Koos Jansen Interviews Jim Rickards On The Death Of Money

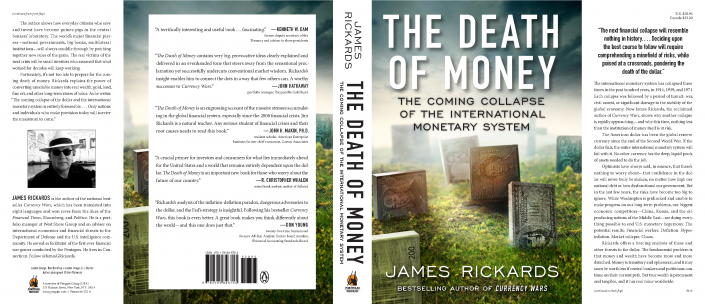

I had the privilege to meet with Jim Rickards, while he was in The Netherlands for one day, to do an interview about his new book “The Death Of Money“. Accompanied by friend (and author of the book the The Big Reset) Willem Middelkoop we met at the hotel were Jim was staying and for one and a half hours we fired questions at him. Below you can read the highlights of the conversation.

March 12, 2014

Koos Jansen: Do you think there will be a collapse in the worldwide monetary system, including chaos, social unrest and bank failures because all policy makers will do too little too late?

Jim Rickards: My new book, The Death Of Money, is about the demise of the dollar. A world wide monetary collapse and the collapse of the dollar are the same thing. The dollar is the keystone of the system today, if the world loses confidence in the dollar the whole system collapses. Could there be disruptions, social unrest and other problems before the monetary system collapses? I think we’re seeing them already, in the Ukraine, in the Crimea and the Chinese navy sending vessels to these islands they are in disputes with near Japan. US monetary policy was also a contributing factor to protests in the Arab Spring’s early stages. We’re seeing signs happening already and that will continue.

I do expect that policy makers will continue to pursue the wrong policies, they won’t make the structural adjustments that are needed; unemployment remains high, growth remains weak and deflation continues to have us in its grip. These are all things that will lead to social instability, income and wealth inequality and we could see a lot of stresses before the collapse of the monetary system.

Central banks and governments have made it clear that the big banks can’t fail. That’s what they stated, all these too big to fail banks will not be allowed to fail. Now what are the consequences once they’ve said that? It invites reckless, parasitic and exploitative behaviour on behalf of the bankers. This allows them to grow too large which destabilizes the system. I don’t think we’ll see big bank failures along the way, but big banks will fail as part of the collapse. It’s the policy of too big to fail that leads to the dysfunction of the system that will lead to the collapse.

Koos Jansen: Will the coming collapse of the monetary system be more severe than any prior one?

Jim Rickards: The point I’m making in the book is that the international monetary system has collapsed three times in the last one hundred year. In 1914, 1939 and 1971. So it does happen, it’s not that unusual. When it happens it not the end of the world. What it means is that the major trading powers, the financial powers, come together and reset the system. There is actually a name for this, it’s “the rules of the game”. That’s not a phrase I made up, it goes back one hundred years. So the major powers will rewrite the rules of the game, but here’s the problem. The last crisis we had the Fed reliquify the world. There were tens of trillions of dollars in swap lines with the ECB, they guaranteed all the bank deposits in the US and they guaranteed all the money market funds in the US. It did prevent things from getting worse, but the problem is the Fed raised their own balance from $800 billion to $4 trillion after the liquidity crisis. We had a liquidity crisis in late 2008, but we haven’t had one in the last five years. So now what happens if we have a liquidity crisis tomorrow? They’ve got no more dry powder; they can’t go to $12 trillion.

The next crisis will be bigger than the last one, and it will be bigger than the Fed because they already trashed their own balance sheet. Then the only balance sheet left is the IMF’s.

