The Advantages of a BullionStar Cash & Bullion Account

As a global financial hub, Singapore bank accounts are much sought after by offshore investors and savers. Singapore is host to some of the region’s most stable and successful banks such as DBS, OCBC and UOB. Opening an offshore Singapore bank account with DBS, OCC or UOB has however become increasingly difficult for many international clients. The banks often require personal visits and large deposits to open a Singapore bank account for international clients.

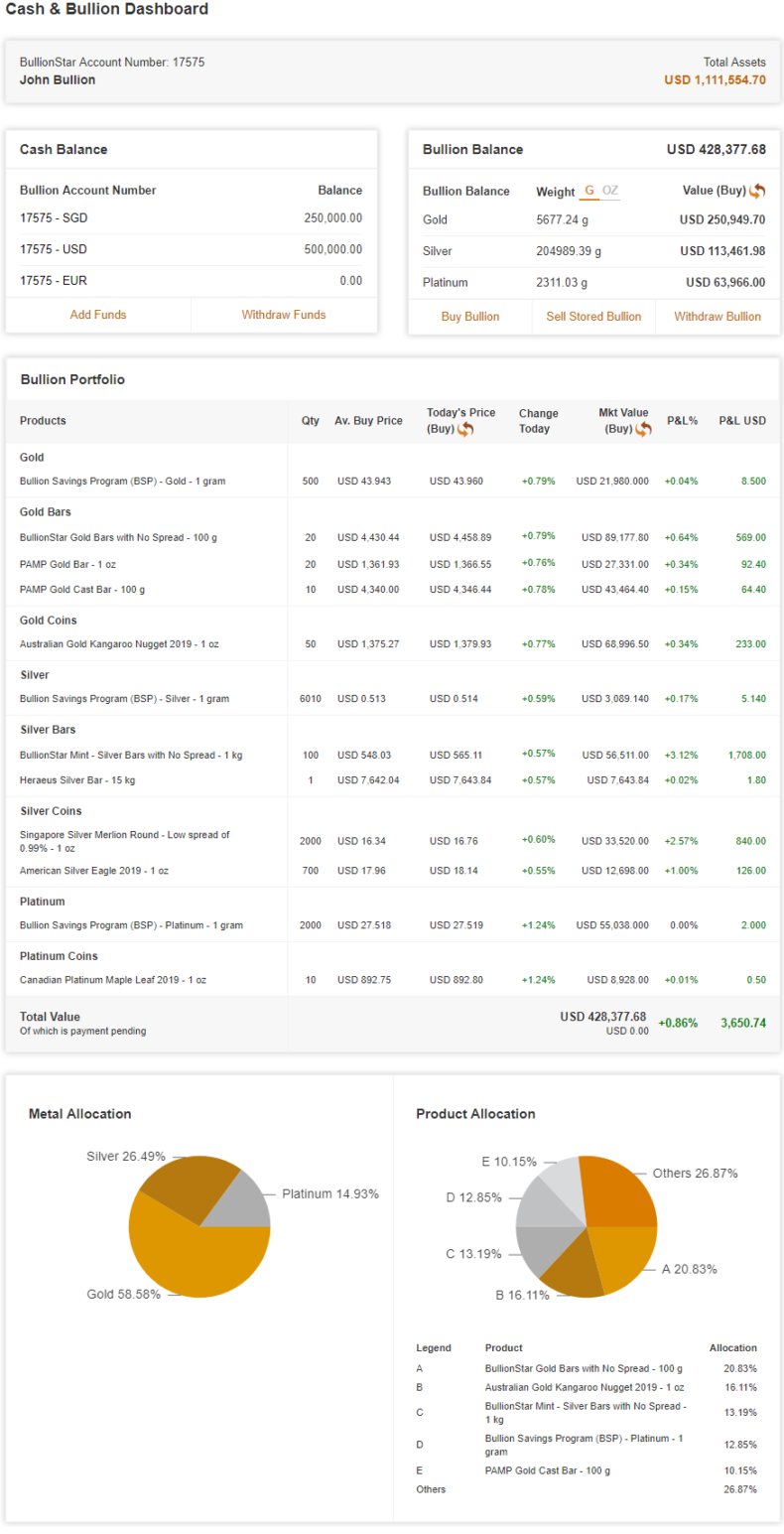

BullionStar is renowned for making it simple for customers to save and invest in precious metals bars and coins. One of the innovative features offered by BullionStar is the BullionStar account where you can hold both bullion and cash on one and the same account.

BullionStar Cash & Bullion Account

As a BullionStar account holder, you can keep cash on your account in Singapore dollars, US dollars and Euros.

