JP Morgan Gold Traders Plan to Appeal Their Convictions

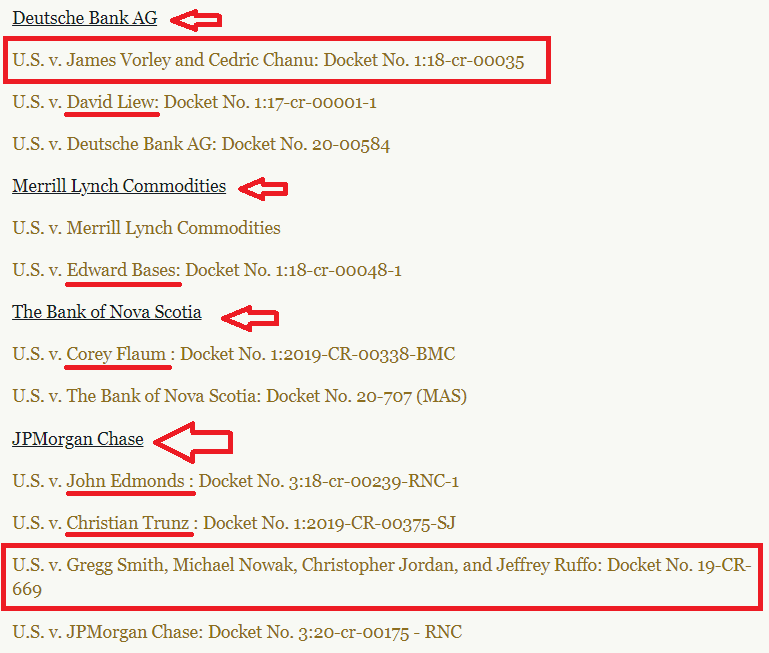

Over the last few years, those in the precious metals investor community who believed that precious metals prices were being manipulated felt vindicated following a series of prosecutions of leading investment banks and their traders by US authorities such as the Department of Justice (DoJ), and Federal Bureau of Investigation (FBI), not least the successful convictions of precious metals traders who worked for JP Morgan.

These trader convictions included:

A successful US criminal trial prosecution by a federal jury of Michael Nowak (former head of JP Morgan’s precious metals trading desk), and Gregg Smith (former JP Morgan precious metals trader) in August 2022.

Nowak was convicted for 13 counts of attempted price manipulation, commodities fraud, wire fraud, and spoofing prices in the gold, silver, platinum and palladium futures markets.

Smith was convicted of 11 counts of attempted price manipulation, commodities fraud, wire fraud, and spoofing.

The BullionStar article discussing the conviction of Nowak and Smith can be read here. To illustrate how important the news of the Nowak and Smith convictions in August 2022 was, the Assistant Director of the FBI’s Criminal Investigative Division said at the time that:

“Today’s conviction demonstrates that no matter how complex or long-running a scheme is, the FBI is committed to bringing those involved in crimes like this to justice.”

In addition to Nowak and Smith, there was a successful US criminal trial prosecution by a federal jury of Christopher Jordan (former JP Morgan precious metals trader) in December 2022.

Jordan was convicted of convicted of wire fraud affecting a financial institution.

JP Morgan’s Michael Nowak also had the dubious distinction of being a board member of the London Bullion Market Association (LBMA) at the time that he was charged and indicted by the DoJ in September 2019.

- In addition to the trader convictions, JP Morgan (the firm) was also successfully prosecuted by the Department of Justice and forced into a resolution with the DoJ in September 2020, wherein JP Morgan entered into a deferred prosecution agreement (DPA) and “paid over $920 million in a criminal monetary penalty, criminal disgorgement, and victim compensation.” JP Morgan’s Deferred Prosecution Agreement can be seen here.

Again to illustrate the severity of what it meant for JP Morgan to agree to a DPA about precious metals market manipulation, at the time in September 2020, the Acting Assistant Attorney of the Justice Department’s Criminal Division said that:

“For over eight years, traders on JP Morgan’s precious metals and U.S. Treasuries desks engaged in separate schemes to defraud other market participants that involved thousands of instances of unlawful trading meant to enhance profits and avoid losses.”

Colleagues turned State Witnesses

While all three of Nowak, Smith and Jordan were charged on the same indictment on 16 September 2019, Jordan managed to secure a separate trial since his lawyers argued that he would not get a fair trial if tried jointly with Nowak and Smith.

