Second Thoughts On U.S. Official Gold Reserves Audits

This post is a sequel to “A First Glance At US Official Gold Reserves Audits”.

What is not often covered in the media or blogosphere are the audits of the US official gold reserves stored at the US Mint, which is the custodian for 95 % (7716 tonnes) of the stash – nowadays also referred to as custodial deep storage, and at the Federal Reserve Bank Of New York that safeguards the remaining 5 % (418 tonnes). The lawful owner of the US official gold reserves is the US Treasury. Part one covered the most recent records I could find published by the US government, in this post we’ll examine more historical records and approach this matter from a more critical angle. Because of the amount of information I found this post is split in multiple parts.

What Is A Gold Audit?

From Wikipedia:

Auditing is defined as a systematic and independent examination of data, statements, records, operations and performances (financial or otherwise) of an enterprise for a stated purpose. In any auditing the auditor perceives and recognizes the propositions before him for examination, collects evidence, evaluates the same and on this basis formulates his judgment, which is communicated through his audit report.

Due to constraints, an audit seeks to provide only reasonable assurance that the statements are free from material error. Hence, statistical sampling is often adopted in audits.

To be sure, I’ve asked several bullion dealers about how their audits are being conducted. They all agreed an audit involves three parties: the owner of the gold, the custodian and an external (independent) auditor. The external auditor examines the gold, compares its findings with the statements of the custodian and then reports on the accuracy of the statements of the custodian to the owner of the gold. An example of an audit report by such an external auditor can be found here.

The fact that the auditor is an external party is essential; if the custodian itself would perform the audit it could easily falsify the reports and lend gold that isn’t often transferred in and out of the vaults.

What Is A Gold Assay?

Assaying gold is done to test the purity of the metal; to make sure a bar contains at least the amount of fine gold disclosed on its inscription. For assay tests often samples are taken from random bars (not from all bars of a specific inventory). From Wikipedia:

A metallurgical assay is a compositional analysis of an ore, metal, or alloy. Raw precious metals (bullion) are assayed by an assay office. Silver is assayed by titration, gold by cupellation and platinum by inductively coupled plasma optical emission spectrometry.

Ron Paul

Allegedly the deep storage gold at the US Mint is currently stored in 42 vault compartments at three different locations in the US. 4,583 tonnes is stored at Fort Knox, Kentucky, 1,364 tonnes in Denver, Colorado, and 1,682 tonnes at West Point, New York.

The last time the US official gold reserve audits were publicly discussed was in 2011 when Ron Paul, who was a well informed member of the US House of Representatives, proposed new legislation at the time to have a full audit of the US holdings: The Gold Reserve Transparency Act (H.R. 1495, not enacted). Strangely Dr Paul wasn’t up to date of the audit and assay procedures performed since 1974, while he was in politics because of gold since 1971. From Wikipedia:

When President Richard Nixon “closed the gold window" … on August 15, 1971, Paul decided to enter politics and became a Republican candidate for the United States Congress.

Only during the preparation of the congressional hearing Dr Paul became aware of the audit and assay procedures. From Paul’s opening statement at the hearing June 23, 2011:

For far too long, the United States Government has been less than transparent in releasing information relating to its gold holdings. Not surprisingly, this secrecy has given rise to a number of theories about the gold at Fort Knox and other depositories.

Some people speculate that the gold has been involved in gold swaps with foreign governments or bullion banks. Others believe that the gold has been secretly shipped out of Fort Knox and sold. And, still others believe that the bars at Fort Knox are actually gold-plated tungsten. Historically, the Treasury and the Mint have dismissed these theories rather than addressing these concerns with substantive rebuttals.

The difference between custody and ownership, questions about the responsibility for U.S. gold held at the New York Fed, and that issue of which division at Treasury is ultimately responsible for the gold reserves are just some of the questions that have come up during the research for this hearing. In a way, it seems as though someone decided to lock up the gold, put the key in a desk somewhere, and walk off without telling anyone anything. Only during the preparation for this hearing was my office informed that the Mint has in fact conducted assays of statistically representative samples of gold bars, and we were provided with a sample assay report.

