LBMA Gold Price Benchmark Ignoring Market Conditions

As the gaping spread between London (LBMA) spot gold prices and front-month COMEX gold futures prices persists for a sixth week triggered by the bullion bank EFP liquidity blow up on Monday 23 March 2020, one unappreciated aspect of this gold price discovery scandal is that daily London LBMA Gold Price auctions are deliberately ignoring COMEX gold prices when setting the Opening Price (starting price) in the twice daily gold price auction.

Ignoring the Obvious

By ignoring the much higher COMEX gold futures prices while setting the LBMA gold auction starting price, the auction administrator IBA is ignoring current market conditions in the gold market (note – a stated methodology of the auction is to use current market conditions). The LBMA Gold Price auction is thus short-changing global gold market participants and investors who all use the LBMA Gold Price benchmark (the final price from the auction) as a critical reference rate. Their motivation? To take the spotlight off the fact that the London spot gold market is broken and that the LBMA market makers have liquidity problems.

However, such is the importance of the LBMA Gold Price benchmark that it is a regulated commodity benchmark under European Benchmark Regulation (BMR), including Annex II of the BMR. Prior to BMR, the LBMA Gold Price was a benchmark regulated by the UK Financial Conduct Authority (FCA).

In short, the LBMA Gold Price benchmark is used all throughout the gold market to value everything from gold-backed Exchange Traded Funds (such as the SPDR Gold Trust GLD) to ISDA Commodity Definitions (e.g. ISDA swaps), and from OTC structured product valuations to central bank gold lending agreements. The LBMA Gold Price benchmark is also used to value mining contracts, refining contracts and by thousands of other precious metals market participants, such as wholesalers and bullion retailers to value their own bi-lateral transactions.

By failing to take into account current market conditions in the gold market, the LBMA Gold Price is not only short-changing investors who rely on the benchmark, but as a regulated benchmark, it’s operation is in breach of European Benchmark Regulations as not being a representative benchmark, and IBA is in breach of not explaining to the public how the LBMA Gold Price methodology works (see below).

