LBMA Threatens to Blacklist Entire Gold Trading Centres

In a move in early November which is already causing controversy, self-styled gold market authority, the bullion-bank controlled London Bullion Market Association (LBMA), issued a letter to a group of leading bullion markets around the world, threatening to blacklist gold bullion from any country that fails to meet new LBMA recommendations covering gold sourcing and supply chains, the elimination of cash transactions, and the support for artisanal and small scale mining (ASM).

These recommendations, which have no legal standing, attempt to coerce the bullion markets into examining and verifying the supply chains of gold, while forcing co-operation with regional and international organisations.

The LBMA letter, dated 6 November, is addressed to national authorities in the following major bullion markets, markets which the LBMA refers to as International Bullion Centres (IBCs): China, Hong Kong, India, Russia, Japan, Singapore, Turkey, United Arab Emirates, South Africa, Switzerland, the United States, and the United Kingdom.

LBMA, established and run by bullion banks and never elected by anyone to be an authority, now ups the ante in bullying international gold bullion markets – “Gold market authority threatens to blacklist UAE and other centres” | Reuters https://t.co/pa6MvTqFTr

— BullionStar (@BullionStar) November 12, 2020

Ostensibly pitched as an initiative in support of both the OECD Due Diligence Guidance on Responsible Mineral Supply Chains and the Financial Action Task Force’s (FATF) guidance on money laundering, the LBMA’s real agenda, as is often the case, is otherwise, with the letter and the LBMA’s recommendations taking particular aim at bullion centres in the United Arab Emirates (Dubai) and India.

This is clearly illustrated in a report on ‘the Letter’ from none other than the LBMA’s favorite reporting mouthpiece – Reuters, and its LBMA embedded reporter Peter Hobson, who in an ‘exclusive’ dated 12 November titled “Gold market authority threatens to blacklist UAE and other centres” says that:

“The world’s most influential gold market authority is threatening to stop bullion from countries including the United Arab Emirates entering the mainstream market if they fail to meet regulatory standards, a letter seen by Reuters showed.”

Hobson then spends a good portion of the remainder of the Reuters article discussing Dubai, revealing that drafting the letter was a team effort, and that the main reason for this LBMA smokescreen is to target Dubai:

“The LBMA letter did not target any centre in particular, but four people involved in drafting it told Reuters the gold industry in Dubai in the United Arab Emirates (UAE) was the main focus."

“The whole bullion centres initiative is because of serious issues in Dubai,” one of the sources said. “Unless they shape up, the LBMA by early next year will say refiners can’t source from Dubai.”

Some clues as to identities of the behind the scenes actors who influenced the writing of the LBMA letter are also provided by Reuters:

“The LBMA is a trade group rather than a state agency but it holds sway over the market because the large international banks that dominate gold trading typically only deal with metal from refineries the association has accredited."

The UAE is one of the world’s largest gold hubs and exports bullion worth billions of dollars to refiners accredited by the LBMA each year. The Financial Action Task Force (FATF), an intergovernmental anti- money laundering monitor, has criticised its controls, as have non-governmental organsations (NGOs).

Off the bat, we can therefore say that LBMA bullion banks, the OECD’s FATF, and the politically backed so-called NGOs are part of the behind the scenes influencers.

Elsewhere in the letter to the International Bullion Centres (a letter which by the way has not been published anywhere), Reuters reveals that the LBMA has asked:

“recipients to declare their support for the LBMA’s standards by 11 December and share an action plan for their implementation by the end of January, if they have not been met.”

If this sounds eerily similar to the ”you’re either with us or against us“ bullying tactics of major political powers when forcing unaligned powers into conflict, you would be correct – it is. But it gets worse, since the letter says that:

“A lack of cooperation or unwillingness to publicly commit to these standards and share a proposed timeline with the LBMA will mean LBMA may no longer permit GDL Refiners to source material which has originated from or passed through the International Bullion Centre.”

Sounding more like a head-mistress of a girls’ school than a CEO, the LBMA Chief Executive Ruth Crowell told Reuters: “We are also committed to act if there is not meaningful and effective improvement”.

Later on 12 November, the Financial Times picked up on the LBMA news in an article by Henry Sanderson titled “Bullion industry group threatens to blacklist suppliers that do not meet OECD standards”, where it too had a head-mistressesque quote from Crowell, to wit:

“’The ultimate stick is that we could say to these jurisdictions that they are no longer considered credible and therefore not responsible sources of gold’, Ruth Crowell, chief executive of the LBMA, told the Financial Times.”

