Why Central Banks Should Hold Gold & Other Assets

Canada is notorious among gold watchers for not owning any gold. In 2016, the Ministry of Finance sold off its last few ounces of Canada’s gold reserves. As for the Bank of Canada, Canada’s central bank, it doesn’t own a single ounce of the yellow metal. Canadian government securities make up all of the Bank of Canada’s portfolio of assets.

This concentrated exposure to one issuer, the Federal government, is reckless. So is the Bank’s focus on a single asset class, bonds.

At risk is one of Canada’s most important weights and measures, the dollar. The Bank of Canada is the steward of the dollar measurement. Along with other key units of measurement like the metre, kilogram, and liter, the dollar is vital to Canadians’ existence. We use it to make calculations every day. Sometimes many times a day.

Central banks are overexposed to national government debt

The Bank of Canada’s main tool for managing the accuracy of the dollar are the assets in its vaults. It needs these assets to repurchase unwanted Canadian currency, thus ensuring that the dollar unit of measurement hews to the target that the Bank has set out for it. To ensure precision, the Bank of Canada should be holding a large variety of assets issued by a wide gamut of issuers. But it has chosen to expose itself to one asset issued by a single issuer.

This argument doesn’t just apply to Canada. Other central banks also have highly concentrated portfolios. The U.S. Federal Reserve, for instance, is the steward of the all-important U.S. dollar measurement. It has questionable title to over 261 million ounces of gold, but for the most part its assets are bonds or bills either issued by the US Federal government or one of its agencies.

One way to dilute the massive amount of credit risk that each of these two central banks has vis-a-vis its national government would be to hold a broader range of domestic assets. How about state/provincial bonds or municipal bonds? Or why not have these central banks allocate a portion of their portfolios to corporate debt? Or real-estate, e.g. via real-estate investment trusts?

Central banks suffer from home bias

Just as worrisome is these central banks’ lack of global diversification. Neither the Fed nor the Bank of Canada own much in the way of foreign securities. This is a good example of home bias. Home bias is the tendency for investors to invest in a large number of domestic assets rather than diversifying into foreign assets.

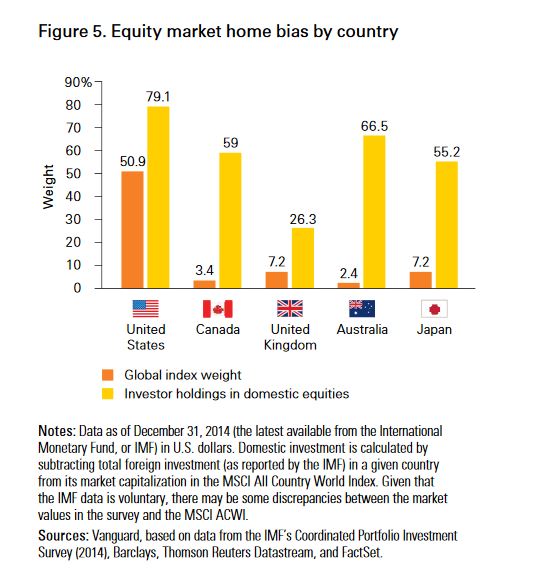

For instance, Canadian households invest most of their portfolios in Canadian bonds and equities, even though Canada represents just 3% of the global economy. Canadians are thus far less diversified than they believe themselves to be. This phenomena isn’t confined to Canada, as the chart above shows.

The danger of home bias is that if a shock or crisis hits a single country then its citizens’ portfolios don’t have an effective counterbalance. While home bias is typically used in the context of individuals and households, it should apply to central banks too.

Accuracy requires a strong portfolio

Who cares about a central bank’s portfolio? As I wrote at the outset of this post, the assets it holds are one of a central bank’s main tools for ensuring the accuracy of society’s monetary unit of measurement. Let me investigate this idea a bit more.

Most central banks set a target for the monetary unit. One option is a constant dollar target. This target ensures that a dollar can purchase the same basket of consumption goods & services year-in year-out. Another option is a crawling goods & services target. The basket of goods & services that a dollar can purchase steadily declines 1-3% each year. For a number of reasons, falling targets have been adopted by most Western central banks.

If the actual purchasing power of the dollar starts to exceed the central bank’s target, then the bank needs to expand the money supply and bring the dollar back on track. If the purchasing power is falling too fast relative to target, the central bank needs to contract the money supply.

It is in contracting the money supply that the bank’s portfolio quality is important. A contraction of the money supply requires a sale of assets from the central bank’s vault. If any of its assets have been impaired, the central bank may not be able to repurchase as much currency as is required. It will start to routinely miss its target.

And that’s why a central bank portfolio that is 100% allocated to national government debt is dangerous. Most of the time the national government’s credit quality will be good. But when its credit deteriorates, the central bank’s ability to use those assets to repurchase money (and thus ensure a precise measurement) could be compromised.

Why are central bank so geared towards government bonds?

Historically, central banks have been known as the government’s bank. In this subservient relationship, central banks offered to fund the government in return for favors like monopolies over the note issue. Central bank’s home bias and a lack of diversification may simply be a hold-over of meeting the government’s financing requirements.

But government finances have come a long way over the decades. Government debt auctions do a great job of facilitating the flow of public savings to the government. There is no longer any need for central banks to play a role in the direct financing of government spending.

The incredible liquidity of government bond markets is another reason that central banks may still prefer to hold so much national government debt. If so, why not hold foreign government debt? As for gold, it is one of the most liquid assets in the world.

What should central banks switch into?

On way to diversify away from their respective national governments is to hold a wider range of domestic assets. Earlier in this post I mentioned local real estate or provincial/state debt, but even a small allocation to highly-liquid domestic equity ETFs would be prudent. Foreign government debt, a globally diversified basket of equities, and short-term corporate debt issued by large multinationals are also worth considering.

Gold and commodities are another way to achieve diversification. Gold is a useful asset because it can be easily sold anywhere in the world while being stored domestically. This is useful for national security reasons. Unlike many types of foreign assets (i.e. real-estate or sovereign debt), bullion can’t be expropriated or repudiated by an unfriendly government.

If the credit quality of any one of these issuers deteriorates, or if the price of gold or real estate tumbles, then the central bank needn’t worry. Having invested in so many other assets both domestically and around the world, it will have plenty of powder left to ensure the accuracy of the monetary measure.

A nation’s central bank is the custodian of one of society’s most important weights and measures: the monetary unit. Those running the central bank shouldn’t have to rely on a single resource to do their job, they should have multiple diverse resources.

Popular Blog Posts by JP Koning

How Mints Will Be Affected by Surging Bullion Coin Demand

How Mints Will Be Affected by Surging Bullion Coin Demand

Banknotes and Coronavirus

Banknotes and Coronavirus

Gold Confiscation – Can It Happen Again?

Gold Confiscation – Can It Happen Again?

Eight Centuries of Interest Rates

Eight Centuries of Interest Rates

The Shrinking Window For Anonymous Exchange

The Shrinking Window For Anonymous Exchange

A New Era of Digital Gold Payment Systems?

A New Era of Digital Gold Payment Systems?

Life Under a Gold Standard

Life Under a Gold Standard

Why Are Gold & Bonds Rising Together?

Why Are Gold & Bonds Rising Together?

Does Anyone Use the IMF’s SDR?

Does Anyone Use the IMF’s SDR?

HyperBitcoinization

HyperBitcoinization

JP Koning

JP Koning 0 Comments

0 Comments