China, Gold, SDRs & the Future of the Global Monetary System

Possibly China’s national currency will be part of the IMF’s Special Drawing Rights (SDR) this year. If so, this would have substantial implications for the international monetary system.

Currently the SDR, which was invented in 1969 right after the London Gold Pool collapsed, consists of US dollars (41.9 %), Euros (37.4 %), Pound sterling (11.3 %) and the Japanese yen (9.4%). The weights assigned to each currency in the SDR are adjusted to take into account their prominence in terms of international trade and national foreign exchange reserves.

China has been interested in SDRs at least since the seventies, but became more outspoken in 2009, when Zhou Xiaochuan, Governor of the People’s Bank of China (PBOC), called for replacement of the US dollar as the world reserve currency by the SDR as to achieve the objective of safeguarding global economic and financial stability. China is currently the second largest economy in the world and its wishes can ultimately not be denied by other major economies. From Zhou:

… the role of the SDR has not been put into full play due to limitations on its allocation and the scope of its uses. However, it serves as the light in the tunnel for the reform of the international monetary system.

A super-sovereign reserve currency not only eliminates the inherent risks of credit based sovereign currency, but also makes it possible to manage global liquidity.

Special consideration should be given to giving the SDR a greater role. The SDR has the features and potential to act as a super-sovereign reserve currency.

Further improve the valuation and allocation of the SDR. The basket of currencies forming the basis for SDR valuation should be expanded to include currencies of all major economies, and the GDP may also be included as a weight. The allocation of the SDR can be shifted from a purely calculation-based system to a system backed by real assets, such as a reserve pool, to further boost market confidence in its value.

More present, on March 12, 2015, PBOC official Yi Gang said he’s “actively communicating” with the IMF on including the renminbi in the basket of the SDR.

We hope the IMF can fully take into account the progress of renminbi internationalization, to include the renminbi into the basket underlining the SDR in foreseeable, near future.

It should be noted the IMF and the PBOC started communicating long before 2015. For example; since 2013, every year in March, the IMF and the PBOC hold a joint conference in Beijing on “…new issues in monetary policy in an international context and assess their relevance for China. Against the backdrop of the global financial crisis and the use of unconventional monetary policy, it will look at the implications for monetary policy frameworks, as well as the changing toolkit of central banks.” The conference brings together international experts, Chinese academics, PBOC and IMF staff.

Click here for the full transcripts of the 2013 conference, here for the 2014, and here for the March 16, 2015, program.

One of the speakers at the 2014 conference was Dr. Wang Yu, Deputy Director General, Bureau of Research at the PBOC. His biography states:

During his tenure at the People’s Bank of China, Dr. Wang participated in the creation of China’s monetary policy framework and the building of the Chinese financial market. He is involved in market based interest rate reform, exchange rate reform, as well as the convertibility of capital account. Dr. Wang participated in the formulation of rules and development of trading tools for the Chinese currency and gold markets. Dr. Wang’s work supports the opening up of the Chinese financial market to the world,

Every five years the SDR basket is reconsidered, the previous reconsideration was in 2010. The IMF’s Managing Director, Christine Lagarde, will be in China from March 19 to 23, 2015, “among other things, she’ll be meeting with the authorities and participating in the China Development Forum.” Will she talk about the acceptance of the renminbi into the SDR basket? Yes. From the Press Briefing by Gerry Rice, Director, IMF Communications Department, March 12, 2015:

QUESTIONER: Gerry, on her [Lagarde] trip to China, will the Managing Director be having any discussions regarding potentially including the renminbi to the SDR basket? There were some statements out of Beijing today by a senior Chinese official saying that they are having those discussions and they seemed optimistic. Is that on her agenda?

RICE: Yeah, I’m not sure what the actual discussions will be but maybe it will help if I just sort of set the issue a bit in context, the issue that you’re raising.

Again, just stepping back, the IMF’s Board reviews the SDR valuation every five years unless an earlier review is warranted by global financial or economic development. So it’s essentially every five years. So the last review took place in late 2010. And the next one is scheduled then for later this year in the latter part of 2015.

And then, the updated SDR basket would become effective January 1, 2016. So that’s kind of the review schedule, okay?

