Switzerland Gold Exports to China - October 29th

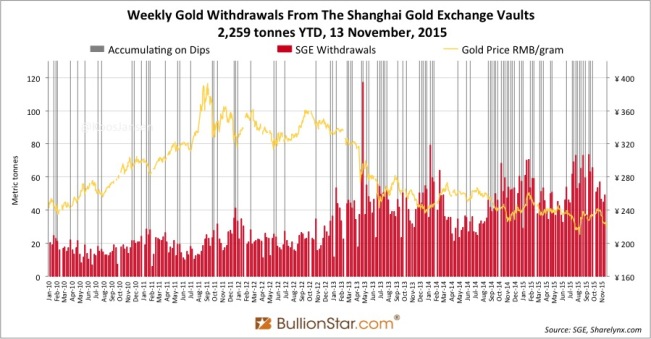

First, withdrawals from the vaults of the Shanghai Gold Exchange (SGE), our best measure for Chinese wholesale gold demand, accounted for 49 tonnes in week 44 (9 – 13 November), up 9 % from the previous week. Year to date SGE withdrawals have reached 2,259 tonnes, which is already more than any previous yearly total.

Seasonally, SGE withdrawals are the highest around new year, therefore I expect them to increase from current levels before the end of 2015 – perhaps transcending 60 tonnes a week. Chinese people traditionally exchange gifts during new year and lunar year, often in the form of gold.

As SGE vaults have likely been depleted from July until September – after the crash in the Chinese stock market withdrawals skyrocketed – I don’t expect Chinese gold imports will decline until the January 2016. Year to date China has net imported 1,058 tonnes, according to lagging data released by various customs departments around the world.

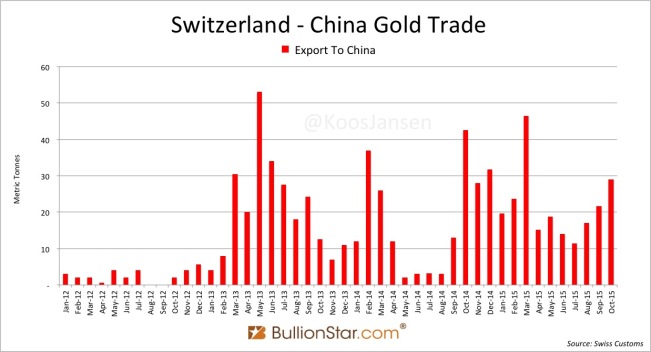

The most recent data from Swiss customs points out there were 29 tonnes of gold shipped directly to China mainland in October, up 34 % m/m. Year to date (Jan – Oct) Switzerland has net exported 217 tonnes directly to China.

A couple of years ago all net gold export from the UK (a large supplier of gold to the East) to China flowed via Switzerland or Hong Kong. Because the UK has started to export gold directly to China since 2014, Swiss gold exports to China have been somewhat decreasing.

Year to date (Jan – Sep) Hong Kong has net exported 582 tonnes directly to China.

Year to date (Jan – Sep) the UK has net exported 210 tonnes directly to China.

Year to date (Jan – July) Australia has net exported 49 tonnes directly to China.

Popular Blog Posts by Koos Jansen

China’s Secret Gold Supplier is Singapore

China’s Secret Gold Supplier is Singapore

Audits of U.S. Monetary Gold Severely Lack Credibility

Audits of U.S. Monetary Gold Severely Lack Credibility

China Gold Import Jan-Sep 797t. Who’s Supplying?

China Gold Import Jan-Sep 797t. Who’s Supplying?

The Gold-Backed-Oil-Yuan Futures Contract Myth

The Gold-Backed-Oil-Yuan Futures Contract Myth

Estimated Chinese Gold Reserves Surpass 20,000t

Estimated Chinese Gold Reserves Surpass 20,000t

Did the Dutch Central Bank Lie About Its Gold Bar List?

Did the Dutch Central Bank Lie About Its Gold Bar List?

PBOC Gold Purchases: Separating Facts from Speculation

PBOC Gold Purchases: Separating Facts from Speculation

U.S. Mint Releases New Fort Knox Audit Documentation

U.S. Mint Releases New Fort Knox Audit Documentation

China Net Imported 1,300t of Gold in 2016

China Net Imported 1,300t of Gold in 2016

Why SGE Withdrawals Equal Chinese Gold Demand and Why Not

Why SGE Withdrawals Equal Chinese Gold Demand and Why Not

Koos Jansen

Koos Jansen