New York Federal Reserve Lost 47t Of Gold In November

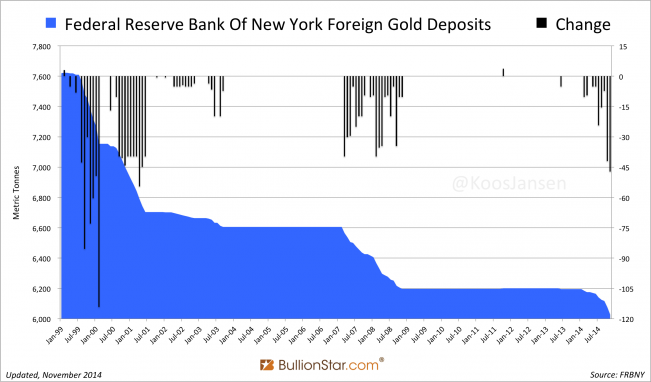

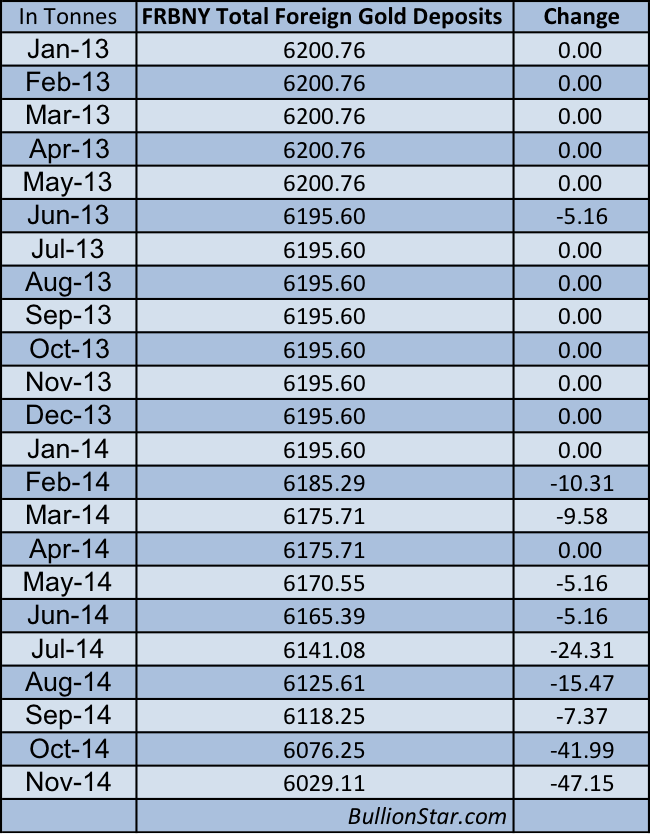

The number we all have been waiting for; The Federal Reserve Bank of New York (FRBNY), which is the custodian for parts of the official gold reserves of 36 nations and the IMF, e.g. The Netherlands and Germany, saw its inventory of foreign gold deposits drop by 47 tonnes in November 2014. Year to date the FRBNY has lost 166 tonnes. The FRBNY only publishes how much gold it stores in total for foreign nations and the IMF, not country specific.

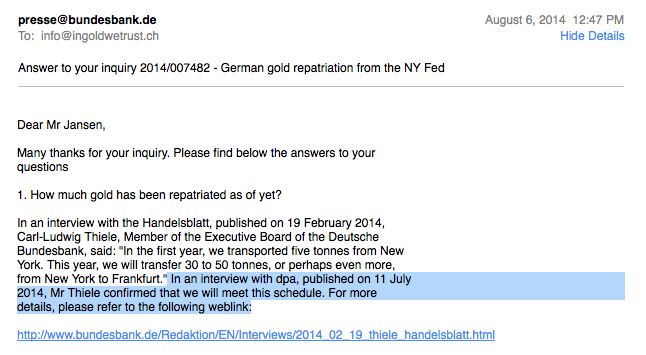

The German central bank, the Bundesbank, or BuBa, first announced a gold repatriation program in 2012. BuBa then revised their program in 2013; it intended to repatriate 300 tonnes of gold from the US and 374 tonnes from France by the end of 2020. However, in 2013 they only received a meager 5 tonnes from the US and 32 tonnes from France. No worries though, said Carl-Ludwig Thiele from BuBa, in 2014 Germany aims to get 30 to 50 tonnes back from New York to remain on schedule.

Last November the Dutch central bank (DNB) surprisingly reported it had secretively repatriated 122.5 tonnes from New York. Quickly everybody in the gold space grabbed his or her calculator. If the Dutch got 122.5 tonnes from the FRBNY somewhere in between January and November, than how much should have been withdrawn in total from the FRBNY over this period, in order for Germany to remain on schedule? Now we know, based on official numbers: 166 tonnes was withdrawn in the first eleven months of this year, The Netherlands got 122.5 tonnes, which leaves 44 tonnes that Germany potentially got out of the vaults in Manhattan.

If the remaining 44 tonnes were all for sie Germans, this means Buba could be exactly on track to repatriate 30 to 50 tonnes this year.

Were both the dot-com bubble and housing bubble in the US preceded by large outflows of foreign gold deposits from the FRBNY?

The German central bank still has some explaining to do. How did the Dutch get 122.5 tonnes back in few months and do they take seven years to repatriate 300 tonnes?

Rectification: in this post I speculated The Netherlands repatriated 122.5 tonnes in two months (October and November 2014). This was obviously incorrect.

Popular Blog Posts by Koos Jansen

China’s Secret Gold Supplier is Singapore

China’s Secret Gold Supplier is Singapore

Audits of U.S. Monetary Gold Severely Lack Credibility

Audits of U.S. Monetary Gold Severely Lack Credibility

China Gold Import Jan-Sep 797t. Who’s Supplying?

China Gold Import Jan-Sep 797t. Who’s Supplying?

The Gold-Backed-Oil-Yuan Futures Contract Myth

The Gold-Backed-Oil-Yuan Futures Contract Myth

Estimated Chinese Gold Reserves Surpass 20,000t

Estimated Chinese Gold Reserves Surpass 20,000t

Did the Dutch Central Bank Lie About Its Gold Bar List?

Did the Dutch Central Bank Lie About Its Gold Bar List?

PBOC Gold Purchases: Separating Facts from Speculation

PBOC Gold Purchases: Separating Facts from Speculation

U.S. Mint Releases New Fort Knox Audit Documentation

U.S. Mint Releases New Fort Knox Audit Documentation

China Net Imported 1,300t of Gold in 2016

China Net Imported 1,300t of Gold in 2016

Why SGE Withdrawals Equal Chinese Gold Demand and Why Not

Why SGE Withdrawals Equal Chinese Gold Demand and Why Not

Koos Jansen

Koos Jansen