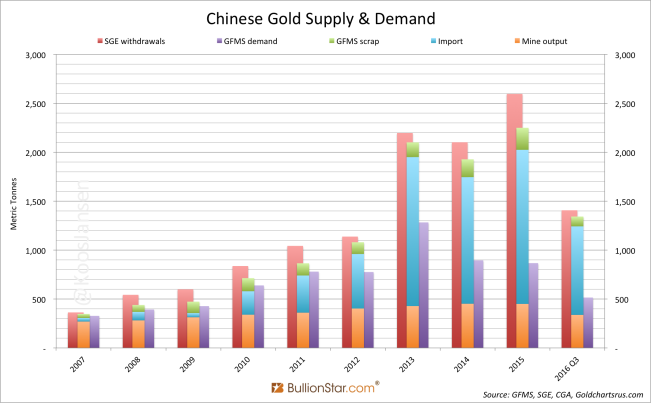

There is a very limited extent to which the VAT scheme can explain the difference between GFMS’ demand and SGE Withdrawals. I wrote previously that indeed there is certain amount of gold being withdrawn from SGE vaults, which, for various reasons, finds its way back to the SGE in newly cast bars – overstating SGE withdrawals as a proxy for wholesale demand. Unfortunately nobody knows exactly the volume flowing through the SGE that distorts withdraw data. But, we do know the upper and lower bound. The upper bound is the difference between SGE Withdrawals and apparent supply, the lower bound is zero.

GFMS only measures consumer demand (jewelry, retail bar and coin, and industrial demand) and not institutional demand (direct purchases at the SGE). This is not speculation this is a fact, and in China everyone can buy gold directly at the SGE so this explains the immense withdrawals. GFMS is fully aware of this but refuses to acknowledge it – because that would ruin their business model. Instead GFMS pretends that the difference between consumer demand and SGE withdrawals is all caused by gold being recycled through the central Chinese exchange. But how is this possible? If the Chinese gold market would simply be a merry-go-round fest, how come the Chinese import thousands of tonnes of gold that are not allowed to be exported? What GFMS suggests is not possible. The fact China keeps importing reveals demand. Another chart:

Theoretically the upper bound for the VAT scheme to have recycled gold through the SGE equals the difference between SGE withdrawals and apparent supply (the difference in exhibit 4 between the red and center columns). That’s the sole leeway we can debate about. As supply equals demand, demand cannot be lower than apparent supply. I should add, not unimportant, we know GFMS’ scrap supply data does not include disinvestment (institutional selling directly to refineries). So disinvestment must be included in the difference between SGE withdrawals and apparent supply as well. Have another look at exhibit 3. But, because we don’t know the amount of disinvestment, neither do we know the amount of distortion (VAT scheme and other recycling flows).

That’s why in exhibit 1 I’ve disclosed the aggregated difference between apparent supply and GFMS demand. There can be no mistake about this volume, it reflects true demand and it has mushroomed into +4,500 tonnes since 2007. GFSM can present many more arguments in future reports, but it won’t change the fact that true demand is at least equal to apparent supply.

To be exact, from January 2007 until September 2016 apparent supply accounted for 11,541 tonnes, and GFMS’ Chinese gold demand accounted for 6,903 tonnes. The difference, which GFMS has pursued to conceal, has aggregated to 4,638 tonnes. And according to my analysis this was not bought by the Chinese central bank.

As over the aforementioned period SGE withdrawals accounted for 12,825 tonnes, we get…

True Chinese gold demand ballpark = 11,541 – 12,825 tonnes

GFMS’ Chinese consumer gold demand = 6,903 tonnes

Let’s see how much longer GFMS can deny reality.

For more detailed information with respect to GFMS’ incomplete global gold supply and demand metrics view this post.

Popular Blog Posts by Koos Jansen

China’s Secret Gold Supplier is Singapore

China’s Secret Gold Supplier is Singapore

Audits of U.S. Monetary Gold Severely Lack Credibility

Audits of U.S. Monetary Gold Severely Lack Credibility

China Gold Import Jan-Sep 797t. Who’s Supplying?

China Gold Import Jan-Sep 797t. Who’s Supplying?

The Gold-Backed-Oil-Yuan Futures Contract Myth

The Gold-Backed-Oil-Yuan Futures Contract Myth

Estimated Chinese Gold Reserves Surpass 20,000t

Estimated Chinese Gold Reserves Surpass 20,000t

Did the Dutch Central Bank Lie About Its Gold Bar List?

Did the Dutch Central Bank Lie About Its Gold Bar List?

PBOC Gold Purchases: Separating Facts from Speculation

PBOC Gold Purchases: Separating Facts from Speculation

U.S. Mint Releases New Fort Knox Audit Documentation

U.S. Mint Releases New Fort Knox Audit Documentation

China Net Imported 1,300t of Gold in 2016

China Net Imported 1,300t of Gold in 2016

Why SGE Withdrawals Equal Chinese Gold Demand and Why Not

Why SGE Withdrawals Equal Chinese Gold Demand and Why Not

Koos Jansen

Koos Jansen