NY Fed Gold Withdrawals Don’t Match Dutch-German Claims

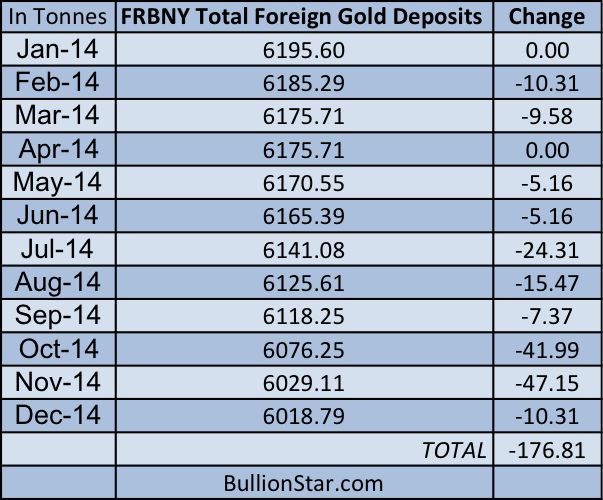

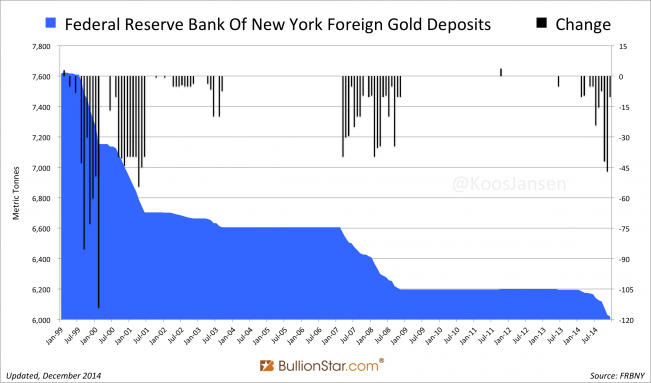

From January to December 2014 the Federal Reserve Bank Of New York (FRBNY) has been drained from 176.81 tonnes of physical gold out of the foreign deposit accounts. A drop from 6,195.60 tonnes to 6,018.79 tonnes over 12 months, FRBNY data published on Friday showed. The FRBNY doesn’t disclose how much is withdrawn by which central bank.

These numbers do not match the claims made in Europe about gold repatriated from the US. This is bad news.

On November 21, 2014, the Dutch central bank, De Nederlandsche Bank (DNB), surprised the world by stating they had in utmost secret repatriated 122.5 tonnes from their gold deposit at the FRBNY. Although not specifically disclosed by DNB, all the gold must have been repatriated in 2014.

January 19, 2015, the German central bank, the Bundesbank, announced they had successfully repatriated 85 tonnes from New York and 35 tonnes from Paris in 2014. Of the 85 tonnes from the FRBNY 50 tonnes were recast according to the London Good Delivery (LGD) standard.

Some simple math: 122.5 tonnes plus 85 tonnes is 207.5 tonnes; this is the amount DNB and the Bundesbank claim to have withdrawn from the vaults in New York. The FRBNY states it only delivered 176.81 tonnes to their European allies across the pond. The gap accounts for 30.69 tonnes; this is “the problem” the three central banks are now facing.

“The problem” adds to a range of events that happened since 2011 and fueled speculation about whether the FRBNY can fulfill all their gold obligations to foreign depositors.

- Repatriating gold from New York in itself means the Europeans don’t trust the FRBNY as the custodian for their gold.

- Allegedly a delegation from the Bundesbank was obstructed by the FRBNY when they came to the New York vaults in 2011 to audit their gold.

- The Bundesbank refuses to publish a bar list of their official gold reserves. Just as the Netherlands, even after a Dutch FOIA request.

- In 2012 the Bundesbank presented a schedule to ship home 150 tonnes from the US in three years (ending in 2015). In 2013 the Bundesbank changed their schedule to repatriate 674 tonnes from New York (300) and Paris (374) over seven years. Why did they change their initial schedule and why would it take seven years to hire a few planes to ship the gold from New York to Germany?

- In 2013 the Bundesbank only received 5 tonnes from New York. That is very little gold given Germany should have safely stored more than 1,400 tonnes in nine compartments at the FRBNY. How hard can it be for the FRBNY to process a withdrawal request by a customer?

- The first batch from New York, the 5 tonnes, was said to be recast into LGD bars before stored in Frankfurt, but the Bundesbank refused to disclose why. In any case, the origin of newly cast bars can’t be traced, that makes it impossible to know if it came from New York or someplace else.

