The Turkish Gold Standard, Part 1

One the most interesting gold markets around, but least talked about, is the Turkish gold market. The Turkish people have a strong tradition that goes back thousands of years to save in physical gold and it’s estimated 5,000 tonnes of gold are owned privately. Additionally, the Turkish central bank (CBRT) has implemented a model in 2011 that allows commercial banks to use physical gold for reserve requirements.

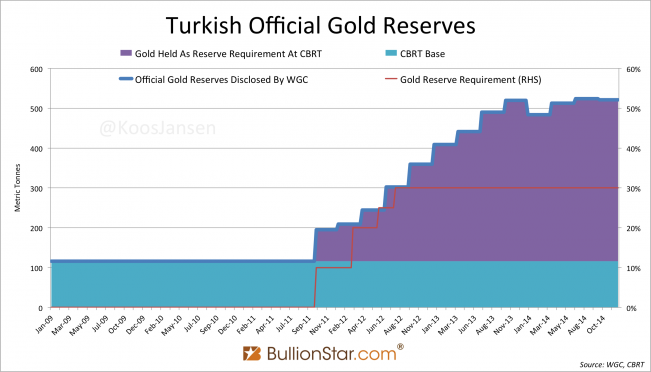

In contrast to what the above chart may suggest the CBRT bought zero grams of gold in the past years on the open market. All gold added to their balance sheet since 2011 is gold from commercial banks that are allowed to use gold for reserve requirements (RR) by the CBRT. The footnote on the World Gold Council’s sheet on global official gold holdings states:

Gold has been added to Turkey’s balance sheet as a result of a policy accepting gold in its reserve requirements from commercial banks.

I started researching the Turkish gold market about a year ago. Though I haven’t figured this market out in detail, I decided to go ahead and publish what I learned thus far, as this is an important story; the Turks have monetized gold through a model that soon might be implemented in other countries.

On the 11th India International Gold Convention, September 12 – 14, 2014, many keynote speakers expanded on the possibilities of monetizing India’s 20,000 tonnes private gold hoard. Soon after the World Gold Council and the Federation of Indian Chambers of Commerce and Industry (FICCI) released a report titled Why India Needs A Gold Policy, proposing India to develop its gold industry; launch a new gold exchange and monetize gold.

In this post we’ll skim the surface on the Turkish gold model, in a future post we can add more texture.

Next to articles available on the internet about this subject, I used the following sources for my analysis:

- The CBRT, that wrote me three official letters in response to my inquiries.

- Two employees from two different Turkish commercial banks. Both insisted not to disclose the name of their banks.

- An employee from the Dutch central bank (DNB), who explained me the structure between commercial banks and their central bank in general and how the Turkish model fits in. (I’m not a schooled banker.)

Brief History Of The Turkish Gold Market

Worth noting is that the first coins of precious metals are believed to have been minted in Lydia, in what is now part of modern day Turkey, around 650 BC. The Kingdom of Lydia was a province of the Achaemenid Persian Empire.

When the Romans entered the Lydian capital Sardis in 133 BC, the region became part of the Eastern Roman Empire, which was also referred to as the Byzantine Empire. Through the 5th century the Western Roman Empire fragmented and collapsed, the Byzantine Empire survived and became one of the most flourishing and resilient economies in the world. The empire’s capital Constantinople, modern day Istanbul, was a trading hub in a network that at various times extended across nearly all of Eurasia and North Africa. Located at the western end of the Silk Road it connected the Orient with Europe.

Coins were the basic form of money though credit did exist, according to archival documents that describe the Byzantine banking system. The Empire’s monetary system functioned for more than a thousand years, from 312 to 1453, because of its relative flexibility. The Byzantine economy was among the most advanced in the region (Europe, North Africa, Middle East).

Since the creation of the Byzantine monetary system by Constantine in 312, its pivot had been the golden Solidus (the Latin word for solid). This coin was a highly priced and stable means of storing and transferring value.

Constantinople fell in 1453 when it was invaded by the Ottoman Empire; in which the financial and political interests of the state dominated the economy. The Byzantine era came to an end, though gold and silver remained a common store of value among the population in the region.

Mustafa Kemal Atatürk was the first President who came in power (1923) of what now officially is called The Republic Of Turkey, founded in the aftermath of World War I. After World War II a period followed of state guided industrialization based on import substituting protectionism. In 1980 Turkey started to liberalize its economy. With regard to gold the most significant developments were:

- 1983, the ban on gold jewelry exports was lifted.

