More On The West To East Gold Exodus

The most significant parameter to measure the gold distribution from west to east is the trade vein that runs from the UK through Switzerland through Hong Kong, eventually reaching Shanghai.

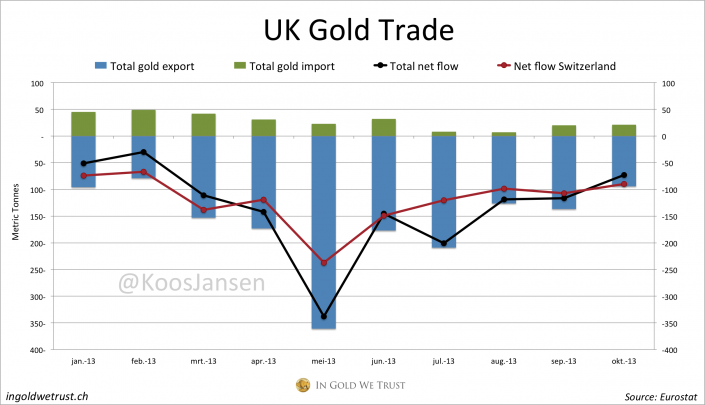

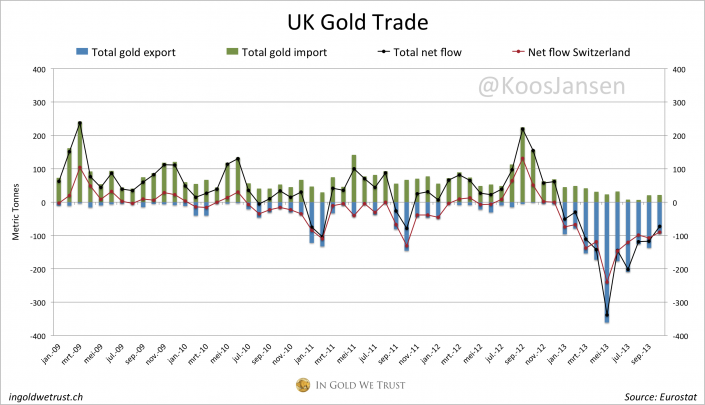

The UK Source

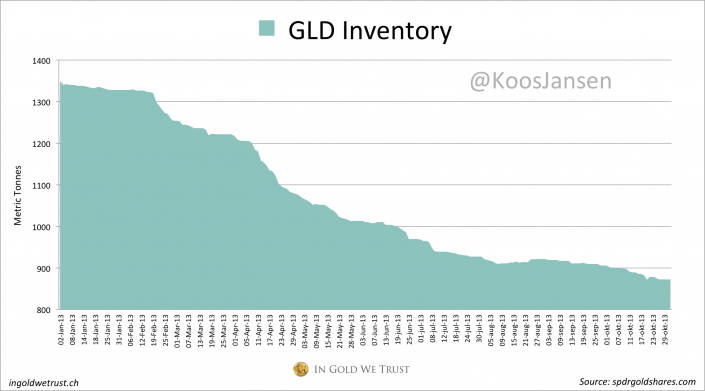

In October the UK has net exported 90 tons of gold to Switzerland, – 16 % m/m, year to date the Swiss have net received 1199 tons. The UK net exported 1326 tons in total in the first ten months of this year, of which 477,9 tons were sourced by GLD. The unusual outflows remain elevated throughout the entire year. Also note, the UK is hardly importing any gold this year, as if physical gold is difficult to source.

From 1 January until 31 October GLD lost 15.3 million shares. Can it be the Chinese redeem physical gold from GLD through “agents" like Blackrock that have sold huge amounts of shares this year and possibly redeemed these shares for physical gold through GLD’s authorized participants? Just a theory..

This is a picture taken on 25 November 2013.

On the right we can see Mr. Xie, president of China’s third largest Sovereign Wealth Fund NSSF, on the left Mr. Lawrence Fink, chairman and CEO of BlackRock.