Reeks of Hypocrisy

Beyond the fact that the LBMA is not a global authority on telling bullion markets what they can and cannot do, these latest moves show the gross hypocrisy of the LBMA in lecturing others about ethics and business practices when all the while some of the LBMA’s most powerful member banks, banks that essentially run and control the LBMA, have recently been prosecuted and fined for the manipulation of precious metals prices in both criminal and civil actions. Such actions have been brought by both the US Department of Justice (DoJ) and the Commodities Futures Trading Commission (CFTC).

This includes two of the LBMA’s most powerful banks, JPMorgan Chase & Co, fined US $920 million in September 2020 for multiyear trading schemes to defraud gold and silver markets, and Scotiabank (The Bank of Nova Scotia) fined US $127 million in August 2020 for precious metals price manipulation. In 2018, the same US authorities (DoJ and CFTC) also fined other LBMA big hitters HSBC, UBS and (formerly) Deutsche Bank for engaging in spoofing of precious metals prices.

Not to forget that in 2014, Barclays Bank was fined £26m by the UK Financial Conduct Authority (FCA) for trading misconduct in precious metals prices. In the same year, the FCA also fined Swiss bank UBS for precious metals price manipulation.

All of these banks are and were the most powerful members of the LBMA. JP Morgan, Scotiabank, HSBC, and UBS are four of the five members of the LBMA’s London Precious Metals Clearing Limited (LPMCL), the group of banks which clears all precious metals trades in the London market. JP Morgan and HSBC operate the two biggest precious metals vaults in the LBMA’s London vaulting system.

JP Morgan, Scotiabank, HSBC, and UBS are all market making members of the LBMA. Market making members are the most important trading members of the LBMA. JP Morgan and HSBC are direct participants in the LBMA’s daily Gold Price and Silver Price auctions, the successors to the LBMA’s London Gold Fixing and London Silver Fixing auctions.

As recently as September 2020, two former Deutsche Bank precious metals traders were found guilty by the US DoJ of fraudulent and manipulative trading practices in precious metals futures contracts on the COMEX exchange. One of these individuals, James Vorley, was even a director of the London Gold Fixing company during the time period for which he has been convicted of precious metals price manipulation.

On 16 September 2019, the US Department of Justice charged JP Morgan traders with a multi-year market manipulation racketeering conspiracy to manipulate precious metals futures contracts. One of these traders is Michael Nowak, who was JP Morgan’s head of precious metals trading and who, when charged, was on the LBMA Board! It was only after the DoJ charged Nowak, that the LBMA was forced to remove Nowak from the LBMA board on 20 September 2019.

Until recently, representatives from these powerful banks such as JP Morgan and Scotiabank were the core contingent (market making member representatives) on the Board of Directors of the LBMA.

In 2017, the LBMA implemented its Global Precious Metals Code, a code which claims to “promote a fair effective and transparent market” and a code to which all LBMA members, including JP Morgan, have attested their conformance to by signing a Statement of Commitment. In the words of LBMA CEO Rutch Crowell:

“The Global Precious Metals Code is a code of conduct which promotes a fair effective and transparent market. It provides market participants with Principles and Guidance to uphold high standards of business conduct. All of this creates confidence in the market for all participants.”

Despite this, manipulation in the precious metals markets continued, with LBMA heavy weights such as JP Morgan and Scotia involved in bigger and bigger gold and silver price manipulations.

This huge litany of criminal manipulations by the powerful bullion bank members of the LBMA shows that the LBMA is not supportive of the physical precious metals markets. In fact, quite the opposite. The banks which run the LBMA have been proven to be undermining the physical gold and silver markets on a global scale through price manipulation and market misconduct. The LBMA is also Orwellian in calling for transparency and ethics, yet stacked to the rafters with criminal bullion banks whose opaque bullion dealings around the world go unchecked.

Dubai’s DMCC is not Impressed

It didn’t take long for some of the bullion centres on the LBMA hitlist to retort with their responses, responses which basically boiled down to:

• How do the LBMA have the audacity thinking that they can blacklist and cut off major financial centres from the bullion market?

