Chinese Gold Demand 694 MT YTD, Silver In Backwardation

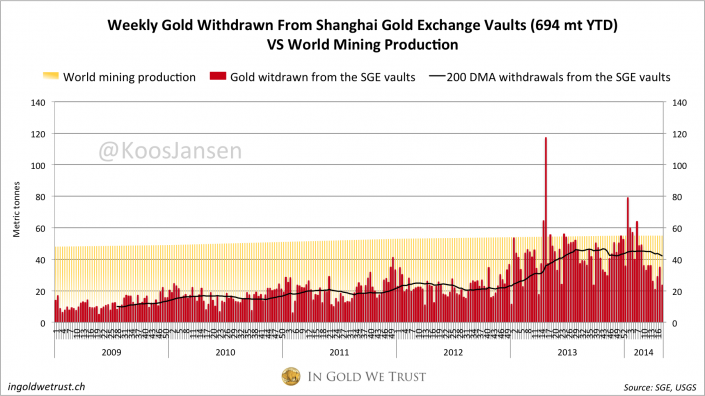

Total Chinese wholesale gold demand year to date reached 694 metric tonnes in week 18 (28-4-2014/30-4-2014), annualized 2004 tonnes. During that week 23 metric tonnes of gold were withdrawn from the vaults of the Shanghai Gold Exchange (SGE) in only three days! The SGE was closed on May 1 and 2. If the SGE would have been open for trading five days in week 18 withdrawals could have reached 39.16 tonnes, which is slightly higher than the yearly average of 38.5 tonnes. Chinese gold demand remains robust.

If at the end of December withdrawals have reached 2004 tonnes, the bulk of this had to be imported. Withdrawals can only be supplied by domestic mine output, import and scrap supply. Mine output will approximately be 430 tonnes in 2014. For scrap it’s hard to say how much is being supplied to the SGE, my conservative estimate is in between 200 and 300 tonnes this year. A quick calculation tells us how much China would need to import to fulfill the needs for non-government demand in 2014.

2004 (SGE withdrawals) – 430 (domestic mine output) – 250 (scrap supply estimate) = 1324 tonnes (non-government net import)

Weekly net import can be calculated as:

Weekly SGE withdrawals – 8.3 (430/52) – 4.8 (250/52)

In week 18 net import was 9.9 tonnes (23 – 8.3 – 4.8). Year to date net import is 467.

As regular readers of this blog know SGE withdrawals equal Chinese gold demand because of the structure of the Chinese gold market (designed by the PBOC). The Chinese silver market is very different from gold and can be compared to silver markets in other countries. Silver can be imported by everyone and sold through any exchange. Physical silver is for example being traded on the Shanghai Futures Exchange (SHFE), the South Rare Precious Metals Exchange and the SGE. All different exchanges in terms of contracts and vaulting silver on different locations in the mainland. The SHFE only has vaults in Shanghai, the South Rare Precious Metals Exchange has vaults in Yingtan, Chenzhou and Hechi. Prices on these exchanges can differ.

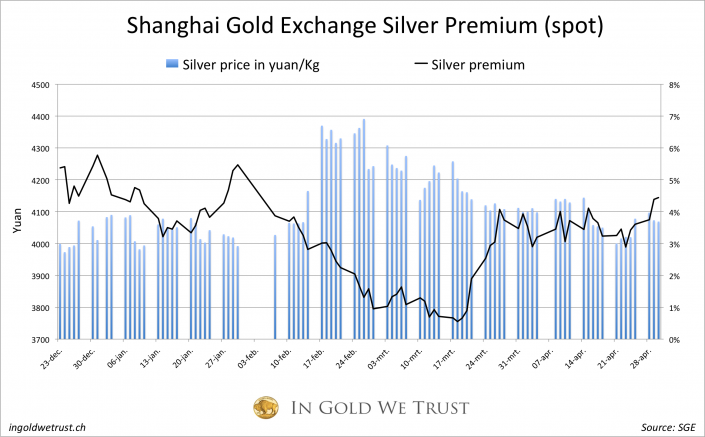

Two events currently suggest a possible shortage of physical silver in Shanghai. The first; premiums for spot silver on the SGE are rising significantly since March 17. From the weekly Chinese SGE reports we can see Shanghai silver prices transcending international prices by 4 %. The data in these reports cover up until week 18 (April 30). The SGE uses its most traded silver contract Ag(T+D) to calculate premiums. I do not have a terminal for live quotes, however, if I compare the LBMA silver fix with the SGE closing price for Ag(T+D) on May 9, the premium on silver in Shanghai has reached 5.3 %.

