Record Monthly Gold Exports From UK to China

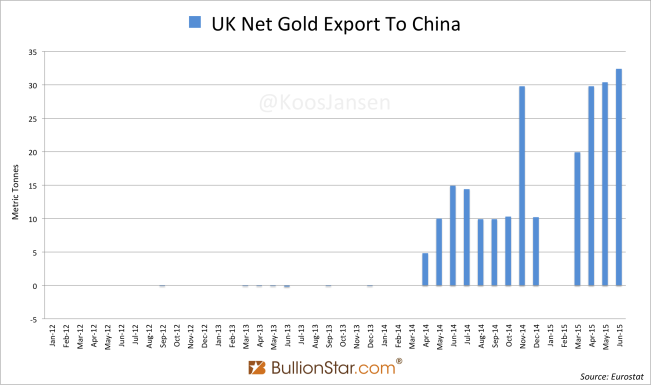

The UK net exported a record 32.4 tonnes of gold directly to China mainland in June 2015.

In 2014 the conventional conduits of bullion flows to China, from all around the world first to Hong Kong and then to the mainland, have been replaced by direct exports. For example, the UK is exporting bullion directly to China since April 2014 – as I reported at the time. The result of the rearrangement in these gold flows is that Hong Kong’s export to the mainland has lost its accuracy as an indicator for China’s gold hunger. In a few posts we’ll have a look at trade data from several gold exporting nations and trading hubs to grasp how much gold China is importing this year.

Starting April last year, UK shipments of gold directly to China have been going up. In June 2015 the UK net exported a record 32.4 tonnes of gold to China, up 6.5 % m/m, up 116 % y/y.

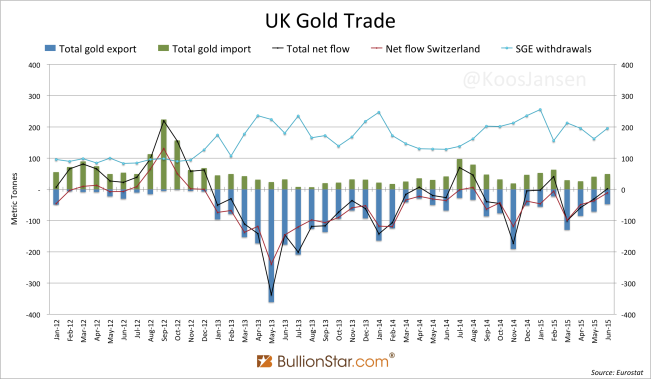

Let’s see if we can learn some more from the UK’s trade data. Remarkably, the UK became a net importer of gold in June with 2 tonnes net imported. Falling total gold exports and rising total gold imports caused this. Concluding, although China imported a record monthly tonnage from the UK in June, the Brits did not suffer a net outflow because of concurrent strong imports into London. UK total gold import in June was 49.3 tonnes, compared to a gold net export to China at 32.4 tonnes. Have a look at the below chart for some clarity.

In the above chart, we can see the UK’s total net export has been going down in the past few months (black line), although we know that net export to China has increased (exhibit 1). Who was exporting gold to the UK to be sent forward to China? In June it was the US at 19.5 tonnes, which was the highest amount since February 2012, and Canada at 18.4 tonnes.

Chinese gold wholesale demand measured by SGE withdrawals was high in June at 196 tonnes (exhibit 2). We shall see what the supply composition (mine/import/scrap) was of SGE withdrawals when gold export data from more countries is released.

Popular Blog Posts by Koos Jansen

China’s Secret Gold Supplier is Singapore

China’s Secret Gold Supplier is Singapore

Audits of U.S. Monetary Gold Severely Lack Credibility

Audits of U.S. Monetary Gold Severely Lack Credibility

China Gold Import Jan-Sep 797t. Who’s Supplying?

China Gold Import Jan-Sep 797t. Who’s Supplying?

The Gold-Backed-Oil-Yuan Futures Contract Myth

The Gold-Backed-Oil-Yuan Futures Contract Myth

Estimated Chinese Gold Reserves Surpass 20,000t

Estimated Chinese Gold Reserves Surpass 20,000t

Did the Dutch Central Bank Lie About Its Gold Bar List?

Did the Dutch Central Bank Lie About Its Gold Bar List?

PBOC Gold Purchases: Separating Facts from Speculation

PBOC Gold Purchases: Separating Facts from Speculation

U.S. Mint Releases New Fort Knox Audit Documentation

U.S. Mint Releases New Fort Knox Audit Documentation

China Net Imported 1,300t of Gold in 2016

China Net Imported 1,300t of Gold in 2016

Why SGE Withdrawals Equal Chinese Gold Demand and Why Not

Why SGE Withdrawals Equal Chinese Gold Demand and Why Not

Koos Jansen

Koos Jansen