• On what basis does the LBMA think that it’s the global authority on precious metals?

Not surprisingly, the most forceful response to date has come from Dubai, specifically from the executive chairman of the Dubai Multi Commodities Centre (DMCC), Ahmed Bin Sulayem. In a strongly-worded post dated 17 November which will raise a few eyebrows, Bin Sulayem writes that:

“LBMA’s authoritarian approach to maintain its majority control through conjecture and double standards has worn out its welcome with the rest of the world which increasingly believes it is time for a fully transparent regulator, composed of an international coalition that is equipped to authorise or blacklist stakeholders based on meritocracy and not self-serving interests.”

Bin Sulayem goes on:

“Should LBMA make good on its proposed strategy, it will be the first time a market or state authority has raised the possibility of cutting off the bullion industry in a major financial centre, a ploy akin to changing the rules of Monopoly on a discretionary basis in order to keep other players off the board.”

“I wonder if anyone at LBMA is concerned about being sued by the World Trade Organisation or UK Courts for attempting to maintain its cartel-like control over an industry by imposing its own discretionary brand of blacklisting, without being a democratically elected trade body?"

“Similarly, to the NGOs that peddle the same narrative with zero accountability, there is an increasing awareness that LBMA’s purpose has become one of industrial hegemony with an agenda to disrupt any centres that threaten its market share."

And there’s more. Bin Sulayem continues:

“In a sense, LBMA’s approach is understandable, given its origins in a bygone era where control was seized, not negotiated and while the British Empire may have had the power to enforce its position a hundred years ago, it is certainly less compelling in today’s increasingly transparent marketplace.”

“perhaps it is time for the sun to set on LBMA and its delusional leadership in order for it to make way for an effective, untied, democratically elected regulator that functions under a policy of inclusion, not subjugation.”

In his response, Bin Sulayem also highlighted the double standards of the LBMA, asking why the the London based association did not call for a ban on gold imports from the United States when two former LBMA member refiners based in the US, Republic Metals Corporation and NTR Metals, declared for bankruptcy “after being unable to account for large amounts of precious metal or be charged by federal prosecutors in Miami for buying $3.6bn in illegal gold from criminal groups in Latin America respectively”.

The Indian Reaction

Across the Arabian sea to the east of Dubai, Indian financial publication MoneyControl, in an article dated 13 November, captures the Indian bullion sector’s reaction to the LBMA letter, saying that:

“The LBMA letter has irked the Indian bullion industry, which feels that the London body has acted arbitrarily. There are suggestions that the Indian bullion trade join hands with Dubai trade and come out with their own standards that will be widely acceptable.”

The LBMA letter has also led to fears that it could lead to vested interests monopolising the trade and this is one reason why Indian players think that main gold buying nations such as India and China could come together and set new norms in bullion trade.

The article continues that the Indian sector is suspicious about why the LBMA is only targeting selective bullion trading markets such as Dubai and India, and not the gold mining countries (such as in Africa) that it has issues with over the origin of gold.

According to MoneyControl, the general view from the Indian bullion sector is that LBMA is an association set up to protect the interest of its members and that “the initiative should probably come from the United Nations Security Council in the [same] way it passed a resolution on “blood” diamonds.”

A further article from the same Indian publication, dated 20 November, says that the Indian bullion sector is now also “questioning the LBMA letter on the grounds that the London association is trying to implement monopolistic policies” and that the Indian bullion industry is in discussions on formulating its own policy. The same article also reveals that “Russia has also questioned LBMA’s letter", according to trade sources”.

Delusions of Grandeur

At this conjuncture let’s consider how the LBMA can think that it is the “global authority for precious metals”, as is frequently claimed on the LBMA website and in the various LBMA publications such as here.

Because at the end of the day, the LBMA is all about the world’s most powerful banks controlling the global bullion market. Remember that the LBMA was set up in 1987 by a group of powerful bullion banks at the behest of the Bank of England. The founding banks were the six powerful banks involved in the London bullion market, namely N.M. Rothschild & Sons, Morgan Guaranty Trust Company of New York (part of JP Morgan), J.Aron & Company (now part of Goldman Sachs), Mocatta & Goldsmid Ltd (acquired by Scotia), the old Sharps Pixley (acquired by Deutsche Bank), and Rudolf Wolff & Company. The original registered office of the LBMA when it was established in December 1987 was N.M. Rothschilds’ offices in New Court, St Swithin’s Lane, London.