According to Bloomberg Law, Jordan’s lawyers submitted a memo to the court saying that “separating the cases would ensure that Jordan gets a fair trial ‘given the complexity of the charges in this case and the disparity in evidence’ between himself and his co-defendants.”

Ironically for Jordan, a separate trial didn’t help him, and he was duly convicted by a federal jury in December 2022, four months after Nowak and Smith had been convicted.

Helping in the prosecutions of Nowak, Smith and Jordan was the fact that a number of their ex-colleagues turned to being witnesses for the prosecution as part of their agreements to cooperate with the US Government / DoJ. These prosecution witnesses were the precious metals traders John Edmonds, Christian Trunz and Corey Flaum.

In November 2018, John Edmonds had pleaded guilty to commodities fraud and conspiracy to commit wire fraud, commodities fraud, commodities price manipulation and spoofing.

In July 2019, Corey Flaum had pleaded guilty to attempted commodities price manipulation.

In August 2020, Christian Trunz had pleaded guilty to conspiracy to engage in spoofing, and spoofing.

Edmonds and Trunz had worked with Nowak, Smith and Jordan on the JP Morgan precious metals trading desk. Flaum had worked with Smith when they were previously together on the Bear Stearns precious metals trading desk. Trunz, by the way, had also worked with Smith on the Bear Stearns precious metals trading desk as well as the JP Morgan precious metals trading desk.

Edmonds and Trunz therefore gave testimony to the jury on how Nowak and Smith were engaged in market manipulation at JP Morgan, while Flaum gave testimony on similar market manipulation by Smith at Bear Stearns.

Contempt for the Law

So you might think, yes, that’s great, justice has been served, but why bring this up now in April 2023?

The reason for bringing this up now, is that, wait for it … all three of Nowak, Smith and Jordan are now appealing their convictions and trying to get their convictions quashed and over-turned.

That’s even though they were tried unanimously by jury and even though their colleagues explained to the DoJ and the juries that Nowak, Smith and Jordan were manipulating precious metals prices over many years.

Like the finale in a bad zombie movie, just when you think these JP Morgan precious metals traders have gone away, they keep getting up and coming back.

While the JP Morgan precious metals trader convictions received widespread media coverage at the time the conviction news was released, the appeals are receiving far less media coverage. Hence the interest in covering them here.

The first development to note since the successful conviction of Nowak and Smith in August 2022, is that in the second half of March 2023, the US Government submitted a sentencing memo to the federal judge who presided over their trial, recommending that Nowak should get 5 years in prison and that Smith should get 6 years in prison because of the severity of their crimes.

“The government said significant sentences are warranted because the two had spoofed for years and knew what they were doing was prohibited.

At trial, prosecutors presented evidence that included detailed trading records, chat logs and testimony by former co-workers who “pulled back the curtain” on how Nowak and Smith moved precious-metals prices up and down for profit from 2008 to 2016.”

Bloomberg continued:

“Both men ‘abused their senior positions on the desk to normalize their market manipulation and indoctrinate younger traders,’ prosecutors said.

Nowak coached one young trader ‘to lie to JPMorgan’s Compliance Department after’ he’d been flagged for spoofing, and Nowak later pressured him ‘not to plead guilty and cooperate with the government’s investigation,’ the government said.”

Economic Harm Across the World

Yet despite all of this damning evidence as well as despite the witness testimony from Edmonds, Trunz and Flaum against them, the “Gang of 3” of Nowak, Smith and Jordan (and their lawyers) are trying to get their convictions overturned by …wait for it .. outrageously claiming that their manipulation didn’t create any economic harm to anyone.

Again we turn to Bloomberg for an update. On 12 April, Bloomberg published a story titled “Ex-JPMorgan gold traders ask for no prison time in spoofing case” stated that Nowak and Smith submitted a court filing just last week on Monday 10 April arguing that:

“the government failed to prove the economic harm from their conduct”

Bloomberg continued:

“There is no evidence that Mike gained anything personally, and the government never once challenged the indisputable truth that any theoretical profit to JPMorgan from Mike’s trades was immaterial to his options portfolio,” which averaged more than $30 million a year, Nowak’s lawyers said in a sentencing memo.

