How Constant Is Gold’s Purchasing Power?

An often-perceived analysis in the gold community is that gold is the constant in our global economy. But is this true? Yes and no. Allow me to share my observations. Although gold has an exceptionally constant nature, and we have yet to see another currency that can compete with gold’s constant nature, the reality is, that there is no exact constant in economics. In any market all goods, assets, currencies, etc. continuously fluctuate in value relative to each other due to ever changing supply and demand dynamics. Having said that, in this post we’ll examine gold’s constant nature by measuring its purchasing power in the short (weeks) medium (years) and long term (decades). Additionally, we’ll compare our findings to fiat’s nature.

We will find that when gold is officially recognized as the center of a monetary system – throughout history there have been several forms of gold standards – gold is approximately constant in the short, medium and long term. Since the gold standard has been abandoned, the metal has become less constant in the short and medium term, but has remained impressively constant in the long term.

In turn, fiat can have periods of being constant in the short term, but will always lose value in the medium term and evaporate in the long term. Thereby, due to fiat’s fragile nature and the current stress in global finance, there are also risks fiat can significantly devalue overnight. Hence, gold is highly suitable to secure one’s purchasing power.

When examining the value of gold we have to measure it in terms of goods and services. In this day and age one might forget the end goal of any participant in the economy is goods and services. All else traded in our vast financial system is merely a means to an end. All sorts of money, but also stocks, bonds, credit default swaps, options, futures, etc., have no use-value for humans as we can’t eat, drink or wear them. Only goods and services we can truly use (for more information regarding use-value please read my post The Concept Of Money.) Therefor, to measure the stability of gold’s value we have to compute the amount of goods and services gold can buy.

For the sake of simplicity, we’ll use publicly available Consumer Price Index (CPI) and Wholesale Price Index (WPI) data to measure the value of goods and services.

Gold’s Purchasing Power In The Short And Medium Term

On occasion we can read gold commentators stating that when the price of gold rises or falls in the short term, it’s actually fiat that is falling or rising. As, according to this analysis gold is the constant. Let’s test if this analysis is accurate. In the week from January 4 until January 9, 2016, the price of gold in British pounds surged 5.9 % from £23,096 pound per Kg to £24,469 per Kg. We can be quite sure that the price of goods and services in the UK remained flat during this period. As a consequence, in this example gold could buy 5.9 % more goods and services at the end of the week, whilst sterling could buy exactly the same amount of goods and services all week long. So, in this particular example, what was more constant? It was sterling. The reason is that currently the international monetary standard is fiat.

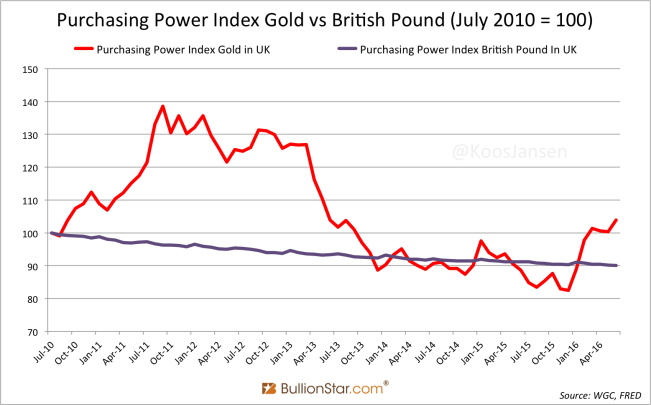

Moving on to the medium term. In the chart below I’ve plotted the purchasing power index of gold versus the British pound, based on CPI data and the gold price, from July 2010 until June 2016.

Over this period we can observe that the British pound was more constant than gold in the short term, but it’s purchasing power has been declining in the medium term due to the inherent inflationary policies by the central bank of the UK. Gold’s purchasing power has been volatile in the short and medium term, but in this case has remained its purchasing power over the shown period. Though, it should be clear that if I would’ve adjusted the period gold’s purchasing power could’ve shown an increase or decrease.