Upon establishment, the consortium expanded to include the powerful Swiss bullion banks UBS and Credit Suisse, as well as the long-standing Midland Montagu and Edmond Safra’s Republic (both of which were subsumed into HSBC). Along the way additional banks came on board, such as Barclays (tapped by Rothschild), Standard Chartered, and Standard Bank – evolving into the cartel of banks that you see more recently in the composition of the LBMA Board, the LBMA market makers lists (JP Morgan Chase, HSBC, Bank of Nova Scotia, UBS Goldman Sachs, ICBC Standard, Standard Chartered, Citibank, Morgan Stanley, BNP Paribas, Merrill Lynch, Toronto-Dominion Bank), and the LBMA bank members of the unallocated metals clearing system LPMCL (JP Morgan, Scotia, HSBC, UBS and ICBC Standard).

The LBMA is an association so dominated by bullion banks that it might be more correctly called the London Bullion Bank Market Association. In short, the LBMA is a joint-venture and a cartel, a consortium of banks that between them control everything about the bullion market, from the gold mines which these banks finance, to the control of gold price discovery using unallocated gold and gold futures, to the control of the international cross-border gold flow trade, and through to gold refining. And all under the watchful eye of the Bank of England.

LBMA is the global authority for precious metals only because it (the trade association that fronts the bullion bank cartel) says so. Why should the LBMA be the global regulator of the gold market?

In regards to the LBMA’s call for international bullion centers to eliminate cash transactions, this is also a demand which primarily serves the vested interests of its bullion bank members. Of course the establishment international bullion banks want to eliminate cash transactions, precisely because they want to control all financial transactions and be judge and jury on who can trade or not.

OECD – LBMA – COVID Opportunism

So where has this new attack by the LBMA arisen from and how has it been pitched?

Following the publication of its letter to the International Bullion Centres (IBCs) in early November, the LBMA issued a press release on 17 November, stating that its letter and recommendations that it expects bullion markets “to adopt” was undertaken so as “to support the OECD Due Diligence Guidance framework and recognise the key findings from the Financial Action Task Force”.

As a reminder, the OECD is the Organisation for Economic Co-operation and Development, the globalist club of rich countries headquartered in Paris. The Financial Action Task Force of FATF is a construct of the Group of Seven (G7) western industrial nations (including the US, UK, Germany and Canada), which focuses on money laundering and terrorist financing, and has a remit to police the global financial sector. The FAFT Secretariat is also, surprise, surprise, located in the OECD headquarters in Paris. In this context, the OECD and FATF are two sides of the same coin.

The main question is why the LBMA is bringing up the OECD/FATF guidelines now? The most recent edition of the OECD Due Diligence Guidance on Responsible Mineral Supply Chains (3rd edition) was published in April 2016. The 1st edition of the OECD Due Diligence Guidance on Responsible Mineral Supply Chains was published all the way back in July 2011 (adopted May 2011). That’s nearly 10 years ago. The OECD gold supplement to its guidance was published in February 2012. That’s almost 9 years ago.

The FATF recommendations on money laundering that the LBMA now refers to are not recent in the slightest, having been published in July 2015 as the Money Laundering and Terrorist Financing Risks and Vulnerabilities associated with Gold. That’s over 5 years ago.

Like the EU war against physical gold transactions, FATF, using the money laundering risk narrative, is on a mission to crack down on cash transactions for gold because the international fiat banking system is not able to control the ultimate money which has no counterparty risk – gold. Hence, the LBMA targeting of bullion markets which it says process large amounts of recycled gold, and the smokescreen accusation about money laundering.

Why then is the LBMA latching on to this OECD – FAFT narrative now? The answer is that, like governments and globalist organisations around the world such as the World Economic Forum (WEF), World Health Organisation (WHO) and United Nations (UN) who are conveniently using the COVID pandemic to push forward their agendas, the OECD has lost no time in opportunistically issuing a “COVID-19 Call to Action for Responsible Mineral Supply Chains” (on 6 May 2020), to push forward its own agenda.

This OECD Covid-19 Call to Action was issued in the form of a statement from what the OECD calls its ”Multi-Stakeholder Steering Group” the committee in charge of pushing forward this OECD guidance. This “call to action” statement can be read in the pdf document here, and is nothing more than a Covid smokescreen to push the existing OECD guidance. The LBMA then took this OECD pronouncement and ran with it.

