China Stops Publishing SGE Withdrawal Figures

UPDATE 11 MARCH 2016: THE SGE HAS CONFIRMED TO CONTINUE PUBLISHING SGE WITHDRAWALS!

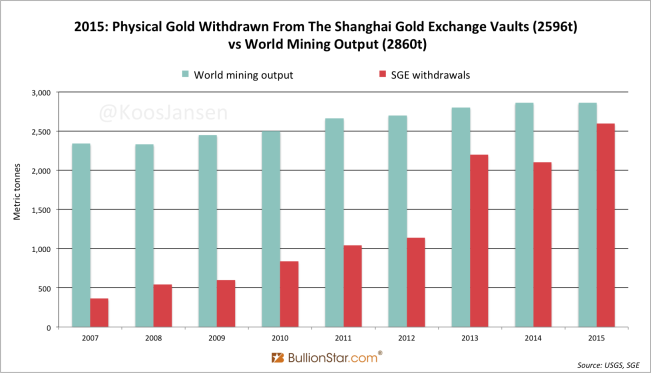

My research into the Chinese gold market started in 2013 when I noted the significance of a number published on a weekly basis in the Chinese Market Data Weekly Reports on the website of the Shanghai Gold Exchange (SGE) regarding the amount of physical gold withdrawn from the vaults. It appeared to me the total amount of gold withdrawn from the SGE vaults on a yearly basis exactly equaled total Chinese gold demand as disclosed in the China Gold Market Report. Consequently, weekly SGE withdrawals served us as an interim indicator for total Chinese (wholesale) gold demand. Subsequently, I started publishing SGE withdrawals every Friday, accompanied with an analysis about the Chinese gold market, which gradually exposed the true size of the Chinese physical gold market. By 2015 the whole gold space was focused on SGE withdrawals!

In addition, genuine Chinese gold demand greatly exceeded Chinese gold demand as reported by the World Gold Council, whose supply and demand data is tracked by most investors around the world. The discrepancy stimulated me to thoroughly investigate the Chinese gold market and SGE withdrawals. Throughout the years all evidence I collected pointed in the same direction; Chinese gold demand is roughly twice as much as what was widely assumed across the globe and SGE withdrawals provide a spy-hole to track the Chinese gold market! However, at the same time my findings were spreading through the gold space the Chinese slowly started to cover their tracks.

The Motive

After the crisis in 2008 it became even more apparent in the higher echelons of the Communist Party that the international fiat monetary system was not sustainable. The development of the Chinese gold market, that has its roots in the late seventies but leaped forward in 2002 when the SGE was erected, had to accelerate to protect the Chinese economy from future turmoil. Being the second largest economy globally but in arrears regarding physical gold reserves – as a result of a closed market since the Communist Party came in power in 1949 – China has a strong motive to buy gold in secret. For, if they would openly buy the volumes they do the gold price would swiftly be affected, damaging China’s window of opportunity in coming on par with Western gold reserves.

And so, the Chinese decided to roll out more measures to hide their insatiable gold demand. On top of being dishonest about their true official gold reserves and eclipsing gold import data in regular customs reports, the Chinese ceased publishing the (English) China Gold Market Reports and SGE Annual Reports – and by 2014 all existing reports were taken offline. The yearly (Chinese) Gold Yearbook by the China Gold Association was no longer digitally published, only in hard copies. When I asked my contact at the SGE last year if I could purchase a copy of the China Gold Market Report I was told, “due to new regulatory measures the reports are not publicly available anymore”. Be aware, in all the aforementioned reports total Chinese gold demand consistently equals SGE withdrawals – confirming the significance of SGE withdrawals – and the reports exactly disclose total Chinese gold import.

SGE Withdrawals Not Disclosed In Most Recent Data

But hiding the reports was not enough for the Chinese gold market architects. Apparently, the publishing of SGE withdrawals had to be discontinued, as it simply attracted too much attention to the true size of the Chinese physical gold market. The (Chinese) Market Data Weekly Reports on the first two trading weeks of 2016 at the SGE listed no withdrawal figures.