Gold’s Purchasing Power in the Long Term

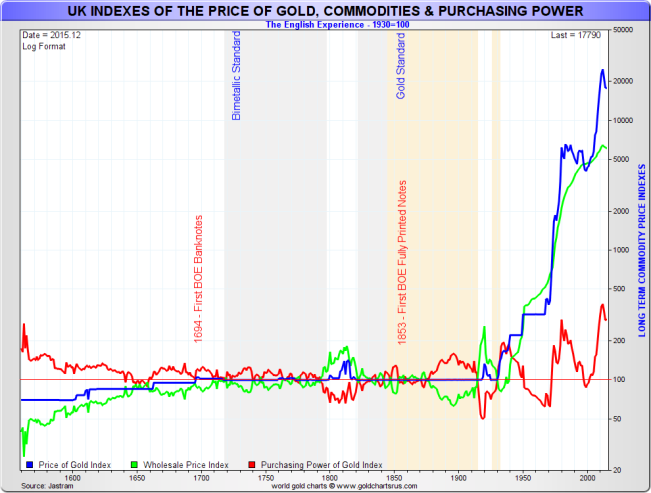

To get the best understanding of his subject, let us zoom out and have a look at gold and the pound’s purchasing power since 1500. The following chart is conceived by Nick Laird from GCRU, based on data collected by himself and Roy Jastram. The chart is perhaps more difficult to interpret than the previous one. To be clear, we can see 3 index lines:

- The red line reflects gold’s purchasing power index (1930 = 100)

- The blue line reflects the price of gold index, denominated in British pounds (1930 =100). Note, until 1914 the blue line was mostly straight which shows fixed parities between sterling and gold.

- The green line reflects the wholesale (/goods) price index, denominated in British pounds (1930 = 100)

As you can see, if the price of gold (blue) transcends wholesale prices (green), as a consequence gold’s purchasing power (red) is escalated – and vice versa.

Clearly the red line has remained roughly flat, around 100, for hundreds of years! This shows gold’s remarkable constant nature. Note, since the gold standard has been gradually dismantled (1914) gold’s purchasing power became more volatile but remained robust in the long term.

Furthermore, we can see that prior to 1914 wholesale prices were also fairly constant but this is due to the fact sterling was tied to gold during this era. Since the gold standard was abandoned step-by-step from 1914 onwards, the blue and the green line have skyrocketed, evaporating the purchasing power of sterling. Since 1971 the British pound has lost over 93 % of its purchasing power – in 1975 inflation topped 20 %.

We can conclude, while there is no exact constant in economics, the stability of gold’s purchasing power is unprecedented. Not only on a gold standard the metal shows it’s constant nature, but also off the gold standard gold’s purchasing power is remarkably constant, albeit more volatile in the short term.

For the future, if the current fiat international monetary system will breach its limits and has to be re-anchored to gold, I expect gold to become more constant in both the short and medium term when providing a center pillar in finance.

Popular Blog Posts by Koos Jansen

China’s Secret Gold Supplier is Singapore

China’s Secret Gold Supplier is Singapore

Audits of U.S. Monetary Gold Severely Lack Credibility

Audits of U.S. Monetary Gold Severely Lack Credibility

China Gold Import Jan-Sep 797t. Who’s Supplying?

China Gold Import Jan-Sep 797t. Who’s Supplying?

The Gold-Backed-Oil-Yuan Futures Contract Myth

The Gold-Backed-Oil-Yuan Futures Contract Myth

Estimated Chinese Gold Reserves Surpass 20,000t

Estimated Chinese Gold Reserves Surpass 20,000t

Did the Dutch Central Bank Lie About Its Gold Bar List?

Did the Dutch Central Bank Lie About Its Gold Bar List?

PBOC Gold Purchases: Separating Facts from Speculation

PBOC Gold Purchases: Separating Facts from Speculation

U.S. Mint Releases New Fort Knox Audit Documentation

U.S. Mint Releases New Fort Knox Audit Documentation

China Net Imported 1,300t of Gold in 2016

China Net Imported 1,300t of Gold in 2016

Why SGE Withdrawals Equal Chinese Gold Demand and Why Not

Why SGE Withdrawals Equal Chinese Gold Demand and Why Not

Koos Jansen

Koos Jansen