Not surprisingly, LBMA is a member of this Multi-Stakeholder Steering Group. Not only that, but the LBMA’s CEO Ruth Crowell is vice-chair of this Multi-Stakeholder Steering Group. Interestingly, Dubai’s DMCC is also a member of the Multi-Stakeholder Steering Group, but for how much longer?

NGOs – Peddling the Narrative

Another group or entities aligned with the LBMA letter and the OECD Covid bogeyman ‘call to action’ are the so-called Non-Governmental Organisations, many of which have their headquarters in Washington DC and London, and which as you will recall from above, the DMCC’s Bin Sulayem describes as “the NGOs that peddle the same narrative [as the LBMA] with zero accountability”.

These NGOs (including Global Witness, The Sentry, IMPACT, and RESOLVE), are increasingly making an appearance in this LBMA overreach drama, from being quoted in the mainstream media (Reuters and FT), to being cosignatories of the OECD Covid call to action, and importantly, to being prominent speakers in the LBMA webinars about responsible sourcing that have taken place this year. Global Witness (headquartered in London) and IMPACT (headquartered in Ottawa, Canada) are also members of the above OECD Multi-Stakeholder Steering Group.

Per the above Reuters article: “This [LBMA] initiative has the leverage that could meaningfully impact conflict gold traders and refiners,” said Sasha Lezhnev, deputy director of policy at The Sentry, an NGO which published a report on Dubai’s gold industry on Tuesday.” The Sentry report in question can be seen here and it states that most gold from artisanal gold mining and refining in conflict areas of eastern and central Africa “is traded through Dubai in the United Arab Emirates”. Convenient for the LBMA. Note that the Sentry is headquartered in Washington DC, and was cofounded by George Clooney and John Prendergast (a long time high level US Government insider).

Per the above FT article: “If the public and the markets are to have faith that the gold certified by the LBMA is not tainted by human rights abuses or money laundering, then it will need to flex its muscles and suspend those not playing by the rules,” said Anneke Van Woudenberg, of the London-based NGO Raid.

RAID is another prominent ‘NGO’ which is critical of gold sourcing and the refinery sector. RAID is also headquartered in London, and in July called for the LBMA to suspend the LBMA membership of MMTC-PAMP (the only Indian refinery on the LBMA Good Delivery List for gold).

Perhaps most interestingly, in April this year the LBMA held a series of webinars on “Responsible Sourcing”. The webinars can be seen here. Among the featured lineup was a FATF and OECD insider (Mark Pieth), a policy director from The Sentry (Sasha Lezhnev), a US State Department advisor (Pamela Fierst-Walsh), a director of RESOLVE (Jennifer Peyser), and an executive director from IMPACT (Joanne Lebert). Like The Sentry, RESOLVE operates out of Washington DC.