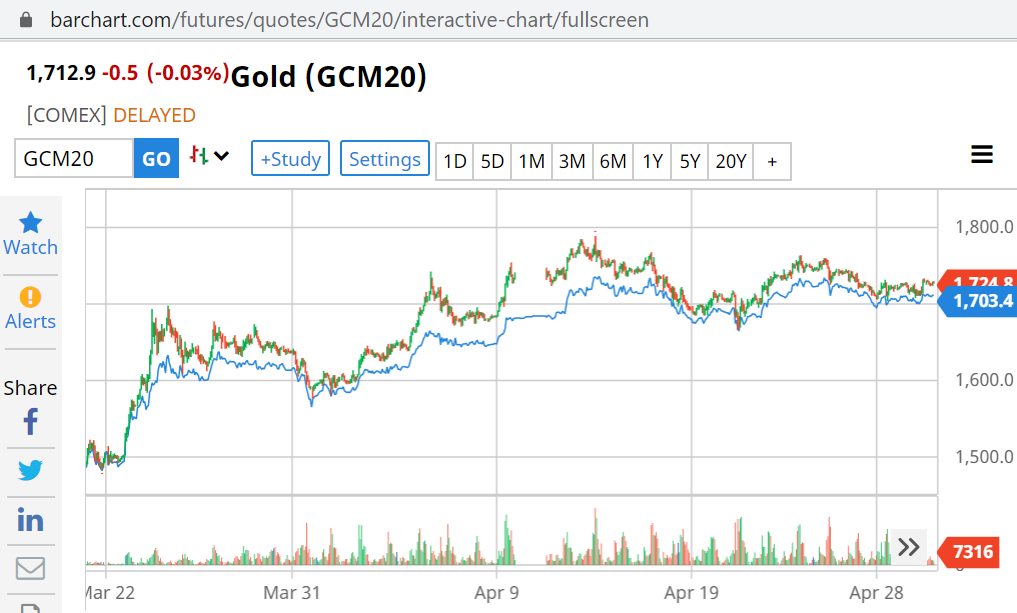

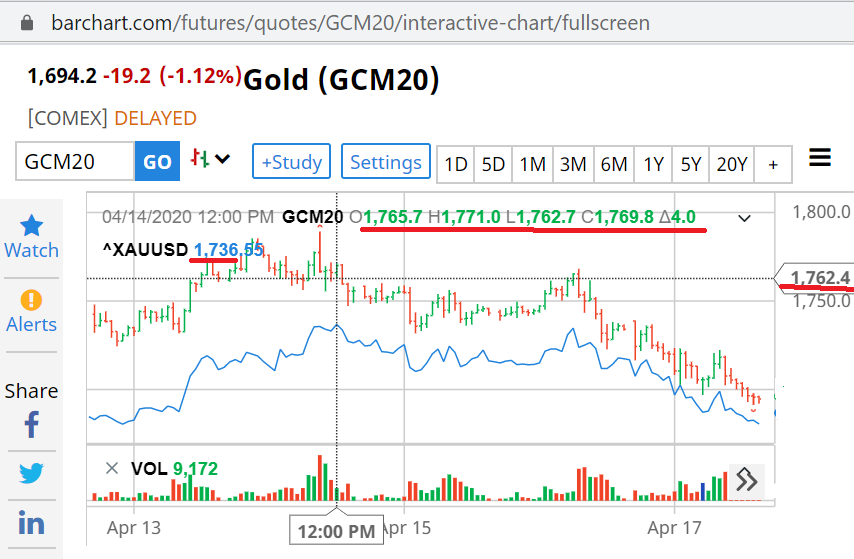

As a reminder, since 23 March 2020, there has been a persist and unprecedented large spread between the active month COMEX gold futures and the London spot gold price, with COMEX gold prices trading far higher than the London spot gold price. In actuality, it is the London spot gold price which is trading at a discount to the COMEX gold prices. See chart below.

COMEX gold futures prices are determined by trading in the CME’s GC100 exchange traded 100 oz gold futures contract. London spot gold prices are determined by trading of unallocated gold in a market made by bullion bank market making members of the London Bullion Market Association (LBMA) such as JP Morgan, HSBC, UBS and Goldman Sachs.

At times during the last 6 weeks, the COMEX front-month gold futures contract has been trading at nearly $100 above the spot price, and regularly at more than $25-40 above the spot price (e.g. 24 March, 26 March, 29 March, 6 April, 9 April, 13 April, 14 April, 16 April, 23 April, 24 April). For granularity, see interactive chart here:

https://www.barchart.com/futures/quotes/GCM20/interactive-chart/fullscreen.