- During the recasting of the bars no independent external auditors were present.

- In 2014 DNB stated to have repatriated 122.5 tonnes from New York – presumably in less than 10 months. Why can’t the Bundesbank repatriate in this tempo?

- 50 of the 85 tonnes Germany repatriated from New York in 2014 were recast in LGD bars before stored in the vaults in Frankfurt. Again, no details were disclosed by the Bundesbank about bar numbers, nor was any independent party allowed to audit and assay the gold. For some reason the Bundesbank did mention the BIS was involved in an audit: “We also called on the expertise of the Bank for International Settlements for the spot checks that had to be carried out. As expected, there were no irregularities"

- Late January 2015 the IMF published an update of the foreign exchange reserves of the Netherlands that showed DNB had bought 10 tonnes of gold in December 2014. A few hours later DNB denied it had bought any gold, without elaborating on how the IMF got the false numbers. Kind of adventitious given everything mentioned above. Perhaps DNB did buy gold in 2014 because there was something wrong with the gold they repatriated from the FRBNY or they wanted to repatriate more, but weren’t allowed? Of course, this had to be carefully covered up. Any problem that would have occurred from repatriating gold from the FRBNY can never be openly discussed for it would destabilize the international monetary order.

The list goes on and on. Perhaps the latest data released by the FRBNY is a typo, perhaps 30.69 tonnes was shipped to Germany early January 2015 and the Bundesbank counted this as repatriated in 2014 to make the tonnage shipped home in 2014 look less worrisome compared to the tonnage DNB got back, perhaps there is a explanation for the gap in tonnage reported by both sides of the Atlantic. I surely hope so. In any case it’s very alarming the three central banks didn’t even take the simple effort to make it seem all the numbers add up.

I will call and email all three central banks on Monday to confront them with the current situation, although I doubt either will change any of their numbers. In my opinion there can only be three causes for “the problem”:

- Someone is lying. That can be DNB, the FRBNY or the Bundesbank.

- There has been a gold swap between the FRBNY and some other central bank. This other central bank (or BIS) would than have delivered 30.69 tonnes to Germany, in return it got a claim on gold at the FRBNY. But why? Such a scenario wouldn’t lift any concerns regarding the FRBNY’s gold obligations, au contraire. Besides, both DNB and the Bundesbank specifically meant to repatriate gold from New York, where according to official sources their gold is supposed to be.

- UPDATE 8 PM GMT+1: Commenter “awgee" (read below) asked me if I failed to consider if a central bank, other than DNB or the Bundesbank, added gold to their stock at the FRBNY in 2014 which could explain the gap. The answer is I didn’t consider this, though it’s a very good point. If any central bank deposited approximately 31 tonnes in 2014 this would actually be the most obvious explanation for “the problem". As far as my data goes back (1995), the last time a deposit was visibly made was in October 2011 (4 tonnes), and before that in February 1999 (3 tonnes). It doesn’t happen often, but it can happen. (as the FRBNY only discloses the total amount of gold in foreign accounts, we can only see deposits being made during a month with no withdrawals or during a month when deposits transcend withdrawals).

To be continued…

Popular Blog Posts by Koos Jansen

China’s Secret Gold Supplier is Singapore

China’s Secret Gold Supplier is Singapore

Audits of U.S. Monetary Gold Severely Lack Credibility

Audits of U.S. Monetary Gold Severely Lack Credibility

China Gold Import Jan-Sep 797t. Who’s Supplying?

China Gold Import Jan-Sep 797t. Who’s Supplying?

The Gold-Backed-Oil-Yuan Futures Contract Myth

The Gold-Backed-Oil-Yuan Futures Contract Myth

Estimated Chinese Gold Reserves Surpass 20,000t

Estimated Chinese Gold Reserves Surpass 20,000t

Did the Dutch Central Bank Lie About Its Gold Bar List?

Did the Dutch Central Bank Lie About Its Gold Bar List?

PBOC Gold Purchases: Separating Facts from Speculation

PBOC Gold Purchases: Separating Facts from Speculation

U.S. Mint Releases New Fort Knox Audit Documentation

U.S. Mint Releases New Fort Knox Audit Documentation

China Net Imported 1,300t of Gold in 2016

China Net Imported 1,300t of Gold in 2016

Why SGE Withdrawals Equal Chinese Gold Demand and Why Not

Why SGE Withdrawals Equal Chinese Gold Demand and Why Not

Koos Jansen

Koos Jansen