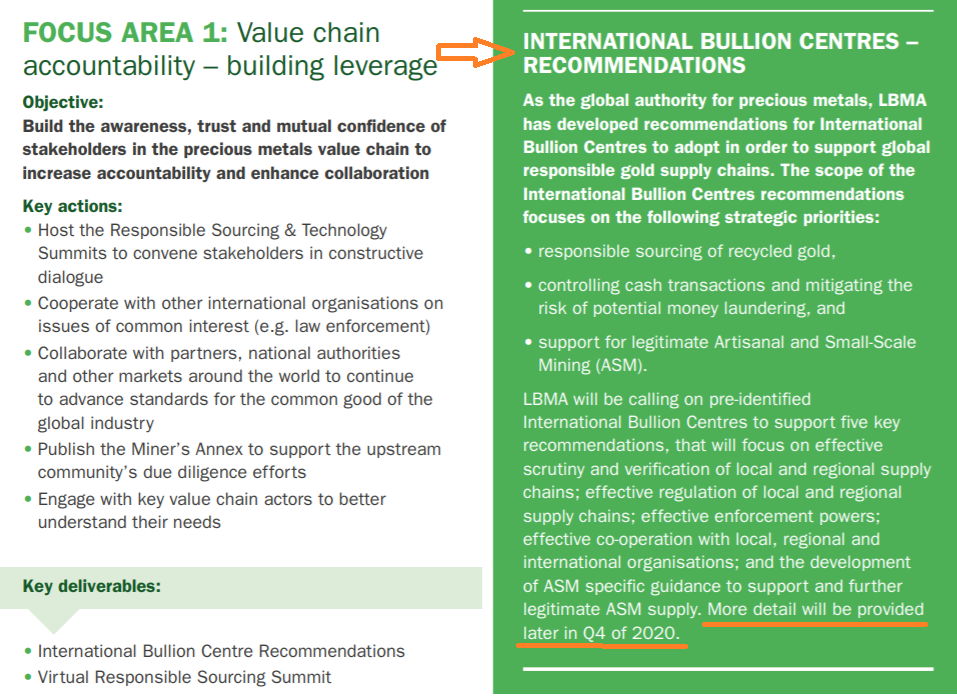

For anyone observing these things, the recent threats from the LBMA towards bullion markets around the world were signaled at least a few months ago in the LBMA’s first Responsible Sourcing Report published in September 2020. That report, on page 32, laid out everything that is in the LBMA recommendations, saying that “LBMA will be calling on pre-identified International Bullion Centres to support five key recommendations” and that “more detail will be provided in Q4”, but did not however mention the subsequent bullying nature of those calls.

The Focus on Dubai

For large gold trading and gold refining centres, it’s notable that not one gold refinery in Dubai or in the wider United Arab Emirates (UAE) (and there are over ten refineries) is accredited by the LBMA, and that only one gold refinery in India, a joint venture between Swiss PAMP and India’s MMTC (called MMTC-PAMP) is LBMA accredited. And there are at least twenty gold refineries in India if not more.

In October, gold refinery expert Corey Keller was interviewed for the BullionStar Perspectives video series, and prophetically, we discussed a lot of the issues which the latest LBMA maneuvering has raised as regards the Dubai refineries, the LBMA as a refining accreditor, and the role of the NGOs in criticizing gold sourcing.

As regards Dubai, Corey explained that the DMCC’s qualifications are exactly the same as the LBMA. The DMCC has the DMCC list, and their certification has the exact same standards that every refiner has to go through. I asked Corey if it is political that refineries in India and Dubai are not on the LBMA Good Delivery List. He replied as follows:

“Originally the LBMA had a great idea, and I think they are exclusive and not inclusive currently, and that’s why refineries are being left out, because they are being exclusive.”

“I don’t know whether it’s a political [issue], as more a protectionist, protectionism in the group [LBMA]”.

See BullionStar video section “The LBMA and the representativeness of the Gold Delivery List” here.

As regards the NGO’s, I also asked Corey did he think that there might be political pressure being funneled through by bullion banks into those entities, Global Witness and RAID, just to target e.g. Dubai or India, because they want to protect the existing establishment?”

Corey’s response: “Yes.. They are absolutely politically motivated, …they [the NGOs] should be discharged with the vigour that they attack the industry with.” See section “Protectionism and the complaints of NGOs such as Global Witness” here.

That the bullion bank establishment has a vendetta against Dubai refineries was brought into focus a few months ago when on 31 July without explanation, the CME Group removed Dubai DMCC’s Al Etihad gold refinery from the COMEX GC 100 gold brand refiner list, having only approved and added the same refinery to the COMEX approved refiner list on 9 July, a mere three weeks earlier. Market rumor at the time had it that Al Etihad was removed from the COMEX approved gold refiner list due to an intervention by JP Morgan.

Despite what the LBMA may want the world to believe, Dubai, through the Dubai Multi Commodities Centre (DMCC) does have gold refinery accreditation initiatives, in fact it has two such initiatives, namely Dubai Good Delivery (DGD) and Market Deliverable Brand (MDB), and the Al Etihad and Emirates Gold DMCC refineries are on the current DGD list.

Per the DMCC website:

“The DGD standard was developed by DMCC in 2005 and is regarded as the international benchmark for quality and technical specification for the production of gold and/or silver. For gold refineries, the certification also includes responsible sourcing of gold in accordance with the ‘DMCC Rules for Risk-Based Due Diligence for Gold and Precious Metals’.”

