Analyze This!

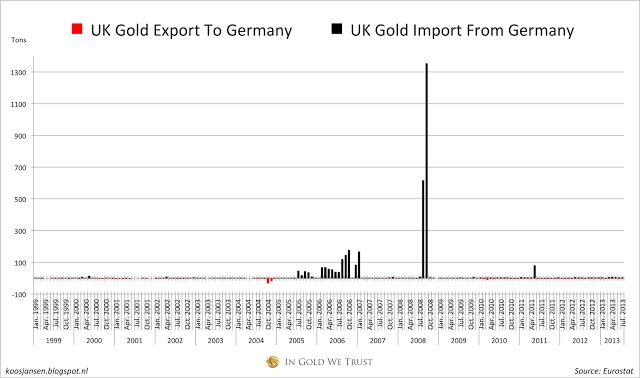

A few weeks ago I was researching UK gold trade data on the Eurostat website when I stumble upon something quite remarkable, or not. When I looked at the 2008 numbers on trade between the UK and Germany I saw a few unusual spikes. In August 2008 the UK imported 613.9 tons from Germany, in September 1351.7 tons. My first thought was this had to be a couple of obesity fingers and an elbow, I closed the file and stopped thinking about it. But yesterday it came back to me and I decided to do a chart from the first months available till present.

|

| Gold trade between the UK and Germany |

Although I can’t think of a single German source that would be able to cough up 1956.6 tons of gold in two months, I opened up to the possibility it wasn’t a fat finger. The dates of the trades are very suspicious, Lehman Brothers collapsed on 15 September. If these trades happened it could imply that certain authorities knew what was coming and distributed huge amounts of gold to the LBMA vaults, so these were sufficiently packed when the stock market would crash and demand for physical gold would explode. Just a theory..

|

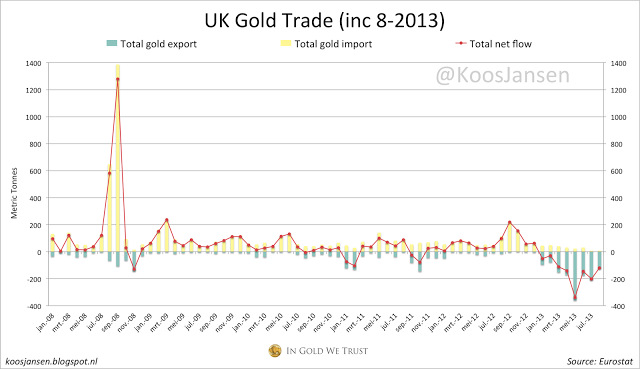

| Total UK gold trade |

But, as we can see from the next more detailed chart, the gold didn’t go out of the UK right after the crash in September, significant outflows started this year. The gold, in theory, could have stayed in London because the bars were in the Good Delivery system (the LBMA standard) and there were no foreign buyers who had the desire to ship the gold home.

The gold was declared by the UK as import from Germany, but Germany never declared the matching export, according to Eurostat. All in all I can’t jump any conclusions on the 2008 trade data between the UK and Germany, but I would like to invite everyone to comment below if he can think of a plausible theory.

Popular Blog Posts by Koos Jansen

China’s Secret Gold Supplier is Singapore

China’s Secret Gold Supplier is Singapore

Audits of U.S. Monetary Gold Severely Lack Credibility

Audits of U.S. Monetary Gold Severely Lack Credibility

China Gold Import Jan-Sep 797t. Who’s Supplying?

China Gold Import Jan-Sep 797t. Who’s Supplying?

The Gold-Backed-Oil-Yuan Futures Contract Myth

The Gold-Backed-Oil-Yuan Futures Contract Myth

Estimated Chinese Gold Reserves Surpass 20,000t

Estimated Chinese Gold Reserves Surpass 20,000t

Did the Dutch Central Bank Lie About Its Gold Bar List?

Did the Dutch Central Bank Lie About Its Gold Bar List?

PBOC Gold Purchases: Separating Facts from Speculation

PBOC Gold Purchases: Separating Facts from Speculation

U.S. Mint Releases New Fort Knox Audit Documentation

U.S. Mint Releases New Fort Knox Audit Documentation

China Net Imported 1,300t of Gold in 2016

China Net Imported 1,300t of Gold in 2016

Why SGE Withdrawals Equal Chinese Gold Demand and Why Not

Why SGE Withdrawals Equal Chinese Gold Demand and Why Not

Koos Jansen

Koos Jansen