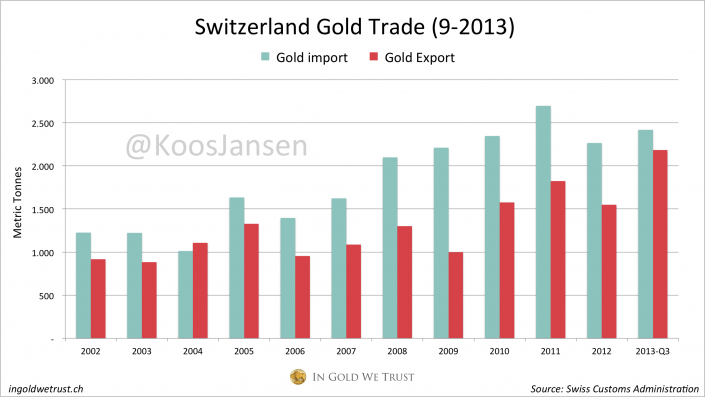

Pass The Swiss

The Swiss only publish their total gold trade numbers every 3 months; last data was from September. As we can see from the chart, all the gold that is being imported into Switzerland this year is being remelted and exported; this was also confirmed by a Swiss refinery. Exports stand at an all time record this year at 2184 tons, and there are 3 months left on the calendar. Annualized exports would be 2912 tons, which is 1362 tons more than what the Swiss exported in 2012. We may assume this difference in exports is additional supply for the east.

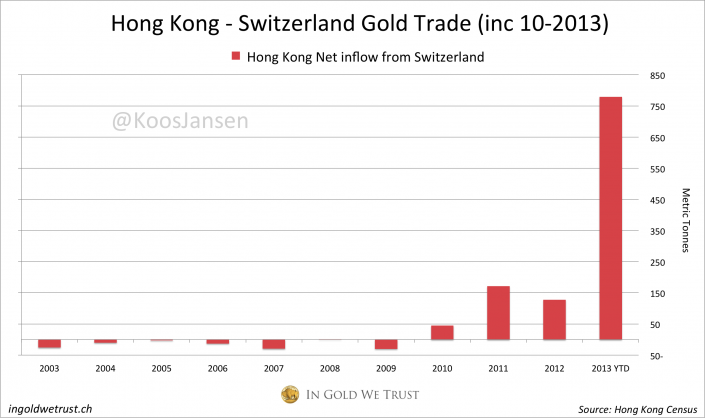

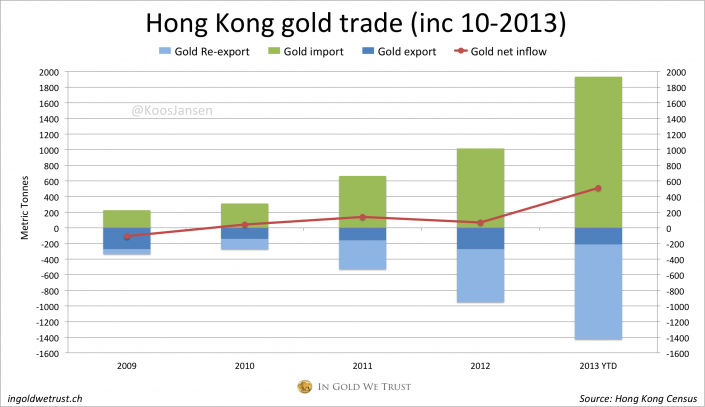

The bulk of Swiss gold export is heading east, some directly to Shanghai, some first to Hong Kong. From the Hong Kong Census And Statistics Department we know 779 tons were net imported from Switzerland into Hong Kong year to date. 651 tons more than what was net imported in total in 2012.