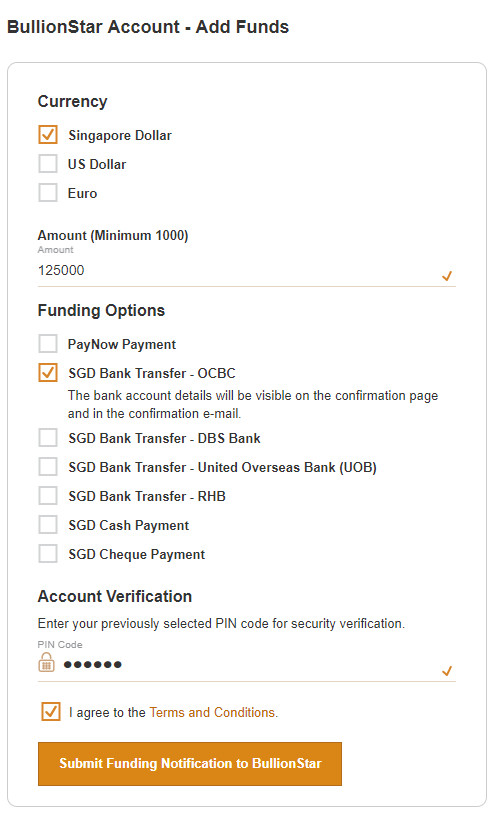

You can fund your BullionStar account with a bank transfer from anywhere in the world. For Singapore dollars, you can also fund your BullionStar account with PayNow, cash or with a cheque.

You can keep cash on your BullionStar account indefinitely. BullionStar does not charge any fees for transactions to and from your BullionStar account. Nor are there any account opening or account maintenance fees, and you can add or withdraw funds from your BullionStar account at any time. You can also use your cash funds towards bullion purchases at anytime or have proceeds from sell orders credited directly to your BullionStar account.

Opening a BullionStar account is a simple and straightforward process, and only takes a couple of minutes. BullionStar accounts are available for individuals including two individuals as joint account holders, for businesses, trusts, foundations and for IRA retirement account structures.

When you have opened your BullionStar account, go to Add Funds to fund your account. There is a minimum top-up amount of SGD / USD / EUR 1000, but no maximum limit to adding funds. BullionStar typically processes all funds transfers to BullionStar accounts within one business day of receiving the funds.

To summarise, a BullionStar account can be used for offshore bullion transactions and bullion storage as well as for holding cash funds in Singapore dollars, US dollars and Euros outside the banking system. A BullionStar account is a good alternative to a Singapore bank account with DBS, OCBC or UOB.

More Information about BullionStar accounts

Overview of the key features of a BullionStar Cash & Bullion account

Setup your BullionStar Account in a matter of seconds

Keeping funds on your BullionStar account

How to fund your BullionStar account

How to withdraw funds from your BullionStar account

How to sell bullion with the proceeds paid to your BullionStar account

9 Benefits of a BullionStar Account

Keeping cash funds on your BullionStar account can be useful for numerous reasons.

Trade in/out of Physical Bullion

With a BullionStar account, you can trade seamlessly in and out of bullion positions without funds having to be transferred and settled via the banking system for each order you place. This also supports strategies where you want to engage in market timing to time your precious metals purchases with cash already waiting in your BullionStar account.

Cost Average

Keeping cash on your BullionStar account supports investment strategies such as purchasing or selling bullion using a dollar-cost average approach over time.

Save on Transaction Fees

With funds already added to your BullionStar account, you avoid costly banking charges each time you place a bullion order.

Keep Proceeds from Sell Orders on your BullionStar Account

When you sell bullion back to BullionStar, you can have the proceeds from your sell orders credited directly to your BullionStar account. You can then use the proceeds to fund bullion purchases or leave them on your account indefinitely if you prefer to hold cash.

Online Control

As your BullionStar account is an integrated bullion and cash account, you can manage all of your precious metals and cash holdings on the same online portfolio dashboard. Buy precious metals for delivery or storage, sell vaulted bullion to BullionStar, or withdraw your vaulted bullion. Add and withdraw cash funds in US dollars, Euros, and Singapore dollars, and view online cash and bullion balances and transaction history.

Speed up Transactions

With cash already added on the BullionStar account, you will speed up bullion transactions and avoid costly banking charges as you don’t need to transfer funds for each bullion purchase that you make.

Insurance Protection

All metals held on your BullionStar account is fully insured against all risks at full replacement value. You never stand any risk whatsoever when you store precious metals with BullionStar.

5 Audit Methods

BullionStar offers 5 different audit methods so that you can verify the existence and correctness of your bullion at any time. You can e.g. walk in to BullionStar’s bullion center at 45 New Bridge Road in Singapore to audit your bullion without any prior notification.

Hold Savings in the Form of Cash Funds Outside the Banking System

Alternatively, if you just have a preference for holding liquid cash, then you can do so safely and conveniently with a BullionStar account.

BullionStar Account: Safer than a Bank Account

When you hold cash in a BullionStar account, you are holding cash outside the fractional-reserve banking system. BullionStar does not operate under any banking system. In this way, a BullionStar account is safer than a Singapore bank account. BullionStar is headquartered in Singapore, one of the safest and most secure jurisdictions in the world, a country with strong property rights and a strong rule of law.

