The Concept of Money & the Money Illusion

Awareness about the concept of money is making a comeback. Gone are the decades in which the global citizenry was fooled to leave this subject to economists, governments and banks – a setup that has proven to end in disaster. The crisis in 2008 has spawned debate about what money is, where it comes from and where it should come from. These developments inspired me to write a post on the concept of money and the money illusion. (All examples in this post are simplified.)

The Concept Of Money

Money is a collective human invention

First, let us have a look at the fundamentals of money. How did Money evolve? Thousand and thousands of years ago before any trade occurred homo sapiens use to be self-sufficient; families or small communities grew their own crops, fished the seas, raised cattle and made their own tools.

When barter emerged the necessity to be self-sufficient ceased to exist. A farmer that grew tomatoes and carrots could exchange some of his production output for bananas or oranges if he wished to do so. There was no necessity for the farmer to grow all crops he wished to consume, when there was an option to trade.

Farmers participating in a barter economy were incentivized to specialize in production, because they could escalate their wealth (gain more goods) by producing fewer crops on a greater scale. Through trade increased productivity (efficiency of production) could be converted into wealth, as the more efficient commodities were produced, the higher the exchange value of the labor put in to produce them. Consequently, barter economized production among its participants.

By exchanging, human beings discovered ‘the division of labor’, the specialization of efforts and talents for mutual gain… Exchange is to cultural evolution as sex is to biological evolution.

From Matt Ridley.

Direct exchange (barter) was a severely limited form of trade because it relied on the mutual coincidence of demand. An orange farmer in demand for potatoes had to find a potato farmer in demand for oranges in order to trade. If he could find a potato farmer in demand for oranges and agree on the exchange rate (price) a transaction occurred. But, often there was no mutual coincidence of demand. When all potato farmers were not in demand for oranges the orange farmer could not exchange his product for potatoes. In this case there was no trade, no one could escalate his or her wealth.

This is how money came into existence: the orange farmer decided to exchange his product for a highly marketable commodity. A bag of salt, for example, could be preserved longer than oranges and was divisible in small parts. He could offer it to a potato farmer, who in turn could store the salt for future trade or consumption. If no potato farmer was in demand for oranges, surely one was to accept salt in exchange. Eventually, the orange farmer succeeded via salt to indirectly exchange his product for potatoes. The medium used for indirect exchange is referred to as money.

In the early stages of indirect exchange there were several forms of money. When economies developed the best marketable commodity surfaced as the sole medium of exchange. A single type of money has the advantage that the value of all goods and services in an economy can be measured in one unit, all prices are denominated in one currency – whereas in barter the exchange rate of every commodity is denominated in an array of other commodities. One set of prices makes trade more efficient, transparent and liquid. Often precious metals, like gold or silver, were used as money as precious metals are scarce (great amounts of value can be transported in small weights), indestructible (gold doesn’t tarnish or corrode) and divisible (gold can be split or merged).

Money is supposed to serve three main purposes: 1) a medium of exchange,

2) a store of value, 3) a unit of account.

Indirect exchange is not restricted by mutual coincidence of demand; every participant in the economy offers and accepts the same medium of exchange, which enormously eases trade. The boost money has given to global wealth is beyond comprehension, the concept of money has been an indispensable discovery of civilisation.

We must realize the subject of money is always a matter of trust, because money in itself has no use-value for us humans. An orange, car, shoebox, t-shirt or house does have use-value. Money does not have use-value as it’s not the end goal of a participant in the economy, the end goal is always goods and services. Therefor, what we use as money is a social contract to be used in trade and to store value, always based on trust. The exchange value of money equals the amount of goods and services it can be traded for at any given moment, popularly called its purchasing power.

Note, Commodity money (like precious metals) does have some use-value, which it derives from its industrial applications – in the case of gold, for example its use in dentistry. Though, the majority of commodity money’s exchange value is based on its monetary applications.

After commodity money came fiat money. The nature of the latter is fundamentally different. From Wikipedia:

Fiat money is currency which derives its value from government regulation or law. The term derives from the Latin fiat (“let it be done", “it shall be").

