West to East Gold Distribution Update

The great distribution of wealth and power, facilitated by gold, from west to east is still going strong. From looking at available global trade numbers we know the main gold vein runs from the UK through Switzerland, through Hong Kong, eventually reaching Shanghai. Let’s take a look at the latest data.

Starting Point: The London Gold Vaults

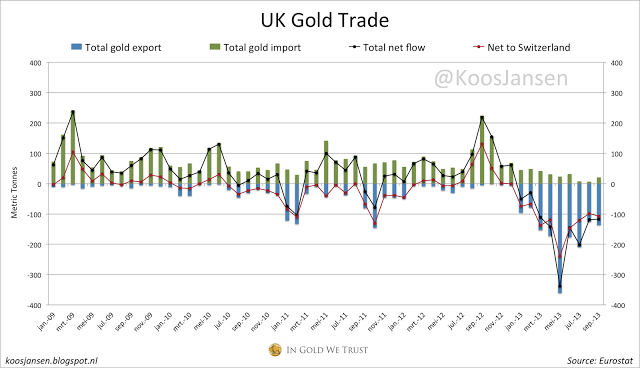

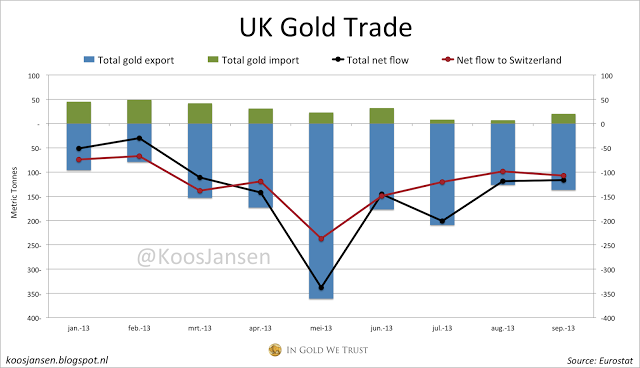

It started in January when the UK, home of the London Gold Market, net exported 74 tons of gold to Switzerland. As we can see in the chart below this is not unusual, we saw similar events in the beginning and in the end of 2011. But this year export accelerated to a spike May, in which 237 tons were net exported to the Swiss. A staggering amount of gold, nearly as much as the official gold reserves of the Bank Of England. Through the summer these exports remained elevated, year to date the UK has net exported 1235 tons of gold in total, of which 1109 tons to Switzerland.

In September the UK net exported 117 tons of gold, down from 119 tons in august, – 1.7 % m/m. Net export to Switzerland was 107 tons in September, up from 98 tons in August, + 9.1 % m/m. This implies we have not seen the end of the gold exodus from the UK.

