We Can Not Pretend That Gold Is Worth $42.22 Forever

The lawful owner of the 8,134 tonnes of official gold holdings of the United States is the US Treasury. The Federal Reserve handed over the official gold reserves to the Treasury in 1934 and in return received gold certificates – which, by the way, are not redeemable for gold, only for dollars, but that’s not the point now. The point is these gold certificates are still valued on the Fed’s balance sheet at $42.22 an ounce.

The free market price of gold is currently about $1,200. The reason the US capped the value of gold on their books at $42.22 in the seventies is because they wanted to phase out gold from the international monetary system to increase the power of King Dollar; denying the true value of the yellow metal supported this ambition. And so the Fed pretends until this day gold is worth $42.22, all in an effort to make us believe in the strength of the dollar. However, the US can’t pretend forever the price of gold is $42.22.

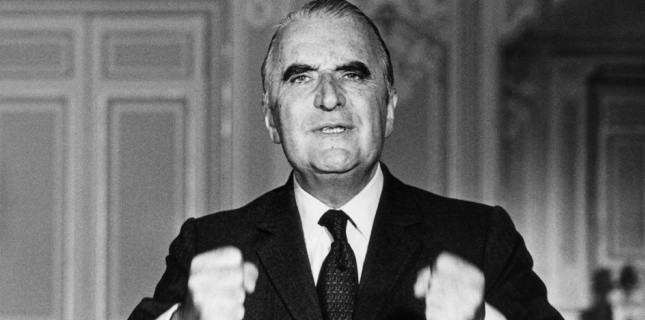

George Pompidou to Henry Kissinger, May 18, 1973:

I would therefore like to discuss the monetary question and also the question of gold—not the role of gold because we could debate that in vain and we know that we are not in agreement; but there is the question of the price of gold and we can no longer continue to go on pretending that an ounce of gold will always be worth thirty-eight dollars when it is now worth one hundred and six dollars.

On August 15, 1971, the President of the United States Richard Nixon announced the convertibility of US dollars for gold would be temporarily suspended. In particular France was not amused by the fact the US broke its promise; which was that the US dollar was as good as gold.

After the anchor in the international monetary system was removed in ‘71 a diplomatic battle ensued about the value of currencies (and gold). The US wanted to cap the value of gold, while Europe wanted to revalue gold. This period is very interesting because I suspect it gave birth to the euro.

Nixon to Kissinger 1971, October 28:

…I would like for you to talk to Schultz first. Burns has this idea that we have to move quickly with Europe.

…The French are key, they won’t make a deal unless we raise the price of gold. It is my view that we can’t. I don’t want you to say that to him but just remember that Arthur [Burns] is pushing for cutting a deal with the French.

…Schultz and I feel that would be a mistake. We have to keep free.

…The first thing to do is talk to George [Schultz] a little. I would like to get it where you, George, Connolly and I — would make this decision. I want to put Burns, McCracken and Peterson off.

I will resume publishing diplomatic documents from this era to find out exactly how the rest of the world (the Arabs, China, Japan, Russia and Europe) reacted and what measures were taken when the US broke its promise. If we figure out what happened in the past we have a better perspective on the future – so we can know more accurate when the US is forced to accept the true value of gold.

Previously I’ve posted:

1971, October 28. Phone call between Nixon and Kissinger on gold

1974, April 22 & 23, Zeist, The Netherlands. Meeting European Ministers Of Finance On Gold

Below a conversation between the President of France George Pompidou and United States National Security Advisor Henry Kissinger. Paris, May 18, 1973, 11 a.m.

FOREIGN RELATIONS OF THE UNITED STATES, 1973–1976

VOLUME XXXI, FOREIGN ECONOMIC POLICY, DOCUMENT 38

- Memorandum of Conversation (1)

Paris, May 18, 1973, 11 a.m. PARTICIPANTS:

- President Georges Pompidou

- Andronikov, Interpreter

- Henry A. Kissinger, Assistant to the President for National Security Affairs

Dr. Kissinger: I am very pleased to see you again and to thank you once again for the arrangements that you have made for my visit here and which allowed me in particular to see in Paris President Sadat’s special envoy. President Nixon is looking forward with pleasure to seeing you in Iceland, (2) and he hopes to be able to reach some fundamental decisions on American policy towards Europe and other questions. In any case, he expects to work in close cooperation with France and with you. What are the questions that you would like to discuss now and in what order?