Unlike a bank account where the depositor is an unsecured creditor of a bank and at risk of a bail-in, BullionStar accounts are operated under what is known as a single-purpose Stored Value Facility (SVF) as defined under Singaporean law. Under this facility, BullionStar customers make use of the SVF to fund and maintain funds on their BullionStar accounts and to purchase products such as bullion from BullionStar. Funds in BullionStar’s SVF are diversified across physical cash, precious metals and a number of different Singapore bank accounts used by BullionStar.

Precious Metals on your Bullion Account

As well as holding cash, your BullionStar account can of course also hold bullion in the form of precious metals bars and coins. All metal held on your BullionStar account is fully insured and BullionStar employs five separate audit methods to verify the existence and accuracy of your bullion holdings.

If you choose to store your precious metals with BullionStar, your BullionStar account provides online access and control to view and manage your bullion holdings. Likewise, with their BullionStar accounts, customers can buy, convert and sell precious metals grams in the Bullion Savings Program (BSP).

Conclusion – BullionStar Cash & Bullion Account

As a way to diversify your cash holdings, a BullionStar account offers an alternative that is outside the banking system in what many regard as the safest and most stable jurisdiction in the world, Singapore.

A BullionStar account has most of the useful features of a Singapore bank account but is safer and has more currency choices on one and the same account (Singapore dollar, US dollar and Euro) than standard bank accounts. A key difference between a Singapore bank account and a BullionStar account is that when you hold cash on a BullionStar account, you are holding your cash outside the fractional-reserve banking system. It’s also safer than keeping your cash at home.

With a BullionStar account, you can maintain cash on your account in Singapore dollars, US dollars and Euro, and use these funds as a liquid cash resource or to transact in precious metals with BullionStar. With no fees, you can transfer funds between a Singapore bank account and your BullionStar account in a clear and simple manner. Given that a BullionStar account allows you to hold both bullion and cash on one and the same account, it is now even easier than ever to buy and store physical precious metals in the safest jurisdiction in the world, Singapore.

Consumer advisory – A BullionStar account is not a bank account and BullionStar is not a deposit-taking institution. BullionStar Pte. Ltd., is the holder of a stored value facility and does not require the approval of the Money Authority of Singapore. Users are advised to read the terms and conditions carefully.

Popular Blog Posts by BullionStar

How Much Gold is in the FIFA World Cup Trophy?

How Much Gold is in the FIFA World Cup Trophy?

Essentials of China's Gold Market

Essentials of China's Gold Market

Singapore Rated the World’s Safest & Most Secure Nation

Singapore Rated the World’s Safest & Most Secure Nation

Infographic: Gold Exchange-Traded Fund (ETF) Mechanics

Infographic: Gold Exchange-Traded Fund (ETF) Mechanics

BullionStar Financials FY 2020 – Year in Review

BullionStar Financials FY 2020 – Year in Review

Why a Powerful Silver Bull Market May Be Ahead

Why a Powerful Silver Bull Market May Be Ahead

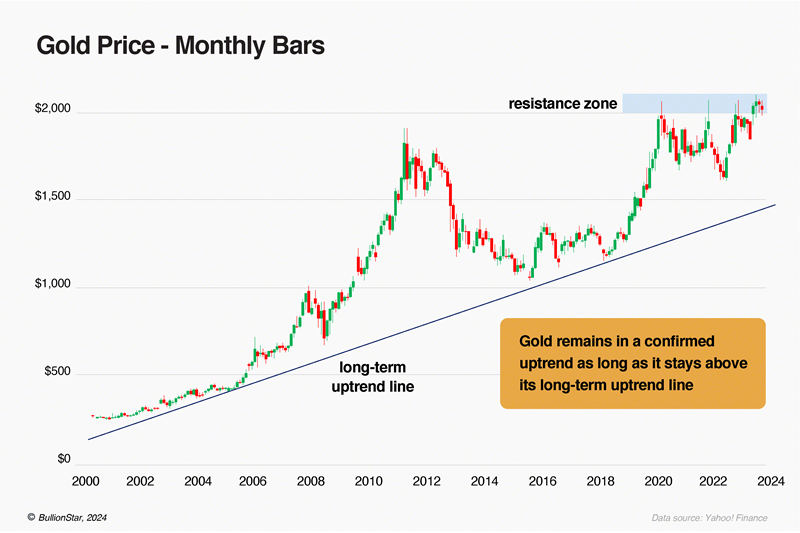

What’s Driving Gold to All-Time Highs?

What’s Driving Gold to All-Time Highs?

What You Need to Know About Gold's Long-Term Bull Market

What You Need to Know About Gold's Long-Term Bull Market

BullionStar Financials FY 2023 – Year in Review

BullionStar Financials FY 2023 – Year in Review

Year of the Dragon: Surge in Singapore's Gold & Silver Sales

Year of the Dragon: Surge in Singapore's Gold & Silver Sales

BullionStar

BullionStar 0 Comments

0 Comments