While the various agencies concerned have been very accommodating to my staff in attempting to shed some light on this issue, it should not require the introduction of legislation or a congressional hearing to gain access to this information.

Why did Paul not know about this? Why did it take a congressional hearing to get the details of the audit and assay tests? Why wasn’t this information easily accessible to him and the American people?

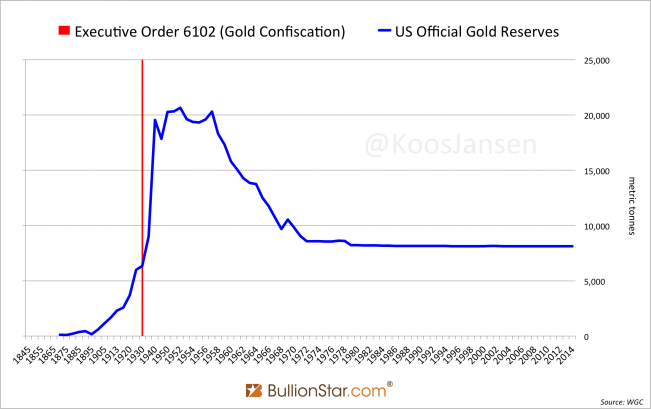

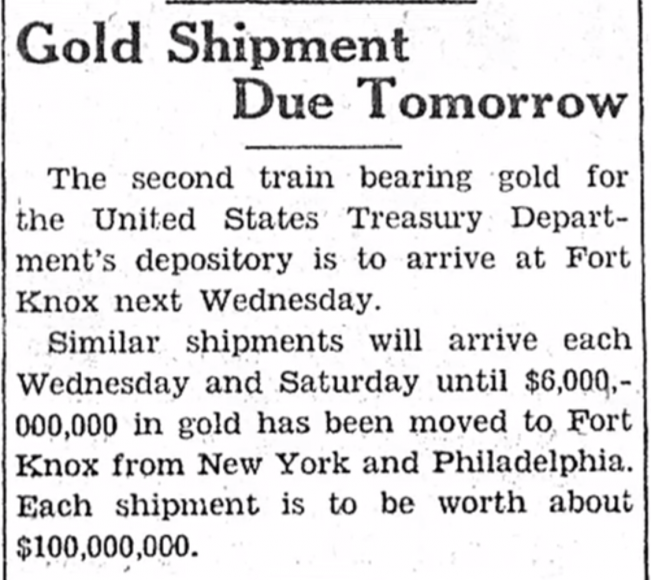

Gold Audits At Fort Knox

The construction of the notorious gold depository was finished in 1936 at the Fort Knox army base in Kentucky; large quantities of gold were first deposited in 1937. After President Roosevelt had ordered the people of the United States to sell all their gold coins and bullion for $20.67 per fine ounce to the Federal Reserve in 1933, through Executive Order 6102 (the great gold confiscation), a fortress was needed to store the bars that were coming out of the smelters of the seized gold. The bars that were melted from gold coins are approximately 90 % pure, the majority of the bars, allegedly, in Fort Knox are coin bars. Though, research has pointed out the huge growth in US official gold reserves after 1933 has primarily been sourced from imports, not by domestic coins.

The Gold Reserve Act of 1934 required the Federal Reserve to transfer ownership of the official gold reserves to the Department of the Treasury, in return it received gold certificates (that are mere redeemable for dollars). The US Mint was assigned to safeguard the Treasury Department’s gold, silver and other assets at several depositories across the US, among others at Fort Knox and Denver.

1953

To research the integrity of the audits performed at Fort Knox (and the other depositories) in all of history, we’ll start from the beginning and work our way to the present. The first audit I could find dates from 1953, when total US reserves accounted for roughly 20,000 tonnes. Many researchers that have worked on this subject in the past refer to the first and last full audit of 1953. However, the audit in 1953 was anything but full.

During my research I came across many articles of researchers that have investigated Fort Knox audits – Ed Durell, James Turk and Tom Szabo, to name a few. Often these articles contained dead web links to documents on US government websites. Everything that was still accessible during my research I copied to my own servers to secure access to them at all times.

The next quotes are from the official report of the gold audit in 1953 (download here).