President Pompidou: We can discuss everything. There are some questions I would like to ask you about your speech.(3) You have already seen Mr. Jobert. I would especially like to mention those questions that I intend to discuss with President Nixon.

When you speak, in your speech, of the regional position of Europe, I am not particularly shocked by what you say. In this sense I am not entirely in agreement with everyone else. I would have been shocked if you had said that we do not have the right to have our own opinion, but you did not say that, and we do have our own opinion. I recognize however that Europe has influence and possibilities for action essentially in Europe, in the Mediterranean basin and in Africa, but that taken together the European countries represent a secondary power. This may shock some but it is more or less true, given that what I say not be taken in a restrictive sense. Likewise, when you declare that it is necessary to study things globally, I am less shocked than others. Of course it is necessary to study each problem in its own context, and for example commercial questions should be treated in the GATT. But we need to consider the entire context on all occasions. It would be impossible to agree, for example, on grapefruit while forgetting the general questions of politics, military problems or monetary problems. Your speech, nonetheless, did lead to considerable discussion; if some were shocked by your ideas I personally did not find your ideas so far from reality.

With President Nixon I would like to have very precise discussions. First of all, there is the monetary problem. We are certainly not going to solve the problem at Reykjavik. In any case the two of us alone could not solve the problem and nobody is yet ready. Nonetheless we cannot go on like this and not know at all where we stand. I would therefore like to discuss the monetary question and also the question of gold—not the role of gold because we could debate that in vain and we know that we are not in agreement; but there is the question of the price of gold and we can no longer continue to go on pretending that an ounce of gold will always be worth thirty-eight dollars when it is now worth one hundred and six dollars. We also have to worry about the enormous speculation on gold. I think that the general interest, as those of the United States and France, are not in conflict and that they are even congruent. I would therefore like to discuss the dollar and also its convertibility, not into gold but into other currencies. The present situation is ridiculous. Each week I have to buy florins and marks, which are weak or wavering, and I receive dollars that I cannot use. Conversely, we give dollars to the Germans or the Dutch. The problem is real, and I would like to discuss it. M. Giscard d’Estaing will come with me, but I have my own ideas that he does not necessarily share.

There are next trade questions and questions of agriculture. As I already told President Nixon in the Azores,(4) we are making mistakes: we are in a period not of overproduction, but of underproduction. The Arabs, who are not exactly a model of unity, have nonetheless been able to reach understandings on oil while we have not been able to reach agreement on wheat. We sell to the Soviet Union and to China, and also to Japan, countries which can pay high prices, and we make of them dominant forces in the market place because we sell to them at low prices. I think it is possible to reach an understanding among France, the United States, Canada and perhaps Argentina, to constitute a sort of OPEC to direct the market, in which there are now shortages, which will only continue to grow, largely because population is expanding rapidly and production is not keeping up with it; and also because the Communist system is not productive. Will President Nixon be disposed to talk about these issues, without radically changing policy? Does he have some ideas on these issues or some practical propositions to make?

[Omitted here is discussion unrelated to foreign economic policy.]

Finally, there are commercial problems. Some are secondary and will be settled. Others, more important, require a certain cooperation between France and the United States in order to resolve them. There is no reason to always discuss issues with the Soviets and never with the United States, especially since these are not equivalent actions: when we sign with the Soviets a piece of paper where we say, for example, that we favor a free exchange of men and ideas we know perfectly well what that means and the limits that exist. But with you, it is a matter of real agreements. If it is written that such and such will happen, it will take place.