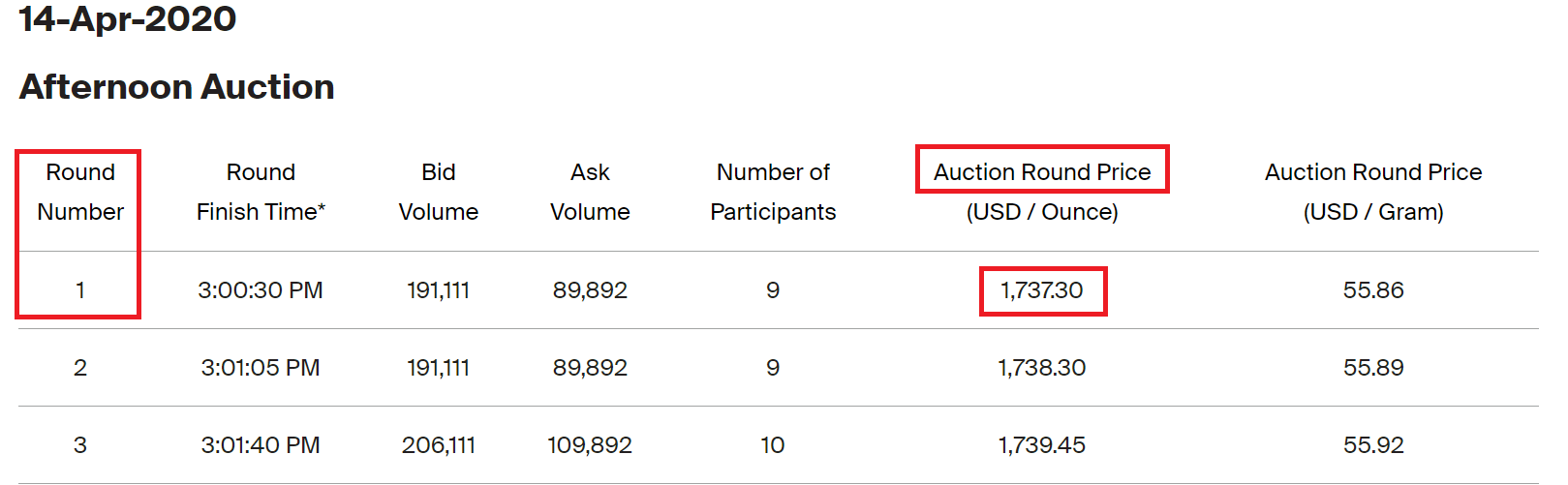

For example, on 14 April when the LBMA GOLD Price afternoon auction was being conducted, the front-month COMEX gold futures price was trading at more than US $1762, yet the opening price of the LBMA Gold Price auction (the price of Round 1) was input by IBA at US $1737.30, a $25 difference on the low side.

The opening price in the LBMA Gold Price auction is critical because it determines everything about the auction, from the bids and offers of the auction participants to the trading volume, and most importantly to the fixing price which becomes that auction’s final price which is then published as the LBMA Gold Price benchmark and reference price which is used by gold market participants on a daily basis all over the world.

For those who may not know, the current LBMA Gold Price is a continuation of the infamous London Gold Fixing auctions, and just like its former version, it rune twice daily auction at 10:30 am and 3:00 pm London time. In its current guise, the LBMA Gold Price auction is administered by ICE Benchmark Administration (IBA), part of Intercontinental Exchange (ICE). LBMA owns the intellectual property rights to the LBMA Gold Price, having registered the trade mark here, so the buck stops with the LBMA.

IBA has been the administrator of the LBMA Gold Price auction since the LBMA worshipful company of bullion banks re-bottled the same old Gold Fixing with a new label and launched it on 20 March 2015 on the first day of the astrological year, which conveniently for the sun and moon worshipers behind the scenes who really run the LBMA, was also a total solar eclipse by a new moon on a vernal equinox, something which hasn’t happened since 1662. And which is reflected in, you guessed it, the LBMA’s logo of sun and crescent moon.

LBMA eclipse sun and moon logo introduced in 1998

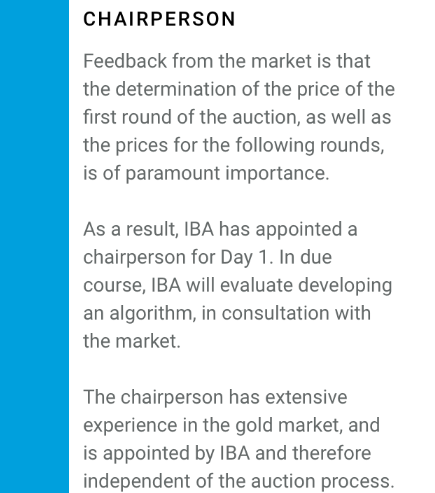

In the same way that the old Gold Fixing auction (London Gold Market Fixing Limited) had an auction chairman who determined the opening price (note Rothschild was the permanent chairman until 2004, then stepped into the shadows in 2004 after which between 2004-2015 there was a rotating chairman), when the Gold Fixing was relaunched in March 2015 as the LBMA Gold Price, the LBMA and IBA also continued to use a human chairman to set the auction starting price in line with market conditions because, in their own words:

“Feedback from the market is that the price in the first round of the auction, as well as the prices for the following rounds, is of paramount importance“

In it’s FAQ document published in March 2015, IBA also underscored the importance of the auction’s initial price, explaining as follows:

“Why are you using a Chairperson and not an algorithm for day one?

