Will Gold Be Part Of A New International Monetary System?

Anyone who has been paying attention to the global economy the past years can agree with me our central bankers have conducted miserable monetary policy and have taken insufficient measures to fight crises. All major economies have embarked in printing unprecedented quantities of money, but the only thing they bought was time. Quantitative easing on such a scale is like kicking the can determined to reach the end of the road. The future looks anything but sanguine.

Where is this going? Are our leaders truly gonna allow for the international monetary system to implode? Is there no plan B? And we are supposed to believe gold isn’t of any significance in economics?

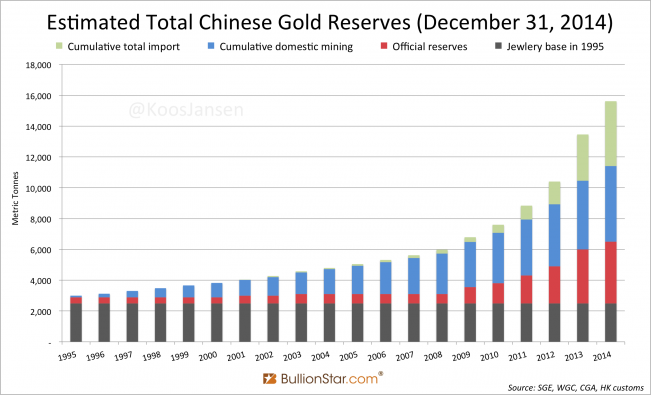

In our current highly unstable economic environment the price of gold is relatively low, according to gold proponents like me. In addition, we can see immense flows of physical gold going from West to East that are guaranteed not to return in the foreseeable future. If the price of gold isn’t suppressed, my previous two observations can only be explained as physical supply outstripping demand since April 2013 – when the price of gold declined substantially to its current relative low levels. But perhaps there is more than meets the eye.

I would like to share a theoretical explanation for the observations just mentioned, supported by historic diplomatic documents that provide some guidance through the present fog.

Let’s start just before gold was removed from the system:

In the sixties France stepped out of the London Gold Pool, as it didn’t want to waste any more gold on the war the US was waging against Vietnam. The London Gold Pool was a joint effort by the US, the Netherlands, France, Germany, Italy, Belgium, Switzerland and the UK to peg the price of gold at $35 an ounce. But because the US was printing dollars to finance the war in Vietnam – this devalued US dollars – a lot of gold was required to be sold to maintain the price at $35. Shortly after France left the Pool it collapsed in March 1968. From the IMF:

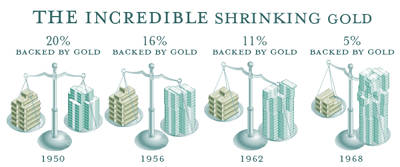

While the total number of U.S. dollars circulating in the United States and abroad steadily grew, the U.S. gold reserves backing those dollars steadily dwindled. International financial leaders suspected that the United States would be forced either to devalue the dollar or stop redeeming dollars for gold.

The dollar problem was particularly troubling because of the mounting number of dollars held by foreign central banks and governments: In 1966, foreign central banks and governments held over 14 billion U.S. dollars. The United States had $13.2 billion in gold reserves, but only $3.2 billion of that was available to cover foreign dollar holdings. The rest was needed to cover domestic holdings. If governments and foreign central banks tried to convert even a quarter of their holdings at one time, the United States would not be able to honor its obligations.

And that is exactly what happened; in 1971 the US closed the gold window, no longer could foreign central banks convert dollars into gold (except on the open market). As I’ve written before: (i) Europe, most notably France was not amused and wanted to revalue gold, (ii) the US was very persistent to completely phase out gold from the monetary system in order to leverage the power of the US dollar hegemony.

I’ve found documents that connect the past with the present. On February 24, 1970, French President Pompidou met with US President Nixon in Washington DC. The oncoming quotes are from the US minutes of the meeting:

Turning to France, the President [Pompidou] said he wished to emphasize again that – as distinguished from the positions of some of his predecessors in this office – he would not comment on the independent French policy. He might have his own views but he felt that a strong independent France devoted to the same goals as we are is in the interest of the US. A strong Europe in the economic sense might seem not to be in the US interest, in the long term it was. What we need is a better balance in the West. It is not healthy to have just two superpowers; in such a situation there is more chance of a conflict than when there are more centers of power. Greater strength of the European economies, an independent French policy, and, in Asia, a stronger Japan, would eventually make for a more stable world. The position of the U. S. at the end of World War II was not healthy. Twenty-five years had passed and things were changed. This we regarded as a healthy development.

In the final analysis with three billion people on earth if civilization is to survive … this will be decided by the Soviet Union, by China, and eventually Japan, by Western Europe, by that he meant France, Britain and Germany and the United States. Africa is moving along, but it is a century away.

Latin America is also moving but it is fifty years or more away. In Asia, India and Pakistan will have enormous difficulty in simply keeping pace with their increase in population. We have a great responsibility to use the power we have to build the kind of a world that keeps the forces of expansion in check and thus give the forces of freedom a chance to grow in their own way and not like tin soldiers lined up behind the biggest one.

