Qatar Ramps Up Gold Reserves as World Cup Approaches

With many eyes across the world soon turning towards the Gulf State of Qatar as it hosts the upcoming 2022 FIFA World Cup later this year, now is a good time to look at another interesting development in the Qatari Emirate, namely the recent rapid growth of Qatar’s monetary gold reserves.

In August, the Qatar Central Bank raised a few eyebrows when it announced that during July, the Bank had purchased about 14.8 tonnes of gold, thereby bringing the country’s official gold reserves to 72.3 tonnes.

This addition to Qatar’s gold holdings was significant because it was both the largest ever single monthly purchase of gold by Qatar’s central bank (or its predecessors), and it also raised Qatar’s monetary gold reserves to their highest level ever. In September, the Qataris continued their gold buying, raising their gold reserve holdings to 77 tonnes (see below).

Note that while the Qatar Central Bank (QCB) was founded in 1993, it was preceded by the Qatar Monetary Agency (QMA) from 1973 to 1993 (which preformed the functions of a central bank), and the QMA was also preceded by the Qatar-Dubai Currency Board from 1966 until 1973. Therefore records of the Bank (and its annual reports) actually began in 1966.

The Central Bank of Qatar added 14.8t of #gold to its official reserves in July 2022 – appears to be the largest monthly increase on record (back to 1967), although early data is patchy. Gold reserves now stand at 72.3t, the highest on record. [Data via IMF IFS] pic.twitter.com/2xnMFAsmcH

— Krishan Gopaul (@KrishanGopaul) August 23, 2022

In a similar manner to the secretive Qatari sovereign wealth fund known as the “Qatar Investment Authority“, Qatar’s central bank is also very secretive concerning details of the central bank’s gold holdings.

Running the Data – June and July

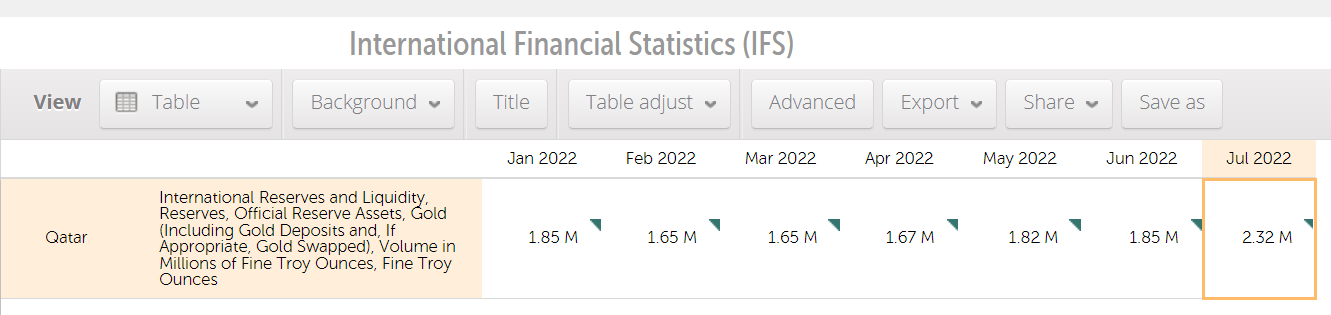

The only two places where changes to the gold holdings of the Qatar Central Bank (QCB) can be seen are in monthly data which the QCB transmits to the IMF’s International Financial Statistics (IFS) database (here), and also in the monthly ‘Official Reserves’ reports on the QCB’s website here.

For July, the IMF IFS central banks’ gold holdings data (which is only to two decimal places) says that Qatar’s gold reserves increased to 2.32 million ozs (72.16 tonnes) from 1.85 million ozs (57.54 tonnes) at the end of June. That would be a 0.47 million ounce increase over the month of July, which is equivalent to an increase of 14.62 tonnes.