Feedback from the market is that the setting of the initial price of the first round of the auction, as well as prices for the following rounds, are important“

From March 2015 to 2017, there were a panel of four of these chairmen running the LBMA Gold Price auction, all bullion bankers, two of which were Jonathan Spall and Philip Clewes-Garner. The IBA website describing the auction methodology even stated that:

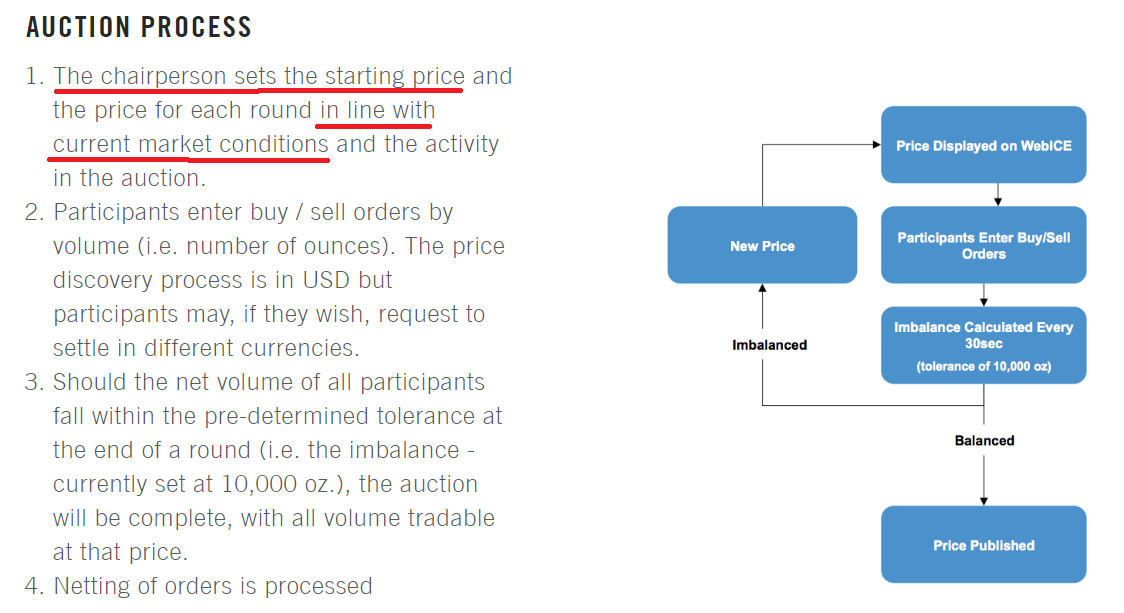

“the chairman sets the starting price…in line with current market conditions“

In fact, the LBMA website still says that “the chairman sets the starting price…in line with current market conditions“.

And what is “in line with current market conditions" in the usual convention of determining the opening price? Answer – both the COMEX futures gold price and the London spot price. As the former gold fixing website makes this clear in a page titled “How is the Price Fixed?"

“(The opening price): The Chair shall identify the opening price. The opening price should be the prevailing US dollar mid-market price for London gold and is identified by the Chair after appropriate consideration of the prevailing spot price and the prevailing bid/offer price in the gold futures market.“

Why the opening price refers to both London spot and COMEX futures is simply because together, trading in the London gold market and in COMEX gold futures jointly determine the international gold price, with COMEX through the CME Globex platform trading 24 hours a day all through the week and at all times before, during and after the LBMA Gold Price auctions.

That London and COMEX New York are the consistent and dominant drivers of gold price discovery, returns and volatility, and that gold prices “spill over“ between London and New York all the time can be seen from a glance at the research of LBMA-affiliated academics such as Brian Lucey and Fergal O’Connor, here here and here.

