#SilverSqueeze: Physical Silver Shortage vs. Paper Silver

The silver short squeeze in physical silver at present is unprecedented. Even so, the spot price of paper silver is not even close to the real physical equilibrium price of silver. BullionStar may soon have no option but to abandon setting prices based on silver spot price altogether and move to fixed prices.

Thanks to r/WallStreetBets (WSB) and related spin offs, the wider public is starting to open its eyes to the corruption and cronyism in the financial markets including in the paper gold and paper silver markets.

For years, BullionStar has been one of the strongest critics of the manipulated precious metals markets where paper issuance of silver (out of thin air) exceeds the physical availability of real silver at a multiple of at least 100 to 1.

While some in the WSB movement have suggested purchases of SLV shares and call options, many others are recommending physical silver. It’s important to understand that purchases of SLV shares does not equate to putting pressure on bullion banks. Bullion banks provide various services to ETF’s, such as custodial services, and ETF’s are known for colluding with central banks. The only way to put pressure on the corrupted paper silver market and on the bullion banks is to buy physical silver. Only then is there a chance that price discovery for real physical silver will shift to be based on the actual trading of physical silver instead of being inherited from synthetic paper trading prone to manipulation.

Click here to see what silver bullion items we currently have in stock.

Click here to see what silver bullion items we currently have in stock.

This week may be the most interesting week for silver savers and investors in decades. The questions asked by this movement are of huge importance for the whole financial and monetary system.

– Is what we are seeing the start of a seminal silver crisis with the potential of finally bringing down the manipulated paper silver market?

– Can this movement lead to an attack of the very nature of unbacked fiat currency?

– Will the bullion banks try to smash the paper spot and paper futures prices back down and if so, will the price of physical silver definitively disconnect from the paper price?

– Can COMEX and SLV really source the physical silver required amidst the high demand?

Paper Silver Manipulation

What was claimed to be a conspiracy theory of bullion banks colluding to manipulate and suppress the paper price of precious metals have been proven true again and again.

BullionStar has also exposed, for example here, here, here, here, here, and here how the precious metals industry organisations, like the London Bullion Market Association (LBMA), protect the interests of the paper dealing bullion banks rather than further the interest of physical producers and dealers.

Suppressing the paper price of gold and silver goes to the very core, not only of the financial system, but to the whole monetary system. In Gold & Silver Price Manipulation – The Greatest Trick ever Pulled, we wrote:

Manipulating gold and silver prices by spoofing futures trades and cancelling them is one thing. Central bank intervention into physical gold markets to dampen the gold price is another. But perhaps the most far reaching yet unappreciated method of manipulation is sitting there in plain sight, and that is the very structure of the contemporary ‘gold’ and ‘silver’ markets where prices are established by trading in vast quantities of fractionally-backed synthetic gold and silver credit, be it in the form of vast quantities of unallocated positions that are ‘gold’ or ‘silver’ in name only, or in the form of gold and silver futures which haven’t the slightest connection with CME approved precious metals vaults and warehouses.

By siphoning off demand for real gold and silver and channeling it into unbacked or fractionally-backed credits and futures, the central banks and their bullion bank counterparts have done an amazing job in creating an entire market structure of futures and synthetics trading that is unconnected to the physical gold and silver markets. This structure siphons off demand away from the physical precious metals markets, and in doing so, creates a system of price discovery which is nothing to do with physical gold and silver supply and demand.

Apart from fractional-reserve banking, precious metals market structure is perhaps one of the biggest cons on the planet. So next time you think of precious metals manipulation, remember that in addition to spoofing and secretive central bank gold loans, the entire structure of the precious metals markets is unfortunately one big manipulation hiding in plain sight.

Silver Price Suppression

Another contributor to the suppression of the paper price for gold and silver is the government manipulation of inflation figures.

Using ShadowStats Alternate CPI, the real inflation-adjusted All-Time-High for silver is US$ 966.77. Yes, nearly US $1,000!