Fiat money is what nowadays is used all around the globe. Instead of being picked by all participants in a free market as the best marketable commodity, it’s created by central banks and it can exist in paper, coin or digital form. Out of thin air and without limitation it can be brought into existence by printing paper bills or typing in digits into a computer.

When fiat money is created (out of thin air) it’s exchanged for assets a central bank puts on its balance sheet. After the first exchange the money can start circulating in the economy. A central bank can buy any asset, but usually it will be government bonds.

Whereas commodity money has its value anchored in the free market economy, the value of fiat money is simply determined by the board of governors of a central bank who can print more or less if they wish to. Throughout history central banks have been able to control the value of fiat money for relatively short periods, over longer periods the value of fiat money is wiped out inevitably.

The value of commodity money is anchored to the value of all goods and services in a free market, because it requires capital and labor to produce commodity money. This is how the anchor mechanism works (in our example gold is the sole medium of exchange: a simplified gold standard). Say, gold mines increase production output in order to literally make more money. The amount of gold circulating in the economy starts to grow faster than the amount of goods and services it can be traded for. The value of gold will decline relative to goods and services, as there is an oversupply of gold. In this price inflationary scenario it would be more profitable for economic agents to produce other goods than gold, as gold’s purchasing power is falling. When gold miners shift to alternate businesses and mines are closed the amount of gold in circulation starts to grow slower than the amount of goods and services it can be traded for, as a result the value of gold will increase relative to goods and services. In this price deflationary scenario gold’s purchasing power increases, which eventually incentivizes entrepreneurs to start mining gold again, until there is an oversupply of gold, etcetera. Gold used as money on a gold standard is not exclusively subjected to this mechanism. Simply put, in any economy entrepreneurs will grow potatoes when they are expensive and stop growing them when they are cheap. A free market economy in theory stabilizes the value of gold. In reality, for several reasons, gold’s exchange value is not exactly constant, but over longer periods gold’s purchasing power is impressive and more constant than any fiat currency.

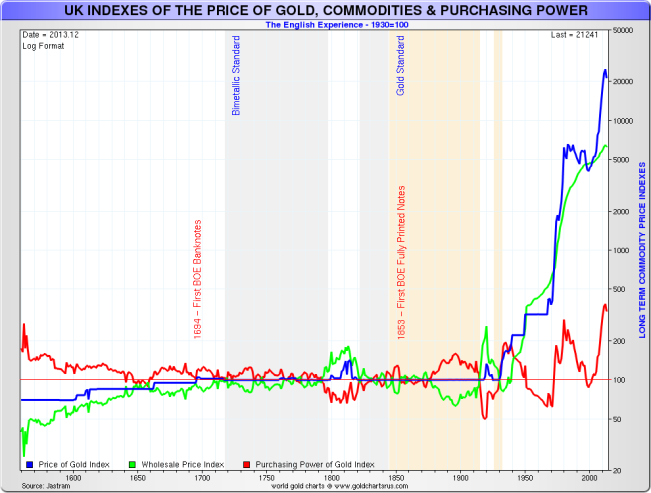

In the above chart we can see the green line resembling the index price of goods and services in the United Kingdom since the sixteenth century. The blue line resembles the index price of gold. Both are denominated in pounds sterling on a logarithmic scale. When the index price of gold overshoots the index price of goods and services gold’s purchasing power – the red line – will rise and vice versa. If your savings had been in fiat money since 1950, your purchasing power would have declined by 94 % as the index price of goods and services rose from 400 to 7,000. If your savings had been in gold since 1950, your purchasing power would have been fairly constant (actually would have increased). The green line takes off at the same time when the gold standard was abandoned from which point in time the currency was no longer tied to gold and became fiat.

What is remarkable is that the red line, gold’s purchasing power, is fairly constant. With or without gold standard it remains, more or less, flat. This is the essence of gold; over long periods of time gold’s purchasing power remains constant. Where fiat currencies can evaporate, gold offers protection of your wealth.

Fractional Reserve Banking And The Money Illusion

Both commodity money and fiat money can be used for fractional reserve banking. The roots of banking go back many centuries to fraudulent practices by blacksmiths. When people used to own gold coins and bring it to a blacksmith for safekeeping they got a receipt that stated a claim on gold in the vault. These receipts began circulating as money substitutes, instead of having to carry gold coins or bars it was more convenient to make payment with lightweight receipts – this is how paper money was born.