Koos Jansen: Do you consider it a possibility the SDR will be the new world reserve currency backed by gold, like mentioned in Willem’s book The Big Reset? And following up on that, could it be all national currencies will be floating around such an SDR?

Jim Rickards: Yes, there is a probability the SDR will be the new global reserve currency. Gold and oil would be then be priced in SDR’s. It will be used for some of the balance of payments between countries, the creation of reserves and probably the financial accounts of the world’s largest corporations. So Siemens, General Electric and IBM will produce their financial statements in SDR’s, because they’re global corporations.

Koos Jansen: But will this SDR be backed by gold at a fixed parity?

Jim Rickards: It might be, this is where it gets interesting. That is not what our global leaders want. What they want is a paper SDR to replace the paper dollar. The question is, will people go along with that? Our global leaders may have to go back to gold not because they want to but because they need to restore confidence. It can go either way. The SDR project that will replace the dollar is already in the works. If the elites get enough time, they need about ten years, they will roll out a paper SDR. If the collapse comes sooner than that they’ll have to gold, or, if they insist on a paper SDR, they’ll have to go with martial law and neo-fascism.

Koos Jansen: Are you familiar with concept of freegold?

Jim Rickards: I’ve heard of it, I’m not really an expert on it.

Koos Jansen: Do you believe in Austrian economics?

Jim Rickards: My view is that Austrian economics has a lot to offer, but it is not a complete explanation of dynamics in capital markets. I consider myself a complexity theorist and I am one of those applying complexity theory to capital markets. Complexity theory is only about 55 years old as a science, but it is highly complementary to Austrian theory because it agrees with Hayek that the economic system has far too many autonomous agents of highly diverse views ever to be efficiently planned. If von Mises had been born 40 years later, he would have warmly embraced complexity theory.

Koos Jansen: If you were the president of the world, what would you implement as the most stable monetary system.

Jim Rickards: I favour what I call the King dollar. I’m a bit of an old school American. I don’t necessarily want the gold standard, and I don’t want the SDR’s, I want the dollar as the dominant currency in the world. I think America has the potential for a force for good in the world and therefore the American dollar as a global monetary standard to me would be a good thing. The problem is, the US government doesn’t agree. They don’t want a strong dollar, they want a weak dollar.

Willem Middelkoop: Is that the reason you began writing books? because you’re fed up with how the dollar is managed.

Jim Rickards: Absolutely.

Koos Jansen: Isn’t it always unsustainable if a national currency is used as the world reserve currency?

Jim Rickards: That doesn’t have to be, it can be. This is Triffin’s dilemma. What Triffin said in the sixties was that if one country issues the global reserve currency they need to run a persistent current account deficit because that’s the only way for the rest of the world to get enough money to finance world trade. But if you run deficits long enough you go broke. Now after 50 years the US is going broke.

There is another solution, which is real growth without money printing. What’s wrong with price stability, real price stability, why do we have to have inflation? Let people earn their dollars, or let the US maintain the value of it’s dollar with education, innovation, growth, productivity, good public policy, low taxes and a good business climate. These are the ways you drive growth, not by money printing. The answer is real growth.

Koos Jansen: If the world starts to lose confidence in the dollar, will Yellen be forced to raise interest rates like Volcker did in the early eighties?

Jim Rickards: The problem is how do you raise interest rates when 50 million Americans are on food stamps, 26 million Americans unemployed or underemployed, 11 million Americans have disability, with all due respect to people with genuine disability, a lot of the disability is abused. My point being, given an extremely weak economy, given deflationary trends, given high unemployment and declining labour force participation how on earth do you raise interest rates? However, the market will raise interest rates in a way the Fed won’t be able to control. That’s when you may see… who knows? Debt restructuring of the treasury market…

– Koos Jansen: More QE?

Jim Rickards: More QE and the Fed may use more financial repression. Why haven’t interest rates gone up already? Because of financial repression.

