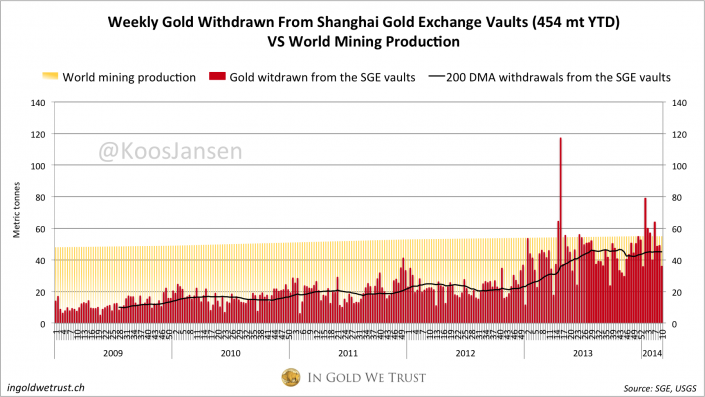

Week 10, SGE withdrawals 36 MT, 454 MT YTD

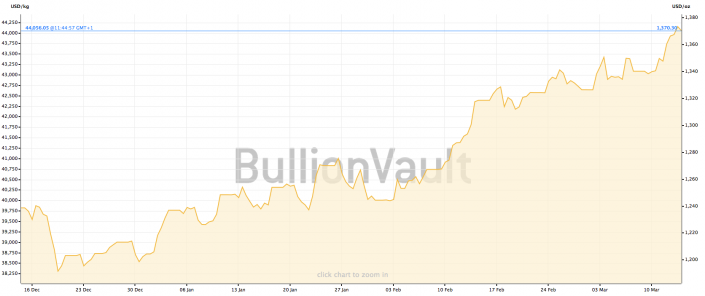

The price of gold is rising, but is this purely because of the tensions in the Ukraine? Not entirely, I think it adds fuel to a supply shortage created by enormous Chinese physical demand since April 2013. While paper sentiment might change today or tomorrow, the physical reality will eventually be the main driver to push the pice upwards.

Throughout history gold has always been the most constant form of money. In 1900 you could buy roughly the same amount of breads with one gram of gold as two thousand years ago. There has been no other currency that is equally constant. But the value of gold has been in for a ride since 1971, when Nixon ended the gold exchange standard in order to maximize the national benefit of issuing the world reserve currency for the US. US’ policy was to remove gold from the international monetary system, from that moment the international monetary system was debt based. To make believe the dollar was stronger than gold in the foreign exchange markets the price of gold had to be suppressed. Controlling CPI would do the rest.

Alan Greenspan, 1998: “…where central banks stand ready to lease gold in increasing quantities should the price rise."

In 1971 the minimum wage in the US was $1.60 per hour, the price of gold was $40.62 per ounce. This meant it took 25.4 hours of labour to earn 1 ounce of gold. In 2014 the minimum wage is $7.25 and the price of gold is $1350. Now it takes 186 hours to earn 1 ounce of gold. Keynesians would say; so what, gold is useless. I would say it’s not useless, in fact for thousands of years it proved best suitable as stable money (next to its exceptional properties as a metal).

But let’s have a look at something we can eat: a loaf of bread. In 1971 the average price of one loaf of bread was $0.25, or 0.16 hours of labour. In 2014, even with automation and scaling, one loaf of bread costs $2, or 0.28 hours of labour. It now takes more labour to earn a loaf of bread; labour has devalued.

By abandoning the gold standard the debt/inflation spiral has widened the gap between the rich and poor, wiping out the purchasing power of the middle class. Perpetual inflation, caused by printing money, drives all wealth to the top. The ones that can spent newly printed money first, in a market where prices are not yet influenced by the new money, have an advantage over the ones that can spent this money last, in a market where prices have been bid upwards.

30 years ago the income of a Dutch bus driver could buy him a house, let his wife raise two kids and go on a holiday once a year. Those days are long gone…

Just some thoughts, maybe shared by some Chinese as they buy physical gold as much as can be supplied.

Overview Shanghai Gold Exchange data 2014 week 10

– 36 metric tonnes withdrawn in week 9 (03-03-2014/07-03-2014)

– w/w – 26.12 %

– 454 metric tonnes withdrawn year to date

My research indicates that SGE withdrawals equals Chinese wholesale gold demand. For more information read this, this, this and this.

