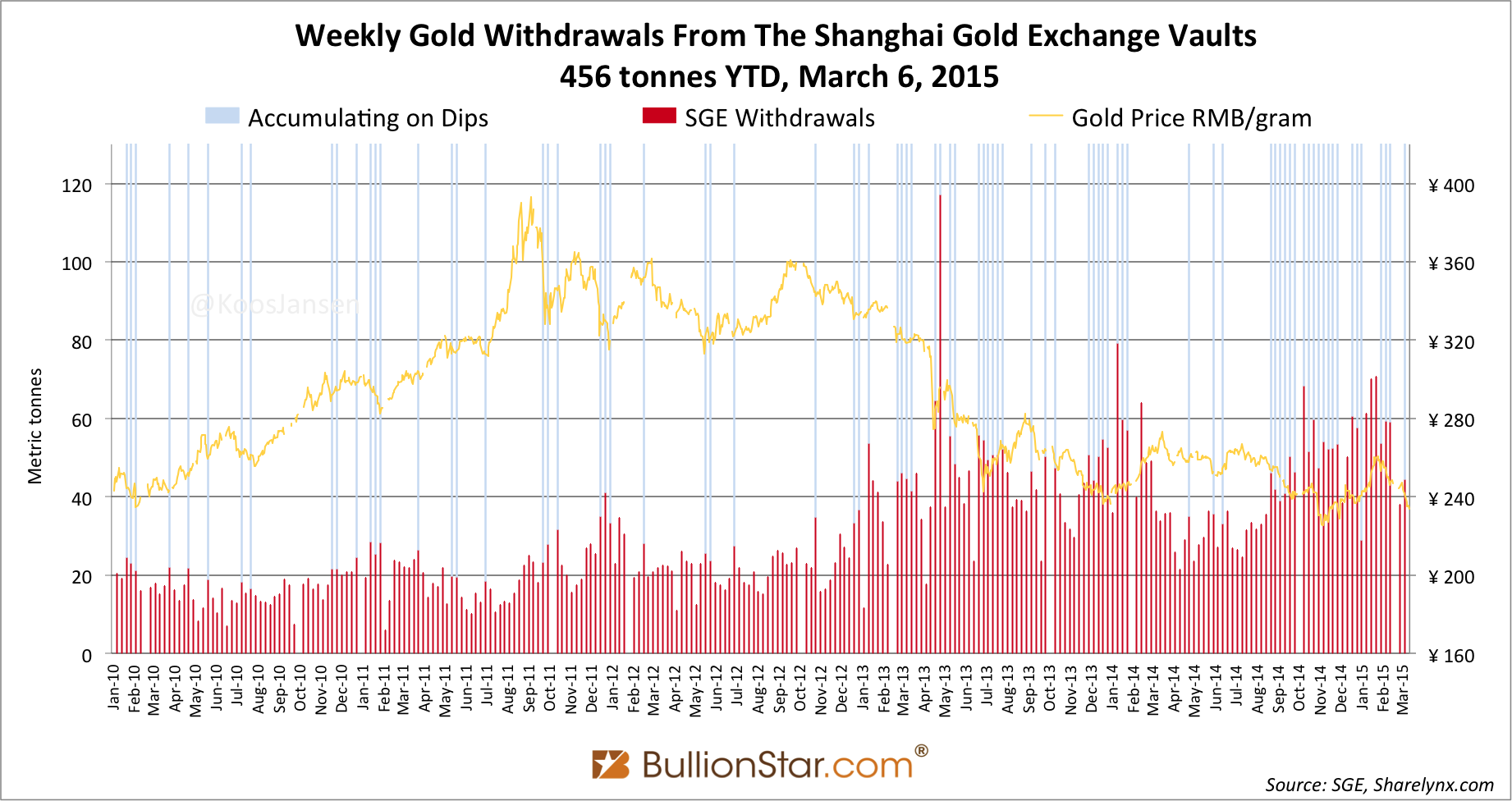

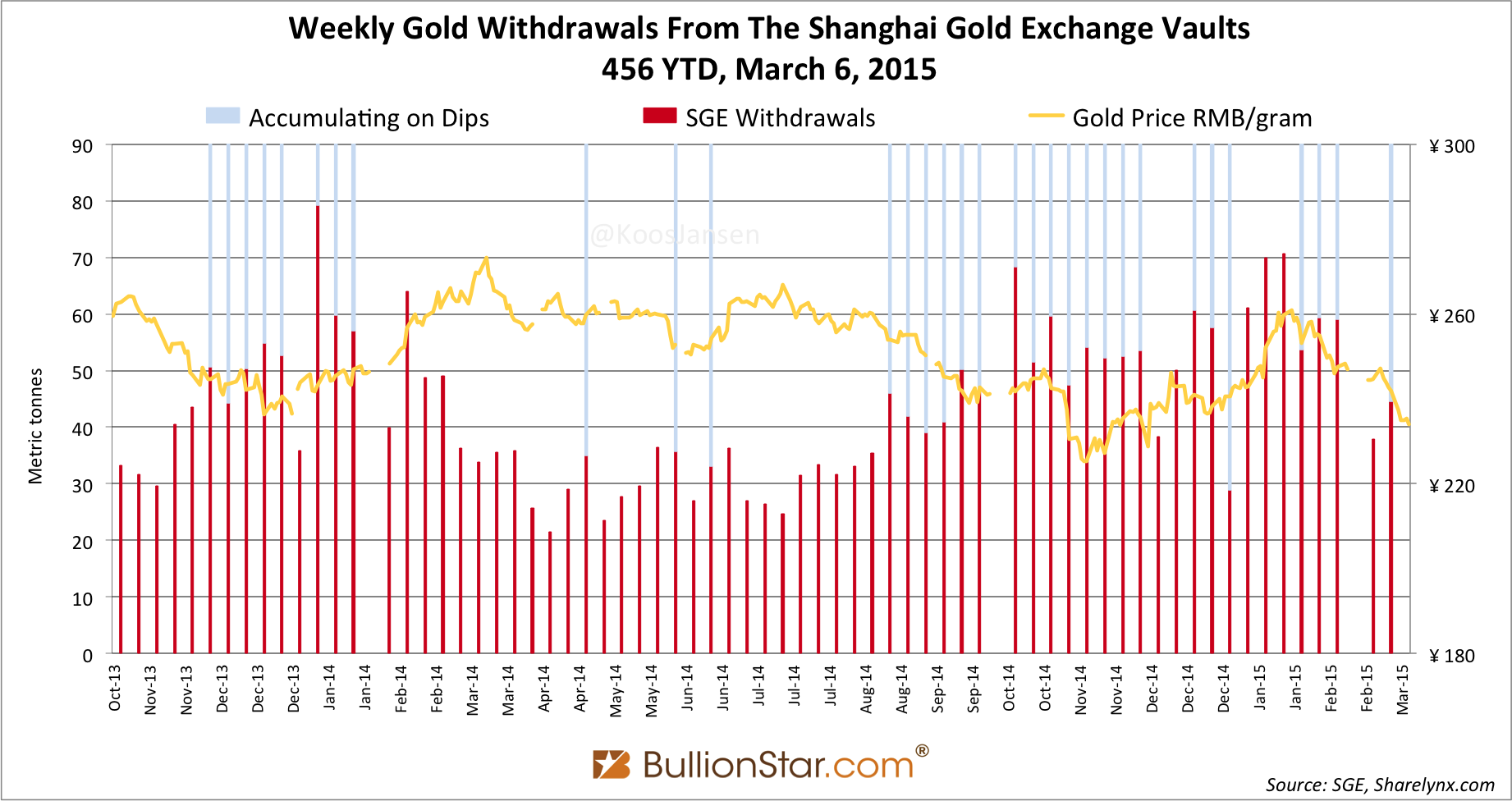

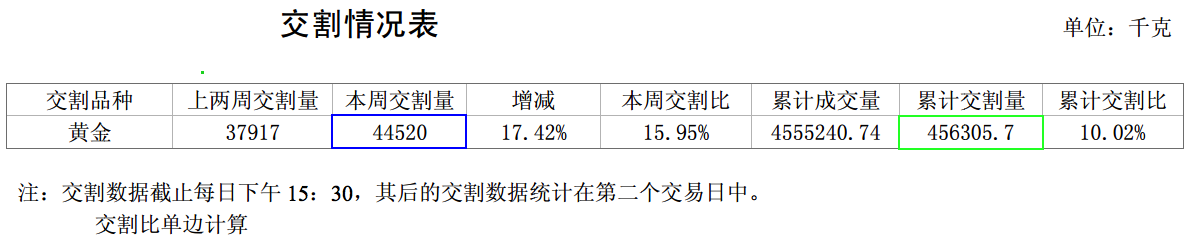

SGE Withdrawals 45t Week 9, YTD 456t

Chinese wholesale gold demand, that equals withdrawals from the vaults of the Shanghai Gold Exchange (SGE), accounted for 45 metric tonnes in week 9 of 2015 (March 2 – 6). Year to date 456 tonnes have been withdrawn from the SGE vaults. An estimate suggests 340 tonnes has been net imported into the Chinese domestic gold market over this period (calculating with a yearly SGE scrap rate of 250 tonnes).

Since the inception of the Shanghai International Gold Exchange (SGEI) there was a possibility the significance of SGE withdrawals, as published in the Chinese weekly reports, became distorted by activity on the SGEI – in the Free Trade Zone. That’s why I corrected SGE withdrawals by trading volume from the SGEI, just to be on the safe side of measuring Chinese wholesale demand.

However, we just learned that what was traded and withdrawn on the SGEI in 2014 was primarily imported into the Chinese domestic gold market. So, for the time being we can assume SGE withdrawals are still an accurate proxy for Chinese wholesale demand – a metric described in this post.

