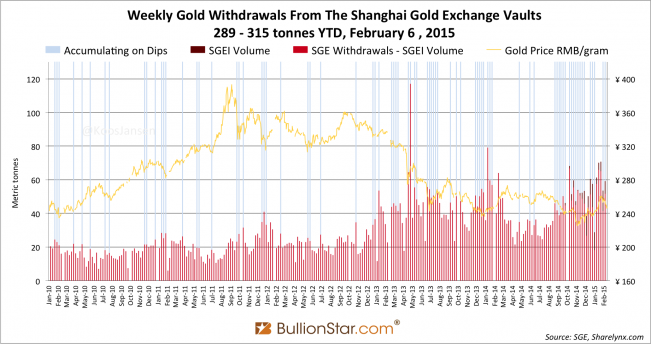

SGE Gold Withdrawals 59t in Week 5. What is China Up To?

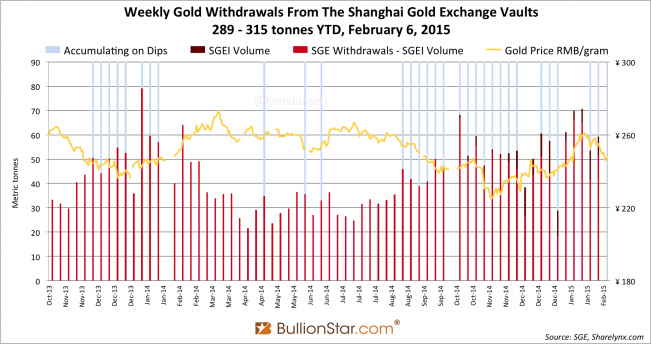

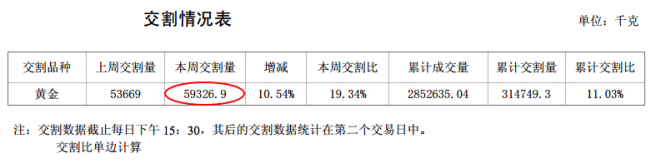

The day after the World Gold Council (WGC) released Gold Demand Trends Full Year 2014 in which they audaciously pretend Chinese gold demand last year was 814 tonnes, we can read from the Chinese SGE trade report of week 5 withdrawals from the vaults have been 59 tonnes. Year to date (– February 6) withdrawals from the vaults of the central bourse in China stand at 315 tonnes. In perspective, during the first five weeks of 2015 Chinese wholesale demand has been 39 % of what the WGC disclosed as total consumer demand in all of 2014.

More perspective; corrected by the volume traded on the Shanghai International Gold Exchange (SGEI), withdrawals in week 5 were at least 42 tonnes (read this post for a comprehensive explanation of the relationship between SGEI trading volume and withdrawals). Year to date withdrawals corrected by SGEI volume were at least 289 tonnes.

Because of the importance of clarifying the mysterious gap between what the WGC discloses as Chinese gold demand in 2014 (814 tonnes) and the amount of gold we saw being supplied to China (at least 1,200 tonnes import, 452 tonnes mine output and 182 scrap supply = 1,834 tonnes), I would like expand on this subject in a separate post.

One quote I wish to share here; when I was researching Chinese market and reading through an old Alchemist copy (#75, page 11), my attention was drawn to a transcript from a keynote speech delivered by Jeremy East at the LBMA Bullion Market Forum in Singapore on 25 June, 2014. He made a remarkable comment we shouldn’t neglect when analyzing the Chinese gold market:

Why are the Chinese Buying?

So what is going on in China? Why are the Chinese buying? It only seems to have been happening over the last few years. What is going on?

China’s Gold Friendly Strategy

I was at the Shanghai Derivatives Forum at the end of May and one of the speakers was a representative of the [China] Gold Association. He gave us quite an interesting insight into the flavor of what is going on in China from a strategic perspective. Some of the things he talked about included that China planned to change the landscape of world gold markets. He talked about having a strong currency and about having that currency backed by gold, like the US dollar. He also talked about people holding more gold and encouraging more people to hold gold. That is not just individuals, but also the central bank. From that perspective, it is also getting gold into the country in terms of encouraging domestic gold production, but also investing in international mining companies and sourcing the product from them. China has got a very friendly gold strategy.

There you have it, China is planning to change the landscape of world gold markets and strengthening the renminbi through supporting it by gold. Therefor it’s in the interest of the People’s Republic Of China not only Chinese individuals hoard gold, but the central bank as well. To achieve this mining and import is stimulated by the State Council.

Remember what Zhou Ming, General Manager of the Precious Metals Department at ICBC, said at the same conference?

…a new global currency setup is being conceived.

Mr East’s statement fits right into what we see the Chinese are doing; accumulating massive amounts of gold, developing their gold market, internationalizing their gold market and the renminbi. This little peak at the China Gold Association’s chessboard is more confirmation of where we’re going! Gold is making its way into the international monetary system.

Popular Blog Posts by Koos Jansen

China’s Secret Gold Supplier is Singapore

China’s Secret Gold Supplier is Singapore

Audits of U.S. Monetary Gold Severely Lack Credibility

Audits of U.S. Monetary Gold Severely Lack Credibility

China Gold Import Jan-Sep 797t. Who’s Supplying?

China Gold Import Jan-Sep 797t. Who’s Supplying?

The Gold-Backed-Oil-Yuan Futures Contract Myth

The Gold-Backed-Oil-Yuan Futures Contract Myth

Estimated Chinese Gold Reserves Surpass 20,000t

Estimated Chinese Gold Reserves Surpass 20,000t

Did the Dutch Central Bank Lie About Its Gold Bar List?

Did the Dutch Central Bank Lie About Its Gold Bar List?

PBOC Gold Purchases: Separating Facts from Speculation

PBOC Gold Purchases: Separating Facts from Speculation

U.S. Mint Releases New Fort Knox Audit Documentation

U.S. Mint Releases New Fort Knox Audit Documentation

China Net Imported 1,300t of Gold in 2016

China Net Imported 1,300t of Gold in 2016

Why SGE Withdrawals Equal Chinese Gold Demand and Why Not

Why SGE Withdrawals Equal Chinese Gold Demand and Why Not

Koos Jansen

Koos Jansen