- 1993, the Turkish central bank’s monopoly on the import of gold was lifted.

- 1995, the Istanbul Gold Exchange was established – currently named Borsa Istanbul.

- 2002, the Istanbul Gold Refinery was launched.

- 2011, the Turkish central bank allowed commercial banks to hold gold for reserve requirements.

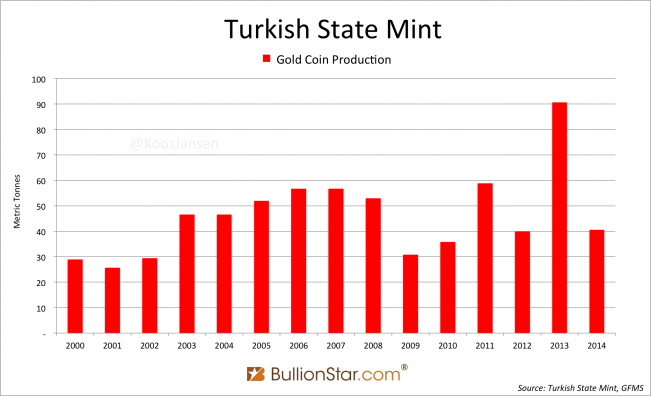

Additionally, the Turkish State Mint, the world’s largest producers of gold coins in the past years, still plays an important role in producing 22-karat Republic coins.

Monetizing Gold

In September 2011 the CBRT announced 10 % of Turkish Lira RR of commercial banks could be fulfilled in US dollars or euros and an additional 10 % in physical gold. The percentages were timely increased; gold was increased to 20% in March 2012, then to 25% in June and finally 30% in August. This press release from the CBRT is the earliest I could find on the subject:

No: 2011 – 35

12 September 2011

PRESS RELEASE ON REQUIRED RESERVES, REDISCOUNT CREDIT IMPLEMENTATIONS AND FOREIGN EXCHANGE SELLING AUCTIONS

The Monetary Policy Committee (the Committee) at the interim meeting on August 4, has laid out the ground for a timely, controlled and effective provision of liquidity to the market in case of a possible financial turmoil that may be triggered by global developments and decided the implementation of a comprehensive package of measures gradually according to conditions.

…

Since the last two meetings, the data announced for the advanced economies and the recent developments have led to increased concerns regarding sovereign debt problems in some European countries and the global growth outlook. In this context, not only in order to meet the Turkish lira liquidity needs of the banking system in a more permanent way and lower cost, but also support and use Central Bank’s foreign exchange reserves timely, controlled and effectively, the implementation of the following additional measures has been decided.

…

2) With the same Communiqué, gold deposit accounts, showing a rapid increase in recent periods, have also been included in the coverage of the reserve requirements.

On the other hand, as a new flexibility provided to the banking system, the facility of maintaining reserves requirement as “standard gold" at the accounts of Central Bank against the total amount of reserve requirement maintained for the precious metal deposit accounts and up to 10 percent of reserves requirement for foreign currency liabilities excluding precious metal deposit accounts, has been provided.

From the CBRT bulletin June 23, 2012:

To strengthen the build-up of the CBRT’s gold reserves and to provide the banking system with more flexibility in liquidity management, the CBRT enabled the facility that allows banks to hold a part of their reserve requirements for Turkish lira deposits in gold as well as FX, and for FX deposits in gold.

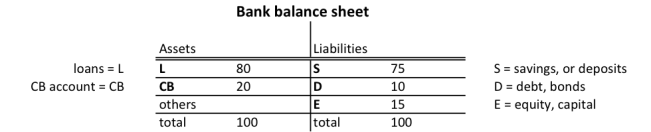

To understand who benefits from this scheme, we must first examine how a (Turkish) commercial bank balance sheet looks like. Below is a simplified example:

Most CB’s around the world, not all, require a fixed percentage of bank deposits to be held in reserve at the CB. In some countries this is 1 % of total deposits (ECB), in others it’s 20.5 % (China), in Turkey it’s 8.5 %. The reserve ratio, is calculated as:

CB / S + D

The capital ratio is calculated as:

E / total

A bank holding reserves in excess of the required amount is said to hold excess reserves. The interest rate banks receive from their CB on excess reserves can be different from the rate on RR.