If there is a loss of confidence and the market wants to push rates higher, the Fed will respond by trying to suppress rates by printing money, which will lead to more loss in confidence. This will show up the foreign exchange market, it will show up in the price of gold and it will show up in some interest rates.

A lot of this will happen really quickly, it wouldn’t play out in one day, but we will see gold making moves of a hundred dollars in one day. People will say it’s a bubble, of course it’s not a bubble it’s a sign of panic. Then we’ll see gold moving five hundred dollars a day.

What I look at is the price of gold; to me gold is a constant. The price of gold is just the inverse of the value of the dollar. If gold goes up, what is actually happing is that the dollar goes down. When you see the price of gold jumping up what that tells you is that the dollar is collapsing. Even if the Fed is repressing interest rates, gold will tell you when the dollar is done.

Willem Middelkoop: That’s why the price of gold has to be controlled.

Jim Rickards: Yes, but a couple of thing on that. The Fed right now wants the price of gold to be higher. The Fed’s problem today is not inflation it’s deflation. The Fed wants controlled inflation and they can’t get it. So how do you get inflation? You have to change expectations. So allowing the price of gold to go up helps to increase inflationary expectations. It can’t go too far too fast, it can’t do what we just described. But the Fed wouldn’t mind if the price of gold would go to $1400, $1500, $1600 dollars because that would get people into an inflationary mindset; trying to get them spending more dollars, borrowing more etc. That’s what the Fed wants. Where the Fed is wrong is to think that they can just dial it up or down. They did do that in 2011 when gold went to $1900, the Fed was very fearful gold would go to $2000, a big psychological threshold, so they had to push it down. Right now I don’t think the Fed is doing anything to hold price of gold down, China might be.

Koos Jansen: Was it China behind the drop in the price of gold In April 2013, or was it maybe a collaboration between the US and China? A scenario could have been: China would support the dollar and in return could buy physical gold at extremely low prices.

Jim Rickards: Look, I’ll tell you what I know and what I don’t know.

When you’re a detective and you have a dead body and are looking for the killer, you’re looking for a motive. So who benefitted from the drop in the price of gold? China – they’re the most likely party. I know for a fact that SAFE, which is a Sovereign Wealth Fund that manages the foreign exchanges reserves of the People’s Bank Of China, bought 600 tons of physical gold through June and July 2013. I know this from the Perth Mint and Chinese dealers. At this moment the gold is on the balance sheet of SAFE but this can be flipped to the PBOC’s sheet like it happened in 2009.

Whether the Chinese caused the drop price I can’t be sure, though I suspect it, but I know for sure they took advantage of it.

China right now has an interest in keeping the price low because they want to buy more. But at some point, if there will be inflation in the US, they want the price to go higher because that’s their hedge. That’s the reason they’re buying gold. All this talk about China backing the renminbi with gold is nonsense.

China has got $4 trillion dollars in reserves, their preference is a stable dollar. If the US devalues the dollar by 10 %, that’s a wealth transfer of $400 billion from China to the US. China’s hedge is gold, if the dollar would go down gold goes up.

Koos Jansen: China knows the US will need to devalue the dollar?

Jim Rickards: Correct.

Koos Jansen: Does SAFE buy it’s gold through the Shanghai Gold Exchange?

Jim Rickards: They have various ways.

Koos Jansen: How will the power be distributed in Asia after the monetary reset?

Jim Rickards: It will be based on gold.

A lot of analysts look at gold as a percentage of foreign exchange reserves, I think that’s meaningless. In the US gold represents 70 % of reserves, but the US can print dollars and they don’t need euros or Swiss francs. A better way of thinking about it is the amount of gold relative to the size of an economy in terms of GDP. Russia is on par with the US. China needs to have at least 4500 tons to get on par with the US.