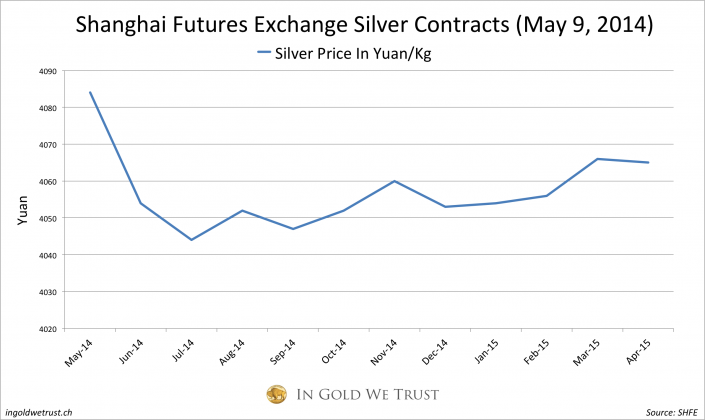

Second; on the Shanghai Futures Exchanges all silver futures contracts are trading in backwardation. Meaning the prices for the futures contracts June 2014 – April 2015 are lower than the price of the futures contract for the first delivery month May 2014. Additionally SHFE silver inventory has dropped 57 % from 575 tonnes on February 28 to 249 tonnes on May 9.

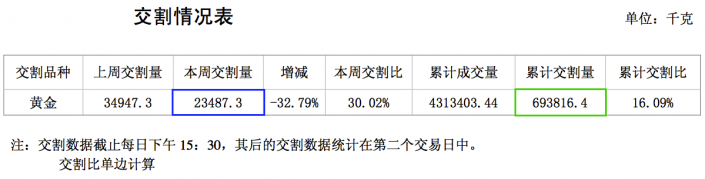

Overview Shanghai Gold Exchange data 2014 week 18

– 23 metric tonnes withdrawn in week 18 (28-4-2014/30-4-2014)

– w/w – 32.79 %

– 694 metric tonnes withdrawn year to date.

My research indicates that SGE withdrawals equal Chinese wholesale gold demand. For more information read this.

This is a screen shot from the weekly Chinese SGE trade report; the second number from the left (blue – 本周交割量) is weekly gold withdrawn from the vaults in Kg, the second number from the right (green – 累计交割量) is the total YTD.

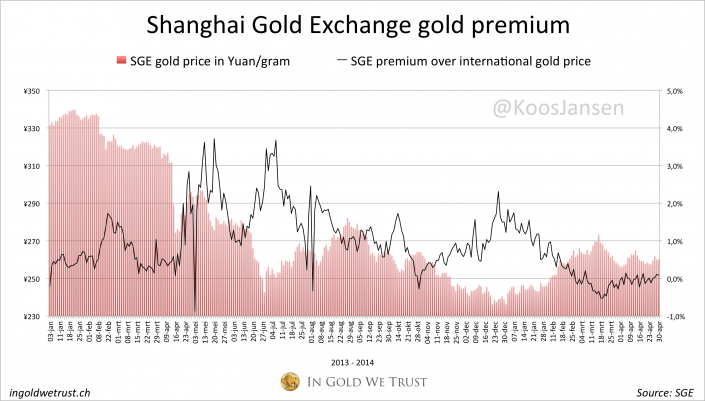

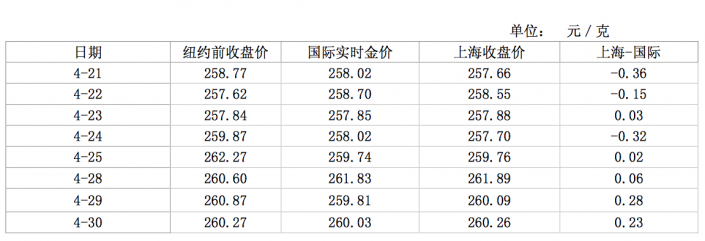

This chart shows SGE gold premiums based on data from the SGE weekly reports (it’s the difference between the SGE gold price in yuan and the international gold price in yuan).

Below is a screen shot of the premium section of the SGE weekly report; the first column is the date, the third is the international gold price in yuan, the fourth is the SGE price in yuan, and the last is the difference.

In Gold We trust

Popular Blog Posts by Koos Jansen

China’s Secret Gold Supplier is Singapore

China’s Secret Gold Supplier is Singapore

Audits of U.S. Monetary Gold Severely Lack Credibility

Audits of U.S. Monetary Gold Severely Lack Credibility

China Gold Import Jan-Sep 797t. Who’s Supplying?

China Gold Import Jan-Sep 797t. Who’s Supplying?

The Gold-Backed-Oil-Yuan Futures Contract Myth

The Gold-Backed-Oil-Yuan Futures Contract Myth

Estimated Chinese Gold Reserves Surpass 20,000t

Estimated Chinese Gold Reserves Surpass 20,000t

Did the Dutch Central Bank Lie About Its Gold Bar List?

Did the Dutch Central Bank Lie About Its Gold Bar List?

PBOC Gold Purchases: Separating Facts from Speculation

PBOC Gold Purchases: Separating Facts from Speculation

U.S. Mint Releases New Fort Knox Audit Documentation

U.S. Mint Releases New Fort Knox Audit Documentation

China Net Imported 1,300t of Gold in 2016

China Net Imported 1,300t of Gold in 2016

Why SGE Withdrawals Equal Chinese Gold Demand and Why Not

Why SGE Withdrawals Equal Chinese Gold Demand and Why Not

Koos Jansen

Koos Jansen