The Shanghai International Gold Exchange Comes To Life

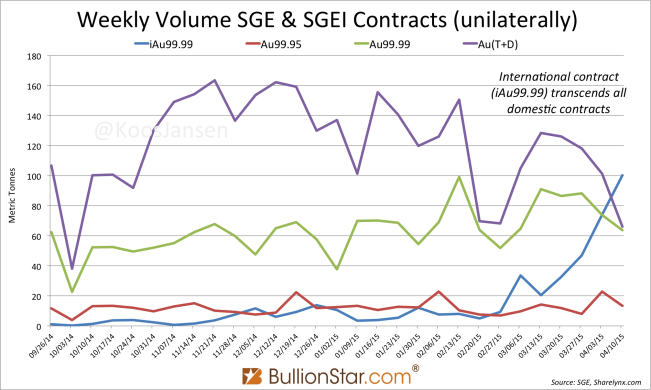

In September 2014 the Shanghai Gold Exchange (SGE) launched its International Board, the Shanghai International Gold Exchange (SGEI). After a slow start, the volume of the physical SGEI kilobar contract (iAu99.99) has transcended all other SGE contracts in week 15 (April 6- 10).

The primary goals for the launch of the SGEI was to facilitate gold trading in renminbi, improve price discovery in renminbi and internationalize the renminbi. The Chinese consider gold as an indispensable component of China’s financial market and for the renminbi to internationalize the renminbi-gold market has to internationalize. It could be that the spike in trading volume of iA99.99 was an incidental burp, it could also be we’re witnessing the Chinese international gold exchange entering its adolescence.

In any case, the chairman of the SGE, Xu Luode, has been very clear about his intentions with the SGEI. A few snippets from Xu…

The Shanghai Gold Exchange chairman Xu Luode said he considers the construction of an offshore gold exchange international gold market in the Shanghai Free Trade Zone, for the cross-border use of renminbi, it will be launched for the international offshore investors… The industry comments that it will be a tool to promote the internationalization of the renminbi, …

…the goal is to build Shanghai into an international gold exchange trading market with global influence.

May 2014 (direct quote):

The Chinese gold market is an important force, a positive energy in the international gold market but its influence does not correspond to its mass and scale. Last year China’s domestic gold mines produced 428 tonnes; at the same time China imported 1540 tonnes of gold, adding up to nearly 2000 tonnes. China’s import volume is significant but China’s influence on the price of gold is very small. Real influence still lies in the West. Data such as Non-farm payroll, or even a speech could impact the gold market in a big way. In this sense, the mass and scale of China’s gold market and its influence in the international gold market does not match. Through the SGE international board Chinese pricing power will increase.

Foreign investors can directly use offshore yuan to trade gold on the SGE international board, which is promoting the internationalization of the renminbi. The international board will form a yuan-denominated gold price index system named “Shanghai Gold”. Shanghai Gold will change the current gold market “consumption in the East priced in the West” situation. When China will have a right to speak in the international gold market, pricing will get revealed. New York prices gold through bidding whereas in London the gold price is fixed by five banks. However the London gold fixing price is now being questioned since these five banks are price-fixers while at the same time they are also the market’s most important participants.

China is fully qualified and may become the world gold market’s very important first class player.

February 2015 (direct quote):

The Chinese government regards the gold market as an indispensable component of China’s financial market and attaches great importance to its growth and development.

… As national efforts to internationalize the renminbi reach their crescendo, China’s domestic gold market is facing an auspicious window and timing for pursuing its internationalization and greater openness.

… China, India, Dubai and Singapore all enjoy vibrant trading scenes and comparative advantages; however, in the eyes of many investors, the influence wielded by the Asian markets is still very limited as a whole. Using the International Board as a launch pad, China’s gold market will embrace greater openness and foster stronger ties with its neighbors and, together, elevate the trading and pricing influence of Asia in the world’s gold market.

…All products listed on the Exchange are denominated in renminbi. As more market participants gather to trade on the Exchange, and onshore investors and domestic funds become more intertwined with offshore investors and offshore funds, the sphere of influence of trading prices on the Exchange will gradually expand from nearby regions to the whole world and, at the same time, renminbi-denominated gold benchmark price will emerge as another financial index of global significance.

As a reminder, from PBOC Governor Zhou Xiaochuan in 2004:

Despite the declining function of gold as currency in the world, the activeness and development of investment activities with gold as the target indicate that gold still has a strong financial nature and remains an indispensable investment tool. In major financial centre’s in the world, the gold market – together with the money market, securities market and FX market – constitutes the main part of the financial market.

In the chart below we can see the weekly trading volumes of the most traded SGE contracts – Au99.95, Au99.99, Au(T+D) – and the most traded SGEI contract – iAu99.99.

The largest spike in volume was on April 8, when total iAu99.99 volume was 31 tonnes for the day (counted unilaterally). Which is still far below the COMEX, where 382 tonnes in gold futures were traded on April 8, though, COMEX gold is leveraged more than 20:1.

