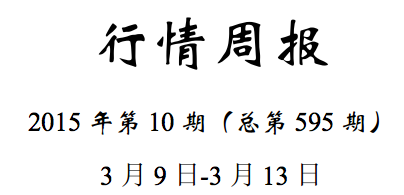

SGE Withdrawals 51t In Week 10, YTD 508t

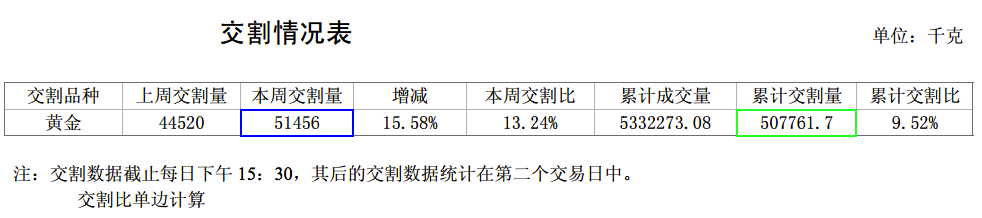

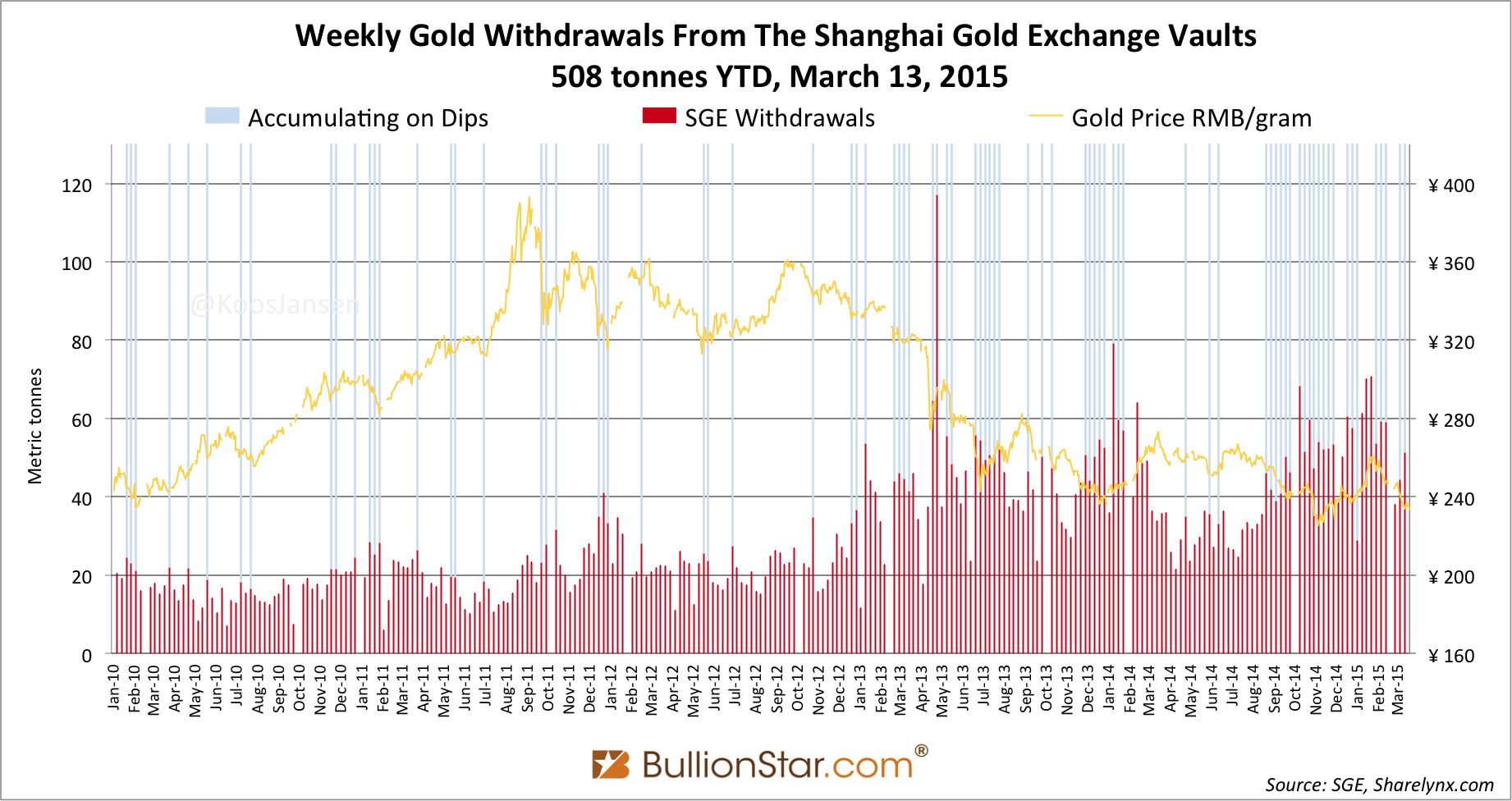

Withdrawals from the Shanghai Gold exchange (SGE), which equal Chinese wholesale gold demand, in week 10 (March 9 – 13) accounted for 51 tonnes. Year to date total withdrawals have reached 508 tonnes.