Pompidou’s idea was clearly to spread economic power across the globe for a more balanced, peaceful and prosperous world. We can also read the first signs of a unified Europe between the lines. Pompidou is one of the best forecasters I’ve ever read, what he said 45 years ago has more or less happened by now. However, Pompidou’s ideology could not coexist along the dollar hegemony. The US, therefor, embarked in divide and conquer, a notorious strategy to gain and maintain power. The next quotes are from a telephone conversation on March 14, 1973, between Henry Kissinger, National Security Advisor, and William Simon, Under Secretary of the Treasury:

K: … I’ve just been called to the President. Let me tell you — Shultz has sent me a copy of the cable that Volker gave him – that Volker sent him about the interventions, and he has asked for my views. I basically have only one view right now which is to do as much as we can to prevent a united European position without showing our hand.

S: Okay. Well, I interpret that as less intervention, which is a good idea, and I think George will be very happy with that comment. Do as much as we can to prevent a unified European position.

K: I don’t think a unified European monetary system is in our interest. I don’t know what you think for technical reasons, but these guys are now helping to put it to us.

S: Yes, sir.

K: I don’t know whether that’s true in the short term, but I’m convinced that that’s true in the long.

S: I just agree with you a thousand percent.

K: So I’d rather play with them individually. You know, if it were a question of supporting an individual currency, I’d be much more inclined to do that.

S: Yes, such as the mark.

K: That’s right.

S: Yes, sir.

K: Does that make sense to you?

S: Yes it does.

K: You understand, my reason’s entirely political, but I got an intelligence report of the discussions in the German Cabinet and when it became clear to me that all our enemies were for the European solution that pretty well decided me.

S: Yes, sir. Well, I pass. I’m going to be talking to George on the telephone.

K: Be careful. Everything in Bonn is tapped.

S: I promise you I will.

Next, from Wikileaks, a report of a meeting held by all European Ministers of Finance about gold, written to the American Ministry Of Foreign Affairs on April 23, 1974 (Europe and the US were debating this issue for a few years):

MADE IN A WIDER INTERNATIONAL CONTEXT, WHAT CAME OUT OF ZEIST WAS A CONSENSUS ON CERTAIN SUBSTANTIVE PROPOSITIONS THAT ARE TO BE FURTHER EXPLORED BEFORE THEY ARE SUBMITTED TO A NEXT MEETING OF THE COUNCIL OF MINISTERS OF THE EEC [EU]. IF AT A LATER STAGE THE COUNCIL REACHES AGREEMENT ON A CERTAIN POSITION, THE FURTHER PROCEDURE COULD BE THAT THE EUROPEAN COMMUNITY FORMULATES A FORMAL PROPOSAL ON HOW TO DEAL WITH THE PROBLEM OF GOLD IN THE PERIOD BEFORE THE REFORM OF THE INTERNATIONAL MONETARY SYSTEM.

IN ZEIST, MINISTERS HAVE AGREED ON TWO GENERAL PROPOSITIONS. FIRST, THEY HAVE RE-ASSERTED THAT THE SDR SHOULD BECOME THE PRINCIPAL RESERVE ASSET IN THE FUTURE SYSTEM, AND THAT ARRANGEMENTS FOR GOLD IN THE INTERIM PERIOD SHOULD NOT BE INCONSISTENT WITH THAT GOAL. SECOND, THEY HAVE AGREED THAT SUCH INTERIM ARRANGEMENTS SHOULD ENABLE MONETARY AUTHORITIES TO EFFECTIVELY UTILIZE THE MONETARY GOLD STOCKS AS INSTRUMENTS OF INTERNATIONAL SETTLEMENT.

THERE WAS A CONSENSUS AMONG MINISTERS THAT AN INCREASE OF THE OFFICIAL GOLD PRICE, ALTHOUGH IT MIGHT SERVE THE SECOND OBJECTIVE, WOULD BE INCONSISTENT WITH THE FIRST. IN ORDER TO MOBILIZE MONETARY GOLD AS AN INTERNATIONAL RESERVE ASSET, THEY HAVE AGREED THAT:

1) MONETARY AUTHORITIES SHOULD BE PERMITTED TO BUY AND TO SELL GOLD BOTH AMONG THEMSELVES, AT A MARKED-RELATED PRICE, AND ON THE FREE MARKET. THE MONETARY AUTHORITIES WOULD HAVE COMPLETE FREEDOM TO BUY OR TO SELL GOLD, AND WOULD HAVE NO OBLIGATION WHATEVER TO ENTER INTO ANY PARTICULAR TRANSACTION.

2) CERTAIN DELEGATIONS ARE OF THE OPINION THAT GOLD TRANSACTIONS WITH THE FREE MARKET SHOULD NOT, OVER A CERTAIN PERIOD OF TIME, LEAD TO A NET INCREASE OF THE COMBINED OFFICIAL GOLD STOCKS.