Looking at the Qatar Central Bank’s Official Reserves pages for July, the only data provided is the total value of the Bank’s gold reserves specified in Qatar’s currency, the riyal, which says that at the end of July, the Bank’s gold reserves had a total value of Qatari riyals (QR) 14.9409 billion.

Given that the Qatari riyal has a rigid fixed exchange rate to the US dollar of QR 3.64 per USD (the official Qatari exchange rate policy can be seen here), then this means that at the end of July, the value of Qatar’s gold reserves in US dollars was US$ 4.1046 billion.

If you assumed that the QCB calculates a month-end value for its gold using an international gold price such as the LBMA afternoon gold fixing on the last business day of the month, and given that the LBMA PM fix for gold on Friday 29 July was US$ 1753.4 per troy oz), then the US$ 4.1046 billion value would suggest that Qatar held 2,340,962 ozs of gold at the end of July (or 72.81 tonnes). Which is slightly more gold than they claimed to have based on the IMF IFS data.

But if you use the gold price on the actual last day of July, which was Sunday 31 July when the gold price pre-COMEX opening was US$ 1766.2, you get a figure of 2,323,997 ozs, or 72.28 tonnes. Which is very near the reported tonnage in the IMF IFS database. So it looks like the QCB uses a valuation point of the very last day of the month, not the last international business day. And anyway, a Sunday in Qatar is a business day, so 31 July was a business day in Qatar.

Applying the same logic to the end of June (where 30 June was a Friday and the LBMA PM gold fixing was US$ 1817), yields the following: At the end of June, the QCB in its Official Reserves report claimed to hold gold worth QR 12.236 billion. This translates to US$ 3.36159 billion, which at a price of US$ 1817 per oz implies that Qatar held 1,850,079 ozs of gold, or 57.54 tonnes at the end of June. This is also the exact same gold holding (i.e. 1.85 million ozs) as in the IMF IFS data. Which also means that during July, the QCB bought 14.74 tonnes of gold.

Running the Data – August

The reason for explaining all of this is that it also now looks like the Qatar Central Bank purchased even more gold during August. This is because while the QCB has not yet sent any August gold holdings data to the IMF IFS database, the Qatar Central Bank has already gone and independently published its official reserve data for the end of August on its website.

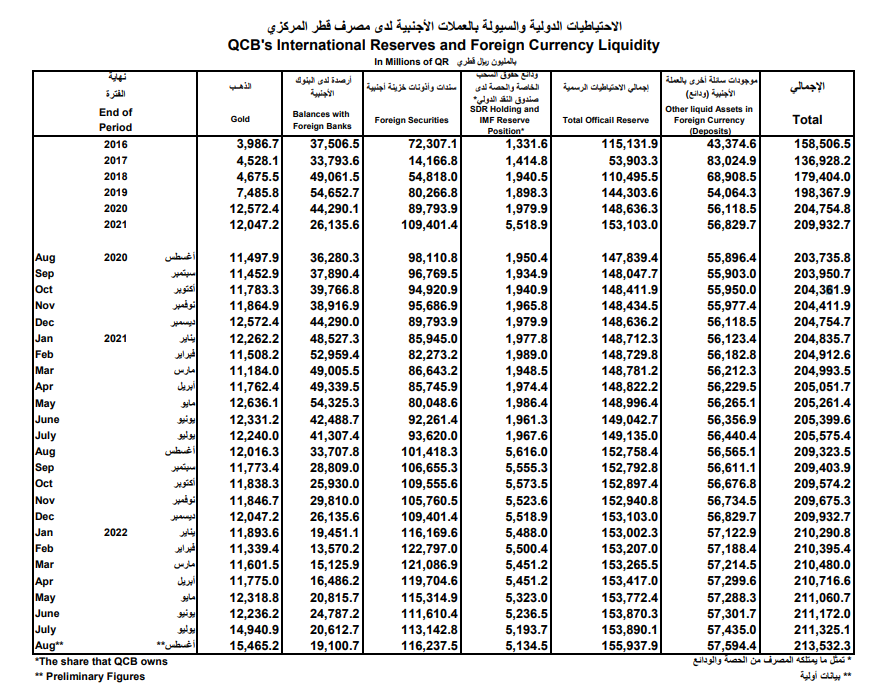

And the QCB Official Reserves report for August (link here) shows the following:

As of the end of August, the QCB held gold worth QR 15,465.2 billion. This translates to US$ 4.24868 billion. Given that 31 August was a Wednesday, we can use the LBMA PM gold fixing price on that date, which was US$ 1715.9 per oz. This implies that on the last day of August, the QCB held 2,476,066 ozs of gold, or 77.01 tonnes. And given the fact that the QCB held 72.28 tonnes of gold at the end of July, this also means that during August, the Qataris bought another 4.73 of gold for Qatar’s monetary gold reserves.

A fact which BullionStar was the first to highlight on 22 September. And which we tweeted about here (see below), while cc’ing the World Gold Council.

Qatar’s central bank continues to buy gold, adding another 4.2 tonnes during August. This follows a 15 tonne gold purchase by the bank in July. Qatar’s central bank gold reserves now stand at about 77 tonnes. Latest data here ?? https://t.co/LGvDiopCbn #WorldCup @KrishanGopaul

— BullionStar (@BullionStar) September 22, 2022

While the World Gold Council (WGC) therefore knows about this August gold purchase (since we told them), they will not officially accept this update until the data appears on the IMF IFS database. As the WGC said here in its 29 September commentary about Qatari central bank gold transactions:

“Finally, preliminary data published by the Qatar Central Bank suggests a further addition to its gold reserves during August.

But as the precise tonnage increase has not yet been reported in the IMF IFS database, we have decided to exclude from our data. If confirmed, it would be the fifth consecutive month in which Qatar’s official gold reserves have risen. Total gold reserves stood at 72t at the end of July, up 16t (+27%) since the start of the year."

However, the precise tonnage can be calculated, as I have shown above. So even though the World Gold Council won’t yet acknowledge it, Qatar’s gold reserves now total 77 tonnes.

This also means, as the WGC says, that the Qatar Central Bank has bought gold for 5 consecutive months now, adding 25.7 tonnes since April, specifically comprising 0.78 tonnes in April, 4.67 tonnes in May, 0.78 tonnes in June, 14.74 tonnes in July, and 4.73 tonnes in August.

Earlier this year, Qatar recorded two more gold transactions, with its gold holdings rising by 0.68 tonnes during January, but then for some reason falling by 6.12 tonnes during February. Which on a net basis means that year-to-date, Qatar has added a net 20.3 tonnes to its gold reserves, which is a 35.8% increase in its monetary gold reserves year-to-date.

A Multi Year Trend of Gold Accumulation

This brings us to the bigger picture trend of the relatively rapid increase in Qatar’s gold reserves over recent years.

It wasn’t that long ago that Qatar had practically no gold reserves at all. As recently as 2006, the Qatar Central Bank held less than 1 tonne of gold. Then in 2007 the Bank added 11.8 tonnes of gold. The QCB’s gold holdings then remained unchanged for the next 7 years from 2008 all the way through 2014.

But something seems to have changed beginning in 2015, for in 2015, the QCB added another 9.8 tonnes of gold. The QCB then bought 7.5 tonnes of gold during 2016, 1.6 tonnes in 2018, 11 tonnes in 2019, 14.5 tonnes in 2020, and now in 2022 has added another 20.3 tonnes.

Which means that since 2014, Qatar has bought 64.6 tonnes of gold, and over the 8 year period from 2015 to 2022, the Qatar Central Bank has increased its gold reserves by a massive sixfold, from less than 13 tonnes to the current 77 tonnes.

During some of that period, Qatar also experienced a diplomatic crisis, specifically between June 2017 and January 2021, during which 4 Gulf Co-operation Council (GCC) regional neighbours of Qatar’s, namely Saudi Arabia, UAE, Bahrain and Egypt, cut diplomatic relations with Qatar over accusations that Qatar was supporting terrorism. That impacted Qatar’s international financial position and may have partially led the QCB to turn to gold as a reserve asset.