Fiscal Year Ended June 30, 1953

REPORT ON FISCAL OPERATIONS

VERIFICATION OF GOLD AND SILVER BULLION AND OTHER TREASURY ASSETS

…The audit was performed in accordance with procedures which were recommended by an advisory committee of consultants appointed jointly by the present Secretary and his predecessor in office. Members of the advisory committee were W. L. Hemingway, Chairman of the Executive Committee of the Mercantile Trust Company, St. Louis, chairman; Wm. Fulton Kurtz, Chairman of the Board, The Pennsylvania Company, Philadelphia; Sidney B. Congdon, President, National City Bank of Cleveland, Cleveland; and James L. Robertson, Member, Board of Governors, Federal Reserve System, Washington. As had been suggested by the advisory committee, the audit was conducted under the general supervision of a continuing committee representing both incoming and outgoing Treasury officials. Representatives of the Comptroller General of the United States observed the audits at each of the various audit sites.

In accordance with a recommendation of the advisory committee the special settlement committee at the Fort Knox depositary opened three gold compartments, or 13.6 per cent of the total of twenty-two sealed compartments at that institution containing 356,669,010.306 fine ounces [11,094 metric tonnes] of gold valued at $12,483,415,360.28. All of the gold contained in the three sealed compartments opened, amounting to 34,399,629.685 fine ounces [1,070 tonnes] valued at $1,203,987,038.94 or approximately 88,000 bars, was counted by members of the settlement committee and found in exact agreement with the recorded contents of the compartments. Slightly in excess of 10 per cent of the total gold values so counted, or some 9,000 bars weighing approximately 130 tons, was further verified through weighing upon special balance scales indicating exact weights to the 1/100 part of a troy ounce. All gold weighed was found in exact agreement with the recorded weight thereof. Further, test assays were made of 26 gold bars selected at random from the total gold counted. The reported results of the test assays indicated, that all gold tested was found to be of a fineness equal to or in excess of that appearing in the mint records and stamped on the particular gold bars involved. Gold samples used for test assay purposes were obtained through drilling from both the top and bottom of each representative gold bar. In final confirmation of the verification of the gold bullion asset values held in the Fort Knox depositary the special settlement committee reported in part as follows:

“0n the basis of assays, your committee can positively report that the gold represented, according to assay, is at the depositary. We have no reason, whatsoever, to believe other than, should all melts be assayed, the results would be the same.”

“We, the undersigned, found the assets verified, to be in full agreement with the assets as indicated by the joint seals affixed to the respective compartments on January 26, 1953.”

“It is the opinion of this committee that the same agreement would be found should all of the compartments be verified."

In short; an advisory committee of “consultants” assembled special settlement committees that, under the supervision of Treasury officials and Representatives of the Comptroller General, audited 3 of in total 22 compartments filled with gold (it’s likely Fort Knox has many more compartments in total). 13.6 % – 1,070 tonnes – of all the gold bars held at Fort Knox was counted, of which 9,000 bars were weighed upon special balance scales and 26 bars were assayed. The document notes procedures at other depositories closely paralleled those employed at Fort Knox, though no numbers are disclosed.

In 1953 the US Treasury held approximately 1,300,000 gold bars at multiple depositories of which 88,000 were counted, 9,000 were carefully weighed and 26 bars (0.00002 %) were assayed; no external auditing firm was present. This was not a full audit.

1974

The other full audit that keeps buzzin around in the media was the one in 1974, because the media was actually allowed to enter the fortress back then. On September 23, 1974, roughly 100 journalists were allowed entrance, accompanied by 9 members of Congress.

When the total US official gold reserves had declined by 11,500 tonnes from 1953 to 1974, many Americans began to doubt if the US actually had any gold left at all, especially after Nixon had temporarily suspended the convertibility of dollars for gold at the US Treasury in 1971. The amount of gold at Fort Knox had dropped from 11,094 tonnes (stored in 22 compartments) to 4,585 tonnes (stored in 13 compartments). In an attempt to reassure the American people not all gold was gone a new audit was scheduled.

From several sources we know for the visual inspection by the press and congressmen only one compartment was opened, in which 368.2 tonnes was stored. I edited a small video clip from a History Channel documentary for us to take a look inside Fort Knox.