Then the criteria for inclusion of a currency in the SDR basket, the selection of currencies for the SDR basket are based on two criteria and these were set out some time ago. They are namely the size of a country’s exports and whether its currency is freely usable. So at the time of the last SDR review that was in 2010, as I said, the renminbi met the export criterion but it was assessed to not meet the freely usable criterion.

Since then, of course, there have been a number of developments regarding the RMB’s international use and so, just to circle back, the upcoming review will take stock of these developments. So that’s something that’s going to be happening toward the end of the year as I said and I’m sure there will be discussions in various fora in the run up to that date.

On the term from the IMF for a currency to be freely usable, in order to be allowed into the SDR basket, we must not commingle this with fully convertible. As was outlined in the paper International Reserves And Foreign Currency Liquidity, from the IMF in 2013:

A7.15 Currently the IMF does not maintain a list of convertible currencies. In 1978, the Second Amendment of the IMF’s Articles of Agreement entered into effect and the concept of “convertible currencies” was replaced by the term “freely usable currency,”

According to Criteria for Broadening the SDR Currency Basket, an IMF paper published in 2011, “that discusses a number of reform options for the eligibility criteria for the SDR currency basket”, this does not exclude the renminbi:

The freely usable concept and its two key elements—currencies should be “widely used” and “widely traded” —are set out in the Articles and serve important operational purposes. A formal requirement for a currency to be freely usable was adopted for SDR valuation only in 2000, although considerations relating to this concept had been taken into account earlier. Indicators for assessing freely usable currencies were first discussed in 1977, and are updated to reflect subsequent developments in financial markets and data availability.

Over the last few years, China’s authorities have steadily loosened capital controls, allowing the renminbi to become the fifth most popular currency for settling global payments. With at least 60 central banks now including the renminbi among their foreign reserves. In October 2014, the UK issued the Western world’s first sovereign renminbi bond. This adds to London’s design to make the City the pre-eminent offshore trading center for the currency as the restrictions on non-domestic use are weakened. All in all, the renminbi is currently “widely used” and “widely traded”.

Furthermore, from Criteria for Broadening the SDR Currency Basket:

At their April 2011 meetings, the IMFC and the G-20 Ministers called for further work on a criteria-based path to broaden the composition of the SDR basket.

Directors have also noted that expanding the SDR basket to major emerging market currencies under appropriate conditions, and based on transparent criteria, could further expand the role of the SDR in the international monetary system.

What other major emerging market currency could they hint at next to the renminbi? Not only China has a desire for its currency to be adopted into the SDR, more G-20 members have an interest into broaden the composition of the SDR basket.

Zooming in on the characteristics of freely usable currency is interesting. From International Reserves and Foreign Currency Liquidity:

A7.18 For the recording of reserve assets, BPM6 states that “reserve assets must be denominated and settled in convertible foreign currencies, that is, currencies that are freely usable for settlement of international transactions" (BPM6, paragraph 6.72). Such currencies potentially extend beyond those currencies determined to meet the ‘freely usable currency" criterion under Article XXX (f) of the IMF’s Articles of Agreement. Countries are required to disclose at least once each year the composition of reserves by groups of currencies (item IV.(2)(a) of the Reserves Data Template). The overwhelming majority (well over 95 percent at the present time) of reserve assets reported in the Reserves Data Template are denominated in the freely usable currencies determined by the Fund under Article XXX (f) (i.e., the currencies currently included in the SDR basket).

It’s likely that if the renminbi were to be adopted into the SDR, China would have to show the composition of reserves by groups of currencies (item IV.(2)(a) of the Reserves Data Template). If we head over to the IMF webpage of the Data Template on International Reserves and Foreign Currency Liquidity, we can see many countries listed, but not China. Additionally, from the Articles of Agreement of the International Monetary Fund:

Section 5. Furnishing of information

(a) The Fund may require members to furnish it with such information as it deems necessary for its activities, including, as the minimum necessary for the effective discharge of the Fund’s duties, national data on the following matters:

(i) official holdings at home and abroad of (1) gold, (2) foreign exchange;

(ii) holdings at home and abroad by banking and financial agencies, other than official agencies, of (1) gold, (2) foreign exchange;

(iii) production of gold;

Currently the PBOC can hide some of its gold holdings at China’s largest sovereign wealth fund SAFE, a subsidiary of the PBOC, which “is responsible for the supervision and management of the foreign exchange market of China, to undertake supervision and management of the settlement and sale of foreign exchange and to cultivate and develop the foreign exchange market.” In short, SAFE is financial agency able to buy gold as a proxy for the PBOC. The IMF may require China to furnish information about its official gold holdings, as well as gold holdings by banks and financial agencies. If China would disclose all this information this would be a huge revelation, as China has net imported thousands of tonnes of gold in recent years that have not been officially assigned to any lawful owner. The financial industry has till thus-far assumed the gold is somewhere in China, but it’s unknown who’s holding it.