The Hong Kong Trading Hub

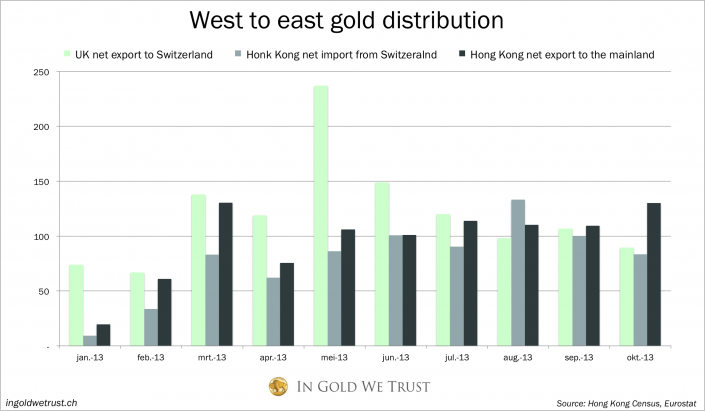

We can see a correlation between the net amount of gold that comes into Honk Kong from Switzerland and the net amount that goes out to the mainland. Concluding, most mainland net gold imports through Hong Kong are being supplied by Switzerland.

We can also see strong UK net export of gold to Switzerland prior to April (in April the price of gold crashed and Chinese physical buying exploded), but this not unusual as we can see from the “UK Gold Trade" chart ranging from 2009-2013. Often huge volumes are shipped between the UK (LBMA) and Switzerland (refineries).

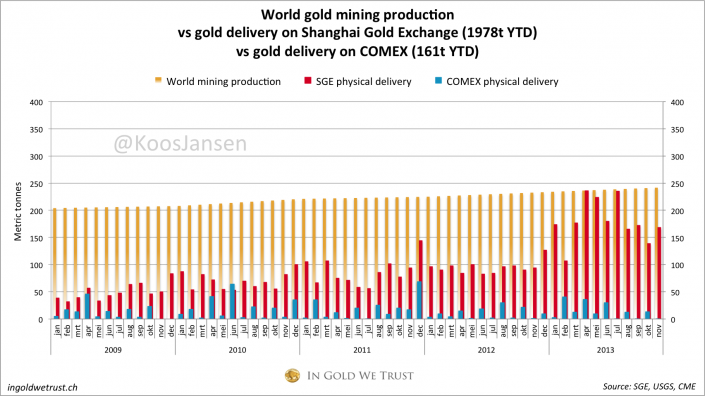

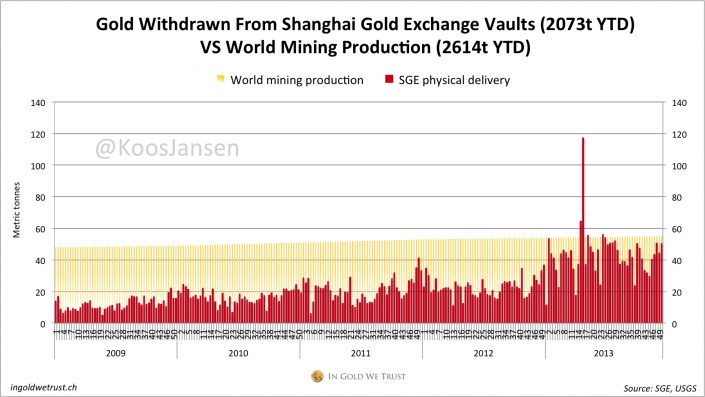

If SGE delivery is mainly supplied by import from Hong Kong, demand is certainly not waning. In November 168 tons were withdrawn from the SGE vaults, up + 21 % from October. (compared to 0.121 tons of physical delivery at the COMEX in November. More information on the differences between physical delivery at the SGE and COMEX can be found here and here)

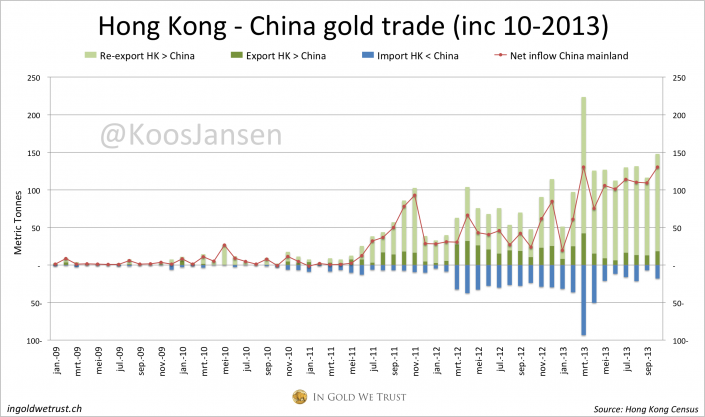

A remarkable phenomenon that has happened in Honk Kong trade earlier this year was this:

There was a huge spike in gold export from Hong Kong to the mainland in March. As if someone knew there was going to be immense demand for physical in April in the mainland. But why would anybody import expensive gold in March to sell it for bottom prices in April? The answer: Chinese import doesn’t have to work like that. Like I described in this article gold can be consigned by, in example, HSBC and ICBC.

This is how it works; the consigner HSBC (Hong Kong and Shanghai Banking Corporation) can ship the gold to the Mainland, without selling it at this stage. On arrival it has to be registered within 7 days at the SGE and move into the vaults. The gold is now merely transported, not sold.

The consignee ICBC will then ask HSBC for a quote in USD/oz (International Spot) and then decides the offer RMB price at the SGE. The SGE Premium is based upon freight costs, insurance costs, customs declaration fee, storage fee, ICBC’s profit, etc.

After the gold is sold on the SGE, ICBC must pay HSBC in USD within 2 days and also needs to let the State Administration of Foreign Exchange verify the payment.

I am aware that there was an arbitrage opportunity in early 2013 that could have explained some of the high volumes of gold trade between Hong Kong and the mainland. Though this couldn’t have explained the record net gold export, just before the price dropped in April and the SGE was stormed for physical gold.

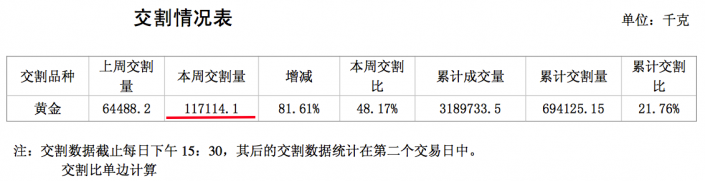

In between 22 and 26 April 117 tons of physical gold was withdrawn from the SGE vaults. That is an exceptional amount of gold to hold in stock, unless one knew demand would rise significant and had made pre orders accordingly. Just a theory..

In any case, the main vain has brought the mainland 957 tons of gold in the first ten months of this year, annualized 1148 tons. But Hong Kong is certainly not the only port through which the mainland is importing gold, my analysis shows the mainland’s total net gold import can reach up to 2000 tons this year.

Hong Kong net imported 510 tons of gold in this period. Further research should point out how much of this was smuggled into the mainland.

In Gold We Trust

Popular Blog Posts by Koos Jansen

China’s Secret Gold Supplier is Singapore

China’s Secret Gold Supplier is Singapore

Audits of U.S. Monetary Gold Severely Lack Credibility

Audits of U.S. Monetary Gold Severely Lack Credibility

China Gold Import Jan-Sep 797t. Who’s Supplying?

China Gold Import Jan-Sep 797t. Who’s Supplying?

The Gold-Backed-Oil-Yuan Futures Contract Myth

The Gold-Backed-Oil-Yuan Futures Contract Myth

Estimated Chinese Gold Reserves Surpass 20,000t

Estimated Chinese Gold Reserves Surpass 20,000t

Did the Dutch Central Bank Lie About Its Gold Bar List?

Did the Dutch Central Bank Lie About Its Gold Bar List?

PBOC Gold Purchases: Separating Facts from Speculation

PBOC Gold Purchases: Separating Facts from Speculation

U.S. Mint Releases New Fort Knox Audit Documentation

U.S. Mint Releases New Fort Knox Audit Documentation

China Net Imported 1,300t of Gold in 2016

China Net Imported 1,300t of Gold in 2016

Why SGE Withdrawals Equal Chinese Gold Demand and Why Not

Why SGE Withdrawals Equal Chinese Gold Demand and Why Not

Koos Jansen

Koos Jansen