Did China Know That Gold Was About to Drop in April?

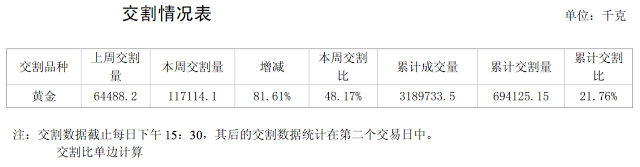

In April the price of gold made its biggest one-day percentage drop in 30 years, it fell 9% starting a bear trend that hit an intra-day price of $1180 in June. In reaction Asian demand for physical gold since the price drop in April exploded. Shanghai Gold Exchange physical delivery was 117 tons in week 17, dating from 22-4-2013 to 26-4-2013. Read a screen dump from the SGE report published 3-5-2013, it’s the second number from the left (which says 本周交割量 ).

One might wonder where 117 tons of gold comes from if physical demand suddenly picks up. One of the supply channels for China mainland is import from Hong Kong (next to mining, scrap and import from other ports). If we look at the these numbers, there is one thing that immediately jumps out.

Import didn’t surge in April or in May to supply the mainland’s demand, but it went up in March! China’s net import from Hong Kong was 61 tons in February, in March it broke all records with 130 tons, + 113 % m/m. After this all-time import record, and the vaults of the SGE were sufficiently packed, the price of gold plunged and Chinese investors bought unparalleled amounts of physical gold on the SGE. Did “some" Chinese know what was coming? Did they instigate a price drop in the paper markets? Are the Chinese co-operating (/blackmailing with $ reserves) with western central banks to get to a desired distribution of core money in a lead-up to a new monetary order? Or was it just coincidence? We don’t know, but we’ll find out in coming years.

Popular Blog Posts by Koos Jansen

China’s Secret Gold Supplier is Singapore

China’s Secret Gold Supplier is Singapore

Audits of U.S. Monetary Gold Severely Lack Credibility

Audits of U.S. Monetary Gold Severely Lack Credibility

China Gold Import Jan-Sep 797t. Who’s Supplying?

China Gold Import Jan-Sep 797t. Who’s Supplying?

The Gold-Backed-Oil-Yuan Futures Contract Myth

The Gold-Backed-Oil-Yuan Futures Contract Myth

Estimated Chinese Gold Reserves Surpass 20,000t

Estimated Chinese Gold Reserves Surpass 20,000t

Did the Dutch Central Bank Lie About Its Gold Bar List?

Did the Dutch Central Bank Lie About Its Gold Bar List?

PBOC Gold Purchases: Separating Facts from Speculation

PBOC Gold Purchases: Separating Facts from Speculation

U.S. Mint Releases New Fort Knox Audit Documentation

U.S. Mint Releases New Fort Knox Audit Documentation

China Net Imported 1,300t of Gold in 2016

China Net Imported 1,300t of Gold in 2016

Why SGE Withdrawals Equal Chinese Gold Demand and Why Not

Why SGE Withdrawals Equal Chinese Gold Demand and Why Not

Koos Jansen

Koos Jansen