Algorithm – But with a Driver

In March 2017, ICE Benchmark Administration ditched the human chairman, and began using an algorithm to run the LBMA Gold Price auction. This was after a consultation which assured that “once the algorithm is adopted“:

“IBA can confirm that the auction will always be supervised by at least two

IBA analysts. This approach is consistent with how we operate our other benchmarks. Our aim is to put the auction on auto-pilot, not to make it driverless.“

Since 2017, the LBMA Gold Price methodology on the IBA website now states that"

“The prices during the auction are determined by an algorithm that takes into account current market conditions and the activity in the auction. Each auction is actively supervised by IBA staff.”

Dodging the Question

Given the fact that the LBMA Gold Price auction is not using COMEX gold prices as a factor when choosing an opening price for the daily auctions, and is therefore not ”taking into account current market conditions”, last week I asked ICE Benchmark Administration by email some basic questions about its source for the opening prices, and who sets the opening price, if this opening price is manually input by an IBA analyst or is calculated by the algorithm?

At first IBA deflected the question, not providing any answer in its response.

Then I asked again:

”Would you be able to confirm who sets the opening price, is it manually input by a human (similar to when a few years ago the opening price was chosen by a chairman) or is the opening price calculated by the algorithm?

And how is the source of the opening price determined during times, like now, when ‘market conditions’ have a large spread between spot and COMEX futures prices.”

To which I got an unhelpful answer from ICE:

”All information you require can be found on our website at the following link: https://www.theice.com/iba/lbma-gold-silver-price”

As the information I asked about is not explained at all on the IBA website, I sent another response:

”The IBA website does not specify if the opening price of the LBMA Gold Price auction is chosen by a human or an algorithm.

And the IBA website explains nothing about why the opening price of the auction is not taking into account the actual market conditions of the near month COMEX futures prices, which are far above the LBMA spot prices.

Hence the questions, which is why I asked. Sending me to a web page which does not provide these answers is unhelpful. So the questions still stand…:

1. Who sets the opening price, is it manually input by a human or is the opening price calculated by the algorithm?

2. How is the source of the opening price determined during times, like now, when ‘market conditions’ have a large spread between spot and COMEX futures prices?”

To which IBA replied:

”1. The pricing within the auctions is determined by an algorithm as per our website.

2. The price is determined using many market sources and taking market conditions into consideration.

I cannot and will not go into the specifics of how our algorithm works, nor the input sources.”

Not in Compliance

You can see straight up the problems with this above answer from IBA:

a) The answer still does not confirm who chooses the opening price

b) The answer ignores any discussion of COMEX gold prices in the current environment

c) The answer reiterates the line about taking into account market conditions when that is patently not the case, and the answer fails to list any of its claimed “many market sources"

d) The answer fails to explain the pricing sources or pricing hierarchy of the opening price

e) And most shockingly, the part of the answer which states ”I cannot and will not go into the specifics of how our algorithm works, nor the input sources” is in breach of EU Benchmark Regulations (BMR).

Why this is so is because European Benchmark Regulations (BMR) Annex II, which regulates the LBMA Gold Price states that:

ANNEX II

COMMODITY BENCHMARKS

Methodology

1. The administrator of a commodity benchmark shall formalise, document, and make public any methodology that the administrator uses for a benchmark calculation. At a minimum, such methodology shall contain and describe the following:

a) all criteria and procedures that are used to develop the benchmark, including how the administrator uses input data including the specific volume, concluded and reported transactions, bids, offers and any other market information in its assessment or assessment time periods or windows, why a specific reference unit is used, how the administrator collects such input data, the guidelines that control the exercise of judgement by assessors and any other information, such as assumptions, models or extrapolation from collected data that are considered in making an assessment.

c) the relative importance that shall be assigned to each criterion used in benchmark calculation, in particular the type of input data used and the type of criterion used to guide judgement so as to ensure the quality and integrity of the benchmark calculation;

h) criteria according to which transaction data may be excluded from a benchmark calculation.