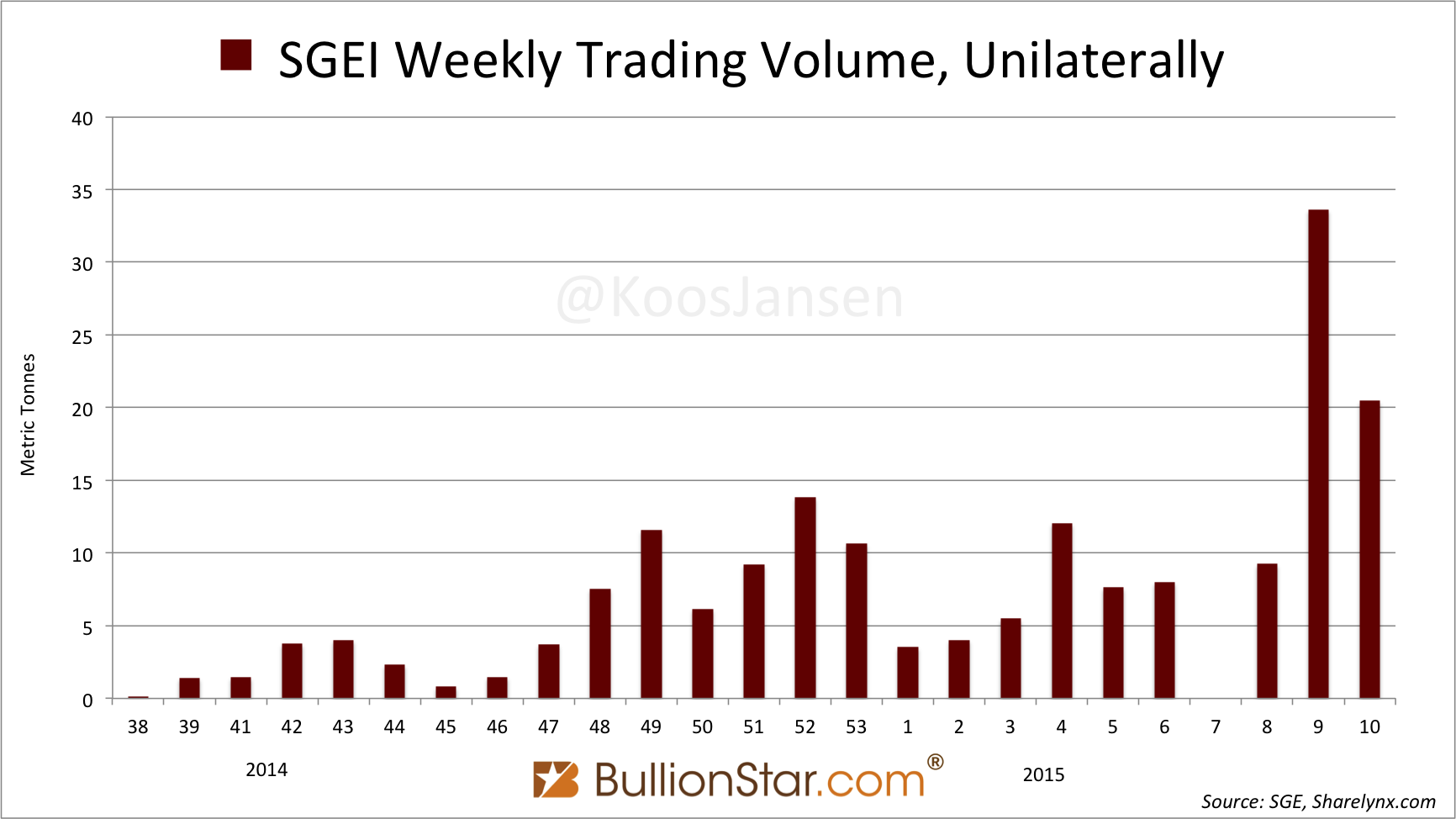

I like to note SGEI trading volume has jumped recently, reaching a record in week 9 at 34 tonnes (counted unilaterally). Perhaps this is exchange is slowly coming to life.

Only the 1kg physical contract iAu99.99 is traded on the International Board (SGEI), there seems to be nil interest in the 100 gram physical contract iAu100 and in the 12.5kg (London Good Delivery bars) contract iAu995.

