Gold Establishment Supports Central Bank Secrecy

This week, the World Gold Council (WGC), which is a gold market development organization representing 32 of the world’s gold mining companies, published the latest quarterly edition of it’s well-known “Gold Demand Trends” research publication.

In the latest edition, which is titled “Gold Demand Trends Q3 2022”, the World Gold Council claims that during Q3 2022, “central banks continued to accumulate gold, with purchases estimated at a quarterly record of nearly 400 tonnes.”

And for my Next Trick

According to the WGC:

“Global central bank purchases leapt to almost 400 tonnes in Q3 (+115% q-o-q). This is the largest single quarter of demand from this sector in our records back to 2000 and almost double the previous record of 241t in Q3 2018.

It also marks the eighth consecutive quarter of net purchases and lifts the y-t-d total to 673 tonnes, higher than any other full year total since 1967.”

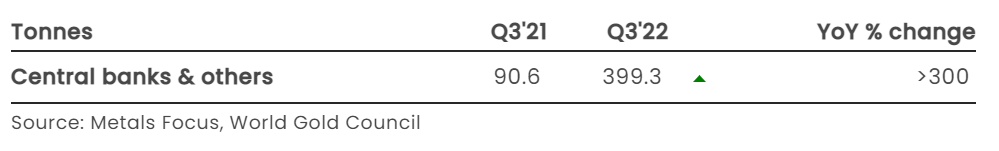

Specifically, the World Gold Council claims that Q3 2022 central bank gold demand was 399.3 tonnes, which is a massive 340% higher than Q3 2021.

Sounding impressive enough, the world’s financial media not surprisingly ran with the soundbite, publishing articles with headlines such as “Record central bank buying lifts global gold demand, WGC says” and “Central bank gold purchases set an all-time high” and “Central banks are buying gold at the fastest pace in 55 years”.

Until that is, you read a bit further and see that the World Gold Council added a caveat for Q 3 2022 central bank gold demand, saying that for “Q3 net demand includes a substantial estimate for unreported purchases”.

Wait, what was that? The Q3 gold buying from central banks includes “a substantial estimate for unreported purchases”? At first glance, and at subsequent glances, this sentence doesn’t add up. Some purchases went unreported, but were somehow estimated? By who? If unreported, how were they estimated? If the estimate was a substantial estimate, does this mean that there were substantial unreported purchases?

The World Gold Council report continues:

“The level of official sector demand in Q3 is the combination of steady reported purchases by central banks and a substantial estimate for unreported buying.”

It was only a Suggestion

So the 399.3 tonnes number in the WGC report is made up of some purchases which were reported by central banks, and also someone estimated a large quantity of buying which was not reported anywhere. What kind of scientific methodology is this, you may ask? Confused? You will be.

The WGC report tries to explain it’s numbers, but arguably digs itself deeper into a hole:

“This is not uncommon as not all official institutions publicly report their gold holdings or may do so with a lag.

It’s also worth noting that while Metals Focus suggests purchases occurred during Q3, it’s possible they may have started earlier in the year. In turn, this may result in future revisions as more information becomes available.”

Wait a minute! Metals Focus ‘suggests’ that unreported purchases occurred in Q3, but possibly these weren’t from Q3. And who is “Metals Focus” anyway? And why is the WGC replying on a methodology based on mere suggestions? i.e. ‘suggesting purchases occurred in Q3’?

Before looking at who Metals Focus is, and why they are involved in the World Gold Council reports, let’s see what else the World Gold Council said about Q3 2022 central bank gold buying.

Reported gold buying – Emerging Market central banks

Given that the elephant in the room is “a substantial estimate for unreported buying”, the World Gold Council report plays it safe and does not address this point further, and limits itself to only addressing central bank gold transactions that were reported at a country level, stating that these were “confined to a relatively small number of emerging market banks.”

These emerging market central bank gold purchases included the Turkish central bank, which accumulated another 31 tonnes of gold during the third quarter, the Central Bank of Uzbekistan which bought 26 tonnes of gold in Q3, the Reserve Bank of India which bought 17 tonnes of gold in Q3, and the central banks of Mozambique (2 tonnes), the Philippines (2 tonnes) and Mongolia (1 tonne).

On the sell side, during Q3 Kazakhstan sold a net 2 tonnes, while the UAE sold a net 1 tonne.

A summary of most of the main country level central bank gold purchases and sales during Q3 can be seen on this WGC website page here.

Qatar – An Inconvenient Fact

Importantly, the WGC report also refers to the Qatar Central Bank, saying that the Qataris bought 15 tonnes of gold in July, but then at the same time the WGC refuses to recognise that the Qatar Central Bank bought an additional 15.75 tonnes of gold between August and September, saying that the Qatar Central Bank “seemingly added more in both August and September, but we are awaiting IMF data to confirm the exact level of buying”, because “early data from the IMF is patchy”.