2. The administrator of a commodity benchmark shall publish or make available the key elements of the methodology that the administrator uses for each commodity benchmark provided and published or, when applicable, for each family of benchmarks provided and published

3. Along with the methodology referred to in paragraph 2, the administrator of a commodity benchmark shall also describe and publish all of the following:

(a) the rationale for adopting a particular methodology, including any price adjustment techniques and a justification of why the time period or window within which input data is accepted is a reliable indicator of physical market values;

(c) the procedure for external review of a given methodology, including the procedures to gain market acceptance of the methodology through consultation with users on important changes to their benchmark calculation processes.

Conclusion

As recently as 7 April 2020, IBA claims that it is in compliance with the European Benchmark Regulations for the regulated benchmarks that it administers via the “ICE Benchmark Administration Statement of Compliance with the EU Benchmarks Regulation and Independent Assurance" which is signed by the president of ICE of Benchmark Administration, Timothy Bowler, see here.

This Statement by IBA is accompanied by a full and detailed “Independent practitioner’s assurance report" by consultancy EY assuring that IBA is in full compliance with the European Benchmark Regulations.

IBA president, Timothy Bowler, on 7 April 2020, in the very middle of this period where the LBMA Gold Price is using an opening price far lower than prevailing market conditions claims that:

“Access to accurate, reliable information is essential to the integrity and everyday functioning of global markets and the economies which they support. Benchmarks form a vital part of this ecosystem, helping market participants to assess the value of assets and make informed business decisions with confidence“

All very laudable objectives. But hollow and totally at odds with the reality on the ground where IBA refuses to divulge its methodology with the shocking statement “I cannot and will not go into the specifics of how our algorithm works, nor the input sources“.

In conclusion, anyone who has investment and assets with values based on the LBMA Gold Price should at this point be worried by this and should urgently be asking why IBA is refusing to explain why the LBMA Gold Price is not taking into account current market conditions in the form of the highly liquid COMEX gold futures prices, and thereby completely understating the LBMA Gold Price benchmark reference price that is used to value trillions of dollars worth of gold related investments around the world every day.

As the owner of the LBMA Gold Price, the same questions should be asked to the London Bullion Market Association. Remember a fish rots from the head down. Because if your investments are based on the LBMA Gold Price, you and your assets are right now being short-changed. And don’t let the LBMA bluff about physical gold not being able to make it on flights from London to New York. That was never the problem. The problem is a liquidity problem within the LBMA market caused by liquidity problems at LBMA market making bullion banks.

Popular Blog Posts by Ronan Manly

How Many Silver Bars Are in the LBMA's London Vaults?

How Many Silver Bars Are in the LBMA's London Vaults?

ECB Gold Stored in 5 Locations, Won't Disclose Gold Bar List

ECB Gold Stored in 5 Locations, Won't Disclose Gold Bar List

German Government Escalates War On Gold

German Government Escalates War On Gold

Polish Central Bank Airlifts 8,000 Gold Bars From London

Polish Central Bank Airlifts 8,000 Gold Bars From London

Quantum Leap as ABN AMRO Questions Gold Price Discovery

Quantum Leap as ABN AMRO Questions Gold Price Discovery

How Militaries Use Gold Coins as Emergency Money

How Militaries Use Gold Coins as Emergency Money

JP Morgan's Nowak Charged With Rigging Precious Metals

JP Morgan's Nowak Charged With Rigging Precious Metals

Hungary Announces 10-Fold Jump in Gold Reserves

Hungary Announces 10-Fold Jump in Gold Reserves

Planned in Advance by Central Banks: a 2020 System Reset

Planned in Advance by Central Banks: a 2020 System Reset

China’s Golden Gateway: How the SGE’s Hong Kong Vault will shake up global gold markets

China’s Golden Gateway: How the SGE’s Hong Kong Vault will shake up global gold markets

Ronan Manly

Ronan Manly 0 Comments

0 Comments