Inside the Portuguese Central Bank's Gold Vault

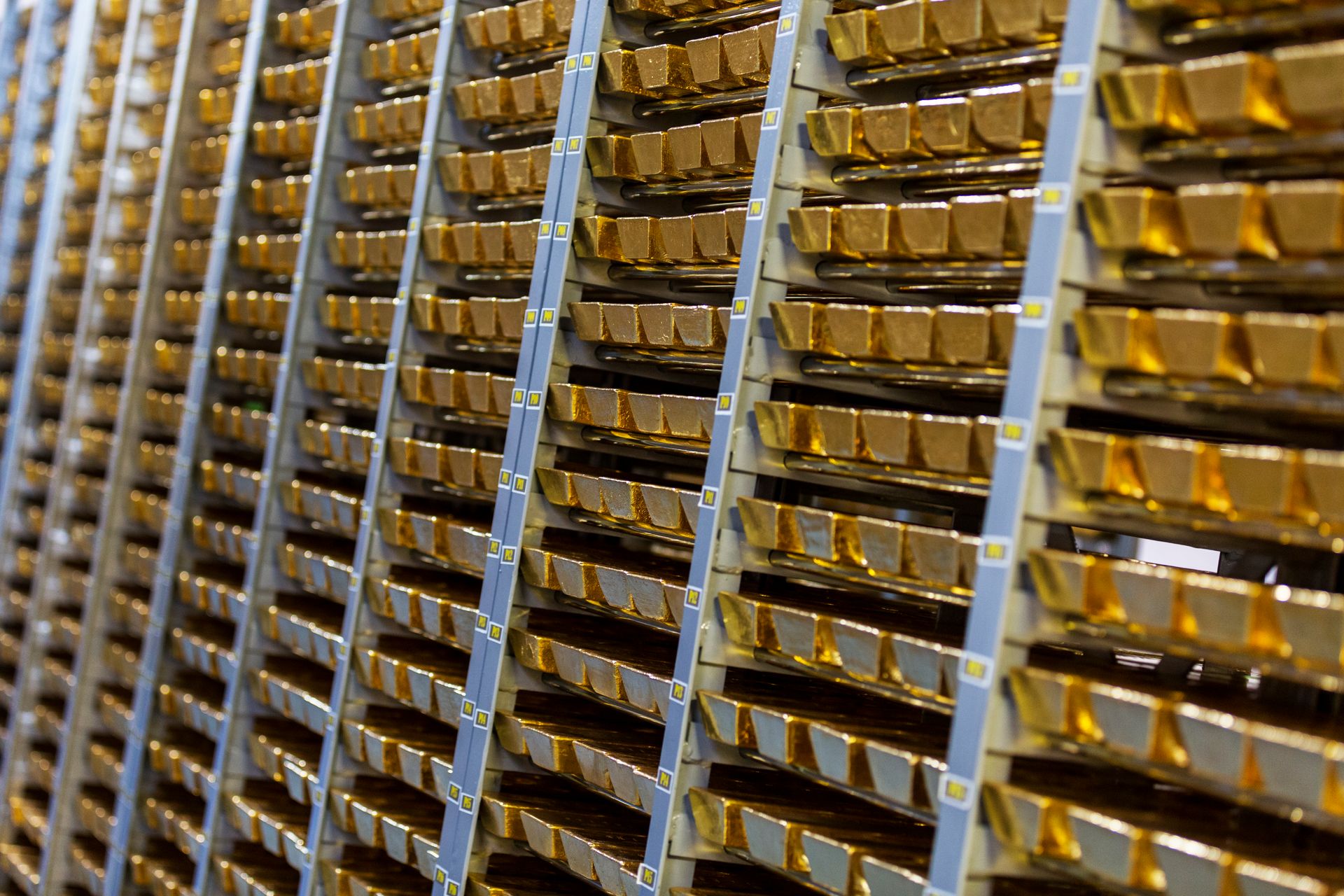

On Tuesday 17 May, the central bank of Portugal brought a group of Portuguese reporters and photographers on a visit to its gold vault located in a high security compound in a town called Carregado, about 30 minutes drive north-east of Portugal’s capital Lisbon.

