2014 India Silver Imports At 7,063 Tonnes, Up 15%

India’s customs department, the Directorate General of Commercial Intelligence & Statistics (DGCIS), just released the QUICK ESTIMATES FOR SELECTED MAJOR COMMODITIES for December 2014. According to DGCIS the figures for December are provisional and subject to change, however, I’ve been tracking these quick estimates for months and they are reasonably accurate – compared to the official numbers that lag a few months.

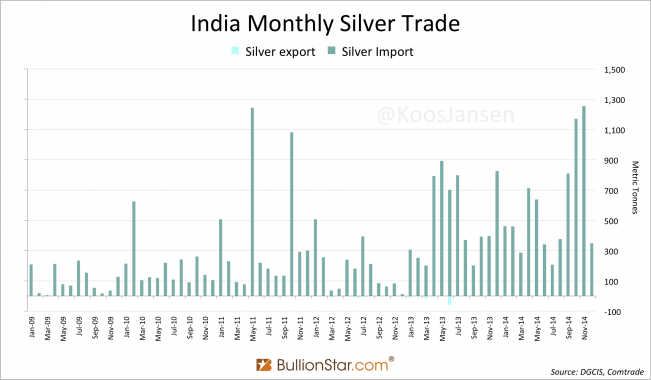

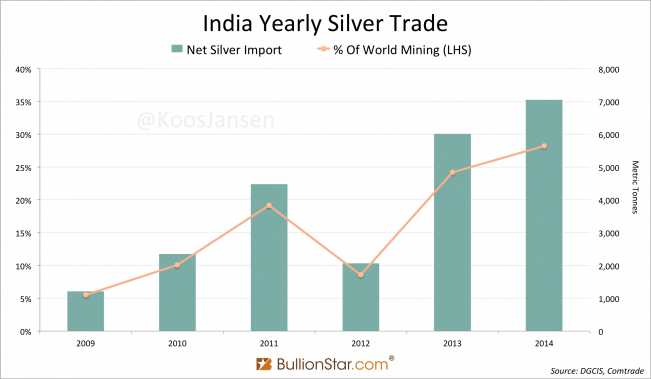

In December India imported $182.31 million in silver; divided by an average price of $16.3 an ounce this accounts for 11,188,095 ounces, or 348 tonnes, down 72 % from 1,254 tonnes in November. The total gross amount of silver imported in 2014 accounted for a whopping 7,063 tonnes, up 15 % from the shocking 6,125 tonnes in 2013. As far as my data goes back (2009) net silver import 2014, 7,055 tonnes, is a record.

Bullion Bulletin released a report in 2014, called An Empirical Study Of Silver Markets In India. In the intro it states:

Why has the silver import into India increased in 2013? We started talking to the industry. We could identify two causes – investment demand and jewelry demand. Investment demand was largely due to demand switch from gold and relative attractiveness of silver to gold.

The quick estimates do not disclose any silver export; the official numbers do, but these are negligible as we can see in the next chart.

Note, the previous charts are build from numbers on silver as disclosed by the DGCIS, I do not know how much silver is exported in the form of jewelry or silverware. There are numbers available about the value of silver jewelry exports from India, published by the Gem & Jewelry Export Promotion Council (GJEPC), however these values can capture fabrication costs, gems and other precious metals. There for I don’t feel comfortable deriving exported silver tonnage from GJEPC data.

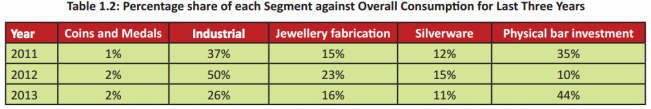

According to Bullion Bulletin total silver demand in India has been strong in recent years, 3,381 tonnes in 2010, 5,519 tonnes in 2011, 3,890 tonnes in 2012 and 5,822 in 2013. This demonstrates little silver import, as disclosed by DGCIS, is exported in the form of jewelry, silverware or industrial products.

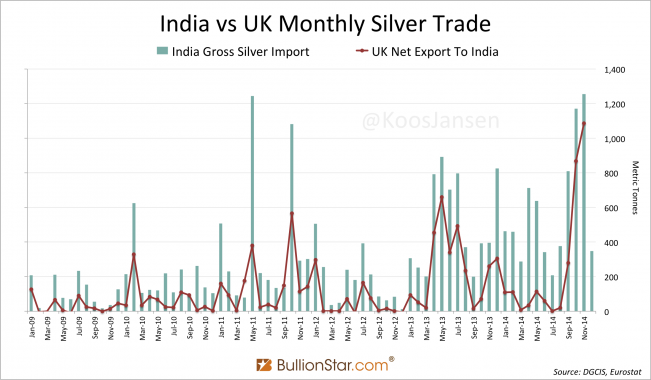

Large inflows of silver into India are often supplied by the UK; we can see a clear pattern if we compare India gross import with UK net export to India.

Meaning the UK, the London Bullion Market, is drained from silver by the East just like it’s drained from gold by the East. I don’t see any silver shortages in the near term in the UK, but I’ll keep an eye on it.

Popular Blog Posts by Koos Jansen

China’s Secret Gold Supplier is Singapore

China’s Secret Gold Supplier is Singapore

Audits of U.S. Monetary Gold Severely Lack Credibility

Audits of U.S. Monetary Gold Severely Lack Credibility

China Gold Import Jan-Sep 797t. Who’s Supplying?

China Gold Import Jan-Sep 797t. Who’s Supplying?

The Gold-Backed-Oil-Yuan Futures Contract Myth

The Gold-Backed-Oil-Yuan Futures Contract Myth

Estimated Chinese Gold Reserves Surpass 20,000t

Estimated Chinese Gold Reserves Surpass 20,000t

Did the Dutch Central Bank Lie About Its Gold Bar List?

Did the Dutch Central Bank Lie About Its Gold Bar List?

PBOC Gold Purchases: Separating Facts from Speculation

PBOC Gold Purchases: Separating Facts from Speculation

U.S. Mint Releases New Fort Knox Audit Documentation

U.S. Mint Releases New Fort Knox Audit Documentation

China Net Imported 1,300t of Gold in 2016

China Net Imported 1,300t of Gold in 2016

Why SGE Withdrawals Equal Chinese Gold Demand and Why Not

Why SGE Withdrawals Equal Chinese Gold Demand and Why Not

Koos Jansen

Koos Jansen