Since, as every good central banker knows, physical gold is an asset with no counterparty risk, no default risk, and is an asset that is critical to hold in times of financial or economic crisis or potential crisis.

Prediction – Qatar Gold Buying Will Continue

Fast forward to Q4 2022, and while Qatar’s this gold reserve accumulation over the last 8 years has been impressive, this might only be the beginning. Let me explain.

Qatar is one of the world’s richest countries on a per capita basis. It has the third largest natural gas reserves in the world and is the world’s third largest natural gas exporter (and the world’s leading exports of liquified natural gas (LNG)). Qatar is also a leading crude petroleum exporter. Not surprisingly, hydrocarbons represent the vast majority of the country’s resource wealth, while exports of natural gas, crude oil, and other petroleum products represent a significant majority of Qatari government revenues.

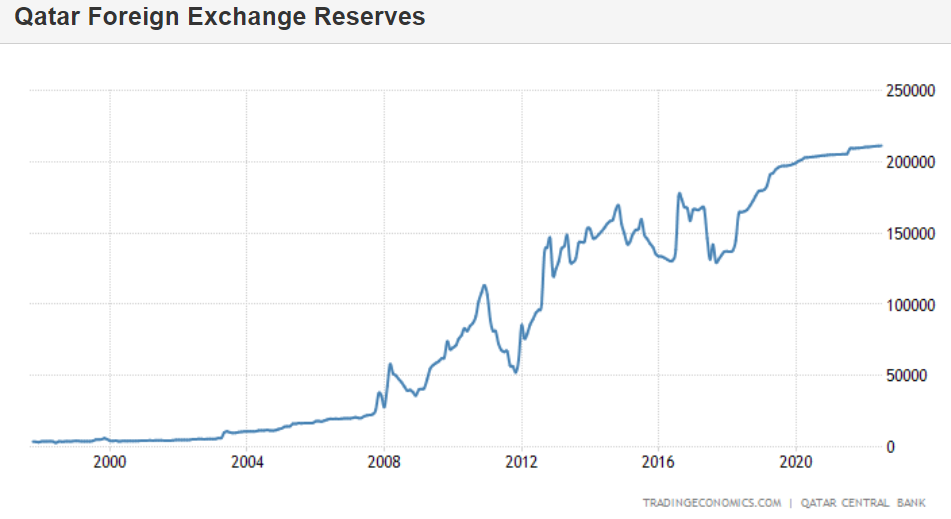

These exports have also fueled Qatar’s economy growth and are reflected in its balance of payments position, in its capital inflows, and through to the growth of the Qatari’s Central Bank’s foreign reserves.

For example, Qatar’s international reserves have grown from QR 115.1 billion at the end December 2016 to QR 155.9 billion at the end of August 2022, a 35.5% increase. These official reserves comprise gold, cash balances with foreign banks, foreign securities (such as treasury bonds), and holdings of IMF SDRs and the QCB’s IMF reserve position. Add in Qatar’s foreign currency deposits, and the Qatar Central Bank’s “International Reserves and Foreign Currency Liquidity" has risen from QR 158.5 billion at the end of 2016 to QR 213.3 billion at the end of August 2022, a 34.5% increase.

But critically, within this growth of official reserve assets, the portion that the Qatar Central Bank invests in gold has also been rising.

For example, at the end of August 2022, the QCB had 9.91% of its foreign reserve assets invested in gold (QR 15.46 billion of QR 155.94 billion). A year ago in August 2021, that percentage was 7.86% (QR 12.02 billion of QR 152.76 billion). Back at the end of 2018, the QCB’s gold as a percentage of reserve assets was only 4.23% (QR 4.67 billion of QR 110.49 billion).