Whether one or multiple compartments were opened is actually irrelevant, unqualified people looking at a wall of yellow bricks and weighing a few bars will not pass as an audit.

The director of the Mint in 1974, Mary Brooks, did a remarkable confession when the press asked if there is a tunnel to the vault. She showed a narrow tunnel, the size of a sewer pipe, which could only be opened from inside the vault in case someone was trapped – no pictures were allowed to be taken from the tunnel. The escape could only be made outside the vault, not the building itself, she said. There are thus three connections to the vault, the front door, the back door and the tunnel.

The real audit started the day after, on September 24, 1974. This audit was performed by “a committee including auditors from GAO and from Treasury’s Office of the Secretary, Bureau of Government Financial Operations (BGFO), U.S. Customs Service, and Bureau of the Mint. The committee also included Bureau of the Mint technicians trained in assaying and weighing gold bullion". No external auditor was hired; the US Mint, a department of the US government, can audit the gold in cooperation with thousands of other government departments, only an external auditing party can ensure the integrity of an audit.

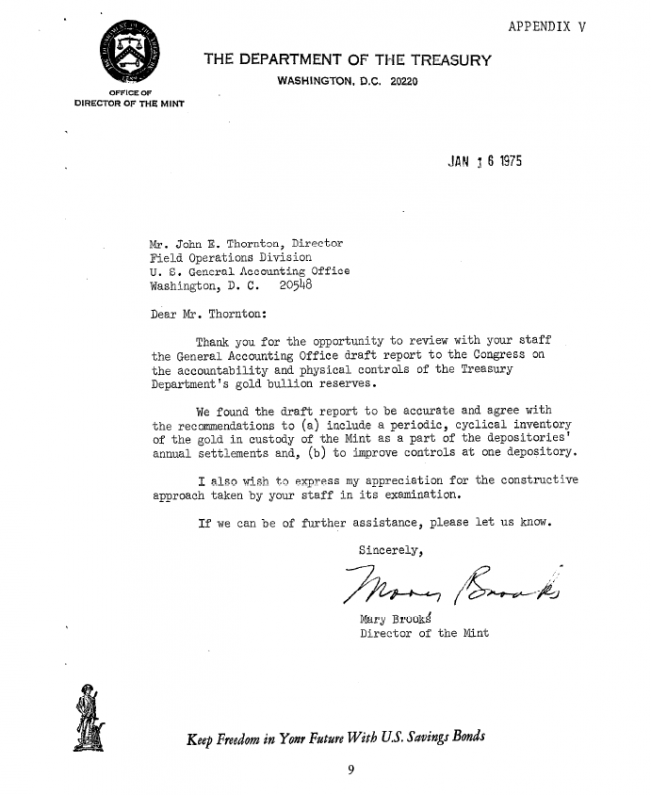

Again three random compartments were opened (theoretically one or two could have been the same compartments that were opened as in 1953 as no compartment numbers have been disclosed in the audit reports). From the official audit report published in 1975 (download here):

Mint regulations require that a special settlement committee be established to inventory and maintain physical control over the gold as it is being inventoried, weighed, and sampled. We selected the compartments to be audited, and we did not disclose this information until the inventory began. The committee opened 3 compartments and counted and inspected 91,604 bars representing about 31.1 million fine troy ounces [967 tonnes] of gold valued at about $1.3 billion, or approximately 21 per cent of the gold stored at the depository. From a random sample of all melts in the 3 compartments, the committee weighed 95 melts to the 100th part of a troy ounce. The committee also compared the weights and physical characteristics of all gold … inventoried to inventory records.

To verify the gold’s fineness, a bar from each melt weighed was assayed. Gold samples were obtained by taking a tetrahedron-shaped chip, weighing about four-tenths of an ounce, from both the top and the bottom of the representative gold bar. We assigned control numbers to the sample chips, because the assayer could possibly determine, without assay, the gold’s fineness if he knew the value or melt number from which the chips came. The New York assay office assayed the gold and gave us the results for comparison with inventory records. We observed the assaying of the first samples. The results of the assays indicated that the recorded finenesses were within the tolerances the Mint established.

No assay report was included.