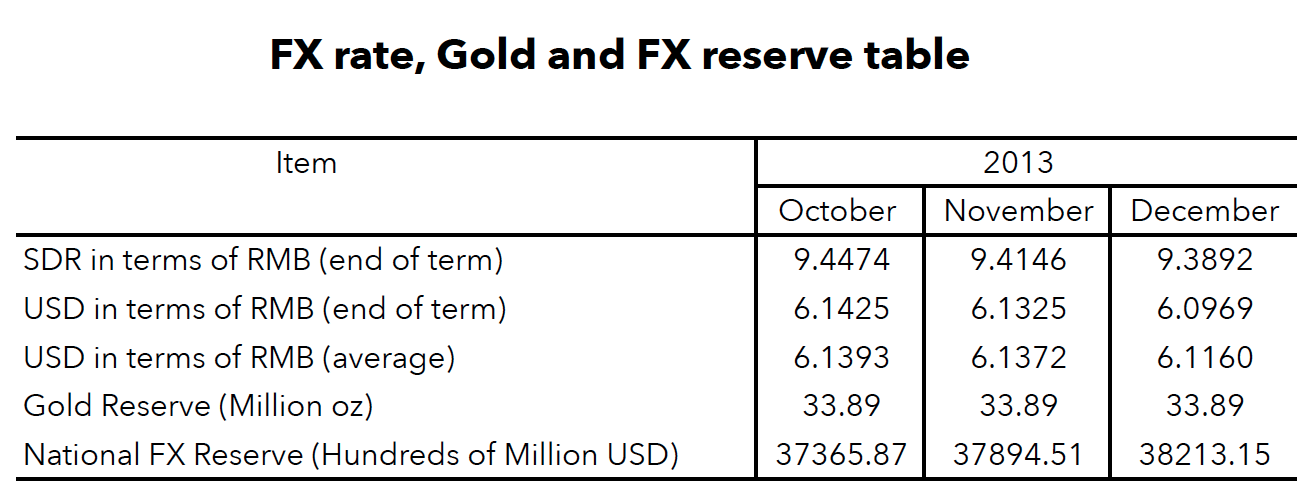

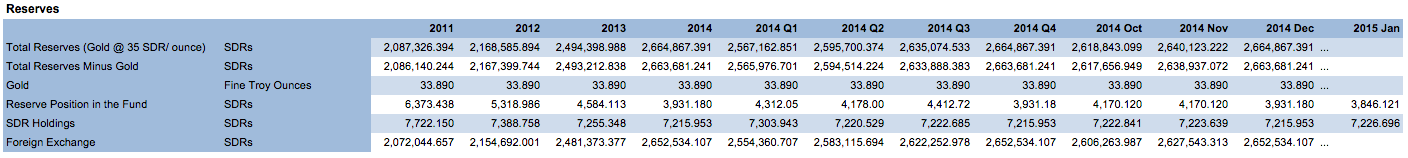

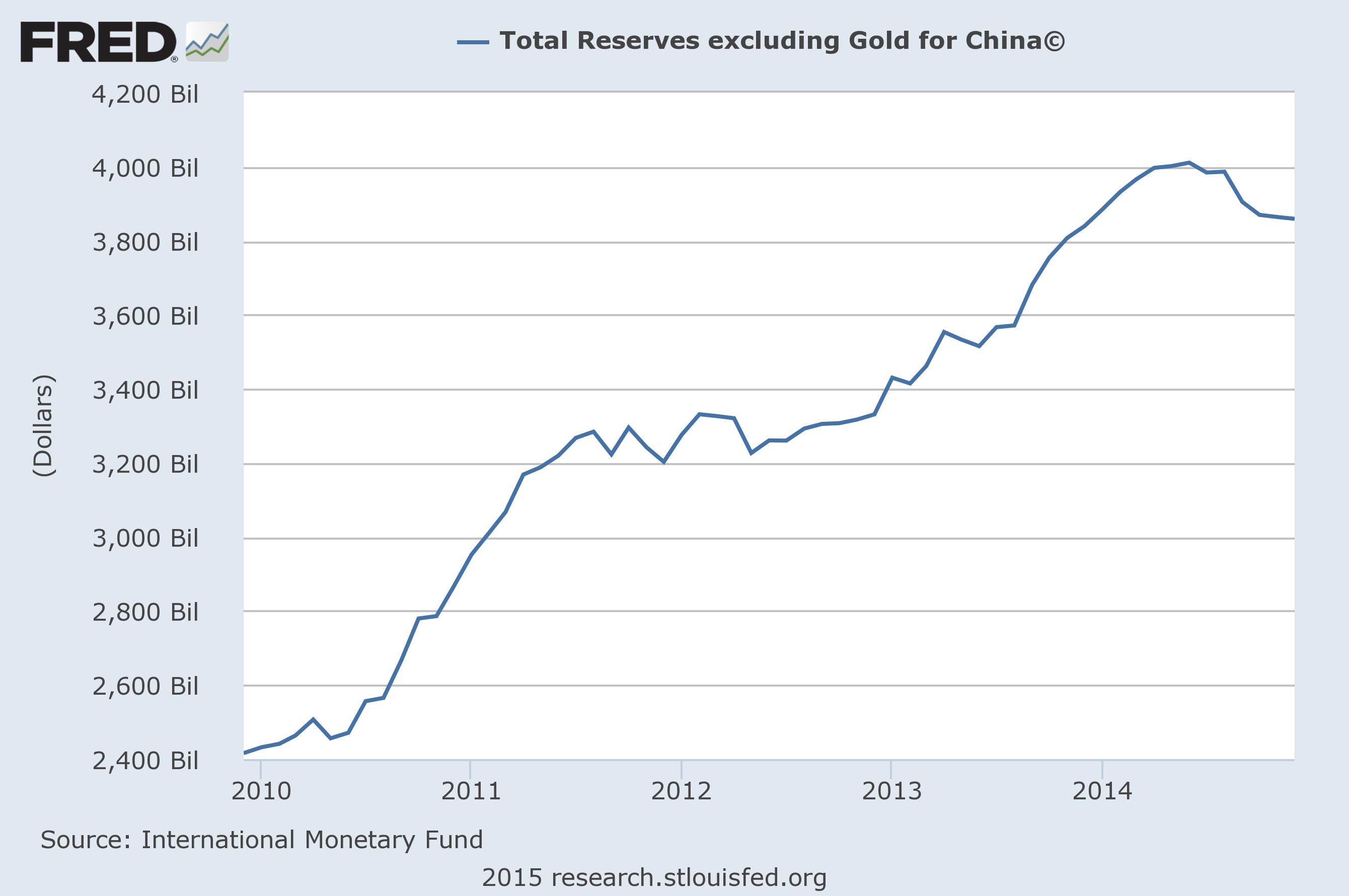

The PBOC publishes data on total FX reserves and gold, but without any specifications. These tables from the PBOC website…

can be translated into …

These numbers are about as much as I can find on the IMF’s website about Chinese reserves (excluding TIC data).

It’s safe to assume PBOC gold reserves at 33.89 million ounces (1.054 tonnes) are not accurate as there is circumstantial evidence the PBOC has been buying gold in recent years through proxies.

In May 2015, there will be an informal SDR basket review, in October the basket will be revised officially.

But there is more…

OMFIF, a well-connected economic think tank, in conjunction with the World Gold Council has released a report in January 2013 titled, Gold, the renminbi and the multi-currency reserve system. One of the writers of the report was Chairman Meghnad Desai, Emeritus Professor, London School of Economics:

When it comes to international monetary reform, well before the renminbi advances to fully-fledged reserve currency status, gold might stand to reclaim a right to which it has long aspired by returning to the heart of the system. Rebuilding and reinforcing the Special Drawing Right (SDR), the IMF’s composite currency spawned in the 1960s, have been much mooted, but nothing has been done to realize this aim.