Chinese wholesale gold demand can be slightly less than what is disclosed because of withdrawals from the Shanghai International Gold Exchange. My best estimate is SGE withdrawals could be 3 tonnes less at 505 tonnes. However, I have no hard evidence any foreign traders are withdrawing gold from the Shanghai International Gold Exchange. I’ve made an inquiry at the SGE if they can shed some light on this. Hopefully, next week I know more.

Week 10 was a clear example of a falling gold price in renminbi, which spurred the Chinese to purchase gold at the SGE and subsequently withdraw from the vaults.

BullionStar has a new unique feature online; a chart widget to measure anything in anything (stock indexes, precious metals, fiat currencies, commodities and stocks). For example Gold in Euros, the S&P 500 in Crude Oil, or US dollars in Renminbi. The next screenshot is an example of the price of gold in renminbi in week 10, 2015.

Click here to use the widget!

Because of the mechanics of the Chinese gold market,

Import + mine + scrap = SGE withdrawals

And thus

Import = SGE withdrawals – mine – scrap

Over the first ten weeks in 2015 domestic mine supply has been roughly 85 tonnes, SGE scrap supply (at a yearly rate of 250 tonnes) approximately 45 tonnes.

508 withdrawals – 85 mine – 45 scrap = 378 import

From January 1 until March 13, in just over two months, China has imported an estimated 378 tonnes.

A rough estimate suggests SGE withdrawals are set to reach 600 tonnes in Q1; net import 450 tonnes, domestic mining 100 tonnes and scrap (gold-for-gold and gold-for-cash) 50 tonnes. Depending on what metric used, Chinese gold demand will be somewhere in between 570 and 600 tonnes. Let’s wait what the World Gold Council (WGC) will publish as Chinese gold demand Q1. Probably about half of this, just like they did last year.

While the WGC is understating Chinese gold demand, it’s allegedly overstating Vietnamese gold demand. I came across an article titled; Experts doubt WGC’s report on Vietnam’s gold consumption:

VietNamNet Bridge – The World Gold Council (WGC) has reported that Vietnam consumed 69.1 tons of gold in 2014. However, Vietnamese experts disagree with that assessment.

“It is unclear where WGC sought information to make report. But I can say for sure that the total revenue of all Vietnamese gold companies could not make up such a figure,” he said.

Trong said a large jewelry company needs about 200 kilos of materials a month to make jewelry.

The number of large jewelry companies can be counted on one hand or two, and the actual volume of gold materials is not high.

Other goldsmith shops mostly process finished products they buy from customers, and do not have demand for gold materials.

“12.7 tons of jewelry gold consumed in 2014 was reasonable, if counting the jewelry illegally imported from China. The jewelry market last year was very gloomy,” he noted.

“The remaining 56.4 tons of gold was listed as bullion gold for investment. However, it’s unclear where the imported bullion gold has gone,” he said.

Popular Blog Posts by Koos Jansen

China’s Secret Gold Supplier is Singapore

China’s Secret Gold Supplier is Singapore

Audits of U.S. Monetary Gold Severely Lack Credibility

Audits of U.S. Monetary Gold Severely Lack Credibility

China Gold Import Jan-Sep 797t. Who’s Supplying?

China Gold Import Jan-Sep 797t. Who’s Supplying?

The Gold-Backed-Oil-Yuan Futures Contract Myth

The Gold-Backed-Oil-Yuan Futures Contract Myth

Estimated Chinese Gold Reserves Surpass 20,000t

Estimated Chinese Gold Reserves Surpass 20,000t

Did the Dutch Central Bank Lie About Its Gold Bar List?

Did the Dutch Central Bank Lie About Its Gold Bar List?

PBOC Gold Purchases: Separating Facts from Speculation

PBOC Gold Purchases: Separating Facts from Speculation

U.S. Mint Releases New Fort Knox Audit Documentation

U.S. Mint Releases New Fort Knox Audit Documentation

China Net Imported 1,300t of Gold in 2016

China Net Imported 1,300t of Gold in 2016

Why SGE Withdrawals Equal Chinese Gold Demand and Why Not

Why SGE Withdrawals Equal Chinese Gold Demand and Why Not

Koos Jansen

Koos Jansen