As readers of BullionStar will know, after buying 15 tonnes of gold during July, the Qatar Central Bank then bought another 4.73 tonnes of gold in August (see here), and then purchased an additional 11 tonnes of gold during September.

Qatar’s Central Bank (QCB) appears to have bought an additional 11 tonnes of gold during September, bringing its total gold holdings to 88 tonnes. Latest QCB International Reserves data here? https://t.co/cKAGvOidYw #WorldCup @KrishanGopaul

— BullionStar (@BullionStar) October 10, 2022

The full country level central bank gold purchases and sales which the WGC data includes can be seen in a WGC Excel spreadsheet at this link. Tallying all the monthly changes of every country over July, August and September 2022 (and taking out the double counting of Turkey’s central banks and commercial banks) gives a net purchase total of only about 89.5 tonnes over Q3, which is a far cry from the 399.3 tonnes which the WGC (and Metals Focus) claim central banks bought during the third quarter.

In fact, there are an astounding 310 tonnes of purchases attributed to unreported buying, which is an incredible 77.6% of total claimed central bank gold purchases during Q3 2022.

In other words, only 22.4% of the Q3 total of 400 tonnes of claimed central bank gold purchases can be attributed to reported purchases by central banks.

So hang on a minute? The World Gold Council won’t acknowledge that the Qatar Central Bank bought 15.75 tonnes of gold in August and September (even though it’s clearly stated on the Qatar Central Bank international reserves reports on the Bank’s website here), but the World Gold Council is, at the same time, willing to accept mere “suggestions” from Metals Focus that other central banks bought a massive 310 tonnes of gold during Q3? What kind of double standards are these?

And what kind of methodology is it that uses ‘suggestions’ from a third party – i.e. Metals Focus? Turning to the “notes and definitions” page of the WGC’s Gold Demand Trends Q3 2022, central Bank gold buying is merely defined as:

“Net purchases (i.e. gross purchases less gross sales) by central banks and other official sector institutions, including supra national entities such as the IMF. Swaps and the effects of delta hedging are excluded.”

The Puppet Master – Metals Focus

There is no mention of Metals Focus. Nor does the World Gold Council’s ‘Central Bank data Methodology‘ pdf mention Metals Focus either.

The Q3 Gold Demand Trends report (the full pdf version of which is here also provides no clues on who Metals Focus is, only mentioning Metals Focus as a source in a few of the charts in the report, and also in a footnote mentioning Metals Focus as follows:

“Country-level gross sales and purchases based on the most recent IMF IFS and respective central bank data available at the time of writing.

This may not match the net central bank demand figures published in this report as Metals Focus uses additional sources of information to obtain its estimates.”

(page 12 – footnote 4)

But to see any explanation of who Metals Focus is, we need to go to the WGC’s Gold Demand Trends “Supply and demand data methodology note” (pdf) which is linked from this WGC page here.

In section 1 of this note, titled “Demand & supply data provider”, we find that:

“Our core demand and supply data are provided by Metals Focus, a leading independent precious metals consultancy.

Metals Focus meets our strict criteria for the provision of demand and supply data, which includes the need for an extensive global network, an experienced team, and a robust methodology.

These elements combine to create a framework for collecting accurate, granular and transparent estimates for gold demand and supply.”

Hold on another minute? Transparent? And a robust methodology?

Section 3 of the same note, titled “Data collection process”, has the following to say about how Metals Focus collects central bank gold demand data:

“Central bank demand is calculated using information from three different sources.

Monthly International Financial Statistics (IFS) produced by the IMF serve as an initial check for central bank transactions, but it is important to be aware that not all changes will reflect an outright sale or purchase – for example, swap activity can appear as a change to central bank holdings.

A second vital source is confidential information regarding unrecorded sales and purchases.

The final element in calculated net central bank purchases is analysis of trade flow data.”

In the case of this of 310 tonnes of unreported gold buying in Q3, this was by definition not in the IMF IFS data, since it wasn’t reported in any country level reporting to the IMF IFS database.

Also the 310 tonnes can’t have been in ‘trade flow data’ since monetary gold HS Code 71082000), as Metals Focus well knows, is globally exempt from being reported in any trade flows.

London Confidential

So that leaves “confidential information regarding unrecorded sales and purchases”.

So basically, as you can see, the World Gold Council’s claim of central banks buying over 310 tonnes of unreported purchases in Q3 is based on a suggestion from Metals Focus, which is based on ‘confidential information’. And since no one knows what this ‘confidential information’ is, nor where it came from, there is no way to verify it.

How’s that for “granular and transparent estimates for gold demand"?