I favor extending the SDR to include the R-currencies – the renminbi, rupee, real, rand and ruble – with the addition of gold. This would be a form of indexation to add to the SDR’s attractiveness. Gold would not need to be paid out, but its dollar or renminbi or ruble equivalent would be if the SDR had a gold content. By moving counter-cyclically to the dollar, gold could improve the stabilizing properties of the SDR. Particularly if the threats to the dollar and the euro worsen, a large SDR issue improved by some gold content and the R-currencies may be urgently required.

In its absence, we may face a huge liquidity crunch if a combination of US and European shortcomings and the natural ambitions of Asia produce an attack on the major currencies – and open up a further hole in the framework of the world’s reserve currency arrangements.

As the international community attempts to take on these challenges, gold waits in the wings. For the first time in many years, gold stands well prepared to move once more towards the centre-stage. This could be the start of an immensely important phase in the history of world money.

What do the Chinese think about this idea? Well, we’re familiar with their official policy of accumulating physical gold by the PBOC and the citizenry, more hints we can find from less official sources. According to a report from the Chinese Research Centre For International Finance, February 1, 2013:

This paper concentrates on the issue of currency convertibility in the context of Chinese strategy of the RMB internationalization. It argues that the motive for that strategy was ignited by China’s dissatisfaction with the long lasting unstable international monetary system. The recent global financial crisis intensified China’s urge to get rid of the “dollar trap” and look for a diversified international reserve currency system where the Chinese renminbi could take a place.

Looking elsewhere, there seems limited ‘high quality’ paper money in the world. The public debt in G7 countries has reached the highest level of 60 years. The traditional alerting ratio of 60% is no longer applied. Fiat money seems to have encountered a confidence crisis. The SDR, a collective form of currencies under the IMF’s account has been put under the spot light along with Stiglitz’s proposal. The proposal aimed to enlarge the SDR’s role as a supplement to the US dollar under the supervision of the IMF. However, there has been no consensus reached among the IMF member countries. Apart from paper currencies, gold has become a popular hedge instrument in the market. It has also drawn attention of its possible role to play in the reform of international monetary system.

In 2011, Chatham House set up a global Taskforce of experts to assess the possible role that gold could play, including an anchor, a hedge or safe haven, collateral or guarantee and a policy indicator.

The world is now in the transition from the US dollar hegemony to a diversified reserve currency system. China, among many other countries, is looking for dollar’s alternatives and its own currency is certainly one candidate for consideration.

One of the members of the Chatham House global Taskforce was … Meghnad Desai, who is also Chairman for OMFIF. Small world. In its research the taskforce was greatly helped by the “Chinese Academy of Social Sciences (CASS), and Professor Yu Yongding and Mr Zhang Yuyan." Could it be there is a team of academics and policy makers around the world working behind the scenes to reform the international monetary system by adding, among other currencies, the renminbi and gold to the SDR?

Popular Blog Posts by Koos Jansen

China’s Secret Gold Supplier is Singapore

China’s Secret Gold Supplier is Singapore

Audits of U.S. Monetary Gold Severely Lack Credibility

Audits of U.S. Monetary Gold Severely Lack Credibility

China Gold Import Jan-Sep 797t. Who’s Supplying?

China Gold Import Jan-Sep 797t. Who’s Supplying?

The Gold-Backed-Oil-Yuan Futures Contract Myth

The Gold-Backed-Oil-Yuan Futures Contract Myth

Estimated Chinese Gold Reserves Surpass 20,000t

Estimated Chinese Gold Reserves Surpass 20,000t

Did the Dutch Central Bank Lie About Its Gold Bar List?

Did the Dutch Central Bank Lie About Its Gold Bar List?

PBOC Gold Purchases: Separating Facts from Speculation

PBOC Gold Purchases: Separating Facts from Speculation

U.S. Mint Releases New Fort Knox Audit Documentation

U.S. Mint Releases New Fort Knox Audit Documentation

China Net Imported 1,300t of Gold in 2016

China Net Imported 1,300t of Gold in 2016

Why SGE Withdrawals Equal Chinese Gold Demand and Why Not

Why SGE Withdrawals Equal Chinese Gold Demand and Why Not

Koos Jansen

Koos Jansen