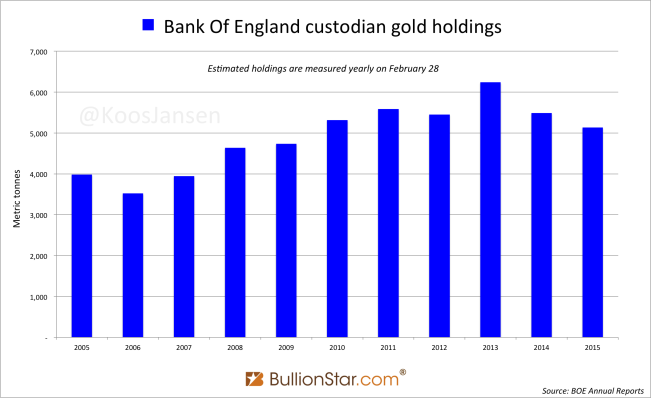

Gold in Bank of England Custody Drops 351t

The Bank Of England (BOE) has recently released its annual report in which it’s disclosed the gold held in custody for a range of customers was 5,134 metric tonnes on February 28, 2015, down 351 tonnes (6 %) form the previous year.

The data on gold in custody at the BOE is disclosed in billions of Great British Pounds. The annual report states the BOE’s custodian gold was worth £130 billion on February 28, 2015. Because the data is disclosed in round numbers the derived tonnage is an estimate.

The BOE isn’t a member of the LBMA, but members of the LBMA hold gold in custody accounts with the BOE – next to foreign central banks and international financial institutions.

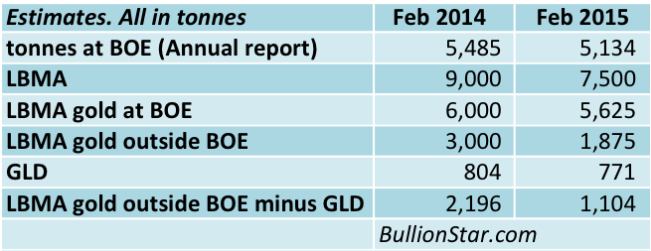

Let’s throw in some more numbers that are publicly available to get a bette handle on gold stored in London and to see if we can figure out how much gold is left in London:

Since January 2015 the LBMA website claims the total gold stored in London is 7,500 tonnes of which three quarters is stored at the BOE vaults. We’ll use 5,625 tonnes as an estimate for gold held in custody at the BOE on February 28, 2015.

From the Internet Archive it can be seen the same website claimed in April 2014 there was 9,000 tonnes in London of which two thirds was stored at the BOE. We’ll use 6,000 tonnes as an estimate for gold held in custody at the BOE in custody on February 28, 2014.

Gold from the GLD ETF is also stored in the LBMA system, at an HSBC vault located within the M25 London Orbital Ringway (typically LBMA vaults are within M25 to limit transportation and security costs), but this is all outside the BOE vaults.

The BOE could be a subcustodian for HSBC, as can be read in the GLD prospectus:

Gold bars may be held by one or more subcustodians appointed by the Custodian [HSBC], or employed by the subcustodians appointed by the Custodian, until it is transported to the Custodian’s London vault premises [the HSBC vault].

However, it’s likely in February there was nil GLD gold held by a subcustodian. From the prospectus:

As at March 31, 2015, the Custodian [HSBC] held 23,702,920 ounces of gold on behalf of the Trust [GLD] in its vault, 100% of which is allocated gold in the form of London Good Delivery gold bars with a market value of $28,135,365,641 (cost — $29,341,051,196) based on the LBMA Gold Price PM on March 31, 2015. Subcustodians held nil ounces of gold in their vaults on behalf of the Trust.

GLD was holding 771 tonnes on February 28, 2015, and 804 tonnes on February, 28, 2014.

Next is an overview of the estimates we just talked about:

- ‘tonnes at BOE’ is the data from the BOE annual reports

- ‘LBMA’ is the data from the LBMA website

- ‘LBMA gold at BOE’ is derived from the data from the LBMA website

- ‘LBMA gold outside BOE’ is ‘LBMA’ minus ‘LBMA gold at BOE’

- ‘LBMA gold outside BOE minus GLD’ is exactly what is says it is

What can be seen is that ‘tonnes at the BOE’ and ‘LBMA gold at BOE’ roughly corresponds. It can be that, ‘LBMA gold at the BOE’ includes foreign central bank gold, or put differently; foreign central bank gold at the BOE is maybe counted as gold in the LBMA system. I will further investigate this possibility.

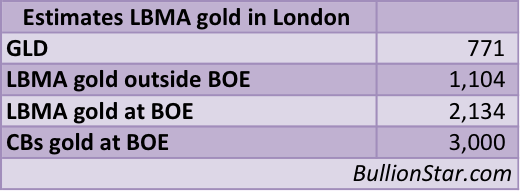

It’s hard to say how much gold foreign central banks store at the BOE, but according to my estimates it is at least 2,000 tonnes – based on data from the central bank of the Netherlands (123t), Austria (230t), Germany (441t), Australia (80t), Switzerland (208t), Sweden (61t), Finland (25t), Belgium (±200t) and India (±250t) in addition to the IMF (±450t).

Let us assume foreign central banks store 3,000 tonnes at the BOE. This means the floating supply of London Good Delivery bars at the BOE is:

5,134 (annual report) – 3,000 (foreign central banks) = 2,134 tonnes

‘LBMA gold outside BOE minus GLD’ (exhibit 2) = 1,104 tonnes

Summed up, there is an estimated 3,238 tonnes of floating supply in London. This excludes GLD and gold stored by foreign central banks at the BOE.

This post will be continued.

Popular Blog Posts by Koos Jansen

China’s Secret Gold Supplier is Singapore

China’s Secret Gold Supplier is Singapore

Audits of U.S. Monetary Gold Severely Lack Credibility

Audits of U.S. Monetary Gold Severely Lack Credibility

China Gold Import Jan-Sep 797t. Who’s Supplying?

China Gold Import Jan-Sep 797t. Who’s Supplying?

The Gold-Backed-Oil-Yuan Futures Contract Myth

The Gold-Backed-Oil-Yuan Futures Contract Myth

Estimated Chinese Gold Reserves Surpass 20,000t

Estimated Chinese Gold Reserves Surpass 20,000t

Did the Dutch Central Bank Lie About Its Gold Bar List?

Did the Dutch Central Bank Lie About Its Gold Bar List?

PBOC Gold Purchases: Separating Facts from Speculation

PBOC Gold Purchases: Separating Facts from Speculation

U.S. Mint Releases New Fort Knox Audit Documentation

U.S. Mint Releases New Fort Knox Audit Documentation

China Net Imported 1,300t of Gold in 2016

China Net Imported 1,300t of Gold in 2016

Why SGE Withdrawals Equal Chinese Gold Demand and Why Not

Why SGE Withdrawals Equal Chinese Gold Demand and Why Not

Koos Jansen

Koos Jansen