So now you can see the problem. Apart from undermining any sense of confidence in the data that the World Gold Council and Metals Focus have seemingly pulled out of the ether, there is also the problem that the major financial news outlets all ran with the 400 tonnes number for Q3 central bank gold demand, and didn’t point out the obvious issues with the data. And this reporting was everywhere this week, in multiple articles all over the world and across the web.

Bloomberg – What exactly do they do?

Furthermore, not one of the major financial news companies such as Bloomberg and Reuters, which have thousands of employees and investigative resources, even bothered to question the validity of this number, let alone devote journalistic resources to try to verify it using independent sources. How’s that for lack of professionalism in journalistic standards from Bloomberg and Reuters?

A large chunk of the purchases that have helped push central bank gold buying this year to the highest since 1967 are from as-yet unknown players https://t.co/8qcwcK7S4b

— Bloomberg (@business) November 1, 2022

I have been to Bloomberg’s London headquarters, and indeed it is impressive, with hundreds and hundreds of reporters and data analytics staff located on every floor, and even TV studios. Up to 4000 staff says the official Bloomberg London website.

So are we to believe that Bloomberg can’t find any staff to independently verify the data of the Metals Focus consultancy, or even visit the Metals Focus office? Or maybe they don’t want to.

Because Metals Focus has it’s head office in London at 74/76 St John St, London EC1M 4DT. And Bloomberg has it’s European headquarters office in London at 3 Queen Victoria St, London EC4N 4TQ. And these buildings are less than 1 mile away from each other, as you can see on the map below:

So instead of questioning the data and using some of it’s 4000 London staff to go out and investigate the identity of the central banks in question, Bloomberg is content to run with the World Gold Council / Metal Focus ‘substantial estimate’ that is based on non-verifiable ‘confidential information’, and to write shallow clickbait articles such as “Mystery Whales Baffle Gold Market After Central Bank Purchases” and “Who Are The Mystery Buyers Responsible For Central Bank Gold Boom?” referring to a secretive bunch of unidentified sovereign buyers. All Bloomberg can do is speculate that it might be China or Russia or India or some of the middle eastern nations:

“Central banks bought 399 tons of bullion in the third quarter, almost double the previous record, according to the World Gold Council. Just under a quarter went to publicly identified institutions, stoking speculation about mystery buyers."

A normally dry research report jolted the gold market this week, when it pointed to massive but so far unidentified sovereign buyers https://t.co/xjCVGqAv2l

— Bloomberg Markets (@markets) November 3, 2022

If at this stage, you’re thinking why didn’t I ask Metals Focus to explain it’s sources for unreported central bank gold buying, I did. But they didn’t answer.

@MetalsFocus You make a substantial estimate of about 310 tonnes of unreported gold buying by central banks during Q3. What are your sources? https://t.co/rbG3GZZubO

— BullionStar (@BullionStar) November 4, 2022

Plugging in the Numbers?

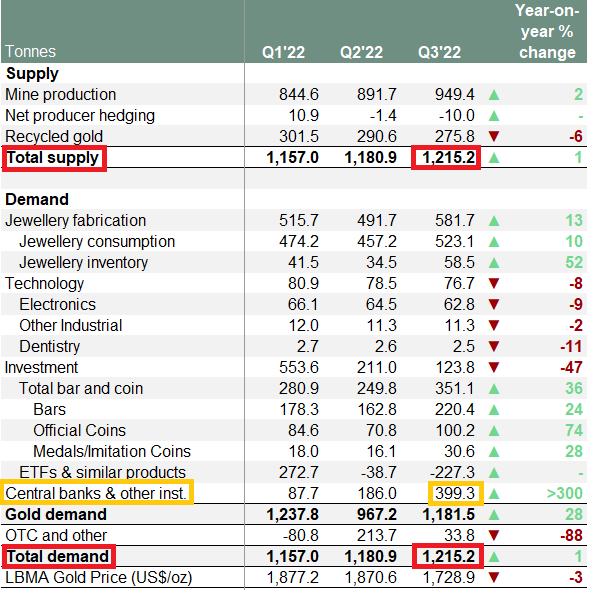

When looking at physical gold demand and supply, Metals Focus and the World Gold Council use a supply – demand model where total gold supply in any year or quarter has to equal total gold demand in that same year or quarter. Here,

‘Gold supply’ = The total of mine production, net producer hedging

and recycling, and

‘Gold demand’ = The total of jewellery fabrication, technology fabrication, investment and net purchases by central banks”

For example, in Q3 2022, the above components of gold supply and the above components of gold demand each total 1215.2 tonnes, and demand has to equal supply for the model to work.

But could it be that this quarter, that the only way for the model to balance was to plug in a figure for central bank gold demand and claim that the data is a substantial estimate due to unreported buying? As the data is based on ‘confidential information’, no one would be able to verify it or confirm or deny it.