The Portuguese central bank, known as “Banco de Portugal”, boasts significant gold reserves, and claims to hold 382.6 tonnes of gold, a figure which puts in in 6th place among European central bank gold holders, only behind Germany, Italy, France, Switzerland, and the Netherlands, and in 14th place on a global basis.

Like anything in the central bank gold world, there is no transparency into the claimed gold of any of these central banks nor any independent physical audits of the gold bars they claim to hold, so when talking about relative rankings, we will just have to go with the figures of the IMF / World Gold Council.

Just Outside Lisbon

The Banco de Portugal maintains that just over 45% of its total gold reserves, or 127.6 tonnes (5,549,238 ozs), is held in the form of gold bars in its vault in Carregado, and it was these gold bars which the Portuguese reporters and photographers were briefly shown in what the Reuters report about the visit called a ‘Rare Glimpse’.

But apart from Reuters, a whole host of Portuguese media seemed to be present for the tour of the vault, judging by the extensive coverage this gold vault ‘tour’ received in the Portuguese media. So it is these reports of the Portuguese media which we turn to get more details about the Carregado vault and what the media saw. And since there were photographers present, quite a few photographs of the gold were taken, a selection of which are included below.

The Banco de Portugal’s Carregado Complex is a 67,000 square metre compound in an industrial part of the town which is surrounded by high walls and barbed wire, and which is guarded by machine gun toting members of Portugal’s National Republican Guard, and their four-legged friends, German Shepherds. As well as the gold vault, this Carregado Complex, built in 1995, is where the Portuguese central bank prints Euro banknotes, so there are said to be more than 200 bank employees working in this operational centre.

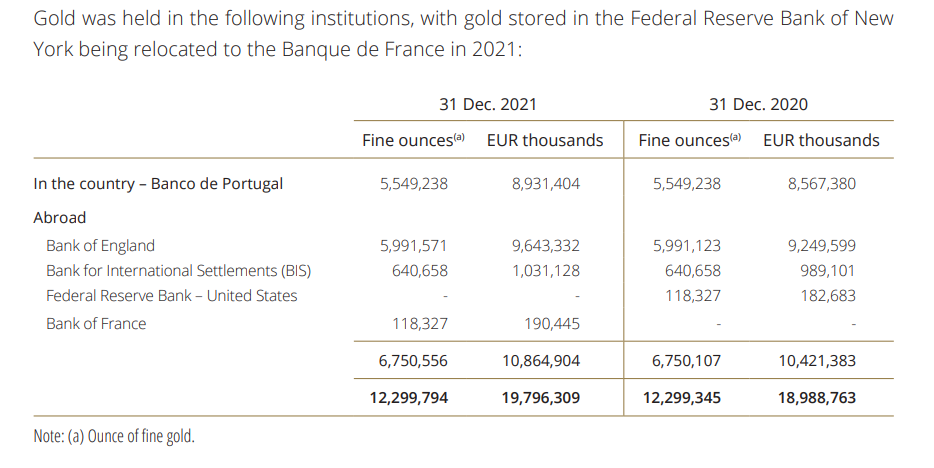

Apart from the 172.6 tonnes (45%) of Portuguese gold in the Carregado vault near Lisbon, the Banco de Portugal maintains that another 186.4 tonnes (48.7%) of its gold is stored in the Bank of England in London, with an additional 20 tonnes (5.2%) stored with the Bank for International Settlements (BIS), and the remaining 3.7% tonnes (1%) now stored at the Banque de France in Paris after having been moved in 2021 from the vault of the Federal Reserve Bank of New York (FRBNY). So overall, the split is 45% of Portugal’s gold is supposedly stored in Portugal, with the remaining 55% stored abroad.

