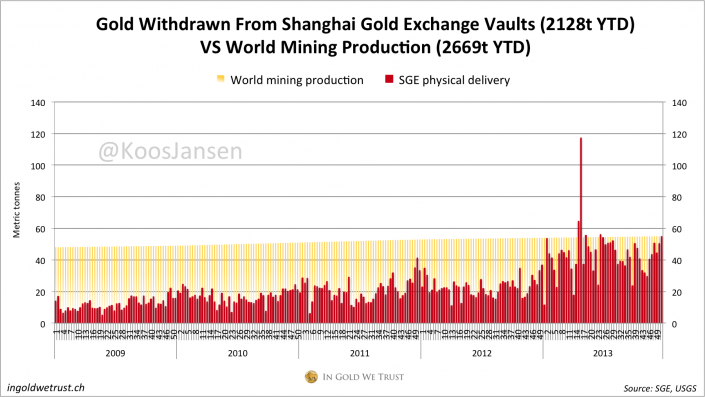

YTD SGE Delivery 16-20 December 55 Tons, 2128 Tons

In the end stage of 2013, in between 16 – 20 December, the “Chinese Aunties" have withdrawn 55 tons of gold from the vaults of the Shanghai Gold Exchange. That’s more than the official gold reserves of Finland and most likely more than what has been globally mined that week. The Chinese gold rush has been in an upward trend in recent weeks. Lets see how much gold will be drawn from the vaults in the last trading week of 2013. The yearly total of withdrawals, which equal Chinese gold demand, are on track to reach 2169 tons.

SGE gold premiums remained stable over this period around 1 %.

Overview Shanghai Gold Exchange data week 51

– 55 metric tonnes withdrawn in week 51 (underlined in blue two images below), 16-12-2013/20-12-2013

– w/w + 8.81 %

– 2128 metric tonnes delivered year to date (underlined in red two images below)

– weekly average 41.7 tonnes YTD, 2013 estimate yearly total 2169 tonnes.

For more information on SGE withdrawals read this, this, this and this.

This is a screen dump from Chinese SGE trade report; the second number from the left (本周交割量) is weekly gold withdrawn from the vault, the second number from the right (累计交割量) is the total YTD.

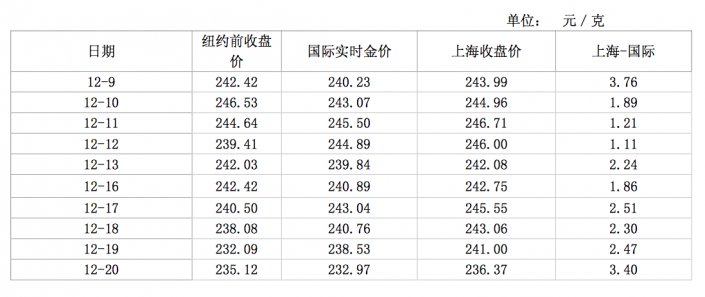

This chart illustrates SGE gold premiums based on data from the SGE weekly reports (it’s the difference between the SGE gold price in yuan and the international gold price in yuan).

Below is a screen dump of the premium section of the SGE weekly report; the first column is the date, the third is the international gold price in yuan, the fourth is the SGE price in yuan, and the last is the difference.

On December 28 there was a podcast released on SilverDoctors.com named: PM FUND MANAGER: 57 TONS OF GOLD DRAINED FROM SHANGHAI VAULTS IN PAST WEEK! It’s a conversation between the Doc and Dave Kanzler.

My comment on the part where they talk about the SGE (starts at 6:50):

The Doc states correctly that in between 9 and 13 December 2013 there were 50 tons of gold withdrawn from the SGE vaults (look a few images up at the screen dump from the Chinese SGE weekly report, I drew a green line under this amount of withdrawals). The Doc also states there has been roughly 2100 tons of gold withdrawn year to date which equals Chinese demand according to the PBOC (underlined in red). Again correct, IMVHO.

Then Dave Kanzler responds that is was actually 57 tons in that week (9-13 December). From this moment on Dave an the Doc start talking about two different subjects. The Doc refers to gold withdrawn from the vaults, where Dave refers to the amount of gold in the vaults that changes ownership at the end of a trading day through settlement between long and short contracts (a process that can be repeated into infinity, not quite significant data for gold investors that are interested in demand). I know this not only because they state different numbers, I know this because it’s clear where Dave gets his data from. Dave looks at the English SGE website that only publishes data on gold ownership changes in the vaults (if you check the website it exactly coincides with Dave’s numbers). The Doc looks at the Chinese SGE website (or my blog) that publishes how much physical gold actually leaves the vaults and tells us a lot about Chinese demand.

On a second note the title of the podcast bears a false statement. In week 50 (nor 51) there has not been 57 tons of gold being withdrawn from the vaults of the Shanghai Gold Exchange.

I wrote an open letter to Andrew Maguire once on the same matter.

Happy new year!

Popular Blog Posts by Koos Jansen

China’s Secret Gold Supplier is Singapore

China’s Secret Gold Supplier is Singapore

Audits of U.S. Monetary Gold Severely Lack Credibility

Audits of U.S. Monetary Gold Severely Lack Credibility

China Gold Import Jan-Sep 797t. Who’s Supplying?

China Gold Import Jan-Sep 797t. Who’s Supplying?

The Gold-Backed-Oil-Yuan Futures Contract Myth

The Gold-Backed-Oil-Yuan Futures Contract Myth

Estimated Chinese Gold Reserves Surpass 20,000t

Estimated Chinese Gold Reserves Surpass 20,000t

Did the Dutch Central Bank Lie About Its Gold Bar List?

Did the Dutch Central Bank Lie About Its Gold Bar List?

PBOC Gold Purchases: Separating Facts from Speculation

PBOC Gold Purchases: Separating Facts from Speculation

U.S. Mint Releases New Fort Knox Audit Documentation

U.S. Mint Releases New Fort Knox Audit Documentation

China Net Imported 1,300t of Gold in 2016

China Net Imported 1,300t of Gold in 2016

Why SGE Withdrawals Equal Chinese Gold Demand and Why Not

Why SGE Withdrawals Equal Chinese Gold Demand and Why Not

Koos Jansen

Koos Jansen