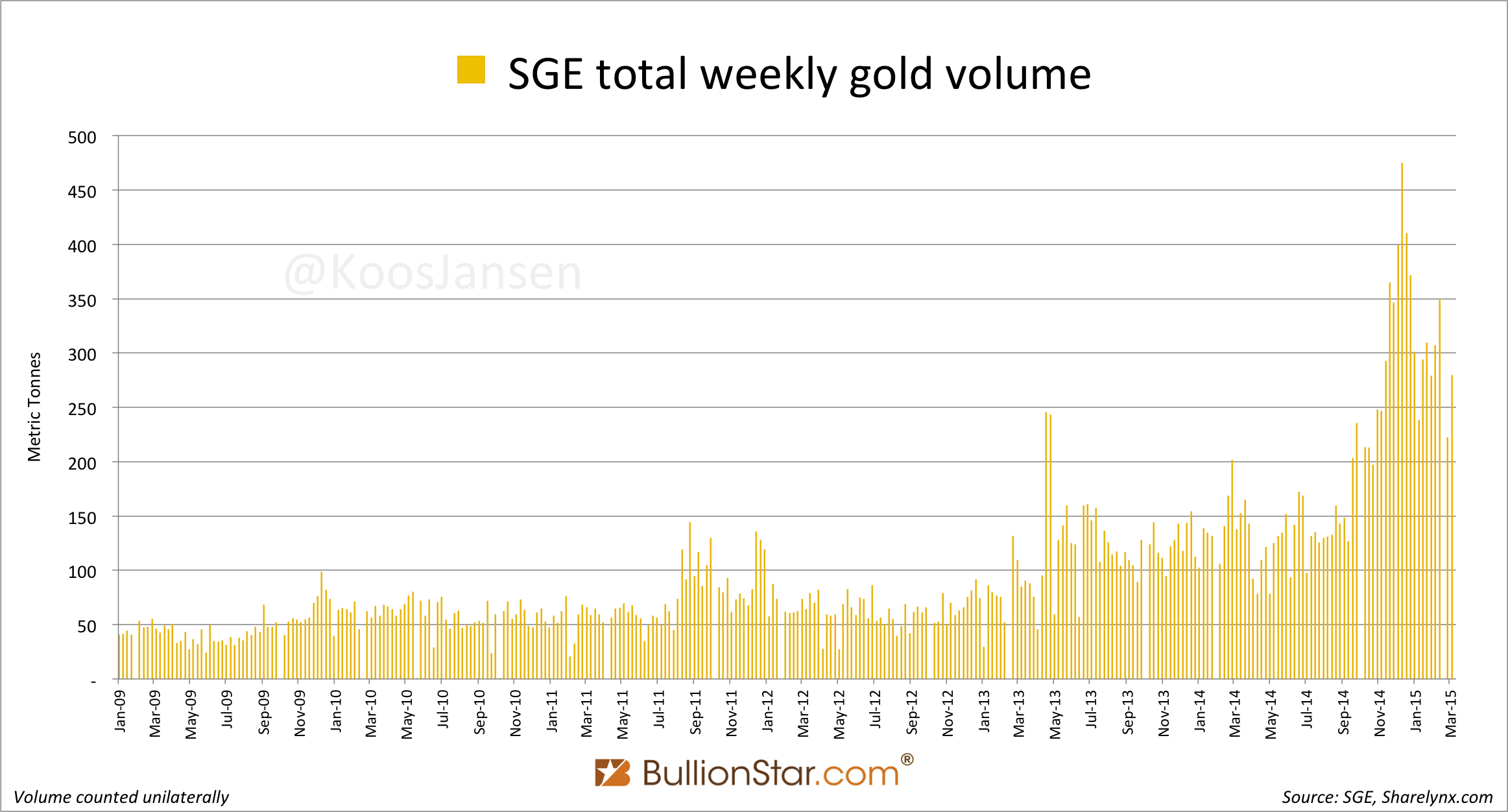

Overall SGE volume is somewhat dropping as the spot deferred contracts Au(T+N1) and Au(T+N2) are falling back after a resurrection that started late November 2014.