According to one of the reporters on the recent Carredago visit, Diogo Cavaleiro, of Portuguese newspaper Espresso, the security layout was as follows:

“Protected by doors and corridors, codes and cards, in a room with a barred door, after a long walk to get there, they are lined up on shelves, five on each one, with the gray of the closet fading into the gold. These are the gold bars that are found in the safe deposit box of Banco de Portugal, located in Carregado.

It is there that little less than half of all the gold reserves of the Portuguese State are located. The rest are around the world, and a portion was even, until last year, in New York, but has now come to Paris.”

Behind bars – View into the gold storage room of the Banco de Portugal, Carregado

A Datacenter – But for Gold

From the photos, you can see that the gold storage vault of the Portuguese central bank has a very orderly design, with tall racks of bars (maybe 30 rows high) laid out in close proximity to each other to form a number of aisles and corridors. It almost has a datacenter feel to it, except instead of servers and routers, there are gold bars.

Commenting on the visit, reporters Sandra Afonso and Marta Grosso from Radio Renascença wrote:

“This Tuesday, on a guided tour, journalists were able for the first time to take photographs of the gold in the Casa Forte de Reserva, located in Carregado.

Much gold is stored in these facilities: 13,666 bars, totaling 173 tons. Each bar weighs about 12 pounds. In Carregado, there are still 406 bars that belong to the European Central Bank (ECB), but are in the custody of the Bank of Portugal (BdP).

“Interestingly, most of the gold is abroad. We have 186 tonnes in custody at the Bank of England, one of the main gold custody and gold transaction locations. We have a significant part of our gold there: around 49%”, said Hélder Rosalino [Banco de Portugal director]”

Interestingly, the Banco de Portugal’s Carregado vault claims to be storing about 5 tonnes of gold which belongs to the European Central Bank (ECB). This is gold that was transferred by the Banco de Portugal to the ECB in 1999 as part of the creation of the Euro when each founding central bank member transferred foreign reserve assets to the ECB, 15% of which had to be in the form of physical gold. See BullionStar article “European Central Bank gold reserves held across 5 locations. ECB will not disclose Gold Bar List.”

Gold bars in very tall metal racks inside the Portuguese stronghold.

The Carredgado gold is stacked in rows on shelves with 5 bars per shelf

From New York to Paris

During 2021, the Portuguese central bank made a change to it’s international gold storage arrangements which is sure to lift some eyebrows in central banking circles, and which is now even more interesting given the subsequent US led sanctions which have played out since then, which have heightened “Confiscation Risk".

For in 2021, the Banco de Portugal took the gold that it had been storing with the Federal Reserve Bank of New York (FRBNY) in Manhattan, and moved it into storage at the Banque De France in Paris. The amount of gold in question was 118,327 ozs or 3.68 tonnes. Whether the gold was actually withdrawn and flown across the Atlantic from New York to Paris is unknown. It could more easily have been moved via a location swap. But the fact that it was moved is the important thing.

According to the Portuguese central bank’s 2021 Annual Report, which has just been released, and whose publication was connected to the timing of the Portuguese reporters’ visit to the gold vault:

“The gold held at the Federal Reserve Bank of New York, amounting to 3.7 tonnes, was transferred to the Banque de France, In order to improve income from gold deposited abroad and place it within the Eurosystem.“

This was a theme revisited by the Banco de Portugal director, Hélder Rosalino, who gave a presentation to the reporters visiting Carregado on Tuesday 17 May. According to ECO, an online economic newspaper in Portugal:

“In the presentation of the report in Carregado, director Hélder Rosalino argued that gold is an important asset for central banks as it is “a safe asset that is resistant to economic contexts” and that “has no credit risk”.

Banco de Portugal “geographically disperses” its gold reserves “for reasons of risk management and profitability” since gold, in order to be profitable, “must be in certain international markets where there are conditions for making investments”. In 2021, the central bank profited 40 million euros from the profitability of the gold it has.

Most of the gold is in the Bank of England (186 tons), followed by Carregado (173 tons), the Bank for International Settlements (20 tons) and 4 tons in the Bank of France.