I would like to discuss all this with President Nixon and with you. We need to clarify our positions to each other. The position of France is fiercely independent. If it were not, we would be overwhelmed by someone or other, because of our relative weakness. Nonetheless we must believe in solidarity, we know this well, and perhaps we must even more than others. We may as well say this frankly so that we don’t run into contradictions at each step.

Dr. Kissinger: You will certainly be able to discuss all these questions with President Nixon.

[Omitted here is discussion unrelated to foreign economic policy.]

As for economic questions, our intention first is not to say that all problems should be dealt with by the same negotiators (there would certainly be different groups), but to make it understood that if the economic questions are not examined in a broader context and if they are only discussed by technicians then a confrontation is inevitable. Our discussions in the Azores are a good example of this. During the preparations for this meeting all our technicians pressed for organizing Germany against France and a confrontation based on the idea of a divided Europe. I am not an expert in monetary matters but I recommended that we discuss these matters with you in a broader context. It seemed to me that the solution we reached in the Azores was very reasonable at that time.

A difficulty and a danger that we notice today in the West (and to which you alluded) is that in each country there is a tendency to judge that a foreign policy is successful when it deals with relations with adversaries; there is no leader and no opinion who see success in our relations with friends. We believe it is essential to create again in each country commitments among friends. It is only in this way that we can resist the Soviet strategy which hopes to weaken our will to resist. It is with this intention that we drafted our “declaration of principle" to elicit common actions among friends.(5) Dealt with in this context I believe that economic questions, monetary questions or agricultural questions will find a sympathetic hearing by President Nixon. It would be a nightmare for us to have a deal for three more years with technical questions while the Soviet Union continues to gain in the psychological realm. When President Nixon has left and when President Pompidou will have completed his term, which is similar to that of Mr. Heath, we will find ourselves in a situation where it will be extremely difficult to organize a Western policy turned toward the future.

[Omitted here is discussion unrelated to foreign economic policy.]

President Pompidou: What you have told me is very important, of course, and I will think about it a great deal. All of this will remain among ourselves and M. Jobert. I place you in the position of Mr. Rogers in order to simplify life. Concerning economic and monetary matters, M. Giscard d’Estaing will naturally have a role to play. For the moment I have not told him anything. I can assure you that we are going to Iceland with the desire to achieve positive things.

[Omitted here is discussion unrelated to foreign economic policy.]

Dr. Kissinger: You will find that the mentality of the Chinese is quite close to that of the French: They are skeptical, precise, analytical and without sentimentality. You will note also in this group of old men a real knowledge of the Western situation. I have been rather surprised that their analysis of Europe is more intelligent than that of Bonn.

President Pompidou: Can you tell me a country whose policy is sentimental?

Dr. Kissinger: Germany.

President Pompidou: It is dominated by sentiment. That is not the same thing.

Dr. Kissinger: All countries tend to act in conformity to their national interest. In this sense the United States is particularly sentimental. Nonetheless not every country is capable of analyzing its own interests coldly. I think that the European left in general is not even able to analyze its national interests, with a few exceptions.

President Pompidou: In any case the text in which President Nixon asked Congress for economic powers was not at all sentimental.(6)

Dr. Kissinger: Not at all. But it is very important that we make understood in this commercial area that one cannot only strive for unilateral advantages. We must address ourselves to Congress on this because of public opinion. It is difficult however not to strive for unilateral advantage unless we can place ourselves in a broader context and a more important context. For example, our economists examined the question of reverse preferences and of compensation from associates of the Common Market such as Spain and Israel.(7) I opposed this for six months, but it is difficult to find a political justification at present that one could oppose to Chinese exports towards the United States: in the case of delivery of $10 million worth of cotton, I had to refuse authorization. I am sure that if you and President Nixon managed to reach an understanding on general relationships, we could deal with commercial relations in a manner that will allow both sides to draw benefits. This in any case would be our attitude. If we sought to extract unilateral advantages from Europe, this would turn against us later on. From all evidence it will be easier to talk of these questions in a broader political context.