So you can see that the QCB has been pursuing a reserve management strategy of over time increasing gold as a percentage of total official reserve assets. At the same time, the QCB’s cash balances at foreign banks have been falling, so there appears to be some rotation out of fiat cash and into physical gold.

But aside from that, given Qatar’s massive and growing foreign reserves, even if the Qatari central bank just continued to invest about 10% of total foreign reserves in gold, it would need to continually buy more gold as its total reserves continue to grow, as they ultimately will given its massive oil and gas resource wealth.

However, at just under 10%, gold as a % of official reserves on the QCB balance sheet is still relatively low compared to other central banks. If you rank the top 100 central bank gold holders by their gold holdings as a % of their total foreign reserves (from high to low), Qatar comes in at only about 44th place, which is behind Arab region neighbours such as Iraq, Egypt, Jordan, Lebanon and Algeria, and well behind almost all major European countries.

So as Qatar’s overall foreign reserves grow, there is also extra room for growth in the Qatar Central Bank’s gold holdings if the QCB increases the portion of foreign reserves allocated to gold. For future wealth planning and preservation, it would also be smart for the Qatar Central Bank to continue to diversify it’s very large but not unlimited hydrocarbon reserves and their revenue streams, and transfer a portion of this gas and petro wealth into the Wealth of the Ages – i.e. Physical Gold.

The Qataris might also be receiving some hidden gold payments for oil and gas. But that’s ‘another’ story. As ANOTHER said in October 1997: “Now all governments don’t get gold for oil, just a few. That’s all it takes. For now!"

The same could be said for the massive Qatari sovereign wealth fund, the Qatar Investment Authority (QIA), which holds assets worth in the region of US$ 450 billion, and being such a secretive fund, could well also hold physical gold within its asset allocation. Perhaps gold even flows between the QCB and the QIA. After all, they are both arms within the tightly controlled Qatari sovereign hierarchy.

Conclusion

While there is no information on where the Qatar Central Bank stores its claimed gold reserves, the gold could be stored either domestically in a vault in Qatar, or abroad with one of the widely used central bank gold custodians. Due to historical connections with Britain, if the Qatar central bank stores gold abroad, it would probably be at the Bank of England in London.

If the gold is stored in a vault in Qatar, it would probably be in a vault in the Qatari capital Doha. However, don’t hold your breath that anyone will see the Qatari gold anytime soon. We’ll just have to make do with seeing the golden FIFA World Cup being presented in Doha to the winning World Cup team on 18 December, a trophy which by the way, contains 118.8 troy ounces of pure gold. And while that team will surely not be Qatar, the host nation is still going for gold in more ways than one.

Popular Blog Posts by Ronan Manly

How Many Silver Bars Are in the LBMA's London Vaults?

How Many Silver Bars Are in the LBMA's London Vaults?

ECB Gold Stored in 5 Locations, Won't Disclose Gold Bar List

ECB Gold Stored in 5 Locations, Won't Disclose Gold Bar List

German Government Escalates War On Gold

German Government Escalates War On Gold

Polish Central Bank Airlifts 8,000 Gold Bars From London

Polish Central Bank Airlifts 8,000 Gold Bars From London

Quantum Leap as ABN AMRO Questions Gold Price Discovery

Quantum Leap as ABN AMRO Questions Gold Price Discovery

How Militaries Use Gold Coins as Emergency Money

How Militaries Use Gold Coins as Emergency Money

JP Morgan's Nowak Charged With Rigging Precious Metals

JP Morgan's Nowak Charged With Rigging Precious Metals

Hungary Announces 10-Fold Jump in Gold Reserves

Hungary Announces 10-Fold Jump in Gold Reserves

Planned in Advance by Central Banks: a 2020 System Reset

Planned in Advance by Central Banks: a 2020 System Reset

China’s Golden Gateway: How the SGE’s Hong Kong Vault will shake up global gold markets

China’s Golden Gateway: How the SGE’s Hong Kong Vault will shake up global gold markets

Ronan Manly

Ronan Manly 0 Comments

0 Comments