The standard says that the DMCC is also aligned with the globally accepted OECD Guidance on Responsible Sourcing. DMCC also has an “Independent Governance Committee (IGC) for Responsible Sourcing which oversees the DMCC Authority (DMCCA) Responsible Sourcing of Gold and Precious Metals Programme". In fact, Matthew Keen, previously an LBMA insider and Deutsche Bank gold fixing director, has recently, through his Evidens Consultancy DMCC, been on this DMCC Independent Governance Committee.

Beyond its Mandate

These latest attacks from the LBMA and its demands do indeed appear to be the delusional rantings of a power-hungry dictator. Not content with managing its own Good Delivery List of approved refiners, LBMA is now going after entire bullion markets in various countries, and with threatening language.

On 17 November, the LBMA CEO Ruth Crowell also made a presentation to the OECD about the LBMA initiative against the targeted bullion markets. In the presentation slides (page 10), the language used is also inflammatory and tyrannical, such as “LBMA will only permit”, “Centres must develop and adopt an Action Plan”, and “failure of International Bullion Centres to adopt these recommendations”.

In the case of the UAE and India, as well as not having any of their refineries on the London Good Delivery List (save the MMTC-PAMP joint venture), the LBMA is now putting pressure on the actual governments of these jurisdictions and threatening to exclude all the gold from these centers being allowed into LBMA accredited refineries. This also goes against the entire concept of OECD responsible sourcing, whose very thrust is to approve responsibly sourced gold (from anywhere) making it to market.

And how in practice does the LBMA think it can enforce any of these threats against sovereign governments? As well as being delusional, courts of law would most likely rule that this is illegal and in breach of international trade agreements.

An organisation whose most powerful members have engaged in criminal corruption against the interests of the physical precious metals market and its investors and participants (as per the above DoJ and CFTC cases), therefore cannot be trusted to be a global authority on anything related to the international bullion markets.

The LBMA states in its ‘Call to Action” (17 November) that:

“Currently, not all IBCs operate to the same responsible sourcing standards. These inconsistencies in standards could have a significant impact on the international market should they remain unaddressed.”

What then about LBMA bullion bank members being criminal enterprises? The membership of the LBMA by powerful banks which have been prosecuted for precious metals price manipulation is also an inconsistency in standards which could have a significant impact on the international bullion market should it remain unaddressed.

The LBMA is untrustworthy and it is not credible. The LBMA works against the interests of the physical precious metals industry, not for the physical precious metals industry.

As the LBMA has issued recommendations to the ‘International Bullion Markets”, we would like to issue some recommendations to the LBMA. These recommendations to the LBMA are as follows:

a) Support the actual physical gold market instead of just the paper gold market run by and manipulated by your criminal member banks.

b) Support the continued use of cash transactions in the international physical bullion markets as this eliminates counterparty risk by avoiding exposure to the electronic banking system run by these criminal banks.

c) In line with the LBMA Global Precious Metals Code which prohibits precious metals price manipulation, penalize and remove from your membership LBMA member banks that have been prosecuted and charged by the DoJ the CFTC and that are in breach of the LBMA Global Precious Metals Code.

Popular Blog Posts by Ronan Manly

How Many Silver Bars Are in the LBMA's London Vaults?

How Many Silver Bars Are in the LBMA's London Vaults?

ECB Gold Stored in 5 Locations, Won't Disclose Gold Bar List

ECB Gold Stored in 5 Locations, Won't Disclose Gold Bar List

German Government Escalates War On Gold

German Government Escalates War On Gold

Polish Central Bank Airlifts 8,000 Gold Bars From London

Polish Central Bank Airlifts 8,000 Gold Bars From London

Quantum Leap as ABN AMRO Questions Gold Price Discovery

Quantum Leap as ABN AMRO Questions Gold Price Discovery

How Militaries Use Gold Coins as Emergency Money

How Militaries Use Gold Coins as Emergency Money

JP Morgan's Nowak Charged With Rigging Precious Metals

JP Morgan's Nowak Charged With Rigging Precious Metals

Hungary Announces 10-Fold Jump in Gold Reserves

Hungary Announces 10-Fold Jump in Gold Reserves

Planned in Advance by Central Banks: a 2020 System Reset

Planned in Advance by Central Banks: a 2020 System Reset

China’s Golden Gateway: How the SGE’s Hong Kong Vault will shake up global gold markets

China’s Golden Gateway: How the SGE’s Hong Kong Vault will shake up global gold markets

Ronan Manly

Ronan Manly 0 Comments

0 Comments