“The Government has failed to carry its burden of proving estimate of loss,” Smith’s lawyers said in a separate sentencing memo."

Talk about twisting the truth. Have these people no shame? It appears not.

The third of the ‘Gang of 3’, Christopher Jordan, is also trying to get acquitted and even though he was convicted in December of 2022 a few months after the convictions of Nowak and Smith, Jordan lost no time in getting his motion for acquittal submitted in January 2023, even before that of Nowak and Smith.

According to an article by FNG (FX New Group) on 31 January 2023:

“Christopher Jordan, a former executive director and trader on JPMorgan’s precious metals desk, is pushing for his acquittal in a spoofing lawsuit.

On January 30, 2023, the former Wall Street trader submitted a motion for a judgment of acquittal at the Illinois Northern District Court.”

While Jordan, who was convicted of wire fraud affecting a financial institution, is trying to get his entire conviction overturned on the basis that “trial evidence was insufficient for a rational juror to conclude beyond a reasonable doubt that Mr. Jordan knowingly participated in a ‘scheme to defraud’ within the meaning of the wire fraud statute”, Jordan is also playing the ‘no economic harm done’ card.

For Jordan’s motion for acquittal outrageously argues, as explained by FNG, that:

“the evidence was insufficient to prove that [Jordan] carried out a deceptive scheme to deprive his trading counterparties of money or property.”

“Even assuming …. that the spoof orders induced at least one counterparty ‘to trade at prices we wouldn’t trade at normally,’ it was undisputed that when the counterparties accepted Mr. Jordan’s orders, they got exactly what they bargained for: valid CME futures contracts, bought or sold, at a given price, for a given quantity.”

The preposterous arguments from Jordan’s lawyers don’t stop there, as they continue:

“there was no testimony or evidence that any of his trading counterparties ever lost money as a result of his spoof orders”

And that:

“Jordan’s sophisticated transaction counterparties who decided – on their own accord – to transact at the prices that were reflected in Mr. Jordan’s bids and offers.

Price Discovery – Global Impact

That the logic of the motions for acquittal by Nowak, Smith and Jordan are disingenuous and themselves manipulative and dishonest should be obvious to see. Their actions undermined global price discovery in global gold, silver, platinum and palladium prices. And this affects every participant in the entire trading world.

Of course there was economic harm from their conduct, and economic loss, because their price manipulations and spoofing caused artificial futures prices, prices which otherwise would not have been created, and prices which in turn triggered other price movements on both COMEX and across other trading venues such as the spot market and the LBMA benchmark reference prices. Their actions also caused false supply and demand.

As Assistant Attorney General Kenneth A. Polite Jr. of the Justice Department’s Criminal Division said upon the conviction of precious metals traders Edward Bases and John Pacillo from BoA Merrill Lynch in August 2021 (see below):

“These defendants undermined public confidence in U.S. commodities markets by manipulating prices to create the false appearance of supply and demand”.

All of these prices based on fake supply and demand also get instantly telegraphed across the world in electronic price feeds and affect everything from gold and silver reference rates, to pricing of swaps and derivatives, to pricing of ETF trades, to pricing of physical transactions between miners and refiners and wholesalers, and also get embedded into retail sales prices online and in gold stores across the world.

So the argument that the counterparties to JP Morgan traders’ price manipulations were not economically out of pocket is irrelevant and spurious.

Everyone in the global market who traded based on the fake prices generated by the JP Morgan traders could have been economically out of pocket. There was economic harm and there was economic loss.

Who is Paying their Legal Fees?

One final point which it would be intriguing to know is, who is paying the legal fees for all the lawyers, the barristers, the court fees and the appeals of these JP Morgan traders? These cases have now been going on for more than three and a half years, and as everyone knows, US lawyers are not cheap.

In a civil case, lawyers may agree to work on the basis that they will win a percentage of the civil damages awarded for one side or the other, but in criminal cases such as here, that is not the case.

If friends and family are paying for the legal costs of these traders, they need to divulge this. If the ex-employer (JP Morgan) paying, there could be ethical issues and they have to divulge this.

Indemnity insurance could not be covering this, as indemnity insurance for trading desks is designed for errors and omissions and not to cover deliberate criminal conduct, especially conduct that was going on for years during which time insurance would need to be renewed, and a desk head signing a renewal of an insurance policy when aware of criminality (as they were in these cases) would make the insurance coverage null and void.

