China Embraces Bitcoin

Bitcoins can vanish, gold can not. That’s the bottom line for me. Like most people I’m not a software engineer, for me it’s nearly impossible to ever be sure about the safety of Bitcoin. My trust in the virtual currency can only be based on my trust in software engineers. If I deposit one troy ounce of gold in a vault, I’m positive it will be there the next day having roughly the same exchange rate against goods and services. Gold is immortal and has proven to maintain it purchasing power over thousands of years. Bitcoin is not immortal and still has a lot to prove.

Money is always a matter of trust

As an Austrian I believe in free markets and little interference in the economy from governments. For thousands of years the free market has chosen gold and silver as money because they were to most marketable things. However, technological development can change this. In the end, money is whatever the free market chooses it to be.

Bitcoin has no intrinsic value? No, but money never has intrinsic value (or use value I would say), because money is never the end goal of a participant in the economy. Money is a generally accepted medium used for indirect exchange, the end goal is always a sandwich, a sweater, a house, a bike, etc. You can’t eat gold, nor can you eat dollars, Bitcoins or tally sticks.

Through technological advancement Bitcoin is suited as money and has advantages over all other currencies not be missed out. It’s decentralized, scarce and it can be used 24 hours a day to send unlimited amounts of value to the other side of the planet without a bank or government being able to interfere. In a global economy destroyed by central banks Bitcoin is a technological reaction of the free market, and thus I fully support the Bitcoin experiment.

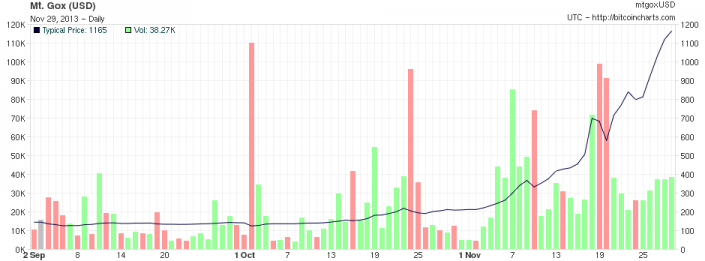

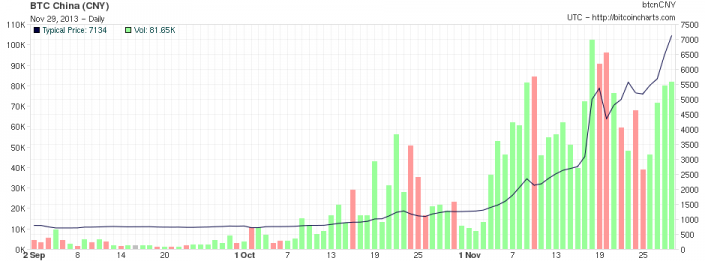

It’s fate, though, will most likely be determined in the east. China has a leading role on the world stage of economics and it’s not averse to Bitcoin. The Chinese exchanges have already surpassed the ones in the west in terms of BTC volume, and they have only just begun. Note the BTC Volumes on the left axis of the charts:

It all started after CCTV, the predominant network in the mainland, broadcasted this in May:

This documentary gives a fair few of Bitcoin. Nothing like the lies that are being spread by mainstream economists in the Netherlands, who don’t understand anything of Bitcoin or economic theory so it seems. Rejecting it because governments can’t control it, expressing their eternal discord with free markets.

In August the Chinese central bank mentioned Bitcoin as a potential “international monetary anchor", in a press release about the need for a new Bretton Woods System. Google Translate:

In the international financial crisis, “Bitcoin” In the generation algorithm, it has been restricted in mathematics Bitcoin within the next 100 years the largest stock of money is 21 million, thus forming the “anchor” recently popular. “Bitcoin” can prove to the international monetary States “anchor” desire. The current international monetary system problems inherent in addition to the “Triffin Dilemma”, but its core defect is not credible “anchor”.

And then in October China’s Google, Baidu, started accepting Bitcoin after which the price skyrocketed from $200 to over $1000, strengthening Bitcoin’s position in global finance. Let’s see where this experiment is going.

In Gold We Trust

Popular Blog Posts by Koos Jansen

China’s Secret Gold Supplier is Singapore

China’s Secret Gold Supplier is Singapore

Audits of U.S. Monetary Gold Severely Lack Credibility

Audits of U.S. Monetary Gold Severely Lack Credibility

China Gold Import Jan-Sep 797t. Who’s Supplying?

China Gold Import Jan-Sep 797t. Who’s Supplying?

The Gold-Backed-Oil-Yuan Futures Contract Myth

The Gold-Backed-Oil-Yuan Futures Contract Myth

Estimated Chinese Gold Reserves Surpass 20,000t

Estimated Chinese Gold Reserves Surpass 20,000t

Did the Dutch Central Bank Lie About Its Gold Bar List?

Did the Dutch Central Bank Lie About Its Gold Bar List?

PBOC Gold Purchases: Separating Facts from Speculation

PBOC Gold Purchases: Separating Facts from Speculation

U.S. Mint Releases New Fort Knox Audit Documentation

U.S. Mint Releases New Fort Knox Audit Documentation

China Net Imported 1,300t of Gold in 2016

China Net Imported 1,300t of Gold in 2016

Why SGE Withdrawals Equal Chinese Gold Demand and Why Not

Why SGE Withdrawals Equal Chinese Gold Demand and Why Not

Koos Jansen

Koos Jansen