This is something that ‘Macro Tourist’ on Twitter suggested, where he used the 399 tonnes but used both sets of Turkish gold additions, and got unreported purchases of 280 tonnes (and not 310 tonnes). He says “I have a feeling they made this number up to balance Q3 supply and demand“:

The WGC number of 399t is made up of 119t reported purchases and 280t their own estimate of “unreported purchases". I have a feeling they made this number up to balance Q3 supply and demand

— MacroTourist (@Gloeschi) November 3, 2022

If this is the case, that would explain why the World Gold Council is so eager to taken on board all the ‘suggestions’ of Metals Focus as regards estimates of unreported buying, since the WGC has even revised it’s 2022 full year estimate for central bank gold purchases, saying that:

“We can’t rule out further unreported buying so have revised our forecast higher for FY 2022.” (page 3 of the report)

Conclusion

So what are we to make of the fact that more than three-quarters of the claimed central bank gold purchases have been estimated by Metals Focus due to Metals Focus saying that they are ‘unreported purchases’? Because if they are unreported, how does Metals Focus know about the purchases, but no one else knows? Did they overhear it down the pub in the City of London where the gold traders hang out? And who were the sellers? Because for every buyer, there’s a seller.

At the end of the day, it’s very unscientific and un-transparent of Metals Focus and the World Gold Council to expect people to just consume these claims, and unprofessional of Bloomberg, Reuters and others to run with the number without doing their own investigations.

The main question really is, why does the Gold Establishment not want a light shone on the central bank gold world and why are they protecting the secrecy. Equally, why do the large financial media organisations such as Bloomberg, never want to investigate the central bank gold market. If this was the international oil market, they’d be all over OPEC and the producers and the industry with a huge number of reporters and journalists doing an extensive investigation.

Could it be that none of them want to rock the boat and irritate the central banks so they never look to investigate the central bank gold market?

On it’s website, the World Gold Council claims that it’s people are “the global experts on gold”, as well as “the authority on gold”, and some of the Council’s stated aims are to “facilitate greater market efficiency”, and “improve trust”.

For example, the WGC says:

“Trust is earned when words and actions meet. In conjunction with our members and other market participants, we build confidence in the gold market by creating and upholding standards for transparency and integrity across the gold value chain.”

But how can publishing an opaque figure of 310 tonnes of unreported central bank gold buying be in any way “upholding standards for transparency”? It’s not.

On it’s website, Metals Focus claims to be:

“dedicated to providing world-class statistics, analysis and forecasts to the global precious metals market.”

Except that these world-class statistics and analyses don’t extend to explaining how Metals Focus came up with the massive figure of 310 tonnes of central bank gold demand during Q3. The figure was just quietly slipped into the “largest single quarter of demand from this sector since records began” back in 2000.

On Bloomberg’s official London headquarters website, there is a quote from founder Michael Bloomberg stating that:

“This building is designed to encourage cooperation and collaboration, and that’s what makes for a successful business.”

Sadly, when it comes to the central bank gold market, Bloomberg, in not encouraging cooperation and collaboration in devoting some of it’s massive resources to establishing facts and investigating sources, but is instead running with unverified data.

But maybe that’s what they want. To protect central bank secrecy in the gold market instead of exposing it.

Popular Blog Posts by Ronan Manly

How Many Silver Bars Are in the LBMA's London Vaults?

How Many Silver Bars Are in the LBMA's London Vaults?

ECB Gold Stored in 5 Locations, Won't Disclose Gold Bar List

ECB Gold Stored in 5 Locations, Won't Disclose Gold Bar List

German Government Escalates War On Gold

German Government Escalates War On Gold

Polish Central Bank Airlifts 8,000 Gold Bars From London

Polish Central Bank Airlifts 8,000 Gold Bars From London

Quantum Leap as ABN AMRO Questions Gold Price Discovery

Quantum Leap as ABN AMRO Questions Gold Price Discovery

How Militaries Use Gold Coins as Emergency Money

How Militaries Use Gold Coins as Emergency Money

JP Morgan's Nowak Charged With Rigging Precious Metals

JP Morgan's Nowak Charged With Rigging Precious Metals

Hungary Announces 10-Fold Jump in Gold Reserves

Hungary Announces 10-Fold Jump in Gold Reserves

Planned in Advance by Central Banks: a 2020 System Reset

Planned in Advance by Central Banks: a 2020 System Reset

China’s Golden Gateway: How the SGE’s Hong Kong Vault will shake up global gold markets

China’s Golden Gateway: How the SGE’s Hong Kong Vault will shake up global gold markets

Ronan Manly

Ronan Manly 0 Comments

0 Comments