Official India PM Import August: Gold Down, Silver Holds

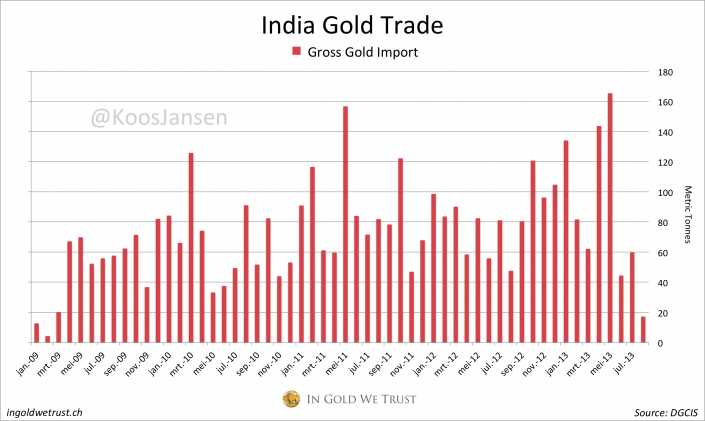

India’s official gold import is coming down like a hammer. In August India’s gross gold import was a mere 17 tons, – 72 % m/m, – 65 % y/y. The lowest since February 2009. In the first 8 months of this year total gross import accounted for 708 tons, up 111 tons compared to the same period in 2012, or + 19 % y/y.

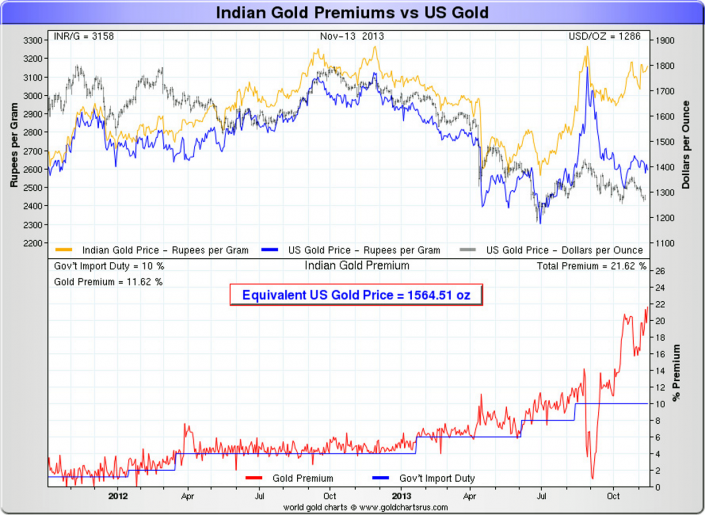

The main reason for this slump is India’s import duty on gold that was raised in January from 4% to 6 %, in June to 8 % and in August to 10 %. Another reason is the 80/20 rule that came in force in August, forcing importers to directly re-export 20 % of their gold import. The results are that official import is decreasing, gold smuggling is increasing, premiums are making al time highs and silver imports are up. If we look at a chart from Nick Laird we can see that on top of the import duty Indians have to pay a premium of 12 % on gold, 22 % in total!

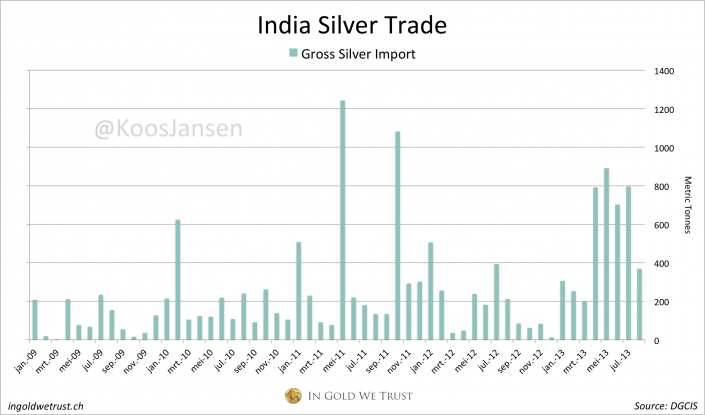

Silver demand in india is extraordinary high this year. India gross silver import in August was 369 tons versus 212 tons in August 2012, an increase of 157 tons, + 74 % y/y. Compared to July 2013 imports decreased 428 tons from 797 tons, – 54 % m/m. Year to date India gross silver import stands at 4311 tons, up 2440 tons compared to the same period in 2012, or + 130 %.

The DGCIS has not disclosed any gold or silver export numbers from August.

In Gold We Trust

Popular Blog Posts by Koos Jansen

China’s Secret Gold Supplier is Singapore

China’s Secret Gold Supplier is Singapore

Audits of U.S. Monetary Gold Severely Lack Credibility

Audits of U.S. Monetary Gold Severely Lack Credibility

China Gold Import Jan-Sep 797t. Who’s Supplying?

China Gold Import Jan-Sep 797t. Who’s Supplying?

The Gold-Backed-Oil-Yuan Futures Contract Myth

The Gold-Backed-Oil-Yuan Futures Contract Myth

Estimated Chinese Gold Reserves Surpass 20,000t

Estimated Chinese Gold Reserves Surpass 20,000t

Did the Dutch Central Bank Lie About Its Gold Bar List?

Did the Dutch Central Bank Lie About Its Gold Bar List?

PBOC Gold Purchases: Separating Facts from Speculation

PBOC Gold Purchases: Separating Facts from Speculation

U.S. Mint Releases New Fort Knox Audit Documentation

U.S. Mint Releases New Fort Knox Audit Documentation

China Net Imported 1,300t of Gold in 2016

China Net Imported 1,300t of Gold in 2016

Why SGE Withdrawals Equal Chinese Gold Demand and Why Not

Why SGE Withdrawals Equal Chinese Gold Demand and Why Not

Koos Jansen

Koos Jansen