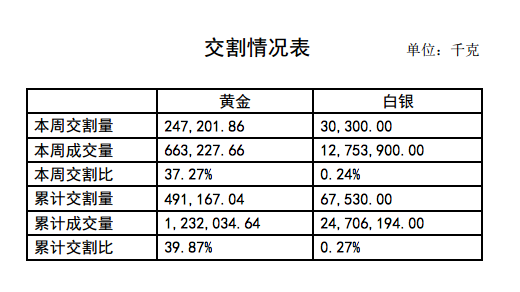

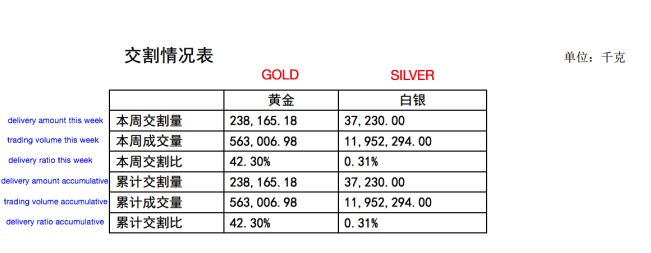

In an announcement on the SGE website from 11 January 2016 it stated the giant bourse would henceforth publish its weekly “delivery amount” (total deliveries from both spot deferred products and physical products) and “load-out volume” (withdrawals). Though in week 1 there was no “load-out volume” published and the disclosed “delivery amount” excluded delivery of physical products as I reported last week. The reporting by the SGE in week 1 did not match the announcement.

The 2016 week 2 report is different, now it seems the top left number (247,201.86 Kg) in the overview table indeed resembles total deliveries of all spot deferred products (114,536 Kg) plus total deliveries of all physical products (182,833 Kg). Yet, the sum of both deliveries is 297,359 Kg according to my calculations, not 247,203 Kg. So, I’m probably missing something, in any case SGE withdrawals are not disclosed!

When I called the SGE I was told the “load-out volume” (withdrawals) will not be published anymore, a statement that matches the new reports. This is a disaster for the gold community. SGE withdrawals provided a unique transparent metric for Chinese gold demand and it’s gone. However, the fact the Chinese stopped publishing SGE withdrawals once again strongly confirms the importance of these numbers from the past! Until December 2015 these numbers gave us a direct measure of Chinese wholesale gold demand. The truth became a little uncomfortable for the Chinese.

Ah well, I guess I’ll be focusing more on other gold markets from now on

Popular Blog Posts by Koos Jansen

China’s Secret Gold Supplier is Singapore

China’s Secret Gold Supplier is Singapore

Audits of U.S. Monetary Gold Severely Lack Credibility

Audits of U.S. Monetary Gold Severely Lack Credibility

China Gold Import Jan-Sep 797t. Who’s Supplying?

China Gold Import Jan-Sep 797t. Who’s Supplying?

The Gold-Backed-Oil-Yuan Futures Contract Myth

The Gold-Backed-Oil-Yuan Futures Contract Myth

Estimated Chinese Gold Reserves Surpass 20,000t

Estimated Chinese Gold Reserves Surpass 20,000t

Did the Dutch Central Bank Lie About Its Gold Bar List?

Did the Dutch Central Bank Lie About Its Gold Bar List?

PBOC Gold Purchases: Separating Facts from Speculation

PBOC Gold Purchases: Separating Facts from Speculation

U.S. Mint Releases New Fort Knox Audit Documentation

U.S. Mint Releases New Fort Knox Audit Documentation

China Net Imported 1,300t of Gold in 2016

China Net Imported 1,300t of Gold in 2016

Why SGE Withdrawals Equal Chinese Gold Demand and Why Not

Why SGE Withdrawals Equal Chinese Gold Demand and Why Not

Koos Jansen

Koos Jansen