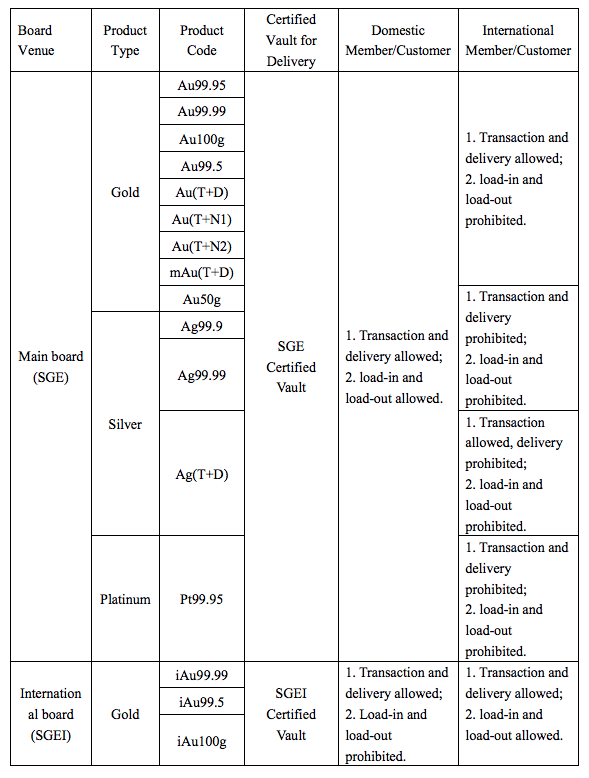

Note, the SGE contracts can be traded by international members of the SGEI, and domestic members of the SGE are allowed to trade SGEI contracts. Though, a limited number of members of the SGE can trade iAu99.99 and are allowed to import this gold from the Free Trade Zone into the mainland. No international SGEI member can export the gold from the SGE (mainland) to abroad. For more information read The Workings Of The Shanghai International Gold Exchange.

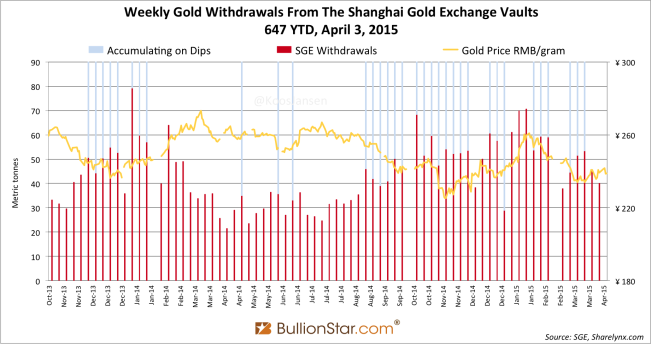

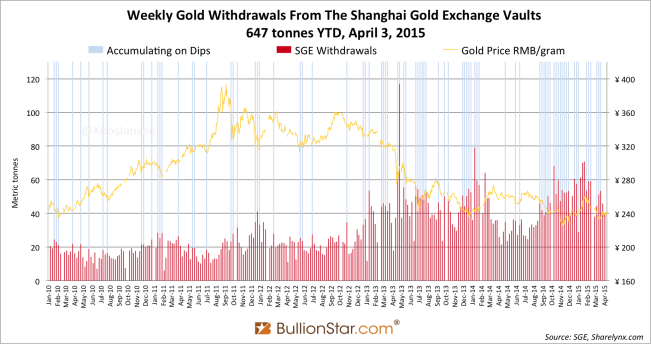

SGE Withdrawals

Unfortunately we don’t know who is exactly trading the iAu99.99 contracts, international or domestic members. Nor do we know if the traded gold is withdrawn from the vaults, and if withdrawn, if it’s subsequently imported into the mainland or exported from the Shanghai Free Trade Zone. Based on data released in February and low iAu99.99 volume we could be fairly sure SGEI trading didn’t substantially distort our proxy of Chinese wholesale gold demand, SGE withdrawals. From SGE Withdrawals In Perspective:

For now, the SGE withdrawal distortion ratio is at most 0.0246 (3/122). Measuring Chinese wholesale gold demand conservatively would be

SGE withdrawals – (0.0246 X SGEI volume)

However, now SGEI volume is surging it’s hard to say if this “distortion ratio” is still usable. If the volume is surging the trading pattern can also be changing. We have to wait for new information on withdrawals to come out (believe me I’m trying to get it out) before we can continue to make accurate estimates of Chinese wholesale gold demand measured by SGE withdrawals. Until then, the significance of SGE withdrawals from week 14 is unsure.

The most recent SGE withdrawal data is from week 13 (March 30 – April 3), when SGEI volume hadn’t peaked. In week 13 withdrawals from the vault of the Chinese bourse accounted for 40 tonnes, year to date 647 tonnes have been withdrawn. 647 tonnes corrected by 0.0246 as distortion ratio is 641 tonnes, which is up 9 % from 2014. According to my estimates China has net imported over 450 tonnes year to date.

So much for now on the Chinese gold market, keep you posted!

Popular Blog Posts by Koos Jansen

China’s Secret Gold Supplier is Singapore

China’s Secret Gold Supplier is Singapore

Audits of U.S. Monetary Gold Severely Lack Credibility

Audits of U.S. Monetary Gold Severely Lack Credibility

China Gold Import Jan-Sep 797t. Who’s Supplying?

China Gold Import Jan-Sep 797t. Who’s Supplying?

The Gold-Backed-Oil-Yuan Futures Contract Myth

The Gold-Backed-Oil-Yuan Futures Contract Myth

Estimated Chinese Gold Reserves Surpass 20,000t

Estimated Chinese Gold Reserves Surpass 20,000t

Did the Dutch Central Bank Lie About Its Gold Bar List?

Did the Dutch Central Bank Lie About Its Gold Bar List?

PBOC Gold Purchases: Separating Facts from Speculation

PBOC Gold Purchases: Separating Facts from Speculation

U.S. Mint Releases New Fort Knox Audit Documentation

U.S. Mint Releases New Fort Knox Audit Documentation

China Net Imported 1,300t of Gold in 2016

China Net Imported 1,300t of Gold in 2016

Why SGE Withdrawals Equal Chinese Gold Demand and Why Not

Why SGE Withdrawals Equal Chinese Gold Demand and Why Not

Koos Jansen

Koos Jansen