“We wanted to bring gold to Europe to have opportunities for profitability of that gold”, explained Rosalino, noting that gold reserves correspond to around 10% of the BdP’s balance sheet.

Massive Gold Swaps at the Bank of England

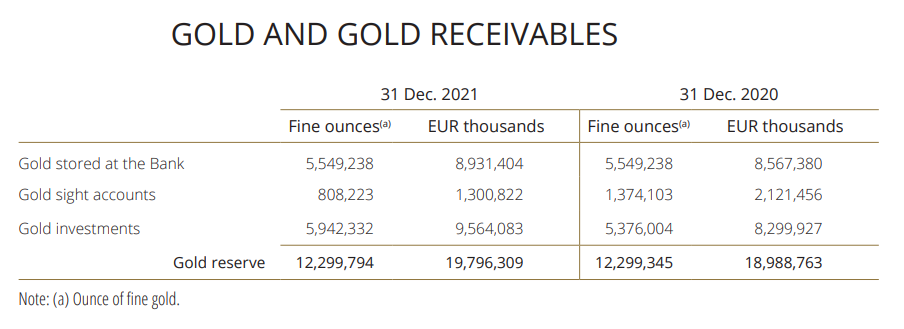

If you look at the central bank of Portugal’s annual report for 2021, you can see what Rosalino means by “opportunities for profitability of gold“. Because all 210 tonnes of Portugal’s gold stored outside Portugal are actively managed, meaning that this actively managed gold is either “swapped", “loaned out" or in some other ways its ‘control’ has passed to other entities. Which is what the central banking smoke and mirrors label of ‘Gold and Gold Receivables’ actually means.

In the Bank’s annual report, there are two interesting tables, one which gives a locational breakdown of the Bank of Portugal’s gold storage locations of Portugal, Bank of England, BIS and Banque de France (see Table 1 below), and the second table which specifies the various ‘forms’ in which the Bank’s gold is classified, i.e. “Gold stored at the Bank", “Gold sight accounts", and “Gold Investments" (see Table 2 below).

As you can see, the quantity (in fine ounces) of “Gold stored at the Bank" in Table 2 is exactly the same as the quantity of “Gold stored in Portugal" from Table 1, i.e. 5,549,238 ounces for 2021. So according to the Portuguese central bank, the gold in Portugal is just stored there and not actively managed. However, even that is debatable given how central banks enter ultra secret loans and collateralized deals for their gold, which at times even their own governments don’t know about.

Turning to the Portuguese gold stored abroad, from Table 1 this totals 6.750,556 ozs, nearly all of which is at the Bank of England, with a small portion in the BIS and less than 1% at the Banque de France. Looking again at Table 2, you can see that all the gold which is not in Portugal is classified as being either “Gold Investments" (88%) or “Gold sight accounts" (12%). Sight deposits are sort of like demand deposits, and in theory can be withdrawn at short notice, but they are a form of “Unallocated gold". The BIS is a big player in offering sight deposits in gold. Given that the ‘sight deposits’ (in gold) of the Portuguese central bank total 808,223 ozs, it’s fair to say that most of these could be with the BIS.

This leaves the massive ‘Gold Investments’ line item of Table 2. As the Bank of Portugal’s annual report makes clear, this refers to Gold Swaps (euro for gold swaps), where the Banco de Portugal has swapped gold for euros.

As the Portuguese central bank’s annual report states:

“In accordance with the Eurosystem’s accounting framework, gold swaps are treated as repurchase agreements and gold flows relating to these operations have no impact on gold reserve levels.

A gold swap for foreign currency (or for euro) is treated as deposit taking, in which interest is agreed (the difference between the spot and forward prices) and is accrued over the transaction’s life."

Involving a huge 5,942,332 ozs of Portuguese gold, valued at Euro 8.9 billion, it is therefore clear that nearly all the gold which the Portuguese central bank claims at the Bank of England is involved in Gold Swaps. The Bank’s annual report says that the euros received from the gold swaps “were used to temporarily reduce liabilities in the TARGET account".