Following BullionStar’s post on the real inflation-adjusted ATH for silver, many followers of WSB has referenced to US$ 1,000 as the price target for silver. A ZeroHedge post from today with more than 2.1M views and 9K comments also makes reference to this price calculated by BullionStar while noting that the silver bullion market is one of the most manipulated on earth.

It’s important for banks, central banks and governments to ensure that precious metals prices remain subdued. This is so because precious metals still indirectly backstops the whole monetary system. If the price of gold and silver were to skyrocket, it would expose that the emperor has no clothes, i.e. that fiat currency is intrinsically worthless.

Central banks and governments have employed a two pronged approach, where on one hand, the money supply is increased via Quantitative Easing to prop up bank and vested interests while on the other hand, the paper price of gold and silver is suppressed.

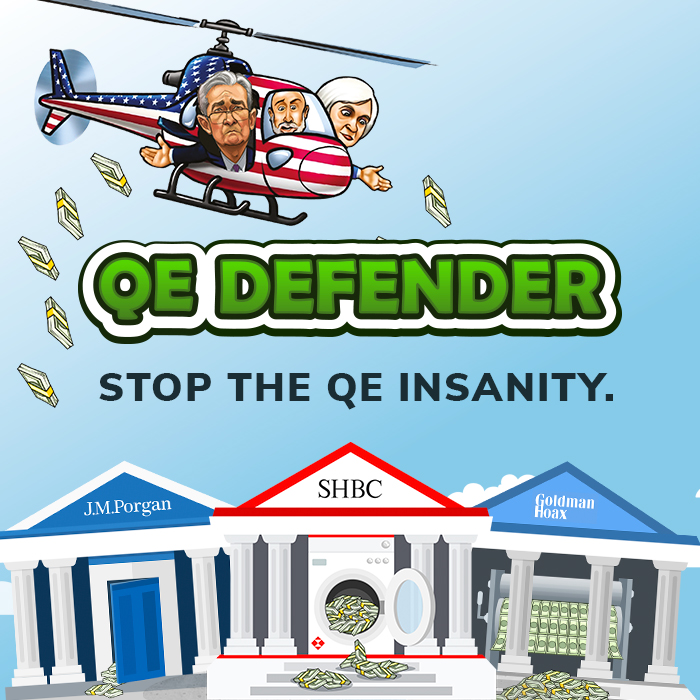

The QE Defender Game developed by BullionStar illustrates how central banks are propping up banks while suppressing gold and silver prices. Give the game a go and see which level you can reach!

Play BullionStar’s QE Defender game that illustrates how the central banks are propping up the banks while at the same time suppressing gold and silver prices.

Play BullionStar’s QE Defender game that illustrates how the central banks are propping up the banks while at the same time suppressing gold and silver prices.

Physical gold and silver is measured in weight, has intrinsic value due to its metallic and monetary characteristics and is money in the true sense. The currency of today is not backed by anything and has no monetary properties. Its value is dependent merely on a (false) perception of value. While BullionStar accepts cryptocurrency for order settlement of both buy and sell orders, cryptocurrency can not replace the age-old monetary properties of precious metals as the ultimate wealth asset.

BullionStar was one of the first bullion dealers in the world to accept Bitcoin as payment for bullion back in 2014.

BullionStar was one of the first bullion dealers in the world to accept Bitcoin as payment for bullion back in 2014.

Paper Silver Price vs. Physical Silver Price

Silver price discovery, which is how the price of silver is established by the market, is akin to a game of charades. Price discovery is based on paper silver spot trading in London and paper silver futures trading in New York. The whole charade is based on the premise of little to no real physical silver ever changing hands. If holders of paper silver were to demand delivery of physical silver, supply would quickly run out, which is exactly what is happening right now. Historically however, almost all paper silver transactions have been digitally cash settled without anyone ever seeing any silver.

As there is no central market place for the trading of physical silver, the price for physical silver has been inherited from the spot and futures paper markets with an added premium covering the costs for refining, minting, shipping, storage, insurance and retail. With the developments over the last few days of investors shifting away from paper silver and taking delivery of physical silver, the whole market construct for precious metals is changing.