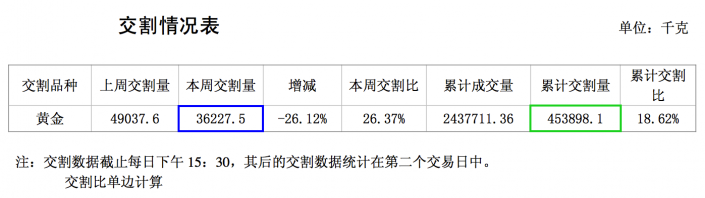

This is a screen shot from the weekly Chinese SGE trade report; the second number from the left (blue – 本周交割量) is weekly gold withdrawn from the vaults in Kg, the second number from the right (green – 累计交割量) is the total YTD.

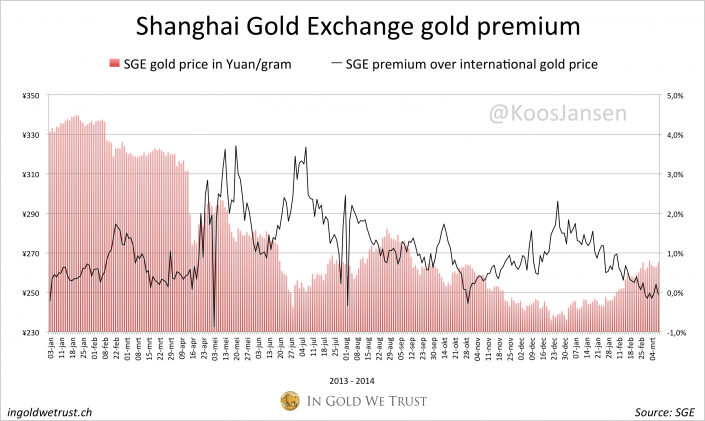

This chart shows SGE gold premiums based on data from the SGE weekly reports (it’s the difference between the SGE gold price in yuan and the international gold price in yuan).

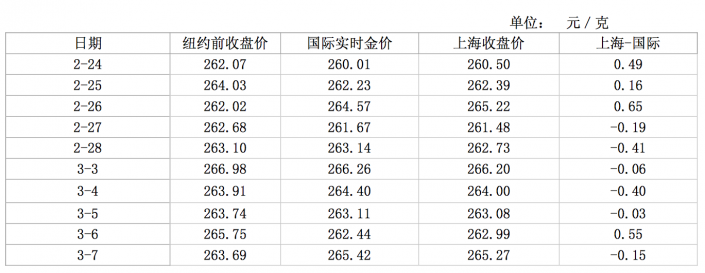

Below is a screen shot of the premium section of the SGE weekly report; the first column is the date, the third is the international gold price in yuan, the fourth is the SGE price in yuan, and the last is the difference.

In Gold We Trust

Popular Blog Posts by Koos Jansen

China’s Secret Gold Supplier is Singapore

China’s Secret Gold Supplier is Singapore

Audits of U.S. Monetary Gold Severely Lack Credibility

Audits of U.S. Monetary Gold Severely Lack Credibility

China Gold Import Jan-Sep 797t. Who’s Supplying?

China Gold Import Jan-Sep 797t. Who’s Supplying?

The Gold-Backed-Oil-Yuan Futures Contract Myth

The Gold-Backed-Oil-Yuan Futures Contract Myth

Estimated Chinese Gold Reserves Surpass 20,000t

Estimated Chinese Gold Reserves Surpass 20,000t

Did the Dutch Central Bank Lie About Its Gold Bar List?

Did the Dutch Central Bank Lie About Its Gold Bar List?

PBOC Gold Purchases: Separating Facts from Speculation

PBOC Gold Purchases: Separating Facts from Speculation

U.S. Mint Releases New Fort Knox Audit Documentation

U.S. Mint Releases New Fort Knox Audit Documentation

China Net Imported 1,300t of Gold in 2016

China Net Imported 1,300t of Gold in 2016

Why SGE Withdrawals Equal Chinese Gold Demand and Why Not

Why SGE Withdrawals Equal Chinese Gold Demand and Why Not

Koos Jansen

Koos Jansen