Then, blacksmiths noticed few receipts were redeemed for metal. The gold backing those receipts was just lying idle in their vaults, or so they thought. Subsequently, they began issuing more receipts than they could back with gold. Covertly lending out money at an attractive interest rate appeared to be profitable. Naturally, the risk was that when customers found out and simultaneously redeemed their receipts, the blacksmiths went bankrupt. More importantly, not all customers holding a receipt got their gold.

Essentially, modern day banking works in a similar fashion although the scheme has been refined. In 1848 a Supreme Court in the United Kingdom ruled:

Money, when paid into a bank, ceases altogether to be the money of the principal; it is then the money of the banker, who is bound to an equivalent by paying a similar sum to that deposited with him when he is asked for it. … The money placed in the custody of a banker is, to all intents and purposes, the money of the banker, to do with it as he pleases; he is guilty of no breach of trust in employing it; he is not answerable to the principal if he puts it into jeopardy, if he engages in a hazardous speculation; he is not bound to keep it or deal with it as the property of his principal; but he is, of course, answerable for the amount, because he has contracted, having received that money, to repay to the principal, when demanded, a sum equivalent to that paid into his hands.

Guess what. Your money at the bank is not your money. A bank deposit is a loan to the bank, which should justify the fact banks only have a fraction of outstanding liabilities (receipts) in reserve. Let us examine this modern day practice of banking and the creation of what I call illusionary money. In our simplified example there is only book entry money, nowadays digital.

The process begins with the European Central Bank (ECB) that creates 10,000 euros, by the stroke of a keyboard, to buy bonds. The seller of these bonds is Paul who receives the 10,000 euros and deposits the funds at bank A. The ECB’s policy is that commercial banks are required to hold 10 % of all deposits in reserve. Meaning, bank A can lend 90 % of Paul’s money to John who needs money to buy a boat. When John borrows these 9,000 euros and receives the funds in his bank account, something remarkable has taken place. John now has 9,000 euros at his disposal, but Paul still owns 10,000 euros. Miraculously 9,000 euros has been created out of thin air! Before bank A had lend 9,000 euros to John there was only 10,000 euros in existence – created by the ECB – after the loan there is 19,000 euros “in existence” (John’s 9,000 euros on top of Paul’s 10,000 euros). Bank A has created 9,000 euros through fractional reserve banking.

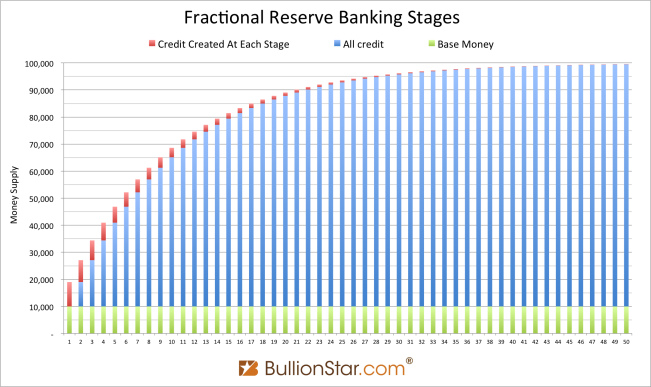

And it doesn’t end there. When John uses his loan to buy a 9,000 euro sailing yacht from Bob, Bob deposits these funds at bank C. For this bank the same rules apply, it’s only required to hold 10 % in reserve, so it lends 8,100 euros to Michael. Another 8,100 euros is created out of thin air, now there is 27,100 euros in existence. Needless to say, Michael’s money will be deposited at a bank and multiplied by 90 % as well, and the new money will multiplied by 90 % as well – you get the picture. Eventually, out of the initial 10,000 euros created by the ECB a fresh 90,000 euros can be created by commercial banks at a required reserve ratio of 10 %.

The degree to which commercial banks can procreate money from central bank money is referred to as the money multiplier (MM), which is the inverse of the reserve requirement ratio (RRR). A smaller RRR will result in a higher MM, and vice versa, as the smaller a bank’s reserves the more it can lend (create).