President Pompidou: If you would drop the term “reciprocity" somewhere, this would help a great deal. For our part we have strong ties with certain African countries, but I am not in favor of extending association everywhere. If we give it to everyone one ends up by not giving anything to anyone and by weakening the others. In fact I am not very far from your position even with respect to Japan. The Minister of Foreign Affairs, Mr. Ohira, said to me “Let us become allies against the United States." I refused and I said that the United States wants Europe to proceed to make purchases in place of the Japanese; it is up to you to produce less or to buy more. I think that he understood.

Dr. Kissinger: In the long term Japan could present formidable problems for everyone, because it has no concept of global interests. It pursues its own interests so narrowly that this could be dangerous for all countries. It is impossible to have only trade surpluses toward everyone.

[The meeting then ended.] (8)

1 Source: National Archives, Nixon Presidential Materials, NSC Files, Kissinger Office Files, Box 56, Country Files, Europe, French Memcons (originals) January–May 1973. Top Secret; Sensitive; Exclusively Eyes Only. The meeting took place in President Pompidou’s office at the Elysée Palace. Kissinger was in Paris to discuss the implementation of the January 1973 Paris Peace Accord with DRV representatives. He also met with Egyptian National Security Adviser Hafez Ismail.

2 President Nixon and President Pompidou met in Reykjavik, Iceland, on May 31 and June 1. See Documents 40–42.

3 On April 23, Kissinger delivered a speech entitled “The Year of Europe" to the Associated Press editors’ annual meeting in New York City in which he called for a rein-vigoration of the Atlantic alliance. For the text of Kissinger’s speech, see Department of State Bulletin, May 14, 1973, pp. 593–598.

4 Nixon and Pompidou met in the Azores December 13–14, 1971. See footnote 6, Document 36.

5 In his April 23 speech on the need to reinvigorate the Atlantic alliance (see footnote 3, above), Kissinger called for the drafting of “a new Atlantic charter setting the goals for the future," an expression of “a clear set of common objectives together with our allies."

6 On April 10, President Nixon sent to Congress the Trade Reform Act, legislation that would give the President the necessary negotiating authority to start a new round of GATT negotiations and introduce important changes to existing U.S. trade laws. For the text of the President’s message to Congress, see Public Papers: Nixon, 1973, pp. 258–270.

7 The reverse preferences issue refers to the granting of trade preferences by LDCs to the EC in exchange for trade preferences granted by the EC to LDCs. The Spanish and Israeli association issue refers to preferential trading agreements between those two countries and the EC. The United States argued that it was being unfairly discriminated against by both arrangements and was at that time in the process of negotiating redress of these issues.

8 Brackets are in the original.

Popular Blog Posts by Koos Jansen

China’s Secret Gold Supplier is Singapore

China’s Secret Gold Supplier is Singapore

Audits of U.S. Monetary Gold Severely Lack Credibility

Audits of U.S. Monetary Gold Severely Lack Credibility

China Gold Import Jan-Sep 797t. Who’s Supplying?

China Gold Import Jan-Sep 797t. Who’s Supplying?

The Gold-Backed-Oil-Yuan Futures Contract Myth

The Gold-Backed-Oil-Yuan Futures Contract Myth

Estimated Chinese Gold Reserves Surpass 20,000t

Estimated Chinese Gold Reserves Surpass 20,000t

Did the Dutch Central Bank Lie About Its Gold Bar List?

Did the Dutch Central Bank Lie About Its Gold Bar List?

PBOC Gold Purchases: Separating Facts from Speculation

PBOC Gold Purchases: Separating Facts from Speculation

U.S. Mint Releases New Fort Knox Audit Documentation

U.S. Mint Releases New Fort Knox Audit Documentation

China Net Imported 1,300t of Gold in 2016

China Net Imported 1,300t of Gold in 2016

Why SGE Withdrawals Equal Chinese Gold Demand and Why Not

Why SGE Withdrawals Equal Chinese Gold Demand and Why Not

Koos Jansen

Koos Jansen