In Chapter 6 of my book I write about the Shanghai Cooperation Organization, it’s not a treaty but a mutual cooperation organization between primarily Asian and central Asian powers. This is the primary forum for Russia and China to cooperate and stand up against the US. Eventually there will be two empires in Asia. Russia will have an empire comprised of Russia, eastern Europe and central Asia. China will have an empire comprised of the mainland, its immediate periphery and east Asia.

Koos Jansen: All the physical gold that’s exported to China is in 1 Kg 9999 bars. Gulf nations are remelting their 400 ounce London Good Delivery bars into 1 Kg 9999 bars through Switzerland. What’s your take on that?

Jim Rickards: In my view the 1 Kg 9999 bars will be the new Good Delivery standard. We’ll look back in a couple of years and wonder why we ever messed around in 400 ounce bars. The history of 400 ounce bars is interesting. They were intentionally made very large so people couldn’t have them – they were for central banks only or very wealthy individuals. In 1910 people used gold coins to pay for goods and services, then little by little central banks wanted to get rid of the gold coins, they wanted people to use paper certificates, which gave central banks more flexibility.

Koos Jansen: Will the Bundesbank get its gold back from the US?

Jim Rickards: What a lot of people don’t understand is that the Bundesbank doesn’t want it’s gold back. The reason the Germans want to have it in New York is because they want to able to engage in price suppression. New York and London are markets for leasing, Frankfurt isn’t. For every ton of gold you remove from New York, there is 10 tons of paper gold that needs to be unwound. That’s why they’re taking eight years and that’s why they’re doing it in tranches.

There’s not such a leasing market in China either. Central banks are able to suppress the price of gold through the leasing market in New York. For example SAFE, a subsidiary of the PBOC, could call JP Morgan in New York and ask to actively lease their gold, which is partially stored in New York, and JP Morgan would do it.

Koos Jansen: Is the NSA Involved in financial warfare?

Jim Rickards: No, not to my knowledge.

Willem Middelkoop: I know wealthy Americans taking measures like getting a second passport and moving their money offshore. Do you see this happening in your surroundings?

Jim Rickards: Yes, I see it all the time. There are billionaires who build vaults in their own houses because they don’t trust Brinks.

Willem Middelkoop: What does that tell you?

Jim Rickards: It tells me that they see what I see, in some ways, but their not willing to talk about it. They’re ready for the collapse but want to milk the system in the meantime.

Willem Middelkoop: Which part of all your activities do you like most?

Jim Rickards: Writing. That’s why I’ve done two books, and now I will start a new book project sooner than later. It will hopefully be a four book series. I have some sketches.

Koos Jansen: We’ll be looking forward to reading more of your books. For now, thank you very much for your time Jim.

In Gold We Trust

Popular Blog Posts by Koos Jansen

China’s Secret Gold Supplier is Singapore

China’s Secret Gold Supplier is Singapore

Audits of U.S. Monetary Gold Severely Lack Credibility

Audits of U.S. Monetary Gold Severely Lack Credibility

China Gold Import Jan-Sep 797t. Who’s Supplying?

China Gold Import Jan-Sep 797t. Who’s Supplying?

The Gold-Backed-Oil-Yuan Futures Contract Myth

The Gold-Backed-Oil-Yuan Futures Contract Myth

Estimated Chinese Gold Reserves Surpass 20,000t

Estimated Chinese Gold Reserves Surpass 20,000t

Did the Dutch Central Bank Lie About Its Gold Bar List?

Did the Dutch Central Bank Lie About Its Gold Bar List?

PBOC Gold Purchases: Separating Facts from Speculation

PBOC Gold Purchases: Separating Facts from Speculation

U.S. Mint Releases New Fort Knox Audit Documentation

U.S. Mint Releases New Fort Knox Audit Documentation

China Net Imported 1,300t of Gold in 2016

China Net Imported 1,300t of Gold in 2016

Why SGE Withdrawals Equal Chinese Gold Demand and Why Not

Why SGE Withdrawals Equal Chinese Gold Demand and Why Not

Koos Jansen

Koos Jansen