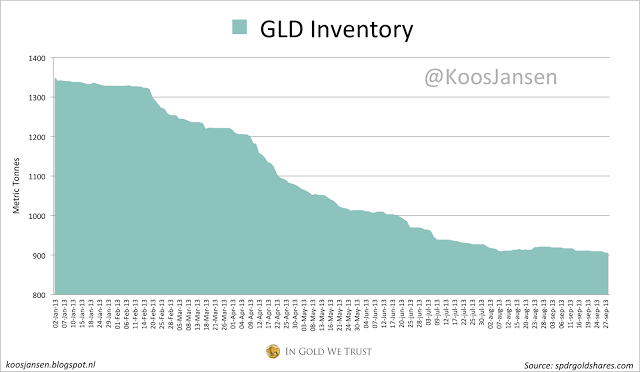

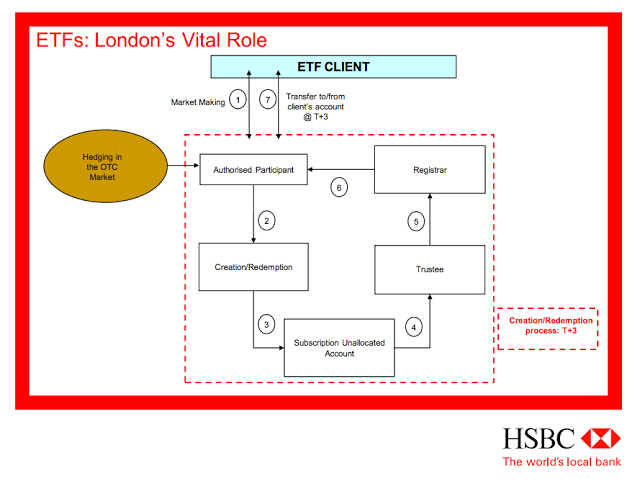

GLD Redemptions

|

| note “Unallocated Accounts" |

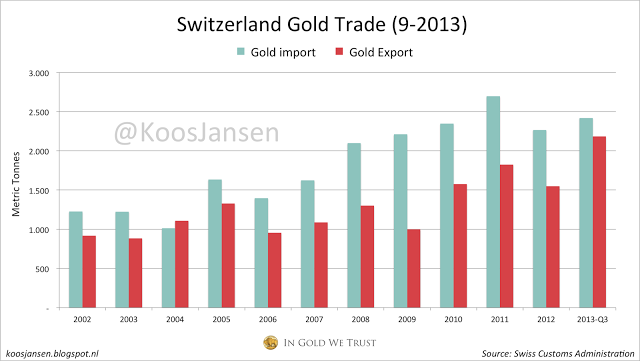

Remelting The Gold Bars In Switzerland

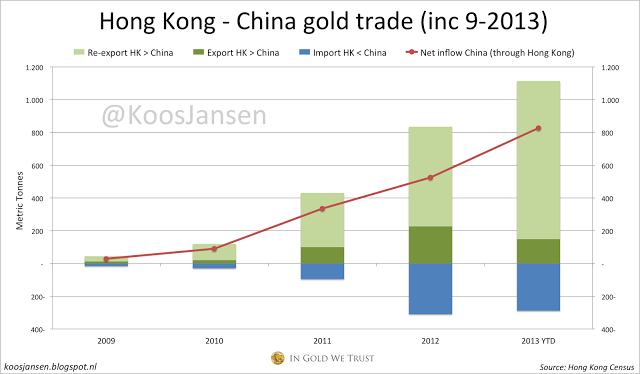

Transit Port Hong Kong

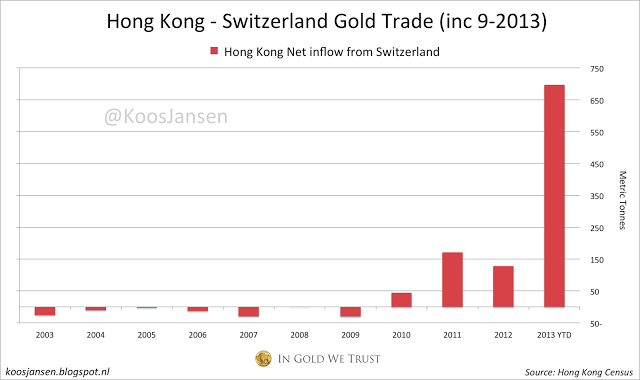

Most (but certainly not all!) gold that is imported by China mainland comes in through Hong Kong. Year to date Switzerland has net exported 697 tons of gold to Hong Kong. A surge of 445 % if we measure just the first three quarters relative to 2012 totals.

Net export from Hong Kong to the mainland is 826 tons of gold year to date.

Popular Blog Posts by Koos Jansen

China’s Secret Gold Supplier is Singapore

China’s Secret Gold Supplier is Singapore

Audits of U.S. Monetary Gold Severely Lack Credibility

Audits of U.S. Monetary Gold Severely Lack Credibility

China Gold Import Jan-Sep 797t. Who’s Supplying?

China Gold Import Jan-Sep 797t. Who’s Supplying?

The Gold-Backed-Oil-Yuan Futures Contract Myth

The Gold-Backed-Oil-Yuan Futures Contract Myth

Estimated Chinese Gold Reserves Surpass 20,000t

Estimated Chinese Gold Reserves Surpass 20,000t

Did the Dutch Central Bank Lie About Its Gold Bar List?

Did the Dutch Central Bank Lie About Its Gold Bar List?

PBOC Gold Purchases: Separating Facts from Speculation

PBOC Gold Purchases: Separating Facts from Speculation

U.S. Mint Releases New Fort Knox Audit Documentation

U.S. Mint Releases New Fort Knox Audit Documentation

China Net Imported 1,300t of Gold in 2016

China Net Imported 1,300t of Gold in 2016

Why SGE Withdrawals Equal Chinese Gold Demand and Why Not

Why SGE Withdrawals Equal Chinese Gold Demand and Why Not

Koos Jansen

Koos Jansen