When in October 2011 Turkish banks could fulfill RR in gold, this freed Turkish Lira (TL) liquidity. The amount of TL needed to meet RR prior to October could now be replaced by gold and subsequently be used to be create new TL loans.

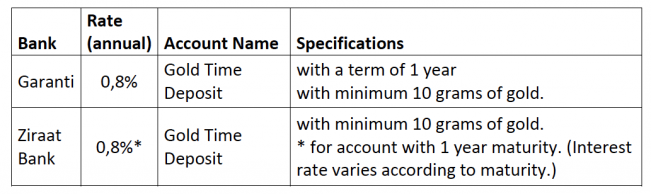

Turkish banks attract gold deposits by offering an interest on gold time deposits. On average a one-year deposit yields 0.8 % (the interest is denominated in gold).

During the loan Garanti can use the gold to meet RR at the CBRT. The TL that are freed by this can be used to make investment that yield higher than 0.8 %. The difference in yield is profit for the bank. I think it’s likely Garanti will hedge itself against gold price fluctuations to pay the interest.

In addition Turkish banks are allowed to use their own gold assets to fulfill RR, and FX gold deposits. Some snippets from an email the CBRT wrote me:

…As it can be seen, banks with even “zero” amount of gold deposits opened by customers, can fulfill some part of their Turkish lira required reserve obligation by depositing gold to the Central Bank, of course if they possess gold in their assets. And of course this amount of gold will show up in Central Bank balance sheet under two items: as “liability” to the bank which brought this gold, and as “assets” of the Central Bank because the Central Bank now “owns” this amount of gold for a specific period (until the end of the RR maintenance period). This is how Central Bank official gold holdings increase.

Options do not exist only for Turkish lira required reserves. There is also an option for the maintenance of the “foreign currency [FX] required reserves”.

In the chart we can clearly see how much gold is added to the CBRT balance sheet over the years without the CB having bought a single gram – this is what the CBRT wrote me.

Once gold is deposited at a commercial bank there is a risk of losing it. The rule of thumb is “no risk, no return”. If Turks deposit gold at a bank they receive an attractive interest instead of having to pay a storage fee. But what happens to their gold if the bank becomes insolvent? It can vanish. Technically they lend it to the bank, partially the interest on a loan is to compensate for the risk of default. The pitfall is that most gold depositors are unaware of the risks. Banks have little incentive to disclose risks when a customer walks in to make a deposit. Have you ever been told by a bank there is a risk of losing your deposit?

People own physical gold to hedge against inflation or financial meltdowns; as happened on a global scale in 2008 and more recently in Cyprus early 2013 – in Cyprus the bail-in template was first introduced. The last thing you want is your gold in a bank when they decide not to open on any given Monday.

I’m not against the Turkish model because in a free market every participant in the economy should be allowed to lend any currency to his or her discretion. My concern is, however, that the majority of depositors are not aware of the risks of banking.

Popular Blog Posts by Koos Jansen

China’s Secret Gold Supplier is Singapore

China’s Secret Gold Supplier is Singapore

Audits of U.S. Monetary Gold Severely Lack Credibility

Audits of U.S. Monetary Gold Severely Lack Credibility

China Gold Import Jan-Sep 797t. Who’s Supplying?

China Gold Import Jan-Sep 797t. Who’s Supplying?

The Gold-Backed-Oil-Yuan Futures Contract Myth

The Gold-Backed-Oil-Yuan Futures Contract Myth

Estimated Chinese Gold Reserves Surpass 20,000t

Estimated Chinese Gold Reserves Surpass 20,000t

Did the Dutch Central Bank Lie About Its Gold Bar List?

Did the Dutch Central Bank Lie About Its Gold Bar List?

PBOC Gold Purchases: Separating Facts from Speculation

PBOC Gold Purchases: Separating Facts from Speculation

U.S. Mint Releases New Fort Knox Audit Documentation

U.S. Mint Releases New Fort Knox Audit Documentation

China Net Imported 1,300t of Gold in 2016

China Net Imported 1,300t of Gold in 2016

Why SGE Withdrawals Equal Chinese Gold Demand and Why Not

Why SGE Withdrawals Equal Chinese Gold Demand and Why Not

Koos Jansen

Koos Jansen