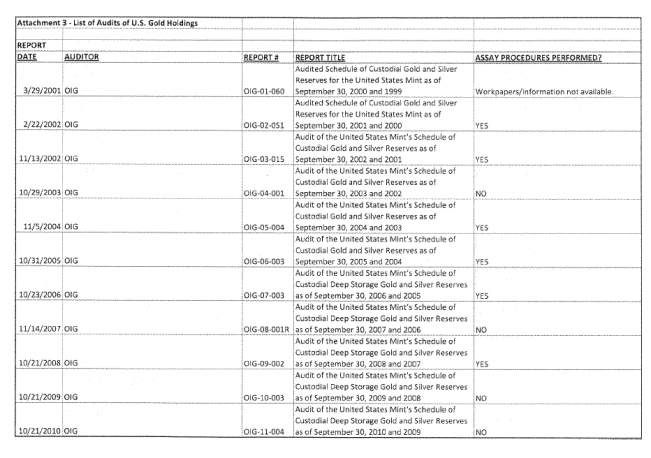

In 1975 a Committee was appointed for the Treasury’s continuing audits of U.S.-owned gold stored at the Mint. The operation was designed to audit 10 % of the Treasury’s gold per annum. Inspector General (IG) Eric Thorson stated in 2011 during the hearing by Ron Paul:

In June 1975, the Treasury Secretary authorized and directed a continuing audit of U.S. Government-owned gold for which Treasury is accountable. Pursuant to that order, the Committee for Continuing Audit of the U.S. Government-owned Gold performed annual audits of Treasury’s gold reserves from 1975 to 1986, placing all inventoried gold that it observed and tested under an official joint seal.

The committee was made up of staff from Treasury, the Mint, and the Federal Reserve Bank of New York. The annual audits by the committee ended in 1986 after 97 per cent of the Government owned gold held by the Mint had been audited and placed under official joint seal.

These continuing audits would be the first to examine such a large share of the US official gold reserves, 97 % of all the gold held by the Mint equals to 7,485 tonnes, or 92 % of total US official gold reserves. At the same time, this is where the confusion starts. Let’s find out all there is to know about the continuing audits conducted from 1975 to 1986, as this should be what we’re after, the audit of nearly all US official gold reserves.

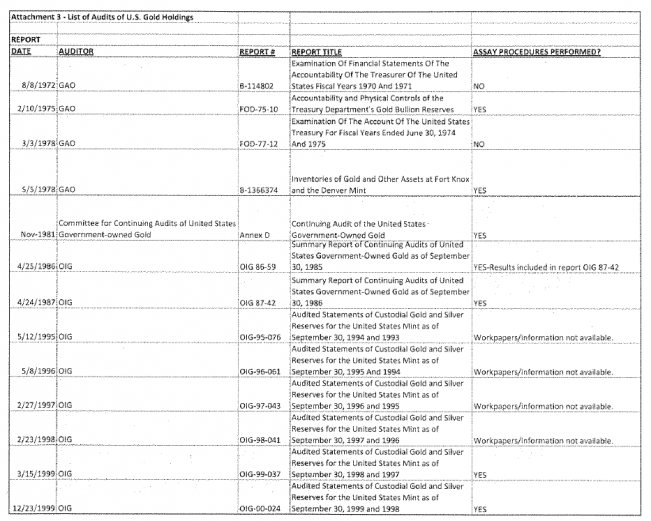

From the full report that came out of the congressional hearing in 2011, the US Treasury’s best defense I assume, these are the audit reports in existence since the early seventies:

We are not interested in the audits of financial statements of the Mint, but in audits of the physical inventory gold.

At first sight we can see that not from all years the continuing audits were supposedly performed (1975 to 1986) reports are listed. Only the following audit are disclosed:

- 1974 (released by the GAO 2/10/1975)

- 1977 (released by the GAO 5/5/1978)

- 1980 (released by the GAO 10/1981)

- 1985 (released by the OIG 4/25/1986)

- 1986 (released by the OIG 4/24/1987)

The continuing audits report of 1981 notes audits have been performed in 1975, 1976, 1978 and 1979, but no reference is made to audit reports. Only the amount of gold audited in each of those years is mentioned.