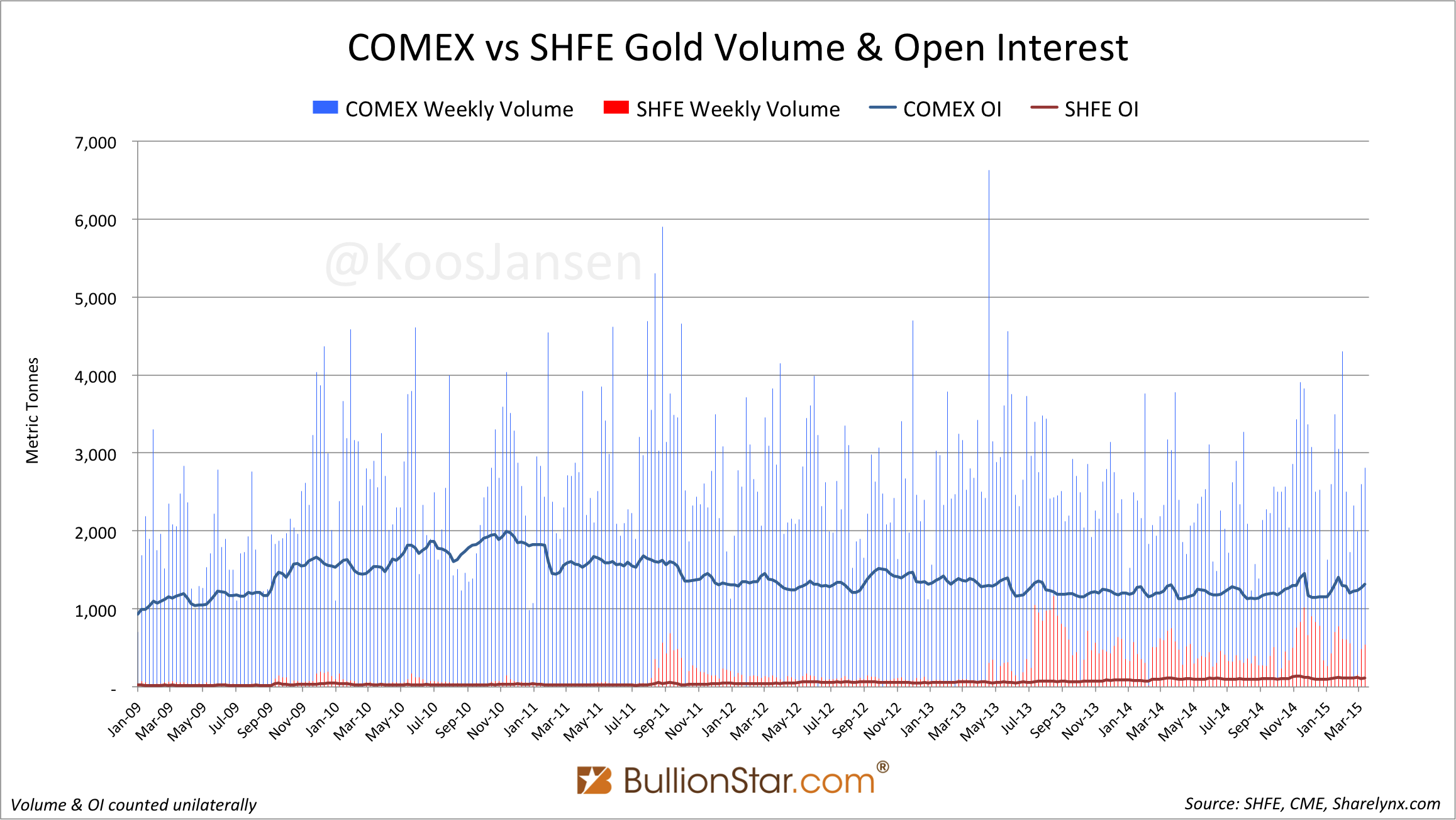

On the Shanghai Futures Exchange (SHFE) we can see the same trend; slightly dropping volumes. Nothing “worth mentioning".

Popular Blog Posts by Koos Jansen

China’s Secret Gold Supplier is Singapore

China’s Secret Gold Supplier is Singapore

Audits of U.S. Monetary Gold Severely Lack Credibility

Audits of U.S. Monetary Gold Severely Lack Credibility

China Gold Import Jan-Sep 797t. Who’s Supplying?

China Gold Import Jan-Sep 797t. Who’s Supplying?

The Gold-Backed-Oil-Yuan Futures Contract Myth

The Gold-Backed-Oil-Yuan Futures Contract Myth

Estimated Chinese Gold Reserves Surpass 20,000t

Estimated Chinese Gold Reserves Surpass 20,000t

Did the Dutch Central Bank Lie About Its Gold Bar List?

Did the Dutch Central Bank Lie About Its Gold Bar List?

PBOC Gold Purchases: Separating Facts from Speculation

PBOC Gold Purchases: Separating Facts from Speculation

U.S. Mint Releases New Fort Knox Audit Documentation

U.S. Mint Releases New Fort Knox Audit Documentation

China Net Imported 1,300t of Gold in 2016

China Net Imported 1,300t of Gold in 2016

Why SGE Withdrawals Equal Chinese Gold Demand and Why Not

Why SGE Withdrawals Equal Chinese Gold Demand and Why Not

Koos Jansen

Koos Jansen