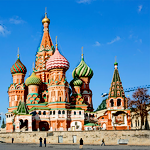

China’s Golden Gateway: How the SGE’s Hong Kong Vault will shake up global gold markets

China’s planned SGE Hong Kong vault marks a pivotal step in global gold trading, making yuan-denominated bullion more accessible to international investors.

By leveraging Hong Kong’s trusted financial and legal environment, China is directly challenging Western dominance in gold price discovery and settlement.

This move accelerates the yuan’s internationalisation... Continue Reading

Ronan Manly

Ronan Manly 1 Comments

1 Comments