3) IN ORDER TO APPLY THESE PRINCIPLES, VARIOUS PRACTICAL SOLUTIONS CAN BE ENVISAGED. TWO WERE MENTIONED IN PARTICULAR. ONE IS THAT MONETARY AUTHORITIES PERIODICALLY FIX A MINIMUM AND A MAXIMUM PRICE BELOW OR ABOVE WHICH THEY WOULD NOT SELL OR BUY ON THE MARKET. THE OTHER CONSISTS IN CREATING A BUFFER STOCK TO BE MANAGED BY AN AGENT WHO WOULD BE CHARGED BY THE MONETARY AUTHORITIES TO INTERVENE ON THE MARKET SUCH AS TO ENSURE ORDERLY CONDITIONS ON THE FREE MARKET FOR GOLD.

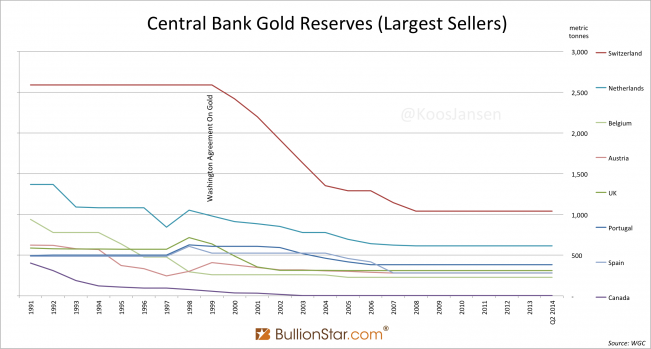

Now we know what Europe was planning in seventies, this explains a lot better what occurred later on. Remember the Washington Agreement On Gold? Just before the euro was introduced in 1999, all European central banks collaborated in a program called the Central Bank Gold Agreements (CBGA), or the Washington Agreement On Gold, to jointly manage gold sales. (note, Eurozone aggregated gold reserves currently still transcend US reserves)

In 1991 the Dutch central bank (DNB) held 1,700 tonnes in official gold reserves, currently it holds 613 tonnes. When the Dutch Minister Of Finance, J.C. de Jager, was questioned about these sales in 2011 he answered:

Question 6: Can you confirm that since 1991 DNB has sold 1,100 tonnes of the 1,700 tonnes it owned…

Answer 6: Since 1991 DNB sold 1,100 tonnes. At the time DNB determined that from an international perspective it owned a lot of gold proportionally. It decided to equalize its gold holdings relative to other important gold holding nations.

Right, so since the seventies Europe wanted to spread economic power across the globe, replace the dollar as the world reserve currency and sold parts of its official gold reserves “to equalize its gold holdings relative to other important gold holding nations”. These types of plans aren’t realized overnight; it can take decades, it can even take more decades than estimated. Who knows? We can be in the final stage right now.

Not so long ago I published a Wikileaks cable from 1976 wherein China expresses its particular interest in gold and SDR’s. Of course this is all just a theory, but it seems as if the redistribution of the chips, physical gold flowing form West to East, is all part of orchestrated preparations for the next international monetary system, anchored by gold. This system would require gold to be spread among the major economic power-blocks proportionally.

Jean-Claude Trichet, former president of the European Central Bank, said on November 4, 2014:

The global economy and global finance is at the turning point in a way, …new rules have been discussed not only inside the advanced economies, but with all emerging economies, including the most important emerging economies, namely, China.

(h/t Freegold)

historic documents:

1970 February 24, Washington DC, US. Pompidou and Nixon.

1971, October 28. Phone call between Nixon and Kissinger on gold.

1973, March 14, Kissinger and Simon telephone conversation.

1973, May 18, Paris, France. Meeting Kissinger And Pompidou on value of gold.

1974, April 22 & 23, Zeist, The Netherlands. Meeting European Ministers Of Finance On Gold.

Popular Blog Posts by Koos Jansen

China’s Secret Gold Supplier is Singapore

China’s Secret Gold Supplier is Singapore

Audits of U.S. Monetary Gold Severely Lack Credibility

Audits of U.S. Monetary Gold Severely Lack Credibility

China Gold Import Jan-Sep 797t. Who’s Supplying?

China Gold Import Jan-Sep 797t. Who’s Supplying?

The Gold-Backed-Oil-Yuan Futures Contract Myth

The Gold-Backed-Oil-Yuan Futures Contract Myth

Estimated Chinese Gold Reserves Surpass 20,000t

Estimated Chinese Gold Reserves Surpass 20,000t

Did the Dutch Central Bank Lie About Its Gold Bar List?

Did the Dutch Central Bank Lie About Its Gold Bar List?

PBOC Gold Purchases: Separating Facts from Speculation

PBOC Gold Purchases: Separating Facts from Speculation

U.S. Mint Releases New Fort Knox Audit Documentation

U.S. Mint Releases New Fort Knox Audit Documentation

China Net Imported 1,300t of Gold in 2016

China Net Imported 1,300t of Gold in 2016

Why SGE Withdrawals Equal Chinese Gold Demand and Why Not

Why SGE Withdrawals Equal Chinese Gold Demand and Why Not

Koos Jansen

Koos Jansen