The list from 2011 is entitled “List of audits of US gold holdings" suggesting these are the only audits performed. If more audits were conducted they surely would have been disclosed on the 2011 list, right? Also the ones from 1981, 1982, 1983 and 1984. Or were audits conducted, but no reports drafted? More on this later, for now, we’ll focus on the content of the audit reports from the 2011 list:

The first audit report (1974) on the list we’ve discussed above, let’s have a look at the second from 5/5/1978 that covers the audit performed in 1977 (download here).

1977

Reading the report unveils a few problems:

- No external auditor was present.

- 11.7 % , or 536 tonnes, of the gold at Fort Knox was audited, but it’s not mentioned how many bars were counted, weighed and assayed.

- The assay tests found irregularities. From the report:

Two sample melts showed the gold was below the fineness (5 parts per 10,000) permitted by the Bureau. Because of this problem, the vault had to be opened twice more in the presence of the Joint Sealing Committee and the gold reevaluated. This involved considerable time and expense, but was necessary because the fineness of gold must be precisely determined.

On July 29, 1977, bore samples, rather than chips, were taken from the questionable melts and sent to two assay offices for independent evaluations. Half of the samples reassayed were still unacceptable. The Bureau decided that the two melts from which the samples were taken had to be remelted and reassayed. This was done on November 16 and 17, 1977. This time, the gold was within the prescribed level of fineness but below the fineness listed on the inventory schedule. The difference in the original and revalued fineness resulted in a $158.77 adjustment to the records, which was considered insignificant. Previous discrepancies in fineness were attributed to improper melting and casting of the melts in 1920 and 1921. Bureau officials said the remelting process confirmed the validity and integrity of their audit procedures and assays.

- We can ascertain the assay tests at Fort Knox in 1953 were done by drilling holes through the bars; in 1974 and 1977 the assay tests were changed to “taking a tetrahedron-shaped chip, weighing about four-tenths of an ounce, from both the top and the bottom of the representative gold bar”. When this method ‘failed’ in 1977, the committee decided to drill holes, but why was the method of initial assaying changed from drilling holes through the bars, into taking chips from the top and bottom of the bars? When in 1977 the bore samples failed to proof the purity on the inventory list, both melts in question were remelted. But, who processed the remelting? How do we know the metal wasn’t refined/supplemented into higher purity gold? The report states that after the remelting, “This time, the gold was within the prescribed level of fineness but below the fineness listed on the inventory schedule. The difference in the original and revalued fineness resulted in a $158.77 adjustment to the records”. To me it’s not clear what this means. Some kind of adjustment was made and the auditors decided to move on? Didn’t this ring any alarm bells, if irregularities were found in two melts why wasn’t more gold assayed?

- Apart from the negative assay test, the 1977 audit report is not reliable because it doesn’t disclose any information about how many bars were counted, weighed or assayed.

In the next part we’ll continue from the 1981 audit.

Popular Blog Posts by Koos Jansen

China’s Secret Gold Supplier is Singapore

China’s Secret Gold Supplier is Singapore

Audits of U.S. Monetary Gold Severely Lack Credibility

Audits of U.S. Monetary Gold Severely Lack Credibility

China Gold Import Jan-Sep 797t. Who’s Supplying?

China Gold Import Jan-Sep 797t. Who’s Supplying?

The Gold-Backed-Oil-Yuan Futures Contract Myth

The Gold-Backed-Oil-Yuan Futures Contract Myth

Estimated Chinese Gold Reserves Surpass 20,000t

Estimated Chinese Gold Reserves Surpass 20,000t

Did the Dutch Central Bank Lie About Its Gold Bar List?

Did the Dutch Central Bank Lie About Its Gold Bar List?

PBOC Gold Purchases: Separating Facts from Speculation

PBOC Gold Purchases: Separating Facts from Speculation

U.S. Mint Releases New Fort Knox Audit Documentation

U.S. Mint Releases New Fort Knox Audit Documentation

China Net Imported 1,300t of Gold in 2016

China Net Imported 1,300t of Gold in 2016

Why SGE Withdrawals Equal Chinese Gold Demand and Why Not

Why SGE Withdrawals Equal Chinese Gold Demand and Why Not

Koos Jansen

Koos Jansen