In terms of counterparties, the annual report accounts for the euro payments which the Banco de Portugal has received as ‘Liabilities to gold swap’ and lists 2 line items with different counterparties, namely, “Liabilities to gold swap – euro area residents denominated in euro" and “Liabilities to gold swap – non-euro area residents denominated in euro".

This means that the Banco de Portugal is engaging in ‘gold for euro’ swaps with LBMA banks domiciled in the Euro area (e.g. French banks such as SocGen) and LBMA banks not domiciled in the euro area (e.g. US, UK and Swiss banks, such as Goldman Sachs, HSBC and UBS). In other words, the usual suspects.

And even though the central bank of Portugal uses the accounting fiction of “Gold and Gold Receivables" to claim that all of it’s gold stored at the Bank of England is part of its monetary gold reserves and an asset on its balance sheet, in reality any gold that has been swapped with the LBMA bullion banks at the Bank of England is under the control and use of these LBMA bullion banks. So swapped gold can be in two (or more) places at once.

Conclusion

While a whole group of Portuguese reporters were eager for a ‘quick glimpse’ of the gold bars stored in the Banco de Portugal’s Carregado compound, not one of the reporters in their subsequent reporting questioned why the Portuguese central bank does not publish a weight list (with serial numbers) of all the gold bars stored in the Carregado vault and all the Banco de Portugal’s gold bars supposedly stored in the Bank of England, Banque de France or with the BIS. And not one reporter looked into the fact that the majority of Portugal’s gold has been swapped with a bunch of LBMA banks at the Bank of England.

Interestingly, the one gold bar which the Banco de Portugal selected to take out and put on a table to show to the Portuguese reporters was an old N.M. Rothschild – Royal Mint Refinery (RMR) gold bar from 1930, serial number R2512.

The gold bar (a Rothschild bar) selected by the Banco de Portugal to show to Portuguese reporters

With Rothschild heavily involved in deals in contemporary Portugal and having bankrolled Portugal (and Brazil) in the 1800s, was it a coincidence that the Banco de Portugal pulled out a Rothschild gold bar or a tribute to the famous banking family. Who knows, given the historical financings of Portugal by the Rothschilds, is the Banco de Portugal signaling that the entire country may still be under a Rothschild influence?

When a central bank such as the Banco de Portugal opens it’s gold vault to a bunch of reporters and allows them for the first time ever to take photographs of the bars, you have to ask yourself ‘Why now?" Why is the Portuguese central bank eager for the media to put its gold in the spotlight. Could it be in preparation for future negotiations during a monetary reset? When the stakes are high, showing the other players a glimpse of your hand.

Popular Blog Posts by Ronan Manly

How Many Silver Bars Are in the LBMA's London Vaults?

How Many Silver Bars Are in the LBMA's London Vaults?

ECB Gold Stored in 5 Locations, Won't Disclose Gold Bar List

ECB Gold Stored in 5 Locations, Won't Disclose Gold Bar List

German Government Escalates War On Gold

German Government Escalates War On Gold

Polish Central Bank Airlifts 8,000 Gold Bars From London

Polish Central Bank Airlifts 8,000 Gold Bars From London

Quantum Leap as ABN AMRO Questions Gold Price Discovery

Quantum Leap as ABN AMRO Questions Gold Price Discovery

How Militaries Use Gold Coins as Emergency Money

How Militaries Use Gold Coins as Emergency Money

JP Morgan's Nowak Charged With Rigging Precious Metals

JP Morgan's Nowak Charged With Rigging Precious Metals

Hungary Announces 10-Fold Jump in Gold Reserves

Hungary Announces 10-Fold Jump in Gold Reserves

Planned in Advance by Central Banks: a 2020 System Reset

Planned in Advance by Central Banks: a 2020 System Reset

China’s Golden Gateway: How the SGE’s Hong Kong Vault will shake up global gold markets

China’s Golden Gateway: How the SGE’s Hong Kong Vault will shake up global gold markets

Ronan Manly

Ronan Manly 0 Comments

0 Comments