If the traders under conviction are paying for their own legal fees, you could argue that they are using money to fund the legal fees that was illegally acquired given that their compensation was linked to performance which was generated by illegally manipulating prices (ill gotten gains).

And if its taxpayers money is funding the legal defense, then it’s a scandal that US taxpayers are paying to defend these JP Morgan traders, and even more so if taxpayers money is financing their appeals.

That could be an assignment for Bloomberg or Reuters, to conduct an investigation into who is financing all of these appeals and the legion of defense lawyers involved in the cases so far.

Precedent for Rejection of Appeals

For those wondering about the chances of Nowak, Smith and Jordan having their convictions over-turned, it might be good to look at recent precedent in this area.

In September 2020, two former Deutsche Bank precious metals traders, James Vorley and Cedric Chanu, were convicted by a US federal jury of spoofing and “fraudulent and manipulative trading practices involving publicly-traded precious metals futures contracts." Vorley, as some may remember, had also while working for Deutsche Bank been a director of the London Gold Fixing Market Limited company and the London Silver Market Fixing Limited company.

In June 2021, Vorley was sentenced to 12 months and a day in prison, and Chanu was sentenced to 12 months and a day in prison. After taking an appeal of their convictions to the 7th U.S. Circuit Court of Appeals in Chicago in July 2022, which got rejected, Vorley and Chanu then took their appeal to the US Supreme Court in October 2022.

However, in January 2023, the US Supreme Court denied the appeals of Vorley and Chanu. According to Bloomberg, the Supreme Court literally ‘refused to review the convictions‘.

In August 2021, a federal jury convicted two former Bank of America Merrill Lynch precious metals traders, Edward Bases and John Pacillo, of price manipulation (specifically Bases guilty of “conspiracy to commit wire fraud affecting a financial institution and wire fraud affecting a financial institution" and Pacillo guilty of the same charges, in addition to commodities fraud).

In August 2022, Bases and Pacillo lost an appeal to overturn their convictions. In March 2023, both Bases and Pacillo were sentenced to 12 months and 1 day on each of the counts to be served concurrently.

Conclusion

While we will have to await the outcomes of the appeals of Nowak, Smith and Jordan, its appropriate to ask, have these ex JP Morgan traders no shame?

Back in 2020 when the Department of Justice forced JP Morgan to sign a Deferred Prosecution Agreement, the Assistant Director in Charge of the FBI’s New York Field Office said that:

“For nearly a decade, a significant number of JP Morgan traders and sales personnel openly disregarded U.S. laws that serve to protect against illegal activity in the marketplace.”

With these plans to appeal their convictions, it is now clear that these same JP Morgan traders have learned nothing and that they still have disregard for US laws. But not just disregard. It is more than that. It is pure contempt.

Popular Blog Posts by Ronan Manly

How Many Silver Bars Are in the LBMA's London Vaults?

How Many Silver Bars Are in the LBMA's London Vaults?

ECB Gold Stored in 5 Locations, Won't Disclose Gold Bar List

ECB Gold Stored in 5 Locations, Won't Disclose Gold Bar List

German Government Escalates War On Gold

German Government Escalates War On Gold

Polish Central Bank Airlifts 8,000 Gold Bars From London

Polish Central Bank Airlifts 8,000 Gold Bars From London

Quantum Leap as ABN AMRO Questions Gold Price Discovery

Quantum Leap as ABN AMRO Questions Gold Price Discovery

How Militaries Use Gold Coins as Emergency Money

How Militaries Use Gold Coins as Emergency Money

JP Morgan's Nowak Charged With Rigging Precious Metals

JP Morgan's Nowak Charged With Rigging Precious Metals

Hungary Announces 10-Fold Jump in Gold Reserves

Hungary Announces 10-Fold Jump in Gold Reserves

Planned in Advance by Central Banks: a 2020 System Reset

Planned in Advance by Central Banks: a 2020 System Reset

China’s Golden Gateway: How the SGE’s Hong Kong Vault will shake up global gold markets

China’s Golden Gateway: How the SGE’s Hong Kong Vault will shake up global gold markets

Ronan Manly

Ronan Manly 0 Comments

0 Comments