Money created by a central bank is called base money and money created by commercial banks is called credit (note, on a gold standard, the gold was base money). If banks make loans they create credit and the total money supply in the economy expands, if these loans are repaid (or default) the money supply shrinks. In the chart above we can see how 10,000 units of base money procreate 90,000 units of credit through 50 stages of fractional reserve banking (RRR = 10 %).

The essence of fractional reserve banking is exactly the same as what the blacksmiths did. When all customers run to a bank to get their money out, the bank has to admit it doesn’t have all the money. Banking thrives on the presumption not all money will be withdrawn from a bank at once. That is, until exactly that happens. Millions of banks have gone bust in the past and many will in the future. The question is not if a bank can go bust, but when, as banks are by definition insolvent in holding a fraction of deposits in reserve. After the bankruptcy of investment bank Lehman Brothers in 2008 an economic depression was triggered and governments globally bailed out banks whose insolvent nature was exposed.

The fact banks are by definition insolvent is “strangely" accepted throughout society. People know banks go belly up when everybody rushes to get their money out, though they’re less aware of alternatives to storing money at the bank. This situation can be explained by the fact people are fooled by how banks operate. In high school and university students are taught banks simply facilitate in lending out money from depositors, striking a profit on the difference in interest rates. While actually banks create money to lend out, whereby a fraction of the initial deposit is held in reserve and the insolvent state is conceived. Most people that work at banks are not even aware about the fine details of credit creation. Henry Ford once said:

It is well enough that people of the nation do not understand our banking and monetary system, for if they did, I believe there would be a revolution before tomorrow morning.

The bait for fractional reserve banking is of course interest. Why do you receive interest on a bank deposit? Basically, because you lend your money to the bank and receive interest for the risk of losing it – the golden rule is: no risk no return. Banks have to offer interest or no one would hand over their money. Then banks charge borrowers a higher interest rate than they pay on deposits and the wheel of credit starts turning round. Until the expansion of credit sends up asset bubbles that eventually pop and the house of cards comes tumbling down. The real problem starts to surface when the money supply shrinks and prices and incomes decline. This makes it harder for everyone to repay debt to banks, pushing bank bankruptcies. Deflation is a huge threat for the fractional reserve system.

The most intriguing fact is that credit simply doesn’t exist. Credit is created through an accounting trick. If more than a fraction of all bank customers want to withdraw their “money”, it’s just not there. Credit only exists as book entries and in our minds. If customers have 1,000,000 euros deposited at a bank in total, they think they truly own that money, whereas in reality there is only a fraction of the 1,000,000 euros held by the bank in reserves. Yet every financial decision they make is based upon the amount of money they think they own. The lion share of their money only exists in their minds. This is what I call the money illusion, in which most of us on this planet are submerged. Will we ever awaken from this dream and will the real value of money and credit be exposed?

Popular Blog Posts by Koos Jansen

China’s Secret Gold Supplier is Singapore

China’s Secret Gold Supplier is Singapore

Audits of U.S. Monetary Gold Severely Lack Credibility

Audits of U.S. Monetary Gold Severely Lack Credibility

China Gold Import Jan-Sep 797t. Who’s Supplying?

China Gold Import Jan-Sep 797t. Who’s Supplying?

The Gold-Backed-Oil-Yuan Futures Contract Myth

The Gold-Backed-Oil-Yuan Futures Contract Myth

Estimated Chinese Gold Reserves Surpass 20,000t

Estimated Chinese Gold Reserves Surpass 20,000t

Did the Dutch Central Bank Lie About Its Gold Bar List?

Did the Dutch Central Bank Lie About Its Gold Bar List?

PBOC Gold Purchases: Separating Facts from Speculation

PBOC Gold Purchases: Separating Facts from Speculation

U.S. Mint Releases New Fort Knox Audit Documentation

U.S. Mint Releases New Fort Knox Audit Documentation

China Net Imported 1,300t of Gold in 2016

China Net Imported 1,300t of Gold in 2016

Why SGE Withdrawals Equal Chinese Gold Demand and Why Not

Why SGE Withdrawals Equal Chinese Gold Demand and Why Not

Koos Jansen

Koos Jansen