Price Disconnect between Paper Silver Price and Physical Silver Price

Despite the 16.2% silver spot price increase from USD 25.58 a week ago to USD 29.72 at the time of writing, the spot price of silver still does not reflect the demand and supply on the physical silver market.

Spot Price of Silver in US Dollars

Spot Price of Silver in US Dollars

Over the last few days, we have seen unprecedented demand for silver bars and silver coins at BullionStar. We currently have about 25 customers buying silver from us for every 1 customer selling. Typically, this ratio is about 2-3 customers buying for every customer selling.

To be able to handle the demand pressure, we have had to introduce a minimum order amount of SGD 499 or equivalent in other currencies. Our team members are working around the clock to try to fulfil all orders that have been placed. Our order volume, call volume and email volume is up exponentially, around ten times to normal.

Furthermore, as the silver squeeze and shortage is getting more serious by the hour, we do not expect to be able to replenish many silver products anytime soon. As the spot price does not match the demand on the physical market, we have had to significantly increase price premiums for silver.

We currently offer Canadian Silver Maples – 1 oz 2021 for a price premium from 29.4 %. This is almost double the premium a few days ago. American Silver Eagles – 1 oz 2021 are offered at a premium of 46%, more than double the premium a few days ago.

Many, if not most, of our competitors worldwide are already sold out of all physical silver bullion. At BullionStar, our strategy is to stock additional physical gold and silver inventory aggressively at higher than normal levels at the first sign of market instability. We therefore still have available supply of the most popular silver products.

Paper Silver Market Default/Failure – Moving to Fixed Prices

As more savers and investors take physical delivery of silver, we believe that there is a significant risk that some of the silver paper markets may default in that they are not able to deliver physical silver in exchange for the paper silver. Baring a full default, the paper price of silver may continue to inaccurately reflect the demand and supply of real physical silver.

With all supply of physical silver drying up at an incredible pace, it is becoming increasingly difficult for us to set prices and price premiums.

Unless the spot spot price of paper silver starts to reflect the real physical equilibrium price of silver, BullionStar may soon have no option but to abandon setting prices based on silver spot price altogether and move to fixed prices.

Worldwide Shipping of Bullion – Reduced Shipping Rates

With the WSB movement starting in the United States, we note that nearly all US bullion dealers seem to be completely sold out on physical silver.

We are currently experiencing a record inflow of new customers. Setting up a BullionStar account is a straightforward 1 minute process. Simply open an account by filling in your details and start trading physical precious metals.

BullionStar ships bullion to most countries worldwide including the United States. To view shipping rates, add the desired bullion to your shopping cart and go to the checkout where you select “Shipping by Courier" to view the shipping cost.

Popular Blog Posts by BullionStar

How Much Gold is in the FIFA World Cup Trophy?

How Much Gold is in the FIFA World Cup Trophy?

Essentials of China's Gold Market

Essentials of China's Gold Market

Singapore Rated the World’s Safest & Most Secure Nation

Singapore Rated the World’s Safest & Most Secure Nation

Infographic: Gold Exchange-Traded Fund (ETF) Mechanics

Infographic: Gold Exchange-Traded Fund (ETF) Mechanics

BullionStar Financials FY 2020 – Year in Review

BullionStar Financials FY 2020 – Year in Review

Why It’s Time to Stop Taxing Gold & Silver

Why It’s Time to Stop Taxing Gold & Silver

Why a Powerful Silver Bull Market May Be Ahead

Why a Powerful Silver Bull Market May Be Ahead

What’s Driving Gold to All-Time Highs?

What’s Driving Gold to All-Time Highs?

What You Need to Know About Gold's Long-Term Bull Market

What You Need to Know About Gold's Long-Term Bull Market

BullionStar Financials FY 2023 – Year in Review

BullionStar Financials FY 2023 – Year in Review

BullionStar

BullionStar 4 Comments

4 Comments