Why the Dutch Central Bank Refuses To Publish Gold Bar List

My hunt for the gold bar list of the Dutch official gold reserves started in 2015. On September 26 of that year I visited a conference in Rotterdam, the Netherlands, called Reinvent Money. One of the speakers was Jacob De Haan from the Dutch central bank (DNB) Economics and Research Division – you can watch his presentation by clicking here.

In his presentation De Haan repeatedly talked about the importance of transparency in central banking. These statements raised my eyebrows, as I submitted a FOIA request at DNB in 2013 to ask for all correspondence between DNB and other central banks in the past 45 years with respect to its monetary gold, which was not honored. From my experience DNB was anything but transparent.

After the presentation I approached De Haan and asked him, if transparency is so important to DNB, why has it never published its gold bar list? An act of transparency that could be accomplished within minutes. De Haan offered me he would look into that. He gave me his email address and we agreed to stay in touch.

The next day I send De Haan an extensive email explicating my request at DNB to publish the gold bar list of the Dutch gold in excel sheet format. I wrote him it wouldn’t take DNB any effort, as I assumed the bar list was readily available.

De Haan never replied to my email, so I called his office in December 2015 to ask what the status was of my request. De Haan’s secretary answered my inquiry was not rejected but still being processed.

Weeks passed but I didn’t get any reply from De Haan.

On February 24, 2016, I decided to call DNB’s press department to ask about my inquiry. DNB’s spokesman, Martijn Pols, told me over the phone the subject was still being discussed internally, he even confirmed De Haan was involved in the decision making. DNB was considering releasing the document while carefully weighing al pros and cons, he said.

In the conversation Pols stated DNB was aware the German central bank (the Deutsche Bundesbank) released a bar list in October 2015 and there was a wish in Amsterdam to mutually harmonize this policy. I added that if DNB would go ahead with the publication their action would only be credible if the Dutch bar list would be complete (disclosing refinery brands, refinery bar numbers and year of manufacturing), in contrast to the incomplete list the Germans had published. Pols was aware of the format the Germans had chosen and took note of my comment. An ensuing question from my side what was holding back DNB in releasing the list could not be clearly answered.

Months passed without any news from DNB. On August 8, 2016 I decided to call Pols again for a status update. He said he would reply over email. A few days later I received an email from DNB Head of Commutations J.W. Stal.

His email to me, translated from Dutch to English, reads:

Dear Mr Jansen,

…. We can share the following information with respect to our gold reserves.

DNB is transparent about the amount (weight) and the value of our gold assets. This information can be found in our annual reports. Thereby, several media have visited the gold vault and video recordings have also been made. However, we do not intend to publish a gold bar list. This serves no additional monetary purpose to our aforementioned transparency policy, however it would incur administrative costs.

If you have any further question please contacts us.

Kind regards,

J.W. Stal

Of course, in this day and age any gold bar list from a central banks should be readily available in excel sheet format, and releasing a sheet would not incur any administrative costs.

My response to Stal translated:

Dear Mr Stal,

If the sole reason not to publish the gold bar list is that such an action would incur administrative costs I must conclude DNB doesn’t have the list readily available. Or is my conclusion erroneous? Does DNB have a complete gold bar list readily available or not?

If not, this is worrying because the gold bar list forms one of the most important checks on the existence of the Dutch official gold reserves, which provide essential stability to our economy.

Is the list in your possession or not?

Kind regards,

Koos Jansen

Dear Mr Jansen,

In response to your email of August 11, 2016, to De Nederlandsche Bank (DNB), we can inform you as follows on our gold reserves and the related gold bar list. DNB has internal gold bar lists, however the conversion of internal lists to documents for publication would create too many administrative burdens.

We maintain our previous email, in which we stated publishing a gold bar list serves no monetary purpose other than transparency. And as previously noted, there are other ways for DNB to transparently communicate about our gold stocks.

We trust to have informed you sufficiently.

Kind regards,

J.W. Stal

If DNB has its gold bar list properly (digitally) archived there should be no administrative cost whatsoever for publication. The argument presented by Stal makes absolutely no sense to me. If one owns over 600 tonnes of gold, why not have the physical assets accurately inventoried?

What could possibly be the problem to release the bar list of the Dutch gold located in Amsterdam, New York, Ottawa and London?

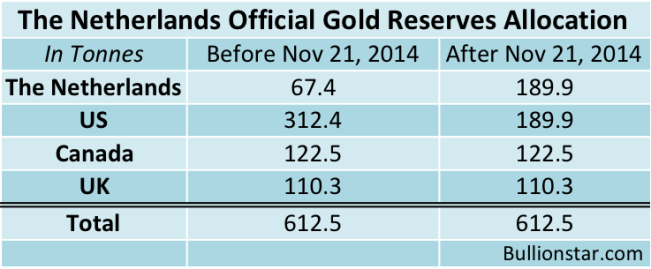

I would like to remind you that DNB is the only Western central bank that in recent years has successfully repatriated a significant amount of gold (122.5 tonnes) from the Federal Reserve Bank Of New York through a covertly executed operation. This underlines DNB is fully aware of the importance of its gold reserves in our current fragile financial climate. I think DNB does have the bar list readily available, but it chooses not to publish it for political reasons – think, tensions between its custodians in New York and London.

DNB claims to be transparent but in reality it’s not.

If you click this link you can see the most recent video recording made inside the DNB vault at the Frederiksplein in Amsterdam on April 26, 2016. The gold you see in the video aggregates to 189.9 tonnes and includes the 122.5 tonnes repatriated from the Federal Reserve Bank of New York in November 2014. Note, the gold at the Frederiksplein has been relocated to a different compartment inside the vault room after November 2014, due to the increased volume by the repatriation.

A few noteworthy comments from the DNB employee in the video:

Gold is the ultimate insurance and anchor in monetary systems.

If there will ever be any financial instability we can use the gold to build a new monetary system and offer trust to the public.

Popular Blog Posts by Koos Jansen

China’s Secret Gold Supplier is Singapore

China’s Secret Gold Supplier is Singapore

Audits of U.S. Monetary Gold Severely Lack Credibility

Audits of U.S. Monetary Gold Severely Lack Credibility

China Gold Import Jan-Sep 797t. Who’s Supplying?

China Gold Import Jan-Sep 797t. Who’s Supplying?

The Gold-Backed-Oil-Yuan Futures Contract Myth

The Gold-Backed-Oil-Yuan Futures Contract Myth

Estimated Chinese Gold Reserves Surpass 20,000t

Estimated Chinese Gold Reserves Surpass 20,000t

Did the Dutch Central Bank Lie About Its Gold Bar List?

Did the Dutch Central Bank Lie About Its Gold Bar List?

PBOC Gold Purchases: Separating Facts from Speculation

PBOC Gold Purchases: Separating Facts from Speculation

U.S. Mint Releases New Fort Knox Audit Documentation

U.S. Mint Releases New Fort Knox Audit Documentation

China Net Imported 1,300t of Gold in 2016

China Net Imported 1,300t of Gold in 2016

Why SGE Withdrawals Equal Chinese Gold Demand and Why Not

Why SGE Withdrawals Equal Chinese Gold Demand and Why Not

Koos Jansen

Koos Jansen