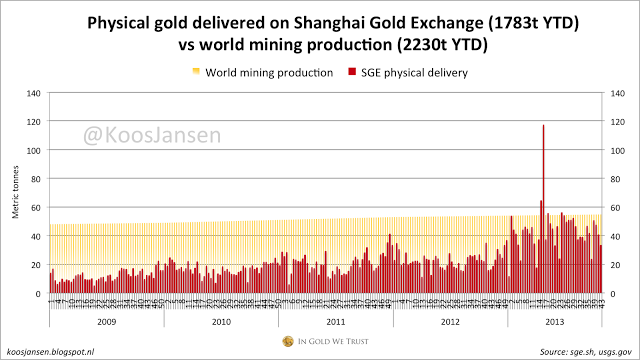

Shanghai Gold Exchange Physical Delivery Week 43

Overview:

– 33 metric tonnes delivered in week 43 (withdraws from the SGE vaults), 21-10-2013/25-10-2013

– w/w – 18 %

– 1783 metric tonnes delivered year to date

– weekly average 41,4 tonnes YTD, 2013 estimate yearly total 2115 tonnes

For more information on SGE delivery read this and this, on it’s relation to Chinese gold demand read this.

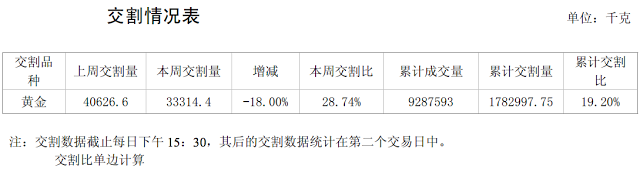

Screen dump from SGE trade report; the second number from the left (本周交割量) is weekly physical delivery, the second number from the right (累计交割量) is total delivery YTD.

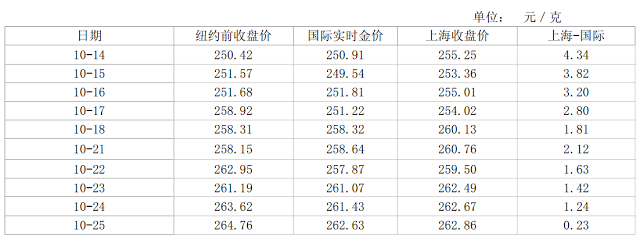

Screen dump of premium section; the first column is the date, the third the international gold price in yuan, the fourth is the SGE price, and the last is the difference.

Popular Blog Posts by Koos Jansen

China’s Secret Gold Supplier is Singapore

China’s Secret Gold Supplier is Singapore

Audits of U.S. Monetary Gold Severely Lack Credibility

Audits of U.S. Monetary Gold Severely Lack Credibility

China Gold Import Jan-Sep 797t. Who’s Supplying?

China Gold Import Jan-Sep 797t. Who’s Supplying?

The Gold-Backed-Oil-Yuan Futures Contract Myth

The Gold-Backed-Oil-Yuan Futures Contract Myth

Estimated Chinese Gold Reserves Surpass 20,000t

Estimated Chinese Gold Reserves Surpass 20,000t

Did the Dutch Central Bank Lie About Its Gold Bar List?

Did the Dutch Central Bank Lie About Its Gold Bar List?

PBOC Gold Purchases: Separating Facts from Speculation

PBOC Gold Purchases: Separating Facts from Speculation

U.S. Mint Releases New Fort Knox Audit Documentation

U.S. Mint Releases New Fort Knox Audit Documentation

China Net Imported 1,300t of Gold in 2016

China Net Imported 1,300t of Gold in 2016

Why SGE Withdrawals Equal Chinese Gold Demand and Why Not

Why SGE Withdrawals Equal Chinese Gold Demand and Why Not

Koos Jansen

Koos Jansen