SGE Gold Withdrawals Down, Silver Premiums 5%

Friday January 10, 2013, the first Chinese gold report was released by the SGE. First let’s look at the amount of gold withdrawn from the vaults. Below is a screen dump from the withdrawals in the first trading week of 2014, which covered 30-12-2013 / 3-1-2014 (there was no trading on 01-01-2014).

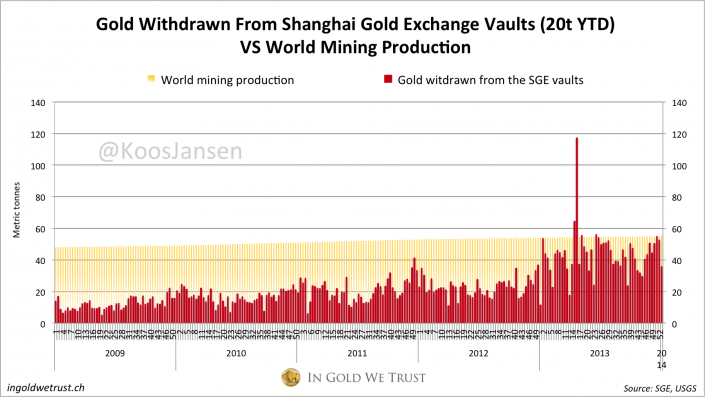

The green number is the gold withdrawn from the vaults in the covered period. The red number is the gold withdrawn from the vaults year to date. Because the first trading week consisted of two days in 2013 and two days in 2014 we can calculate how much was withdrawn in the last two days of 2013; that is 35873 Kg minus 19881 Kg, is 15992 Kg. So we have to add 16 tons to what I had recently reported as total Chinese gold demand in 2013; the exact total is (2181 + 16) 2197 tons.

The purple number is gold withdrawn in the prior reported week. That means weekly withdrawals diminished by 31.85 %. This could be explained by the fact that jewelers purchased large amounts of gold on the SGE in December to prepare for the sale around new year (on which I reported here). Now the sale is cooling down this is also reflected in lower SGE withdrawals. Gold demand may pick up this month as the Chinese will celebrate Chinese new year, the year of the Horse, on January 31, 2014, according to the Chinese Lunar calendar.

Overview Shanghai Gold Exchange data week 1

– 19.8 metric tonnes withdrawn from the SGE vaults in week 1 (02-01-2014 / 03-01-2014)

– 19.8 metric tonnes withdrawn from the SGE vaults year to date (that’s still more than the official gold reserves of Sri Lanka)

Source: SGE, USGS

For more information on SGE withdrawals read this, this, this and this.

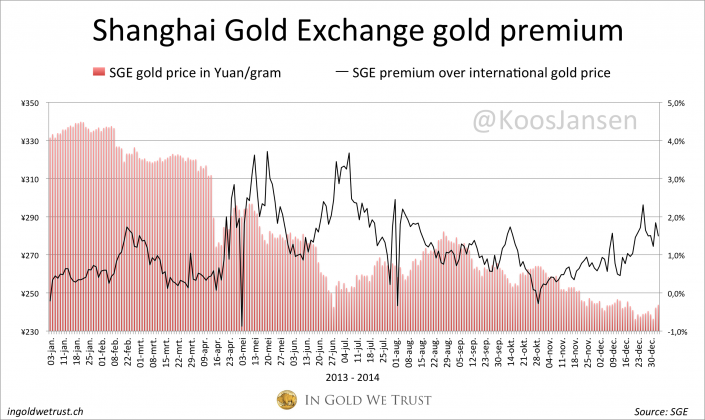

This chart shows SGE gold premiums based on data from the SGE weekly reports (it’s the difference between the SGE gold price in yuan and the international gold price in yuan). We can see gold premiums on the SGE are in an upward trend since November.

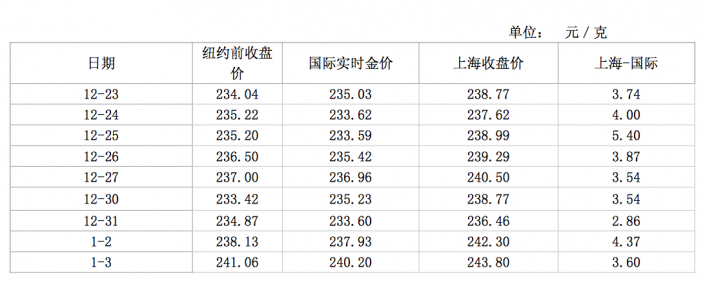

Below is a screen dump of the premium section of the SGE weekly report; the first column is the date, the third is the international gold price in yuan, the fourth is the SGE price in yuan, and the last is the difference.

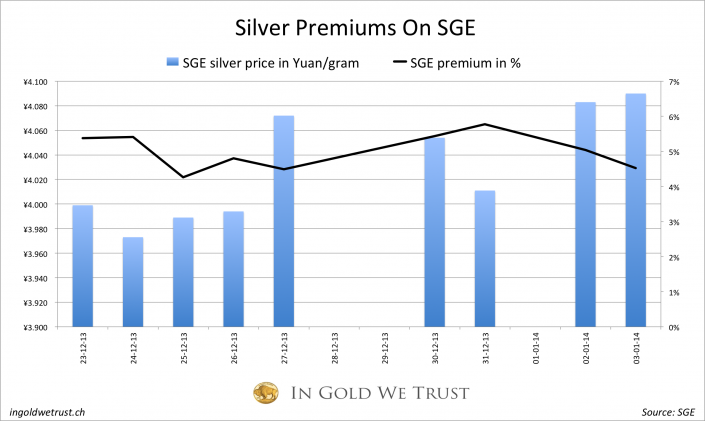

What I also saw was in the reports is that silver premiums are on the move, currently at 5 %. I didn’t track them throughout 2013 but I will from now on.

In Gold (and silver) We Trust

Popular Blog Posts by Koos Jansen

China’s Secret Gold Supplier is Singapore

China’s Secret Gold Supplier is Singapore

Audits of U.S. Monetary Gold Severely Lack Credibility

Audits of U.S. Monetary Gold Severely Lack Credibility

China Gold Import Jan-Sep 797t. Who’s Supplying?

China Gold Import Jan-Sep 797t. Who’s Supplying?

The Gold-Backed-Oil-Yuan Futures Contract Myth

The Gold-Backed-Oil-Yuan Futures Contract Myth

Estimated Chinese Gold Reserves Surpass 20,000t

Estimated Chinese Gold Reserves Surpass 20,000t

Did the Dutch Central Bank Lie About Its Gold Bar List?

Did the Dutch Central Bank Lie About Its Gold Bar List?

PBOC Gold Purchases: Separating Facts from Speculation

PBOC Gold Purchases: Separating Facts from Speculation

U.S. Mint Releases New Fort Knox Audit Documentation

U.S. Mint Releases New Fort Knox Audit Documentation

China Net Imported 1,300t of Gold in 2016

China Net Imported 1,300t of Gold in 2016

Why SGE Withdrawals Equal Chinese Gold Demand and Why Not

Why SGE Withdrawals Equal Chinese Gold Demand and Why Not

Koos Jansen

Koos Jansen